Earnings summaries and quarterly performance for PC CONNECTION.

Executive leadership at PC CONNECTION.

Board of directors at PC CONNECTION.

Research analysts who have asked questions during PC CONNECTION earnings calls.

Recent press releases and 8-K filings for CNXN.

Connection Reports Q4 2025 Results with Increased Gross Profit and EPS

CNXN

Earnings

Guidance Update

Share Buyback

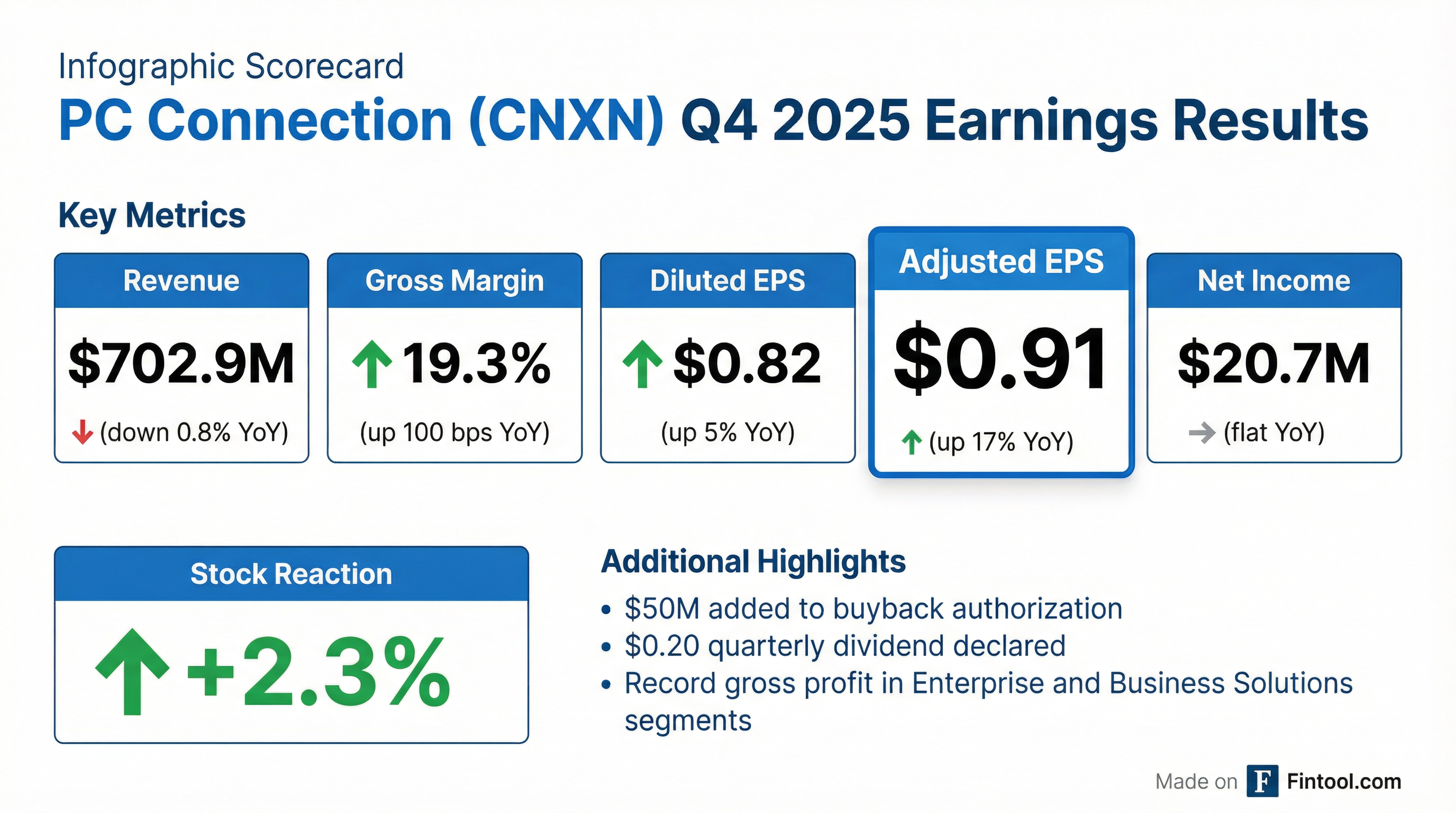

- Connection reported a 4.5% year-over-year increase in gross profit to $135.6 million and a 100 basis point expansion in gross margin to 19.3% for Q4 2025, despite a 0.8% decrease in total net sales to $702.9 million.

- Diluted earnings per share (EPS) increased 5.1% to $0.82, and adjusted diluted EPS rose 16.7% to $0.91 compared to the prior year.

- The company initiated cost-cutting measures, including a $3.1 million severance charge in Q4 2025, with total expected charges of $5.9 million-$6.2 million and anticipated annual cost savings of $7 million-$8 million.

- Connection returned $91.4 million to shareholders in 2025 through $76.1 million in share repurchases and $15.3 million in dividends, and the board authorized an additional $50 million for share repurchases and increased the quarterly dividend by 33% to $0.20 per share.

- For 2026, Connection expects to outperform the U.S. IT market by 200 basis points, with the market's blended growth estimated at 4%, driven by demand in AI-enabled solutions, cloud, and cybersecurity, though memory supply constraints are noted as a potential headwind.

2 days ago

Connection Reports Q4 2025 Results, Highlights Segment Strength and Cost Streamlining

CNXN

Earnings

Guidance Update

Layoffs

- **Connection (CNXN) reported Q4 2025 net sales of $702.9 million, a 0.8% decrease year-over-year, primarily due to a significant decline in the Public Sector segment, while gross profit increased 4.5% to $135.6 million and diluted EPS rose 5.1% to $0.82. **

- **The Business Solutions and Enterprise Solutions segments delivered strong gross profit growth of 11.4% and 7.1% respectively, driven by growth in software, cloud, security, and endpoint devices, which helped offset the Public Sector's 36.8% net sales decline. **

- **The company implemented cost streamlining actions, including a voluntary retirement offering and targeted headcount reductions, resulting in $3.1 million in severance charges in Q4 2025, with these initiatives expected to generate $7 million-$8 million in ongoing annual cost savings. **

- **Connection returned capital to shareholders by repurchasing approximately 179,000 shares for $10.7 million in Q4 2025 and increased its quarterly dividend by 33% to $0.20 per share. **

- **Management expects to outperform the U.S. IT market growth by 200 basis points in 2026, with the market estimated to grow around 4%, and anticipates operating margins to improve to 3.7%-3.9% by the end of 2026. **

2 days ago

Connection Reports Q4 2025 Results, Announces Dividend Increase and Cost Reductions

CNXN

Earnings

Dividends

Layoffs

- Connection reported Q4 2025 net sales of $702.9 million, a 0.8% decrease year-over-year, primarily due to a 36.8% decline in Public Sector Solutions. Despite this, gross profit increased 4.5% to $135.6 million, and gross margin expanded 100 basis points to 19.3%.

- For Q4 2025, diluted earnings per share (EPS) rose 5.1% to $0.82, and adjusted diluted EPS increased 16.7% to $0.91. The company's trailing twelve-month Adjusted EBITDA increased 6% to $126.4 million.

- The company initiated headcount reductions through a voluntary retirement offering and additional actions, incurring $3.1 million in severance charges in Q4 2025, with total expected charges of $5.9 million-$6.2 million over Q4 2025 and Q1 2026, projected to generate $7 million-$8 million in annual cost savings.

- Connection returned $91.4 million to shareholders in 2025 through share buybacks and dividends, and the board authorized an additional $50 million for share repurchases and declared a 33% increase in the quarterly dividend to $0.20 per share.

- Looking ahead to 2026, Connection anticipates outperforming the U.S. IT market by 200 basis points, with the market estimated to grow around 4%. Operating margins are expected to improve, targeting 3.7-3.9% by year-end.

2 days ago

PC Connection Reports Fourth Quarter and Full Year 2025 Results

CNXN

Earnings

Dividends

Share Buyback

- For the fourth quarter of 2025, net sales were $702.9 million, a 0.8% decrease year-over-year, while diluted EPS was $0.82, up from $0.78 in the prior year quarter. Full year 2025 net sales increased by 2.5% to $2.9 billion, and diluted EPS was $3.27, compared to $3.29 in 2024.

- The Board of Directors declared a quarterly dividend of $0.20 per share and approved a $50.0 million increase to the existing share repurchase program, bringing the total available to $81.2 million.

- In Q4 2025, the Business Solutions segment net sales increased by 4.2% to $273.5 million, and the Enterprise Solutions segment net sales increased by 11.9% to $338.7 million, while the Public Sector Solutions segment net sales decreased by 36.8% to $90.8 million.

2 days ago

Connection (CNXN) Reports Fourth Quarter and Full Year 2025 Results

CNXN

Earnings

Dividends

Share Buyback

- Connection (CNXN) reported net sales of $702.9 million for Q4 2025, a 0.8% decrease year-over-year, with diluted EPS of $0.82 and adjusted diluted EPS of $0.91.

- For the full year 2025, net sales increased by 2.5% to $2.9 billion, and adjusted diluted EPS grew by 6% to $3.44.

- The Board of Directors declared a quarterly dividend of $0.20 per share and approved a $50.0 million increase to the share repurchase program, bringing the total available for future repurchases to $81.2 million.

2 days ago

PC Connection Highlights Record Gross Profit, AI Growth Drivers, and Shareholder Returns

CNXN

Dividends

Share Buyback

New Projects/Investments

- PC Connection reported a record gross profit of $138.6 million for the last quarter and $520 million for 2024, achieving an 18.5% gross profit margin in 2024. Earnings per share for 2024 were $3.29, an increase from $3.15 in 2023.

- The company is committed to shareholder returns, having increased its quarterly dividend by 50% to 15 cents per share in 2025 and executing a share buyback program with $40 million remaining and $65 million bought back in the first three quarters of the current year.

- AI is a key growth driver for 2026 and beyond, expected to boost demand for edge compute, AI PCs, network bandwidth, data storage, and cloud access. PC Connection has invested in this area with a Helix center for applied AI and robotics, employing 120 AI specialists and 75 AI expert sales representatives.

- Gross margin expansion is driven by a shift towards higher-margin data center and technology business, along with the accounting treatment of SaaS and off-prem software deals, which contribute significantly to gross margin.

Dec 11, 2025, 4:30 PM

Connection (CNXN) Highlights Strong Financials, AI-Driven Growth, and Shareholder Returns

CNXN

Earnings

Dividends

Share Buyback

- Connection (CNXN) reported strong financial performance, including a record gross profit of $138.6 million in Q3 and $520 million for FY 2024, achieving an 18.5% gross profit margin for FY 2024. The company's FY 2024 gross basis revenue reached almost $3.7 billion.

- The company is actively returning capital to shareholders, having increased its quarterly dividend by 50% to 15 cents per share this year (2025) and executing approximately $65 million in share buybacks in the first three quarters of 2025.

- AI is identified as a significant demand driver for 2026 and beyond, necessitating increased edge compute, AI PCs, network bandwidth, and data storage. Connection is preparing for this with a dedicated AI center, 120 AI specialists, and 75 AI-trained sales representatives, while also pursuing tuck-in acquisitions.

Dec 11, 2025, 4:30 PM

PC Connection Highlights Record Gross Profit and AI-Driven Growth Strategy

CNXN

Earnings

Dividends

Share Buyback

- PC Connection reported a record gross profit of $138.6 million in the last quarter and $520 million for fiscal year 2024, achieving an 18.5% gross profit margin and $3.29 in EPS last year.

- The company is strategically positioned for growth in 2026 and beyond, with AI identified as a significant demand driver for modern infrastructure, digital workspaces, and supply chain solutions, supported by 120 AI specialists and 75 AI expert sales representatives.

- PC Connection demonstrates strong shareholder returns, increasing its quarterly dividend by 50% to 15 cents per share this year and executing $65 million in share buybacks in the first three quarters, with $40 million remaining in the program.

- Gross margin expansion is attributed to a mix shift towards higher-margin data center and technology solutions, alongside the accounting impact of SaaS and software deals, which accounted for 60% of the last quarter's margin improvement. The company maintains high customer loyalty with a Net Promoter Score of 82, significantly exceeding the technology industry average.

Dec 11, 2025, 4:30 PM

Connection (CNXN) Announces Q3 2025 Results

CNXN

Earnings

Guidance Update

Demand Weakening

- Connection reported Q3 2025 net sales of $709.1 million, a 2.2% decrease year-over-year, while gross profit increased 2.4% to a record $138.6 million and gross margin expanded 90 basis points to 19.6%. Diluted earnings per share (EPS) was $0.97, down $0.05 from the prior year, though adjusted diluted EPS remained flat at $0.97.

- Segment performance showed a 24.3% decrease in Public Sector Solutions net sales to $132.5 million, attributed to federal project timing and funding issues, while Business Solutions net sales grew 1.7% to $256.8 million and Enterprise Solutions net sales grew 7.7% to $319.8 million.

- The company returned capital to shareholders by paying a quarterly dividend of $0.15 per share and repurchasing approximately 84,000 shares for $5.1 million during Q3 2025.

- Management anticipates mid-single digit sales growth year-over-year for Q4 2025 and expects mid-single digit growth for 2026, noting that the Q3 backlog reached its highest level in nearly two years.

Oct 29, 2025, 8:30 PM

PC Connection Inc. Reports Third Quarter 2025 Results

CNXN

Earnings

Dividends

Demand Weakening

- For the third quarter ended September 30, 2025, Connection (CNXN) reported net sales of $709.1 million, a 2.2% decrease year-over-year.

- Gross profit increased 2.4% to $138.6 million, with the gross margin rising 90 basis points to 19.6%.

- Net income decreased 8.6% to $24.7 million, resulting in diluted earnings per share of $0.97.

- The company's Board of Directors declared a quarterly dividend of $0.15 per share.

- Segment performance was mixed, with Business Solutions net sales up 1.7% and Enterprise Solutions net sales up 7.7%, while Public Sector Solutions net sales decreased 24.3%.

Oct 29, 2025, 8:05 PM

Quarterly earnings call transcripts for PC CONNECTION.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more