Earnings summaries and quarterly performance for Carlyle Group.

Executive leadership at Carlyle Group.

Harvey M. Schwartz

Chief Executive Officer

Jeff Nedelman

Co-President

Jeffrey W. Ferguson

General Counsel

John C. Redett

Chief Financial Officer and Head of Corporate Strategy

Justin Plouffe

Chief Financial Officer

Lindsay P. LoBue

Chief Operating Officer

Mark Jenkins

Co-President

Board of directors at Carlyle Group.

Afsaneh Beschloss

Director

Anthony Welters

Director

David M. Rubenstein

Co-Chairman of the Board

Derica W. Rice

Director

James H. Hance, Jr.

Director

Lawton W. Fitt

Director

Linda H. Filler

Director

Mark S. Ordan

Lead Independent Director

Sharda Cherwoo

Director

William E. Conway, Jr.

Co-Chairman of the Board

William J. Shaw

Director

Research analysts who have asked questions during Carlyle Group earnings calls.

Brian McKenna

Citizens JMP Securities

7 questions for CG

Michael Cyprys

Morgan Stanley

7 questions for CG

Patrick Davitt

Autonomous Research

7 questions for CG

Glenn Schorr

Evercore ISI

6 questions for CG

Alexander Blostein

Goldman Sachs

5 questions for CG

Brian Bedell

Deutsche Bank

5 questions for CG

Kenneth Worthington

JPMorgan Chase & Co.

5 questions for CG

Steven Chubak

Wolfe Research

5 questions for CG

William Katz

TD Cowen

5 questions for CG

Ben Budish

Barclays PLC

4 questions for CG

Kyle Voigt

Keefe, Bruyette & Woods

4 questions for CG

Benjamin Budish

Barclays PLC

3 questions for CG

Daniel Fannon

Jefferies Financial Group Inc.

3 questions for CG

Michael Brown

Wells Fargo Securities

3 questions for CG

Alex Blostein

Goldman Sachs Group, Inc.

2 questions for CG

Bill Katz

TD Securities

2 questions for CG

Brian MacArthur

Raymond James Financial, Inc.

2 questions for CG

Don DeMarco

National Bank Financial

2 questions for CG

Jeremy Hoy

Canaccord Genuity Group Inc.

2 questions for CG

Ken Worthington

JPMorgan

2 questions for CG

Luke Bertozzi

CIBC Capital Markets

2 questions for CG

Mark Paolini

BMO Capital Markets

2 questions for CG

Mike Brown

UBS

2 questions for CG

Brendan O'Brien

Wolfe Research

1 question for CG

Brennan Hawken

UBS Group AG

1 question for CG

Craig Siegenthaler

Bank of America

1 question for CG

Recent press releases and 8-K filings for CG.

- The Carlyle Group has set financial targets for 2028, aiming for $1.9 billion in Fee Related Earnings (FRE), $2.8 billion+ in management fees, a 50% FRE margin, $200 billion in cumulative inflows from 2026-2028, and $6 or more in Distributable Earnings per share.

- These targets are based on a 100% organic growth model, explicitly excluding assumptions for inorganic growth, significant strategic transactions, or partnerships.

- The company's strategy includes creating a well-defined wealth strategy, establishing an integrated credit and insurance strategy, investing significantly in Carlyle AlpInvest, and driving growth in its capital markets business.

- The firm announced a new $2 billion share repurchase authorization, in addition to its existing one, to return capital to shareholders.

- Carlyle has a track record of exceeding financial targets in both 2024 and 2025, with FRE growing at a 20% compound annual growth rate (CAGR) over the last three years and Distributable Earnings (DE) per share increasing by 24% since 2023.

- The Carlyle Group reported record financial performance in 2025, including $1.24 billion in Fee Related Earnings (FRE), a 47% FRE margin, and Distributable Earnings (DE) of $4+ per share.

- The company set ambitious financial targets for 2028, aiming for $1.9 billion in FRE, a 50% FRE margin, and DE per share of $6 or more.

- These 2028 targets are based on a bottoms-up build and anticipate $200 billion in cumulative inflows from 2026-2028, driven by 100% organic growth without assuming inorganic growth or significant strategic transactions.

- The Board of Directors approved a new $2 billion share repurchase authorization, signaling a commitment to returning capital to shareholders.

- Carlyle Group (CG) has set 2028 financial targets including $1.9 billion in Fee Related Earnings (FRE), $2.8 billion+ in management fees, a 50% FRE margin, and Distributable Earnings per share of $6 or more.

- The company aims for $200 billion in cumulative inflows from 2026-2028, with $90 billion from Global Credit & Insurance, $60 billion from Carlyle AlpInvest, $50 billion from Global Private Equity, and $40 billion (20%) from wealth evergreen solutions.

- Carlyle's balance sheet shows $2 billion in cash and $2.9 billion in net accrued performance revenues , and the board has approved a new $2 billion share repurchase authorization.

- These targets are based on a bottoms-up, 100% organic growth model and do not assume inorganic growth or significant strategic transactions, building on a track record of exceeding prior financial targets.

- Carlyle (CG) is presenting its growth outlook and financial objectives at the 2026 Shareholder Update on February 26, 2026.

- The firm announced three-year financial targets to be achieved by the end of 2028, including FRE of $1.9+ billion, inflows of $200+ billion, and DE per common share of $6.00+.

- Carlyle's Board of Directors has approved a new $2 billion share repurchase authorization.

- As of December 31, 2025, Carlyle's assets under management (AUM) stood at $477 billion.

- Carlyle Group Inc. announced its growth outlook and financial objectives at its 2026 Shareholder Update on February 26, 2026.

- The company set three-year financial targets to be achieved by the end of 2028, including Fee Related Earnings (FRE) of $1.9+ billion, Inflows of $200+ billion, and Distributable Earnings (DE) per common share of $6.00+.

- Carlyle's Board of Directors approved a new $2 billion share repurchase authorization.

- Centerra Gold reported full-year 2025 consolidated gold production over 275,000 ounces and 50 million pounds of copper, surpassing the midpoint of gold production guidance, with consolidated all-in sustaining costs of $1,614 per ounce, outperforming the low end of guidance. The company ended the year with a cash balance of $529 million.

- For full year 2025, adjusted net earnings were $229 million or $1.12 per share, and the company returned $135 million to shareholders, including $94 million in buybacks and $41 million in dividends.

- The 2026 outlook projects consolidated gold production between 250,000 and 280,000 ounces and copper production between 50 and 60 million pounds, with consolidated all-in sustaining costs expected to be between $1,650 and $1,750 per ounce.

- Key project updates include the Kemess PEA outlining robust economics with an after-tax NPV of $1.1 billion and IRR of 16%, and the Thompson Creek restart capital estimate increased to $425 million to $450 million, with production still on track for mid-2027.

- Operations at the Langeloth facility are temporarily suspended following an explosion, with full operations expected to resume by May 2026 and repair costs estimated at $5-$10 million.

- Centerra Gold reported strong operational performance in Q4 and full year 2025, with consolidated full year production exceeding 275,000 ounces of gold and 50 million pounds of copper, and consolidated all-in sustaining costs (AISC) of $1,614 per ounce, outperforming the low end of guidance.

- The company returned $135 million to shareholders in 2025, including $94 million in buybacks and $41 million in dividends, ending the year with a strong cash balance of $529 million.

- For 2026, Centerra Gold expects consolidated gold production between 250,000 and 280,000 ounces and copper production between 50 and 60 million pounds, with consolidated AISC projected to be between $1,650 and $1,750 per ounce.

- Key project updates include the Kemess Preliminary Economic Assessment outlining an initial 15-year mine life with robust economics , an increase in the Thompson Creek restart capital estimate to between $425 million and $450 million , and the temporary suspension of the Langeloth facility with full operations expected to resume by May 2026.

- Centerra Gold reported full year 2025 adjusted net earnings of $229 million, or $1.12 per share, with consolidated gold production over 275,000 ounces and all-in sustaining costs of $1,614 per ounce, outperforming guidance.

- The company ended 2025 with a cash balance of $529 million and returned $135 million to shareholders, including $94 million in buybacks and $41 million in dividends.

- For 2026, consolidated gold production is expected to be 250,000 to 280,000 ounces and all-in sustaining costs are projected between $1,650 and $1,750 per ounce.

- The Thompson Creek restart project's total capital estimate increased to $425-$450 million, with production still on track for mid-2027. The Kemess PEA outlines an after-tax NPV of $1.1 billion.

- Operations at the Langeloth Metallurgical facility are temporarily suspended due to an explosion, with full operations expected to resume by May 2026 and repair costs estimated at $5-$10 million.

- Antin Infrastructure Partners has entered into exclusive negotiations with CARAVELLE to acquire Belambra, a leading French owner and operator of leisure infrastructure.

- Belambra reported €254 million in revenue in 2025.

- This acquisition would be the ninth investment by Antin’s Mid Cap Fund I and is anticipated to close in June 2026, pending customary regulatory approvals.

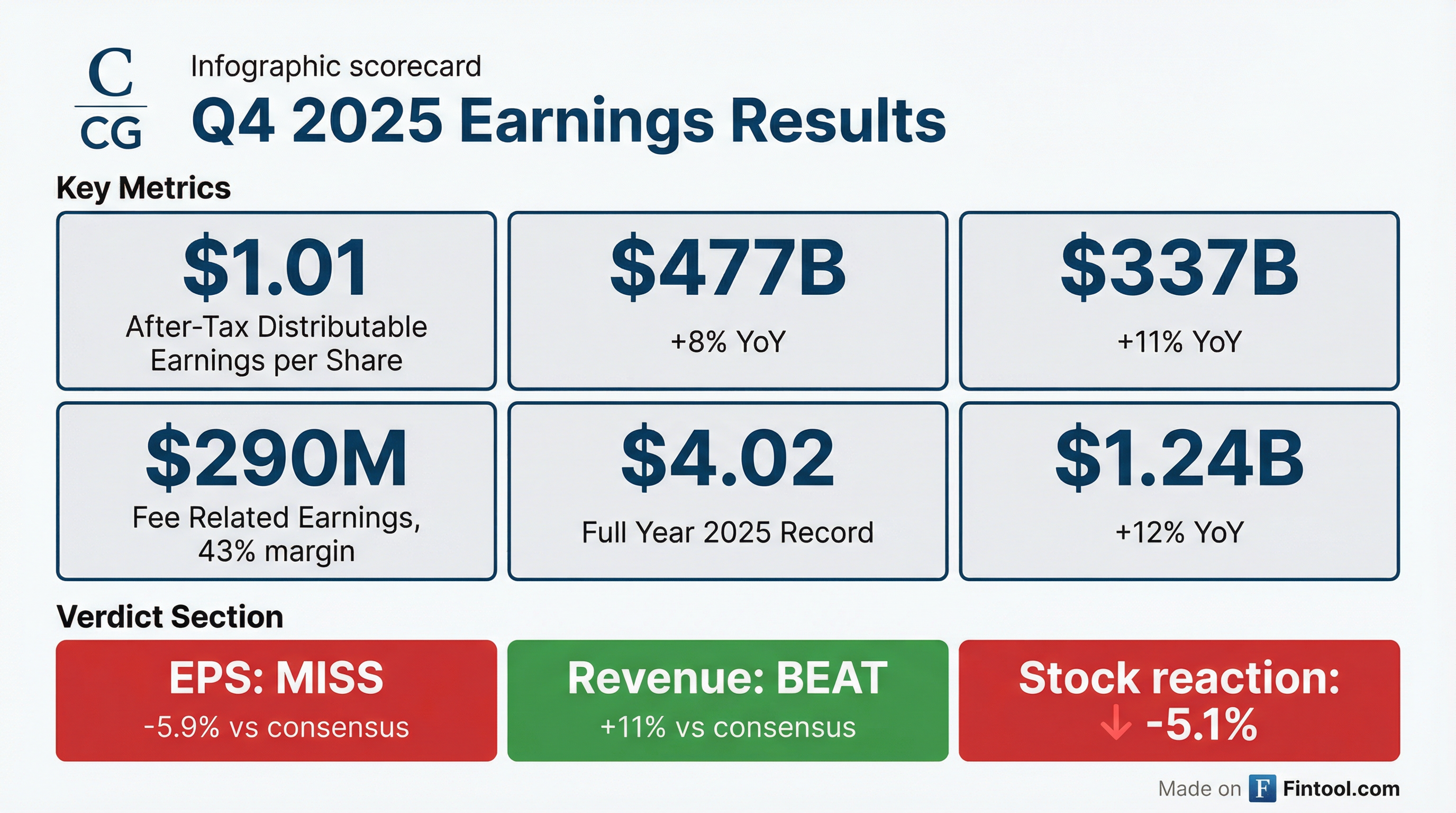

- Carlyle Group reported diluted earnings per share of $0.96 for Q4 2025 and $2.18 for the full year 2025.

- For Q4 2025, Distributable Earnings (DE) were $436 million (or $1.01 per common share on a post-tax basis), and Fee Related Earnings (FRE) were $290 million.

- Total Assets Under Management (AUM) grew 8% year-over-year to $477 billion as of December 31, 2025.

- The company declared a quarterly dividend of $0.35 per common share and repurchased $204 million of common stock in Q4 2025.

Quarterly earnings call transcripts for Carlyle Group.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more