Earnings summaries and quarterly performance for CEMEX SAB DE CV.

Research analysts who have asked questions during CEMEX SAB DE CV earnings calls.

Wilfredo Jorel Guilloty

Goldman Sachs

8 questions for CX

Adrian Huerta

JPMorgan Chase & Co.

7 questions for CX

Alejandra Obregon

Morgan Stanley

7 questions for CX

Anne Milne

Bank of America Merrill Lynch

7 questions for CX

Gordon Lee

BTG Pactual

7 questions for CX

Francisco Suarez

Scotiabank

6 questions for CX

Yassine Touahri

On Field Investment Research

6 questions for CX

Paul Roger

BNP Paribas

5 questions for CX

Benjamin Theurer

Barclays Corporate & Investment Bank

4 questions for CX

Carlos Peyrelongue

Bank of America

4 questions for CX

Adam Thalhimer

Thompson, Davis & Company, Inc.

3 questions for CX

Ben Theurer

Barclays

3 questions for CX

Marcelo Furlan

Itau

3 questions for CX

Anna Schumacher

BNP Paribas

2 questions for CX

Arnaud Pinatel

Onfield

2 questions for CX

Daniel Rojas

Bank of America Corporation

2 questions for CX

Alberto Valerio

UBS Group AG

1 question for CX

Alejandra Obregón Martínez

Morgan Stanley

1 question for CX

Anne Jean Milne

BofA Securities

1 question for CX

Benjamine Theurer

Barclays

1 question for CX

Daniel Sasson

Itaú BBA

1 question for CX

José Itzamna Espitia Hernández

BBVA México

1 question for CX

Recent press releases and 8-K filings for CX.

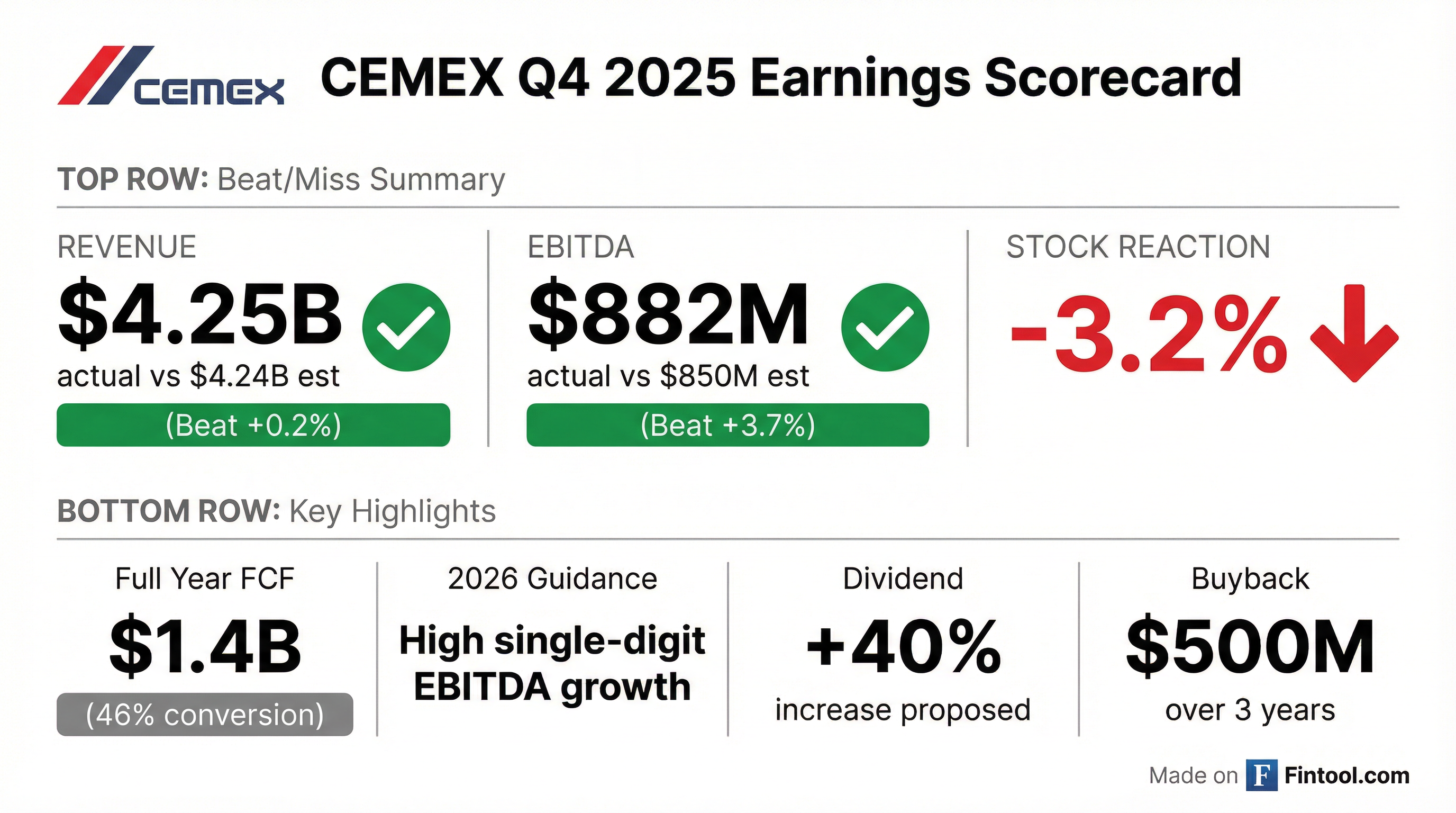

- CEMEX reported $1.4 billion in free cash flow from operations for full year 2025, achieving a 46% conversion rate (adjusted for one-off items) and fully realizing its $200 million EBITDA recurring savings target from Project Cutting Edge.

- For 2026, the company guides for high single-digit EBITDA growth, anticipating $165 million in incremental savings from Project Cutting Edge and $80 million in incremental EBITDA from completed growth portfolio projects.

- The board plans to propose an annual cash dividend close to 40% higher than 2025 and will activate a share buyback program of up to $500 million over the next three years, subject to shareholder approval.

- In Q4 2025, Mexico's EBITDA increased by 20% like-for-like with a 5 percentage point margin expansion, the U.S. posted record Q4 EBITDA, and EMEA achieved record EBITDA and EBITDA margin for full year 2025.

- CEMEX reported $1.4 billion in free cash flow from operations in 2025, with a 46% conversion rate, and an adjusted net income of $1.5 billion, a 41% increase year-over-year.

- The company fully achieved its $200 million EBITDA recurring savings target for 2025 under Project Cutting Edge and expanded the program to target $400 million in recurring savings by 2027.

- For 2026, CEMEX anticipates high single-digit rate growth in EBITDA, driven by a more favorable demand environment, $165 million in incremental Project Cutting Edge savings, and $80 million from completed growth projects.

- The board will propose an annual cash dividend of $180 million, representing an almost 40% increase over the prior year, and plans to activate a share buyback program of up to $500 million over the next three years, subject to shareholder approval.

- CEMEX reported $1.4 billion in adjusted free cash flow from operations in 2025, achieving a 46% conversion rate, and an adjusted net income of $1.5 billion, representing a 41% increase.

- The company fully realized $200 million in EBITDA recurring savings from Project Cutting Edge in 2025 and anticipates high single-digit EBITDA growth for 2026, supported by an additional $125 million in savings and an expected more favorable demand environment.

- To enhance shareholder returns, CEMEX's board will propose an annual cash dividend close to 40% higher than 2025, totaling $180 million, and plans to activate a buyback program for up to $500 million in shares over the next three years.

- CEMEX continued its portfolio rebalancing by divesting most operations in Panama and investing in targeted businesses in the U.S., while aiming to reach and maintain a net total financial leverage target of 1.5-2 times.

- Sales for the fourth quarter of 2025 increased by 11% to $4,179,704 thousand, while full-year 2025 sales remained flat at $16,131,879 thousand.

- Operating EBITDA for Q4 2025 grew by 16% to $781,034 thousand, and for the full year 2025, it increased by 1% to $3,080,073 thousand.

- CEMEX reported a controlling interest net loss of $(355,518) thousand or $(0.25) per ADS in Q4 2025, contrasting with a net income of $48,309 thousand or $0.03 per ADS in Q4 2024. However, full-year 2025 controlling interest net income increased by 2% to $960,158 thousand, or $0.66 per ADS.

- Consolidated cement volume in Q4 2025 increased by 4% to 13,361 thousand metric tons, while ready-mix volume decreased by 3% to 10,715 thousand cubic meters, and aggregates volume increased by 2% to 33,847 thousand metric tons.

- CEMEX reported a strong Q3 2025 performance with consolidated EBITDA rising sharply at a double-digit rate and net sales growing for the first time since Q1 2024. The EBITDA margin expanded by 2.5 percentage points, reaching its highest Q3 level since 2020.

- The company realized approximately $90 million in EBITDA savings in Q3 from Project Cutting Edge, remaining on track for its $200 million full-year 2025 goal. This contributed to free cash flow from operations of close to $540 million in Q3, an improvement of more than $350 million versus the prior year.

- CEMEX is advancing its portfolio rebalancing by divesting operations in Panama and acquiring a majority stake in Couch Aggregates in the U.S..

- The company is targeting around 45% free cash flow conversion from operations in 2026 and approximately 50% beyond 2026. For 2026, CEMEX expects Mexico demand volumes to grow by 2.5% to 3%.

- Cemex reported strong Q3 2025 results, with consolidated EBITDA rising at a double-digit rate and net sales growing for the first time since Q1 2024. The EBITDA margin expanded by 2.5 percentage points, reaching its highest level for a third quarter since 2020, driven by cost savings from Project Cutting Edge and higher prices.

- The company made significant progress on its strategic plan, realizing approximately $90 million in EBITDA savings from Project Cutting Edge in Q3 2025, keeping it on track for a $200 million full-year goal.

- Cemex continued its portfolio rebalancing efforts, completing the divestment of its Panama operations and consolidating Couch Aggregates in the U.S.. This strategy is expected to strengthen its U.S. aggregates footprint and offset the EBITDA loss from the Panama sale.

- Looking ahead, Cemex is targeting a 45% free cash flow conversion from operations in 2026, with further improvement to around 50% beyond 2026. The company anticipates Mexico's demand volumes to grow by at least 2.5%-3% in 2026.

- Consolidated EBITDA increased at a double-digit rate in Q3 2025, with substantive margin gains across all regions, largely driven by cost savings under Project Cutting Edge and higher prices.

- Project Cutting Edge generated approximately $90 million in EBITDA savings in Q3 2025, keeping the company on track to reach its $200 million full-year 2025 goal and $400 million in annualized recurring EBITDA savings by 2027.

- The free cash flow from operations conversion rate reached 41% on a trailing 12-month basis, with targets of around 45% for 2026 and 50% beyond 2026.

- Full-year EBITDA guidance for 2025 remains unchanged, expecting a flat performance versus 2024 with potential upside, and cash taxes guidance for 2025 was lowered by $100 million to $350 million.

- The company is actively pursuing bolt-on acquisitions in the U.S., primarily in aggregates, mortars, and admixtures, while prioritizing the U.S., Mexico, and Europe for growth and maintaining an investment-grade rating.

- Cemex reported strong financial results for Q3 2025, with consolidated Net Sales increasing by 5% to $4,245 million and Operating EBITDA growing by 19% to $882 million compared to Q3 2024.

- The company achieved EBITDA margin expansion of 2.5 percentage points year-over-year, reaching 20.8%, its highest third-quarter level since 2020.

- Project Cutting Edge delivered approximately US$90 million in EBITDA savings in Q3 2025 and is on track to meet its US$200 million full-year goal for 2025.

- Free Cash Flow from Operations significantly improved by 190% to $539 million in Q3 2025.

- Cemex also advanced its portfolio rebalancing strategy by completing the divestment of its operations in Panama and acquiring a majority stake in Couch Aggregates.

- Cemex reported a 38% increase in Controlling interest net income to US$318 million in the second quarter of 2025.

- The company raised its 2025 EBITDA savings target under Project Cutting Edge to US$200 million, up from US$150 million previously, with a run rate of US$400 million in savings expected by 2027.

- For Q2 2025, Net sales were US$4.1 billion and Operating EBITDA was US$823 million, with a 20% EBITDA margin.

- Cemex provided full-year 2025 EBITDA guidance for flat performance with potential upside.

- First installment of USD 32.5 million: MXN $0.014105 per share (USD $0.000746) for ordinary shares; MXN $0.042315 per CPO (USD $0.002238); USD $0.022380 per ADS.

- Payment dates: June 18, 2025 for bearer shares and CPO holders (MXN); ADS holders on or around June 26, 2025.

- Conversion rate: MXN 18.9083 per USD as determined by Banco de México on June 16, 2025.

- Tax treatment: Paid from the CUFIN as of December 31, 2013; no withholding applies.

Quarterly earnings call transcripts for CEMEX SAB DE CV.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more