Earnings summaries and quarterly performance for Carlyle Group.

Executive leadership at Carlyle Group.

Harvey M. Schwartz

Chief Executive Officer

Jeff Nedelman

Co-President

Jeffrey W. Ferguson

General Counsel

John C. Redett

Chief Financial Officer and Head of Corporate Strategy

Justin Plouffe

Chief Financial Officer

Lindsay P. LoBue

Chief Operating Officer

Mark Jenkins

Co-President

Board of directors at Carlyle Group.

Afsaneh Beschloss

Director

Anthony Welters

Director

David M. Rubenstein

Co-Chairman of the Board

Derica W. Rice

Director

James H. Hance, Jr.

Director

Lawton W. Fitt

Director

Linda H. Filler

Director

Mark S. Ordan

Lead Independent Director

Sharda Cherwoo

Director

William E. Conway, Jr.

Co-Chairman of the Board

William J. Shaw

Director

Research analysts who have asked questions during Carlyle Group earnings calls.

Alexander Blostein

Goldman Sachs

5 questions for CG

Brian Bedell

Deutsche Bank

5 questions for CG

Brian McKenna

Citizens JMP Securities

5 questions for CG

Kenneth Worthington

JPMorgan Chase & Co.

5 questions for CG

Michael Cyprys

Morgan Stanley

5 questions for CG

Patrick Davitt

Autonomous Research

5 questions for CG

William Katz

TD Cowen

5 questions for CG

Glenn Schorr

Evercore ISI

4 questions for CG

Kyle Voigt

Keefe, Bruyette & Woods

4 questions for CG

Benjamin Budish

Barclays PLC

3 questions for CG

Daniel Fannon

Jefferies Financial Group Inc.

3 questions for CG

Michael Brown

Wells Fargo Securities

3 questions for CG

Steven Chubak

Wolfe Research

3 questions for CG

Ben Budish

Barclays PLC

2 questions for CG

Brendan O'Brien

Wolfe Research

1 question for CG

Brennan Hawken

UBS Group AG

1 question for CG

Craig Siegenthaler

Bank of America

1 question for CG

Recent press releases and 8-K filings for CG.

- Carlyle Group reported a record year in 2025, with fee-related earnings (FRE) of $1.24 billion, a 12% increase year-over-year, and record FRE margins of 47%.

- The company achieved record inflows of $54 billion, significantly surpassing its initial target, and ended the year with record Assets Under Management (AUM) of $477 billion.

- Carlyle was the number 1 private equity sponsor globally by IPO proceeds since 2024, generating approximately $10 billion in IPO issuance, and returned $1.2 billion of capital to shareholders in 2025.

- Deployment reached a record $54 billion in 2025, with realized proceeds totaling $34 billion, and the company's software exposure was noted as 6% of total AUM.

- The Carlyle Group reported a record year in 2025, with fee-related earnings (FRE) of $1.24 billion, up 12% year-over-year, and a record FRE margin of 47%.

- The company achieved record inflows of $54 billion and record assets under management (AUM) of $477 billion in 2025.

- Distributable Earnings (DE) for 2025 reached $1.7 billion, or $4.02 per share, an 11% increase from the prior year.

- Carlyle demonstrated strong monetization activity, generating approximately $10 billion in IPO proceeds since 2024, including the largest sponsor-backed IPO of all time with Medline.

- The firm returned a record $1.2 billion of capital to shareholders in 2025 through dividends and share buybacks.

- Carlyle Group reported a record year in 2025, with fee-related earnings (FRE) of $1.24 billion, up 12% year-over-year, and record FRE margins of 47%. The company also generated $1.7 billion in distributable earnings (DE), or $4.02 per share, an 11% increase from the prior year.

- The firm achieved record assets under management (AUM) of $477 billion and generated $54 billion in inflows in 2025, significantly exceeding its original $40 billion target. Deployment was a record $54 billion, and realized proceeds totaled $34 billion.

- Carlyle returned a record $1.2 billion of capital to shareholders in 2025 through dividends and share buybacks.

- Strategic growth areas, including global wealth and CLOs, showed strong momentum, with record inflows in Evergreen Wealth and Carlyle being the most active CLO manager for U.S. activity in 2025.

- Justin Plouffe assumed the role of Chief Financial Officer.

- Carlyle Group reported diluted earnings per share of $0.96 for Q4 2025 and $2.18 for the full year 2025.

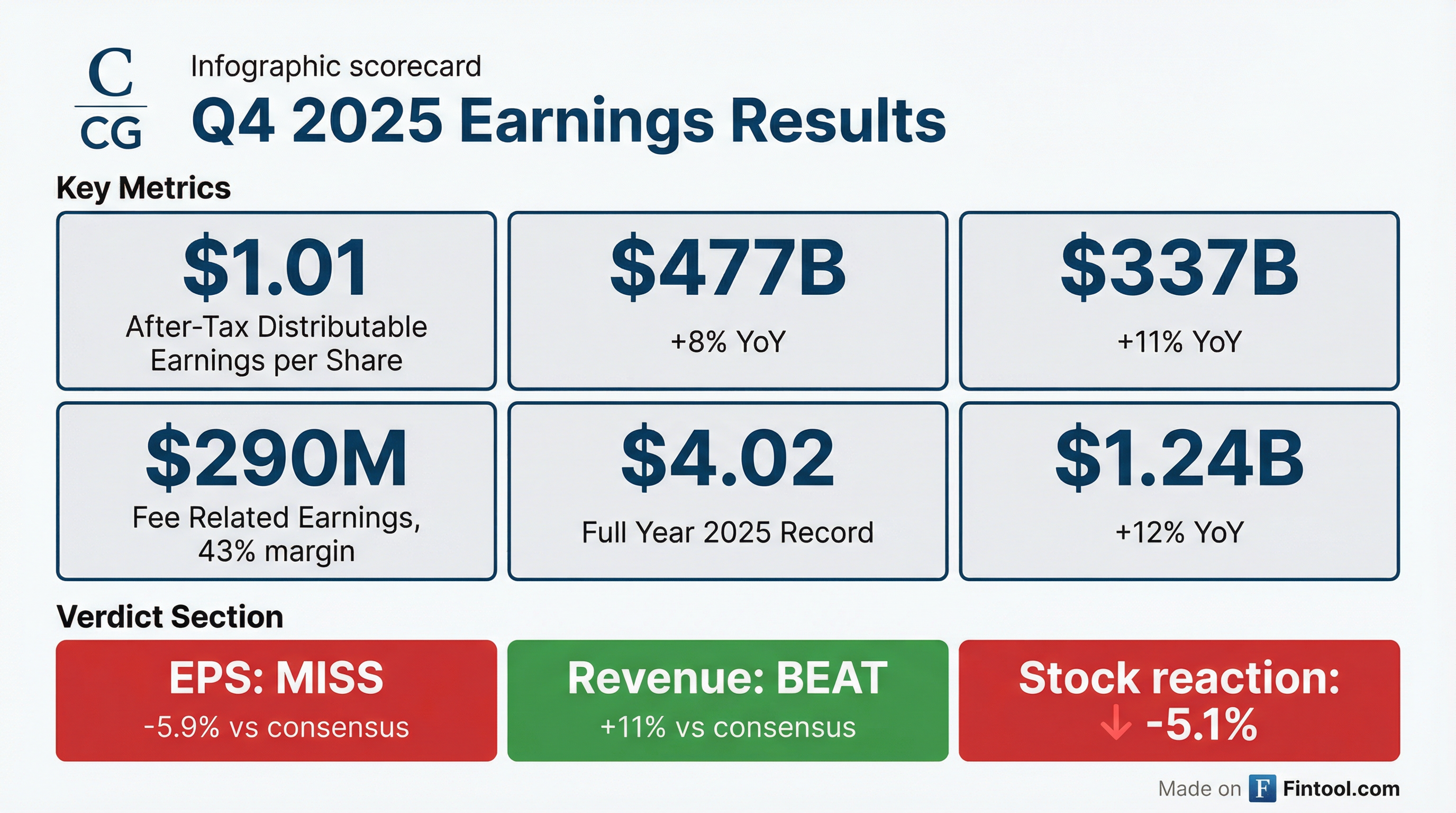

- For Q4 2025, Distributable Earnings (DE) were $436 million (or $1.01 per common share on a post-tax basis), and Fee Related Earnings (FRE) were $290 million.

- Total Assets Under Management (AUM) grew 8% year-over-year to $477 billion as of December 31, 2025.

- The company declared a quarterly dividend of $0.35 per common share and repurchased $204 million of common stock in Q4 2025.

- Carlyle reported record Fee Related Earnings of $290 million for Q4 2025 and $1.2 billion for the full-year 2025. The company's GAAP diluted EPS was $0.96 for Q4 2025 and $2.18 for FY 2025.

- Total Assets Under Management (AUM) increased 8% year-over-year to $477 billion as of December 31, 2025, with Fee-earning AUM growing 11% to $337 billion.

- For the full-year 2025, Inflows were $53.7 billion, a 32% increase from FY 2024, and Deployment totaled $54.5 billion, up 28% from FY 2024.

- The Board of Directors declared a quarterly dividend of $0.35 per common share and the company repurchased $687 million worth of shares in FY 2025.

- Reddy Ice, LLC announced an agreement to acquire Arctic Glacier, LLC from Carlyle (NASDAQ: CG).

- The acquisition, for which terms were not disclosed, is subject to customary closing conditions including regulatory approvals.

- To address the DOJ Antitrust Division's review, Reddy Ice will divest four facilities and associated customer contracts in Washington, Idaho, and California, along with customer contracts in Oregon and in the New York and Boston metropolitan areas.

- The strategic rationale for the acquisition is to create increased operational efficiency and combine geographically complementary platforms across North America.

- Centerra Gold Inc.'s Mount Milligan Mine has received an amended environmental assessment and all related permits, allowing for the continuation of its operations through 2035.

- These authorizations include a 10% expansion in plant throughput beginning in 2028 and increased stockpile capacity.

- The Mount Milligan Mine was selected by the Province of British Columbia in January 2025 for expedited permitting.

- Centerra is also progressing studies to support a further mine life extension for Mount Milligan to 2045, as outlined in a Pre-Feasibility Study published on September 11, 2025.

- Aspen Power, a distributed generation platform backed by Carlyle, has secured a $200 million strategic capital commitment from Deutsche Bank.

- This financing is intended to accelerate Aspen Power’s development of distributed solar and storage projects nationwide, enhancing its financial capacity and supporting growth initiatives.

- Carlyle, as an existing backer, welcomes Deutsche Bank as a partner, noting this commitment strengthens Aspen Power's ability to deliver projects and supports its expansion.

- Carson Group's Market Outlook 2026, titled "Riding the Wave," forecasts continued economic expansion and robust market performance.

- The outlook is driven by expansive fiscal policy, a decisive shift to monetary easing, and unprecedented investment in AI.

- Carson Group predicts the S&P 500 will gain between 12-15% in 2026.

- Key tailwinds include retroactive tax cuts, continued Federal Reserve rate cuts, easing tariff pressures, and strong global economic activity.

- AI-related capital expenditures are at historic highs, expected to reach $515 billion in 2026 from major technology firms, fueling economic growth and corporate profits.

- Conavi Medical reported total revenue of $9.1 million for fiscal year 2025, a significant increase from $2.2 million in the prior year, and a net loss of $20.5 million or $0.36 per common share.

- The company submitted its next-generation Novasight Hybrid™ system to the U.S. FDA for 510(k) clearance in September 2025, advancing its U.S. commercialization plans.

- Conavi strengthened its financial position in fiscal 2025 with $20 million in gross proceeds from a public equity financing in April 2025 and ended the year with $5.8 million in cash and cash equivalents as of September 30, 2025.

- Ki Investments Europe S.à r.l. acquired beneficial ownership of approximately 28.34% of Conavi's common shares on a non-diluted basis from its affiliate Carlyle Services Limited Liability Company, effective December 24, 2025.

Quarterly earnings call transcripts for Carlyle Group.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more