Earnings summaries and quarterly performance for Constellation Energy.

Executive leadership at Constellation Energy.

Joseph Dominguez

President and Chief Executive Officer

Bryan Hanson

Executive Vice President and Chief Generation Officer

Daniel Eggers

Executive Vice President and Chief Financial Officer

James McHugh

Executive Vice President and Chief Commercial Officer

Kathleen Barrón

Executive Vice President and Chief Strategy and Growth Officer

Board of directors at Constellation Energy.

Alan Armstrong

Director

Ashish Khandpur

Director

Bradley Halverson

Director

Charles Harrington

Director

Dhiaa Jamil

Director

Eileen Paterson

Director

John Richardson

Director

Julie Holzrichter

Director

Nneka Rimmer

Director

Peter Oppenheimer

Director

Robert Lawless

Chair of the Board

Yves de Balmann

Director

Research analysts who have asked questions during Constellation Energy earnings calls.

David Arcaro

Morgan Stanley

7 questions for CEG

Jeremy Tonet

JPMorgan Chase & Co.

4 questions for CEG

Paul Zimbardo

Jefferies Financial Group Inc.

4 questions for CEG

Shahriar Pourreza

Guggenheim Partners

4 questions for CEG

Steve Fleishman

Wolfe Research, LLC

4 questions for CEG

Steven Fleishman

Wolfe Research

3 questions for CEG

Andrew Weisel

Scotiabank

2 questions for CEG

Angie Storozynski

Seaport Research Partners

2 questions for CEG

James West

Evercore ISI

2 questions for CEG

Sophie Karp

KeyBanc Capital Markets Inc.

2 questions for CEG

Agnieszka Storozynski

BofA Securities

1 question for CEG

Durgesh Chopra

Evercore ISI

1 question for CEG

Nicholas Campanella

Barclays

1 question for CEG

Recent press releases and 8-K filings for CEG.

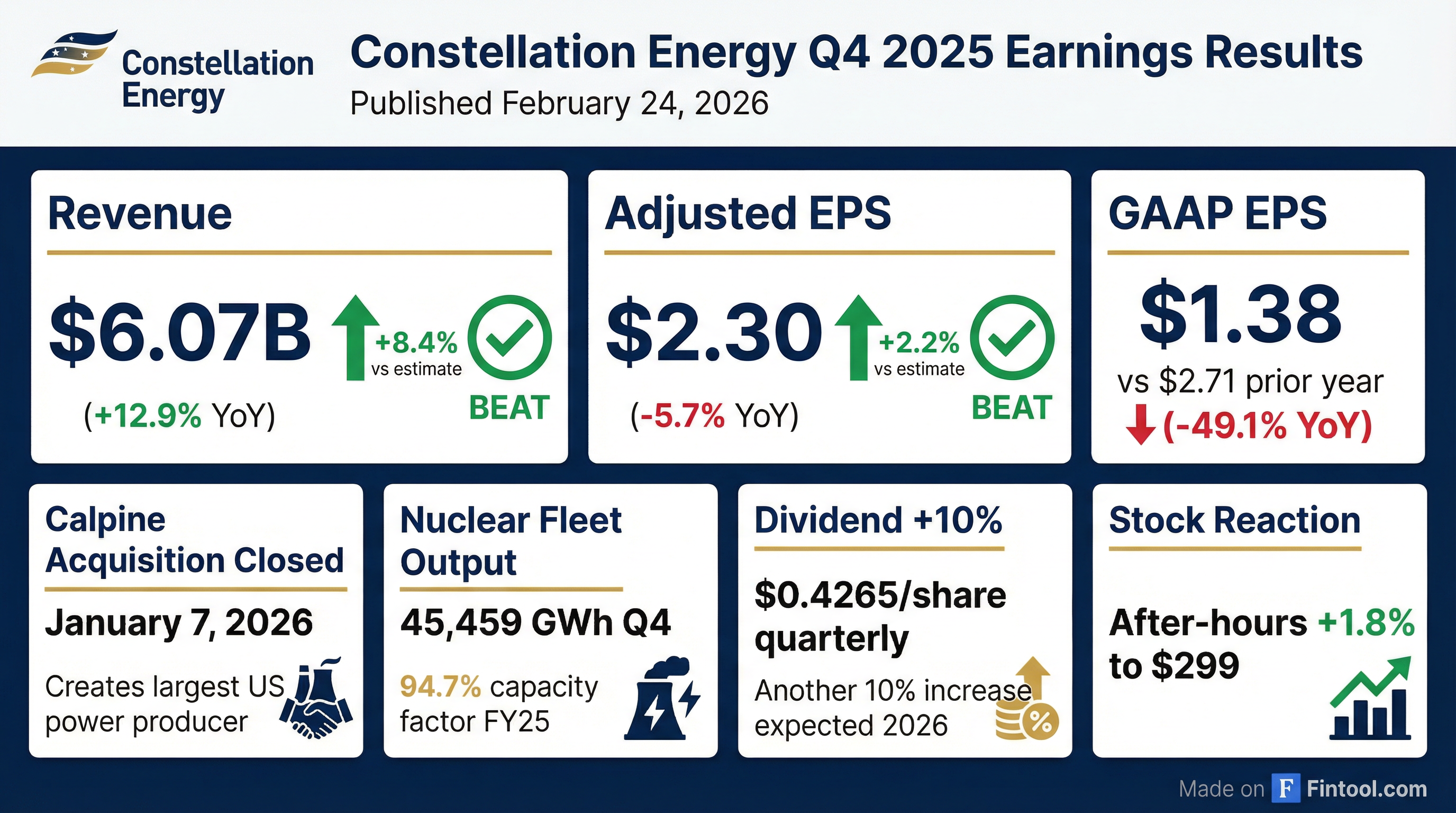

- Q4 2025 GAAP earnings of $1.38 per share and adjusted operating earnings of $2.30 per share; full-year 2025 GAAP earnings of $7.40 per share and adjusted operating earnings of $9.39 per share.

- Completed acquisition of Calpine Corporation, creating the nation’s largest electricity producer by uniting nuclear, natural gas, and geothermal fleets.

- Declared a quarterly dividend of $0.4265 per share, increased the annual dividend by 10%, and plans another 10% increase in 2026.

- Calpine subsidiary signed a 380 MW agreement with CyrusOne for a new data center at Freestone Energy Center, plus an exclusive Phase 2 for an additional 380 MW.

- Secured $1 billion DOE loan guarantee for the Crane Clean Energy Center restart and NRC approval for 20-year license renewals at Clinton and Dresden stations.

- Constellation reported Q4 GAAP EPS of $1.38 and Adjusted (non-GAAP) Operating EPS of $2.30, and full-year GAAP EPS of $7.40 with Adjusted EPS of $9.39.

- Completed the acquisition of Calpine Corporation on January 7, 2026, combining premier nuclear, natural gas, and geothermal fleets under one platform.

- Increased the annual dividend per share by 10%, and declared a quarterly dividend of $0.4265 per share payable March 20, 2026.

- Secured NRC approval for 20-year license renewals at Clinton and Dresden stations, and DOE approved a $1 billion loan guarantee to support the Crane Clean Energy Center restart.

- Announced its 2026 guidance and strategy will be detailed in a Business and Earnings Outlook call on March 31, 2026.

- Constellation Energy has completed its acquisition of Calpine Corporation from Energy Capital Partners, creating the nation’s largest electricity producer with 55 GW of capacity.

- The deal combines Constellation’s zero-emission nuclear fleet with Calpine’s natural gas and geothermal generation to serve over 2.5 million retail and business customers.

- The acquisition strengthens Constellation’s footprint in Texas and California while maintaining significant operations in Illinois, Maryland, New York, and Pennsylvania, and positions the company to scale clean technologies such as advanced nuclear, geothermal, carbon capture, and long-duration storage.

- Meta plans to build a $10 billion AI data center in Louisiana powered by Constellation’s nuclear energy, highlighting growing tech sector demand for reliable, low-carbon baseload power.

- City Electric Group Limited closed a $1.25 billion senior secured global asset-based lending revolving credit facility, with Wells Fargo as agent, PNC and JPMorgan as joint lead arrangers, and Truist and HSBC as co-documentation agents.

- The five-year facility consolidates previously separate credit arrangements across the United States, Canada, the United Kingdom (including Jersey), Ireland, the Netherlands, Spain, and Australia under a single agreement.

- It enhances CEG’s liquidity and flexibility to support product availability, service levels, and continued investment in its branch network.

- CEG serves customers through over 1,200 branches globally—including 750 in North America, nearly 400 in the UK, and about 60 across Europe and Australia.

- Constellation’s Calpine unit signed a 380 MW agreement with CyrusOne to supply power and grid connectivity to a new data-center facility at the Freestone Energy Center in Texas, with an exclusive option for an additional 380 MW for a Phase 2 expansion.

- The deal builds on prior agreements, including 400 MW for the Thad Hill Energy Center, boosting CyrusOne’s contracted Texas capacity to more than 1,100 MW.

- Freestone Energy Center is part of a larger 1,036 MW natural-gas-fired power station located about 80 miles southeast of Dallas.

- Constellation completed its acquisition of Calpine earlier this year in a deal valued at approximately $26.6 billion.

- Constellation’s shares traded higher after the announcement as the company leverages its “Powered Land” approach to provide generation, land, and grid access for large-scale data-center customers.

- Calpine LLC signed a 380-MW power agreement with CyrusOne to serve a new data center adjacent to the Freestone Energy Center in Freestone County, Texas.

- Calpine secured an exclusive agreement for Phase 2 adding another 380 MW of capacity.

- These deals complement prior 400 MW agreements at the Thad Hill Energy Center in Bosque County.

- The project leverages Constellation’s Powered Land Capabilities—integrated generation, land, and grid connectivity—to support large-load customers.

- The new facility is located ~80 miles southeast of Dallas, adjacent to Calpine’s existing Freestone Energy Center.

- Constellation completed private exchange offers on January 15, 2026, exchanging $2.289722 billion of Calpine’s outstanding 4.625%, 5.000% and 3.750% Senior Notes for newly issued Constellation Notes; the tendered Calpine Notes were retired and canceled.

- Concurrently, Calpine solicited and received holder consents to amend its indentures, eliminating most restrictive covenants and non-payment events of default, and entered into three supplemental indentures to effect these amendments.

- The new Constellation Notes, issued under the September 28, 2007 indenture, carry the same interest rates and maturities as the exchanged instruments: 4.625% due February 1, 2029, 5.000% due February 1, 2031, and 3.750% due March 1, 2031 (interest paid semi-annually).

- The Constellation Notes are subject to optional redemption in accordance with the terms set forth in each series’ note indenture.

- Constellation’s private exchange offers and related consent solicitations for Calpine’s notes expired January 12, 2026, with $646.822 million (99.51%) of 4.625% 2029 notes, $847.698 million (99.73%) of 5.000% 2031 notes and $795.202 million (88.36%) of 3.750% 2031 secured notes validly tendered.

- The Proposed Amendments eliminate substantially all restrictive covenants (other than payment- and bankruptcy-related defaults) and will release the collateral securing the 2031 secured notes.

- All conditions for closing the exchange—including Constellation’s acquisition of Calpine on January 7, 2026—have been satisfied or waived, and settlement is expected around January 15, 2026.

- Eligible holders who tendered prior to the early-tender deadline will receive Constellation notes in equal principal amounts plus $1.00 per $1,000 for unsecured notes and $2.83 per $1,000 for secured notes; late tenders receive $970 principal amount of notes per $1,000 tendered.

- 20-year PPAs with Vistra will deliver 2.1 GW from existing Ohio reactors and fund uprates adding 433 MW.

- Deal with TerraPower funds two 690 MW Natrium reactors and rights to energy from up to six additional units by the mid-2030s.

- Oklo agreement supports development of up to a 1.2 GW advanced-reactor campus in Ohio, potentially online around 2030.

- Power from all projects will flow into the PJM grid to help run Meta’s Prometheus AI supercluster in New Albany, Ohio, slated to go online later this year.

- Constellation completed its acquisition of Calpine Corporation from Energy Capital Partners, creating the nation’s largest producer of electricity by uniting its zero-emission nuclear fleet with Calpine’s natural gas and geothermal generation.

- The combined organization serves 2.5 million customers nationwide with 55 GW of capacity—enough to power the equivalent of 27 million homes and supply about 10% of U.S. clean energy.

- The merger strengthens Constellation’s footprint in key regions including Texas, California, Illinois, Maryland, New York and Pennsylvania, and establishes a platform for scaling advanced technologies such as advanced nuclear, geothermal, carbon capture and long-duration storage.

- Constellation will maintain its headquarters in Baltimore with a significant presence in Houston, and expand community impact through more than $23 million in annual giving and thousands of volunteer hours.

Quarterly earnings call transcripts for Constellation Energy.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more