Earnings summaries and quarterly performance for Catalyst Bancorp.

Executive leadership at Catalyst Bancorp.

Board of directors at Catalyst Bancorp.

Research analysts covering Catalyst Bancorp.

Recent press releases and 8-K filings for CLST.

Catalyst Bancorp, Inc. Announces Q4 and Full Year 2025 Results

CLST

Earnings

Share Buyback

Revenue Acceleration/Inflection

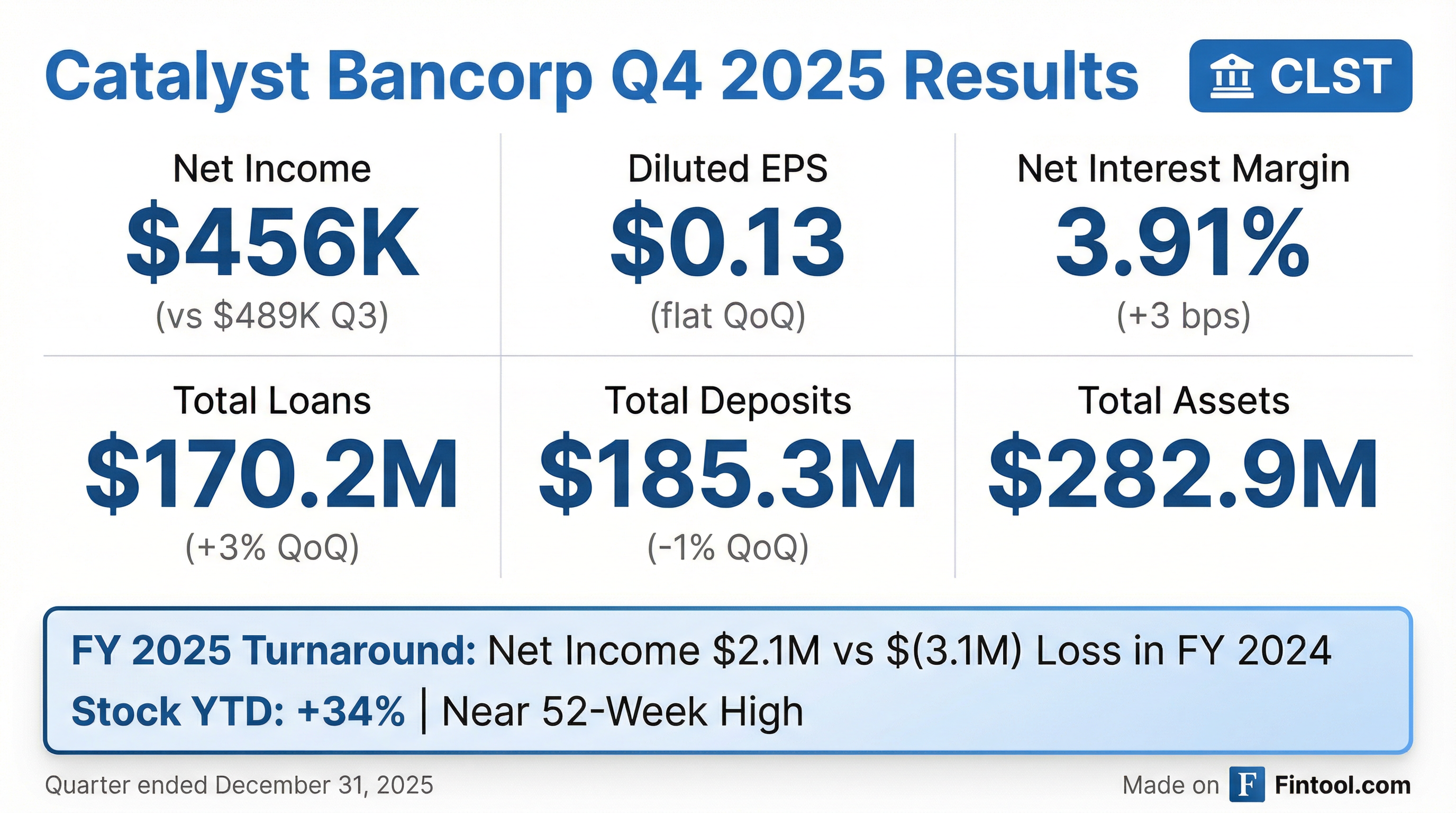

- Catalyst Bancorp, Inc. reported net income of $456,000, or $0.13 diluted EPS, for the fourth quarter of 2025, compared to net income of $489,000, or $0.13 diluted EPS, for the third quarter of 2025.

- For the full year ended December 31, 2025, the company reported net income of $2.1 million, or $0.56 diluted EPS, a significant improvement from a net loss of $3.1 million for the year ended December 31, 2024.

- Total loans increased by $5.4 million, or 3%, to $170.2 million at December 31, 2025, from September 30, 2025, with notable growth in commercial and industrial loans.

- The net interest margin widened to 3.91% for the fourth quarter of 2025, an increase of three basis points compared to the prior quarter, driven by declining funding costs.

- The company repurchased 54,693 shares of its common stock at an average cost of $14.76 per share during the fourth quarter of 2025 and announced a new plan to repurchase up to 205,000 shares.

Jan 29, 2026, 9:43 PM

Catalyst Bancorp, Inc. Reports Strong Full-Year 2025 Profit and Q4 Loan Growth

CLST

Earnings

Share Buyback

Revenue Acceleration/Inflection

- Catalyst Bancorp, Inc. reported net income of $456,000, or $0.13 diluted EPS, for the fourth quarter of 2025, contributing to a full-year 2025 net income of $2.1 million, or $0.56 diluted EPS, a significant improvement from a net loss of $3.1 million in 2024.

- Total loans grew to $170.2 million at December 31, 2025, an increase of 3% from September 30, 2025, primarily driven by a 22% increase in commercial and industrial loans in the fourth quarter.

- The company's net interest margin for the fourth quarter of 2025 was 3.91%, an increase of three basis points compared to the prior quarter.

- Total deposits were $185.3 million at December 31, 2025, a 1% decrease from September 30, 2025, although non-interest-bearing demand deposits increased by 9% during the quarter.

- Catalyst Bancorp repurchased 54,693 shares of its common stock at an average cost of $14.76 per share during Q4 2025 and announced a new repurchase plan for up to 205,000 shares.

Jan 29, 2026, 12:00 PM

Catalyst Bancorp Announces New Share Repurchase Plan

CLST

Share Buyback

- Catalyst Bancorp, Inc.'s Board of Directors approved its sixth share repurchase plan on November 20, 2025.

- Under this new plan, the company is authorized to purchase up to 205,000 shares, which represents approximately 5% of its outstanding common stock.

- From January 2023 through November 18, 2025, the company has repurchased a total of 1,180,817 shares at an average cost of $11.97 per share, accounting for approximately 22% of the common shares originally issued.

- As of the date of the Current Report on Form 8-K, 18,183 shares remained available for repurchase under the previous November 2024 Repurchase Plan.

Nov 21, 2025, 4:30 PM

Catalyst Bancorp Announces New Share Repurchase Plan

CLST

Share Buyback

- Catalyst Bancorp, Inc. approved its sixth share repurchase plan, the November 2025 Repurchase Plan.

- Under this plan, the Company may purchase up to 205,000 shares, representing approximately 5% of its outstanding common stock.

- Since January 2023 through November 18, 2025, the Company has repurchased a total of 1,180,817 shares at an average cost of $11.97 per share, which is approximately 22% of the common shares originally issued.

Nov 20, 2025, 10:30 PM

Catalyst Bancorp Announces Q2 2025 Results

CLST

Earnings

Share Buyback

- Catalyst Bancorp, Inc. reported net income of $521,000 for the second quarter of 2025, a decrease from $586,000 in the first quarter of 2025.

- Total loans increased by $1.5 million to $167.6 million and total deposits increased by $1.6 million to $182.2 million at June 30, 2025, compared to March 31, 2025.

- The net interest margin for the second quarter of 2025 improved to 3.98%, up nine basis points from the prior quarter.

- The company repurchased 62,385 shares of its common stock at an average cost of $11.91 per share during the second quarter of 2025.

- Non-performing assets totaled $1.8 million at June 30, 2025, a slight increase from $1.7 million at March 31, 2025.

Jul 24, 2025, 11:00 AM

Catalyst Bancorp Reports Q1 2025 Earnings and Repurchase Results

CLST

Earnings

Share Buyback

- Catalyst Bancorp reported Q1 2025 net income of $586K, down from $626K in Q4 2024**[1849867_20250424DA71434:0]** , amid muted loan growth and market turbulence.

- Total loans were approximately $166.1 million, reflecting stability with only marginal declines across segments**[1849867_20250424DA71434:0]** .

- Total deposits declined 3% to $180.6 million, with a maintained loan-to-deposit ratio of 92%.

- The bank’s net interest income of $2.4 million dropped by $107K compared to the prior quarter**[1849867_20250424DA71434:0]** .

- Catalyst Bancorp repurchased 72,949 shares at an average cost of $11.86, contributing to a cumulative repurchase of about 21% of its originally issued shares**[1849867_20250424DA71434:1]** .

Apr 24, 2025, 11:00 AM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more