Earnings summaries and quarterly performance for QUEST DIAGNOSTICS.

Executive leadership at QUEST DIAGNOSTICS.

James E. Davis

Chief Executive Officer and President

Catherine T. Doherty

Executive Vice President, Regional Businesses

Karthik Kuppusamy

Senior Vice President, Clinical Solutions

Michael E. Prevoznik

Senior Vice President, General Counsel

Sam A. Samad

Executive Vice President, Chief Financial Officer

Board of directors at QUEST DIAGNOSTICS.

Denise M. Morrison

Director

Gary M. Pfeiffer

Director

Luis A. Diaz, Jr., M.D.

Director

Robert B. Carter

Director

Timothy L. Main

Director

Timothy M. Ring

Lead Independent Director

Tracey C. Doi

Director

Vicky B. Gregg

Director

Wright L. Lassiter III

Director

Research analysts who have asked questions during QUEST DIAGNOSTICS earnings calls.

Elizabeth Anderson

Evercore ISI

8 questions for DGX

Erin Wright

Morgan Stanley

8 questions for DGX

Jack Meehan

Nephron Research LLC

8 questions for DGX

Kevin Caliendo

UBS

8 questions for DGX

Patrick Donnelly

Citi

8 questions for DGX

Michael Cherny

Leerink Partners

7 questions for DGX

Andrew Brackmann

William Blair & Company, L.L.C.

6 questions for DGX

David Westenberg

Piper Sandler

6 questions for DGX

Luke Sergott

Barclays

6 questions for DGX

Michael Ryskin

Bank of America Merrill Lynch

6 questions for DGX

Pito Chickering

Deutsche Bank

6 questions for DGX

Tycho Peterson

Jefferies

5 questions for DGX

Andrew Brackman

William Blair

2 questions for DGX

Ann Hynes

Mizuho Financial Group

2 questions for DGX

Benjamin Shaver

Deutsche Bank AG

2 questions for DGX

Eric Caldwell

Baird

2 questions for DGX

Noah Kava

Jefferies

2 questions for DGX

Aaron David Izen

Bank of America

1 question for DGX

Anna Krasinski

Barclays

1 question for DGX

Eugene Park

Robert W. Baird & Co. Incorporated

1 question for DGX

Lisa Gill

JPMorgan Chase & Co.

1 question for DGX

Meghan Holtz

Jefferies Financial Group Inc.

1 question for DGX

Michael Cherney

Jefferies Financial Group Inc.

1 question for DGX

Stephanie Davis

Barclays

1 question for DGX

Recent press releases and 8-K filings for DGX.

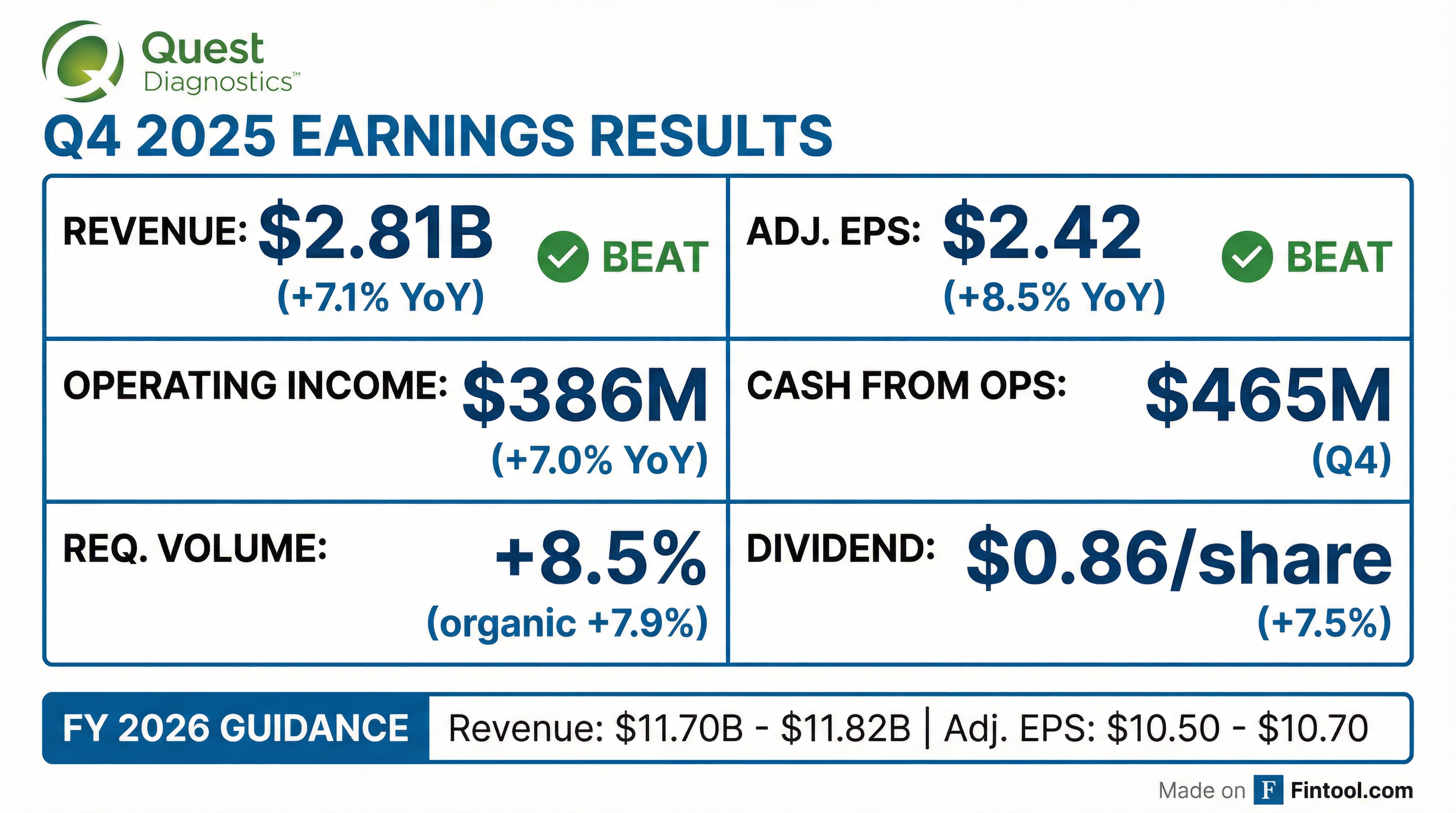

- Quest Diagnostics reported Q4 2025 net revenues of $2.806 billion, up 7.1% year-over-year.

- Q4 2025 adjusted operating margin was 15.3%, down from 15.6% in Q4 2024.

- Q4 2025 adjusted diluted EPS was $2.42, an 8.5% increase year-over-year.

- Full-year 2026 guidance calls for revenues of $11.70 billion–$11.82 billion and adjusted diluted EPS of $10.50–$10.70.

- Q4 consolidated revenues of $2.81 billion, up 7.1% year-over-year; organic revenue growth of 6.4% and requisition volumes up 8.5%.

- Full-year 2025 delivered double-digit growth in revenues and earnings per share.

- 2026 guidance: revenues of $11.7 billion–$11.82 billion (+6.0%–7.1%), adjusted EPS of $10.50–$10.70, and cash from operations of ~$1.75 billion.

- Co-lab solutions expected to generate $1 billion in annual revenues in 2026; partnership with Corewell Health will add $250 million of organic revenue at low single-digit margins.

- Consumer-initiated testing grew >20% in 2025, delivering ~$250 million in revenues; QuestHealth.com expanded to over 150 tests.

- Q4 2025 revenues were $2.81 billion (+7.1% YoY; organic +6.4%), total volume +8.5%, with adjusted EPS of $2.42 (+8.5% YoY).

- 2025 full year delivered double-digit revenue and EPS growth; cash from operations was $1.89 billion.

- 2026 guidance: revenues of $11.7 billion–$11.82 billion (+6.0%–7.1%), adjusted EPS $10.50–$10.70, cash from operations ~ $1.75 billion, and capex ~ $550 million; operating margin is expected to expand.

- Strategic initiatives include scaling co-lab solutions with Corewell Health (targeting $1 billion in annual revenues in 2026) and growing consumer-initiated testing (nearly $250 million in 2025 via QuestHealth.com and wellness partnerships).

- Q4 2025 revenues were $2.81 billion, up 7.1% YoY, with organic revenue growth of 6.4%, and adjusted EPS of $2.42 (vs. $2.23 prior year).

- Full-year 2025 delivered double-digit growth in both revenues and EPS, driven by clinical innovations, strategic collaborations, and operational enhancements.

- 2026 guidance calls for revenues of $11.70 – $11.82 billion (6.0%–7.1% growth), adjusted EPS of $10.50 – $10.70, operating margin expansion, cash from operations of ~$1.75 billion, and CapEx of ~$550 million.

- Strategic initiatives include a one-year delay of PAMA rate cuts through end 2026, 3% cost savings via the Invigorate program, and expected $250 million in low-single-digit-margin co-lab revenues from Corewell Health in 2026.

- Q4 2025 revenues of $2.81 billion (+7.1% y/y); reported diluted EPS of $2.18 (+11.8% y/y) and adjusted diluted EPS of $2.42 (+8.5% y/y)

- FY 2025 net revenues of $11.04 billion (+11.8% y/y); reported diluted EPS of $8.75 (+13.8% y/y); adjusted diluted EPS of $9.85 (+10.3% y/y); cash from operations of $1.89 billion

- 2026 guidance: revenues of $11.70–11.82 billion, reported diluted EPS of $9.45–9.65, and adjusted diluted EPS of $10.50–10.70

- Quest Diagnostics’ Board approved a 7.5% increase in its quarterly cash dividend to $0.86 per share (annualized $3.44), payable April 20, 2026, to shareholders of record April 6, 2026.

- The Board also increased its share repurchase authorization by $1 billion, adding to the roughly $0.4 billion available under the existing program as of December 31, 2025.

- Quest Diagnostics expanded network access with Elevance and secured partnerships with large corporate physician groups to drive growth in hospital labs, reference testing, collaborative lab solutions and life sciences services.

- Consumer-initiated testing grew from $30 million in 2021 to a $250 million run rate by Q4, with QuestHealth.com contributing $100 million and channel partners (e.g., Function Health, Whoop) adding $150 million.

- Focused on advanced diagnostics—including cardiometabolic, autoimmune and brain health—with commercial launch of the AB4240 Alzheimer's blood-based test for amyloid and tau biomarkers.

- Reaffirmed 2026 guidance: 4–5% total revenue growth, 75–150 bps operating margin expansion, 7–9% adjusted EPS growth, and $3–3.3 billion free cash flow after capex.

- Tests one-third of U.S. adults, completing ~220 million requisitions and directly drawing blood for ~80 million individuals in 2024; network spans 8,000 sites and covers 90% of lives with 80 billion data points ( ).

- Prevention and wellness represent ~33% of revenue; consumer-initiated testing surged from $30 million in 2021 to a $250 million run rate in 2025, led by QuestHealth.com’s $100 million business ( ).

- Operates in a $90 billion laboratory market (~2% of a $5 trillion healthcare spend); targets 4–5% organic revenue growth, 75–150 bps margin expansion, 7–9% EPS growth, and $3–3.3 billion free cash flow (2025–27) with capital allocated to M&A, dividends, and share repurchases ( ).

- $2.8 billion deployed in M&A over three years—including the $1 billion LifeLabs Canada acquisition—and growing co-lab hospital services from $800 million toward a $1 billion target by 2026 ( ).

- Quest Diagnostics tested one-third of the U.S. adult population in 2024 with 217 million requisitions and 80 million blood draws, covering 110 million unique patients across 8,000+ locations.

- Prevention and wellness represents ~1/3 of revenue, while the consumer business rose from $30 million in 2021 to a $250 million run rate in Q4 2025 via QuestHealth.com ($100 million) and channel partners ($150 million).

- The company reaffirmed its 2026 outlook: 4–5% revenue growth, 75–150 bps operating margin expansion, 7–9% adjusted EPS growth, and $3–3.3 billion free cash flow (2025–2027) targets.

- Key investments include AI/automation (end-to-end lab systems, digital cytology), $2.8 billion in M&A (2023–25), and Project Nova to modernize the order-to-cash infrastructure.

- Quest Diagnostics and Corewell Health complete laboratory services joint venture, Diagnostic Lab of Michigan, LLC, with Quest owning 51% and Corewell Health 49%

- Existing Quest and Corewell laboratories will continue providing services until a new 100,000-square-foot facility opens in Q1 2027

- Quest begins deploying Co-Lab Solutions across 21 Corewell Health hospitals, including supply chain, lab management, patient blood and anemia management, and lab analytics and stewardship

Quarterly earnings call transcripts for QUEST DIAGNOSTICS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more