Earnings summaries and quarterly performance for CITIZENS FINANCIAL SERVICES.

Executive leadership at CITIZENS FINANCIAL SERVICES.

Randall E. Black

Chief Executive Officer and President

David Z. Richards, Jr.

Senior Executive Vice President, Director of Emerging Markets

Jeffrey L. Wilson

Senior Executive Vice President, Chief Credit Officer

Jeffrey R. White

Executive Vice President, Chief Operating Officer

LeeAnn Gephart

Executive Vice President, Chief Banking Officer

Stephen J. Guillaume

Executive Vice President and Chief Financial Officer

Board of directors at CITIZENS FINANCIAL SERVICES.

Christopher W. Kunes

Director

Janie M. Hilfiger

Director

John P. Painter II

Director

Mickey L. Jones

Director

R. Joseph Landy

Chair of the Board

Rinaldo A. DePaola

Lead Independent Director

Robert W. Chappell

Director

Roger C. Graham, Jr.

Director

Terry B. Osborne

Director

Thomas E. Freeman

Director

Research analysts covering CITIZENS FINANCIAL SERVICES.

Recent press releases and 8-K filings for CZFS.

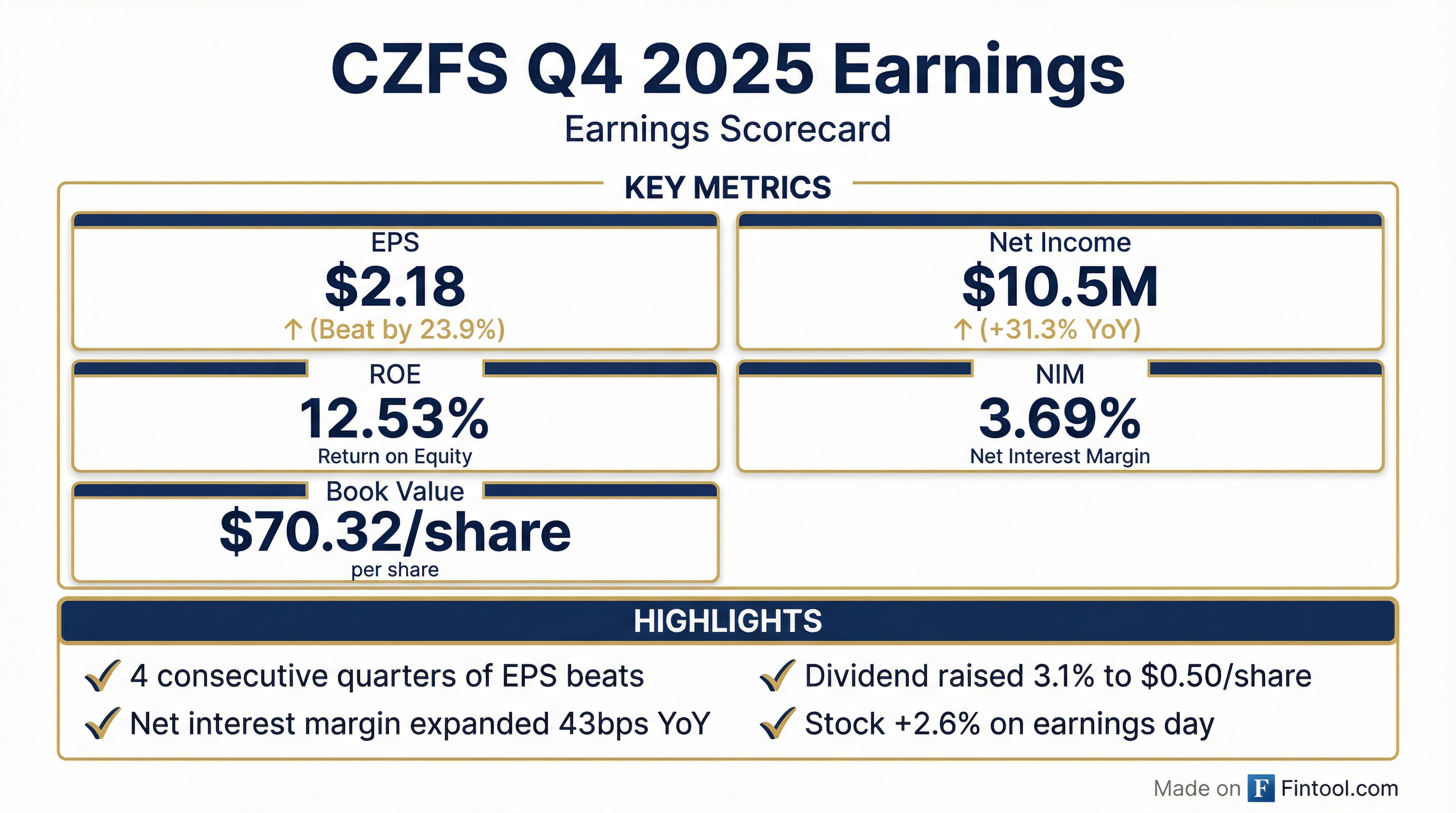

- Net income for Citizens Financial Services increased 31.5% year-over-year to $36,572,000 for the full year 2025, with basic earnings per share reaching $7.62. For the fourth quarter of 2025, net income was $10,483,000 and basic EPS was $2.19.

- The company reported an improved net interest margin of 3.50% for 2025, up from 3.13% in 2024, contributing to a 13.4% increase in net interest income before the provision for credit losses, totaling $98,001,000.

- Profitability ratios showed significant improvement, with return on average assets increasing to 1.21% for 2025 (1.37% annualized for Q4 2025) and return on average equity rising to 11.51% for 2025 (12.53% annualized for Q4 2025).

- As of December 31, 2025, total assets stood at $3.06 billion and stockholders' equity was $338.1 million. Non-performing assets increased by $578,000 since December 31, 2024, totaling $29,190,000, but remained 1.24% of total loans.

- For Q4 2025, Citizens Financial Services Inc. reported diluted EPS of $2.18 and net income of $10.5 million, with a Core Return on Average Tangible Common Equity (ROATCE) of 17.01%. For the full year 2025, diluted EPS was $7.62 and net income reached $36.6 million.

- As of December 31, 2025, the company's balance sheet showed total assets of $3.06 billion, gross loans of $2.35 billion, and deposits of $2.38 billion. Credit quality metrics for Q4 2025 included a Non-Performing Assets (NPAs) to Assets ratio of 0.95% and a Non-Performing Loans (NPLs) to Gross Loans ratio of 1.14%.

- The Tangible Book Value Per Share was $52.02 as of December 31, 2025, and total liquidity sources amounted to $1,392,583 thousand.

- Net income for CITIZENS FINANCIAL SERVICES INC. for the full year 2025 was $36,572,000, marking a 31.5% increase over 2024, with basic and diluted earnings per share reaching $7.62.

- For the three months ended December 31, 2025, net income totaled $10,483,000, an increase of $2,500,000 compared to the same period in 2024, and basic earnings per share was $2.19.

- The company's net interest income before the provision for credit losses for 2025 grew by 13.4% to $98,001,000, primarily due to an increase in the net interest margin to 3.50% from 3.13% in 2024.

- Return on average assets for 2025 improved to 1.21% (from 0.93% in 2024), and return on average equity increased to 11.51% (from 9.59% in 2024).

- As of December 31, 2025, total assets were $3.06 billion, while non-performing assets increased by $578,000 since December 31, 2024, to $29,190,000.

- Citizens Financial Services Inc. (CZFS) reported diluted earnings per share of $2.09 and net income of $10.0 million for the third quarter of 2025.

- As of September 30, 2025, the company's total assets were $3.1 billion, with gross loans of $2.3 billion and deposits of $2.4 billion.

- Profitability metrics for Q3 2025 included a Core Return on Average Tangible Common Equity (ROATCE) of 17.29% and a Net Interest Margin of 3.60%.

- Asset quality improved, with the Non-Performing Assets (NPAs) to Assets Ratio at 0.75% and the Non-Performing Loans (NPLs) to Gross Loans Ratio at 0.88% as of September 30, 2025.

- The Tangible Book Value Per Share was $49.83 as of September 30, 2025.

- Citizens Financial Services (CZFS) reported net income of $10,005,000 for the three months ended September 30, 2025, marking a 32.7% increase compared to the same period in 2024. For the first nine months of 2025, net income was $26,089,000, an increase of 31.5% over the comparable period in 2024.

- This performance translated to basic earnings per share of $2.09 for Q3 2025 and $5.44 for the first nine months of 2025.

- Profitability ratios improved, with annualized return on average assets at 1.33% for Q3 2025 and 1.16% for the nine months ended September 30, 2025. Annualized return on average equity reached 12.52% for Q3 2025 and 11.15% for the nine-month period.

- Net interest income before the provision for credit losses increased by 17.9% to $25,140,000 for Q3 2025 and by 12.9% to $71,790,000 for the first nine months of 2025.

- As of September 30, 2025, total assets stood at $3.06 billion, deposits at $2.41 billion (an increase of $29.2 million from December 31, 2024), and stockholders' equity at $327.7 million (an increase of $27.9 million from December 31, 2024).

- For the three months ended September 30, 2025, Citizens Financial Services reported net income of $10,005,000, an increase of 32.7% from the comparable period in 2024, with basic earnings per share of $2.09. For the first nine months of 2025, net income was $26,089,000, up 31.5% from the same period in 2024, and basic earnings per share was $5.44.

- The company saw improved profitability, with annualized return on average assets reaching 1.33% for Q3 2025 and 1.16% for the nine months ended September 30, 2025, up from 1.01% and 0.89% respectively in 2024. Annualized return on average equity also increased to 12.52% for Q3 2025 and 11.15% for the nine months, compared to 10.31% and 9.23% in the prior year periods.

- Net interest income before the provision for credit losses increased by 17.9% to $25,140,000 for the three months ended September 30, 2025, and by 12.9% to $71,790,000 for the nine months ended September 30, 2025, compared to the respective periods in 2024. The tax-effected net interest margin for the three months ended September 30, 2025, was 3.60%, up from 3.09% in the prior year, and for the nine months, it was 3.44%, up from 3.09%.

- Asset quality improved, with non-performing assets decreasing to $22,994,000 as of September 30, 2025, a 19.6% reduction since December 31, 2024. As a percentage of loans, non-performing assets stood at 0.98% as of September 30, 2025, down from 1.24% at December 31, 2024, and 1.03% at September 30, 2024.

| Metric | As of Sep 30, 2024 | Q3 2024 | YTD Q3 2024 | As of Dec 31, 2024 | Q3 2025 | YTD Q3 2025 | As of Sep 30, 2025 |

|---|---|---|---|---|---|---|---|

| Net Income ($USD Thousands) | N/A | $7,536 | $19,835 | N/A | $10,005 | $26,089 | N/A |

| Basic EPS ($USD) | N/A | $1.57 | $4.14 | N/A | $2.09 | $5.44 | N/A |

| Return on average assets (annualized) (%) | N/A | 1.01% | 0.89% | N/A | 1.33% | 1.16% | N/A |

| Return on average equity (annualized) (%) | N/A | 10.31% | 9.23% | N/A | 12.52% | 11.15% | N/A |

| Net interest income ($USD Thousands) | N/A | $21,324 | $63,582 | N/A | $25,140 | $71,790 | N/A |

| Net interest margin (tax equivalent) (%) | N/A | 3.09% | 3.09% | N/A | 3.60% | 3.44% | N/A |

| Non-performing assets ($USD Thousands) | $24,045 | N/A | N/A | $24,045 | N/A | N/A | $22,994 |

| Non-performing assets to total loans (%) | 1.03% | N/A | N/A | 1.24% | N/A | N/A | 0.98% |

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more