Earnings summaries and quarterly performance for Donnelley Financial Solutions.

Executive leadership at Donnelley Financial Solutions.

Board of directors at Donnelley Financial Solutions.

Research analysts who have asked questions during Donnelley Financial Solutions earnings calls.

Charles Strauzer

CJS Securities

4 questions for DFIN

Kyle Peterson

Needham & Company

3 questions for DFIN

Charlie Strauzer

CJS Securities, Inc.

2 questions for DFIN

Pete Heckmann

D.A. Davidson & Co.

2 questions for DFIN

Peter Heckmann

D.A. Davidson

2 questions for DFIN

Ross Cole

Needham & Company, LLC

2 questions for DFIN

Rajiv Sharma

B. Riley Securities

1 question for DFIN

Sam Salvas

Needham & Company

1 question for DFIN

Recent press releases and 8-K filings for DFIN.

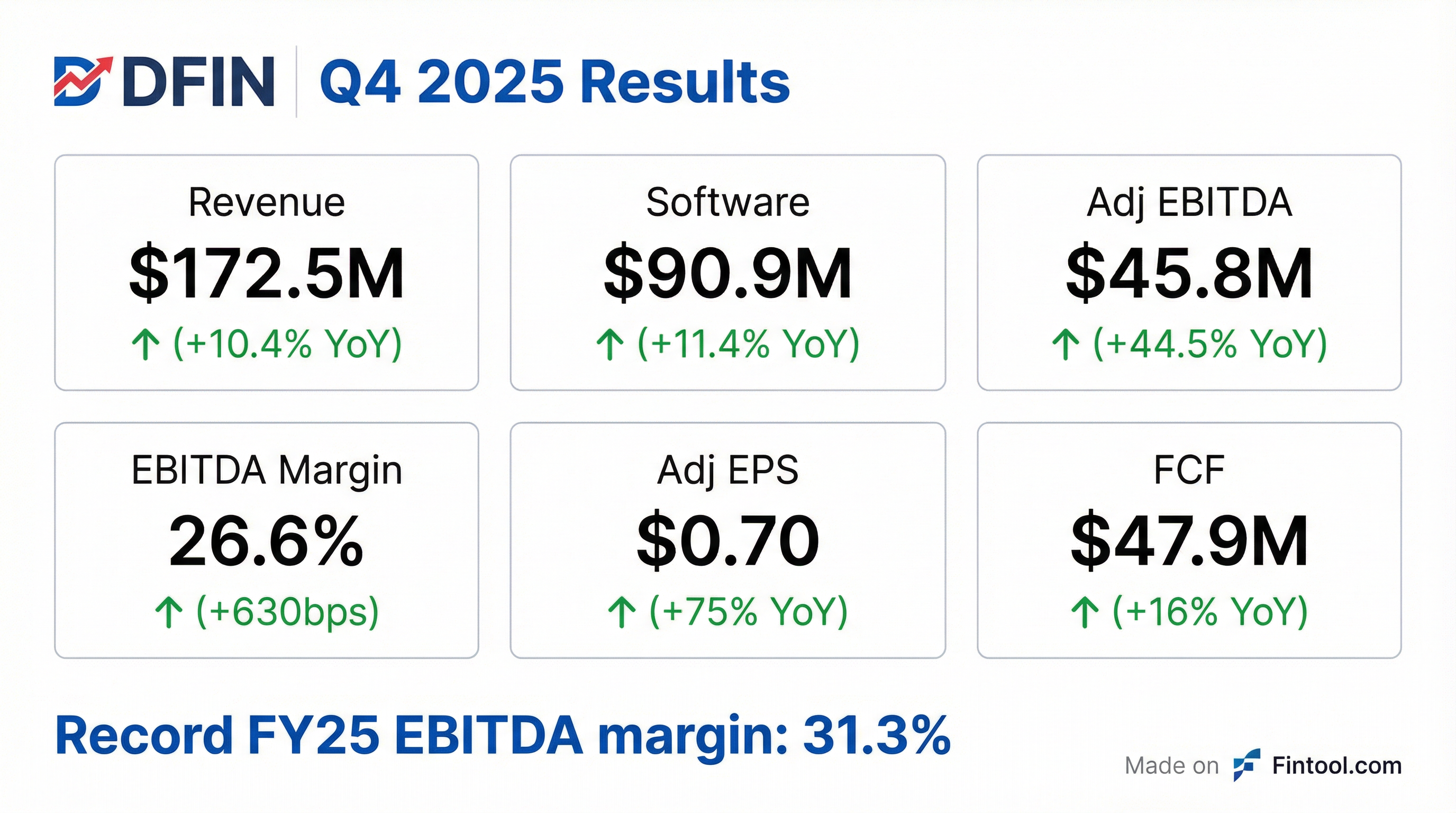

- Donnelley Financial Solutions reported strong Q4 2025 consolidated net sales of $172.5 million, an increase of 10.4% year-over-year, driven by 11.4% growth in software solutions and a 29% increase in transactional revenue.

- For the full year 2025, the company achieved $239.8 million in adjusted EBITDA, a 10.4% increase year-over-year, with a record adjusted EBITDA margin of 31.3%.

- Software solutions net sales reached $358.4 million for full year 2025, up 8.7% from 2024, comprising approximately 47% of total net sales.

- The company repurchased approximately 3.6 million shares in 2025, totaling $172.3 million at an average price of $48.36 per share, and expects Q1 2026 consolidated net sales between $200 million and $210 million with an adjusted EBITDA margin of 33% to 35%.

- Donnelley Financial Solutions delivered strong fourth quarter 2025 results, with 10.4% consolidated net sales growth and a 44% year-over-year increase in Adjusted EBITDA to $45.8 million, achieving an Adjusted EBITDA margin of 26.6%.

- For the full year 2025, the company reported $239.8 million in consolidated Adjusted EBITDA, an increase of 10.4% from 2024, and a record Adjusted EBITDA margin of 31.3%.

- Software solutions net sales grew 8.7% to $358.4 million for the full year 2025, comprising approximately 47% of total net sales.

- The company repurchased approximately 3.6 million shares in 2025, representing about 12% of the company's outstanding shares at an average price of $48.36 per share. In Q4 2025, 1,255,000 shares were repurchased for $60.7 million.

- For the first quarter of 2026, Donnelley Financial Solutions expects consolidated net sales in the range of $200 million-$210 million and a consolidated Adjusted EBITDA margin between 33%-35%.

- Donnelley Financial Solutions (DFIN) reported FY 2025 total revenue of $767.0 million and Q4 2025 total net sales of $172.5 million.

- The company achieved FY 2025 Adjusted EBITDA of $294.8 million with a 31.3% margin, and Q4 2025 Non-GAAP Adjusted EBITDA of $45.8 million.

- Software sales reached $358 million in FY 2025, contributing to a 76% recurring and reoccurring revenue profile.

- Free Cash Flow (reported) for FY 2025 was $107.8 million and $47.9 million for Q4 2025, with net debt at $146.8 million and a leverage ratio of 0.6x as of December 31, 2025.

- Donnelley Financial Solutions (DFIN) delivered strong Q4 2025 results, with consolidated net sales increasing 10.4% year-over-year to $172.5 million and Adjusted EBITDA growing 44% to $45.8 million, achieving an Adjusted EBITDA margin of 26.6%.

- For the full year 2025, DFIN achieved a record Adjusted EBITDA margin of 31.3% and grew software solutions net sales by 8.7% to $358.4 million, which comprised approximately 47% of total net sales.

- The company repurchased approximately 3.6 million shares in 2025, totaling $172.3 million at an average price of $48.36 per share, and concluded the year with a non-GAAP net leverage ratio of 0.6 times.

- DFIN is transitioning to its "sustained growth chapter" in 2026, aiming to accelerate its business mix shift towards recurring SaaS revenue, with recurring offerings approaching 80% of full-year total revenue.

- For Q1 2026, DFIN anticipates consolidated net sales to be in the range of $200 million to $210 million and an Adjusted EBITDA margin between 33% and 35%.

- Donnelley Financial Solutions (DFIN) reported Q4 2025 net sales of $172.5 million, an increase of 10.4% from Q4 2024, driven by 11.4% growth in software solutions and 12.4% in tech-enabled services net sales. Adjusted EBITDA for the quarter increased 44.5% to $45.8 million, with an Adjusted EBITDA margin of 26.6%.

- For the full-year 2025, net sales were $767.0 million, a 1.9% decrease from 2024, while Adjusted EBITDA grew 10.4% to $239.8 million, achieving a record Adjusted EBITDA margin of 31.3%. Software solutions net sales reached $358.4 million, representing 46.7% of total full-year net sales.

- The company repurchased 1,255,108 shares for $60.7 million in Q4 2025 and a total of 3,562,928 shares for $172.3 million for the full year 2025. As of December 31, 2025, $53.8 million remained under the share repurchase authorization.

- DFIN provided Q1 2026 guidance for total net sales between $200 million and $210 million and an Adjusted EBITDA margin of 33% to 35%.

- Donnelley Financial Solutions (DFIN) reported net sales of $172.5 million for the fourth quarter of 2025, an increase of 10.4% from the fourth quarter of 2024, and $767.0 million for the full-year 2025, a decrease of 1.9% from full-year 2024.

- Adjusted EBITDA for Q4 2025 was $45.8 million, up 44.5% compared to Q4 2024, and for full-year 2025 was $239.8 million, an increase of 10.4% from full-year 2024.

- The company repurchased 3,562,928 shares for $172.3 million during full-year 2025, with $53.8 million remaining in share repurchase authorization as of December 31, 2025.

- For the first quarter of 2026, DFIN provided guidance for total net sales between $200 million and $210 million and an Adjusted EBITDA margin of 33% to 35%.

- DFIN's business is transitioning, with software now just under 50% of revenue, and the company targets 60% of total sales from software solutions by 2028.

- EBITDA margins have increased to nearly 30% and are projected to be north of 30% long-term, driven by the shift to software and disciplined cost management.

- The company anticipates significant profitability impact from a rebound in capital markets activity, with incremental margins on a potential $100 million revenue increase estimated at 50%-60%.

- DFIN launched ArcFlex for the private funds market and a rebuilt Venue data room in the fourth quarter of 2025, while leveraging AI (e.g., Active Intelligence) across its products and operations.

- Donnelley Financial Solutions (DFIN) helps clients comply with SEC regulations, with its business currently just under 50% software and a long-term target of 60% of total sales from software solutions by 2028.

- The company's revenue base is 75% recurring or reoccurring, with event-driven revenue making up 25%. An improvement in capital markets activity, which is currently at historical lows, could lead to 50%-60% incremental margins on increased revenue.

- DFIN has improved its EBITDA margins from mid-teens to close to 30%, with a long-term guidance of north of 30%, driven by the shift to software, cost management, and pricing.

- DFIN is leveraging artificial intelligence (AI) across its product suite, including Active Intelligence, and for internal efficiencies, viewing it as a tailwind for the business.

- New growth initiatives include the ArcFlex offering for the private funds market and a rebuild of the Venue data room product rolled out in Q4 2025.

- Donnelley Financial Solutions (DFIN) is undergoing a business transformation, with software solutions now comprising just under 50% of revenue and a target to reach 60% of total sales from software by 2028.

- The company's revenue base is primarily recurring, with 75% of revenue being recurring or reoccurring. Event-driven transactional revenue is currently below $200 million (approximately $160 million on a trailing basis), which is more than $100 million off its long-term average, offering significant upside potential with 50%-60% incremental margins if capital markets activity improves.

- DFIN has significantly improved its EBITDA margins from mid-teens to close to 30%, with a long-term goal of north of 30%, primarily due to the shift towards higher-margin software solutions and disciplined cost management.

- Growth opportunities include the recent Q4 2025 rollout of a rebuilt Venue data room and the new ArcFlex offering for the private funds market, alongside leveraging AI for internal efficiencies and product enhancements like Active Intelligence.

- DFIN reported Q3 2025 consolidated net sales of $175.3 million, a 2.3% decrease from Q3 2024, while adjusted EBITDA increased 14.6% to $49.5 million with an adjusted EBITDA margin of 28.2%.

- Software solutions net sales grew 10.3% year-over-year, representing approximately 52% of total sales in the quarter, driven by strong demand for products like ActiveDisclosure and ArcSuite.

- The company completed the termination of its primary defined benefit pension plan, involving a $12.5 million cash contribution and a non-cash pre-tax settlement charge of $82.8 million, resulting in a $2.20 per diluted share negative EPS impact.

- DFIN repurchased approximately 659,000 shares for $35.5 million in Q3 2025, with $114.5 million remaining on its current share repurchase authorization as of September 30, 2025.

- For Q4 2025, the company expects consolidated net sales in the range of $150 million to $160 million and adjusted EBITDA margin between 22% and 24%, with the U.S. government shutdown impacting capital markets transactional revenue.

Quarterly earnings call transcripts for Donnelley Financial Solutions.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more