Earnings summaries and quarterly performance for DIVERSIFIED HEALTHCARE TRUST.

Executive leadership at DIVERSIFIED HEALTHCARE TRUST.

Board of directors at DIVERSIFIED HEALTHCARE TRUST.

Research analysts who have asked questions during DIVERSIFIED HEALTHCARE TRUST earnings calls.

John Massocca

B. Riley Financial

4 questions for DHC

Also covers: BEEP, CMCT, CTO +13 more

JH

Justin Haasbeek

RBC Capital Markets

3 questions for DHC

Also covers: OHI

MC

Michael Carroll

RBC Capital Markets

3 questions for DHC

Also covers: AHR, ARE, COLD +18 more

MD

Michael Diana

Maxim Group

2 questions for DHC

Also covers: BEEP, FPAY, GIPR +4 more

BM

Bryan Maher

B. Riley Securities

1 question for DHC

Also covers: BEEP, GMRE, GNL +8 more

JM

John Masoka

B. Riley

1 question for DHC

Recent press releases and 8-K filings for DHC.

DIVERSIFIED HEALTHCARE TRUST Reports Strong Q4 and Full-Year 2025 Results, Provides Optimistic 2026 Guidance

DHC

Earnings

Guidance Update

New Projects/Investments

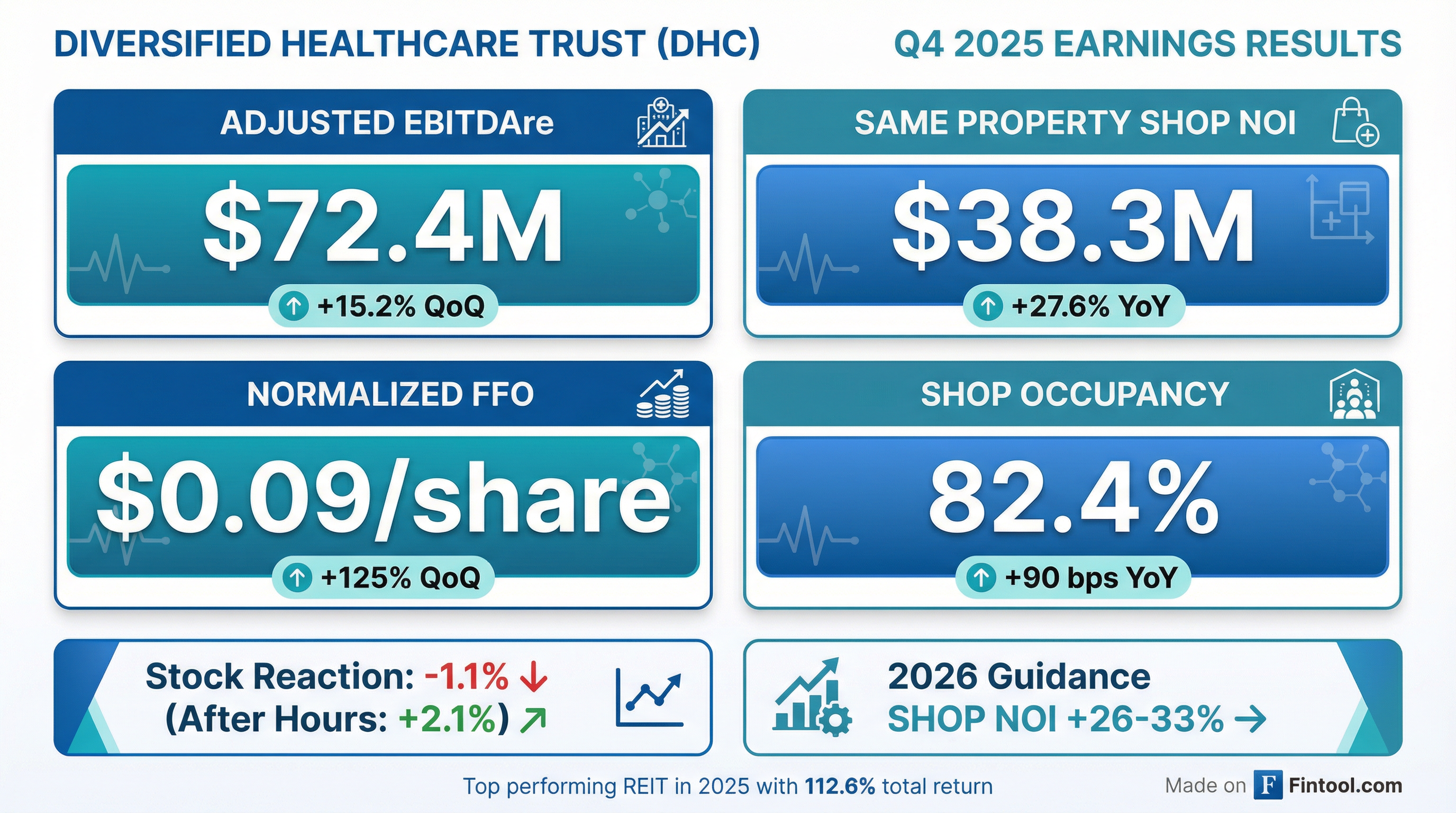

- DHC reported strong Q4 2025 results, including total revenue of $379.6 million, Adjusted EBITDAre of $72.4 million, and Normalized FFO of $0.09 per share.

- For the full year 2025, DHC achieved 31.3% consolidated NOI growth and significantly reduced its leverage, with Net Debt to Adjusted EBITDA decreasing from 11.2x at year-end 2024 to 8.1x at the end of 2025.

- The company completed over $1.4 billion in capital markets activity in 2025, including $605 million in asset sales, resulting in no debt maturities until 2028.

- DHC provided 2026 guidance, projecting Normalized FFO of $0.52-$0.58 per share and Adjusted EBITDAre between $290 million and $305 million.

- The company expects continued strong performance in its SHOP segment, with projected SHOP NOI of $175 million-$185 million for 2026, and plans ROI projects to add approximately 500 SHOP units with an unlevered mid-teens ROI.

4 days ago

Diversified Healthcare Trust Reports Strong Q4 2025 Results and Provides Optimistic 2026 Guidance

DHC

Earnings

Guidance Update

M&A

- Diversified Healthcare Trust (DHC) reported Q4 2025 total revenue of $379.6 million, Adjusted EBITDAre of $72.4 million, and Normalized FFO of $0.09 per share. For the full year 2025, the company achieved 31.3% consolidated NOI growth and reduced its leverage by over three turns, with no debt maturities until 2028.

- In 2025, DHC completed $1.4 billion in capital markets activity, including asset sales, and wound down AlerisLife by transitioning 116 communities to new operators. Full-year dispositions totaled 69 properties for approximately $605 million, reducing net debt to adjusted EBITDAre from 11.2x at year-end 2024 to 8.1x at year-end 2025.

- For 2026, DHC provided guidance including SHOP segment NOI of $175 million-$185 million, Adjusted EBITDAre of $290 million-$305 million, and Normalized FFO of $0.52-$0.58 per share. The company expects to achieve 200 basis points of margin improvement on a same-store basis for SHOP.

- DHC plans to add approximately 500 SHOP units through repositioning underutilized areas, expecting an unlevered mid-teens ROI, and anticipates a reduction in full-year recurring capital expenditures by over 18% at the midpoint compared to 2025.

4 days ago

Diversified Healthcare Trust Announces Strong Q4 and Full Year 2025 Results, Provides 2026 Guidance

DHC

Earnings

Guidance Update

M&A

- Diversified Healthcare Trust reported strong financial performance for Q4 2025, with same property SHOP NOI increasing 27.6% to $38.3 million and full year SHOP NOI growing 31.3% to $139.3 million.

- The company significantly improved its financial position by selling 37 non-core properties for approximately $250.0 million and using the proceeds to fully repay its zero coupon notes due in 2026, resulting in no debt maturities until 2028.

- DHC was recognized as the top performing REIT in the U.S. in 2025, achieving a total shareholder return of 112.6%.

- For full year 2026, DHC provided positive guidance, expecting SHOP NOI growth of 26% to 33% and Normalized FFO per common share between $0.52 and $0.58.

- As of December 31, 2025, DHC maintained $255.4 million in total liquidity, comprising $105.4 million in cash and cash equivalents and $150.0 million available on its undrawn secured revolving credit facility.

4 days ago

DIVERSIFIED HEALTHCARE TRUST Reports Q4 and Full-Year 2025 Results, Highlights Deleveraging and Asset Sales

DHC

Earnings

Debt Issuance

Guidance Update

- DIVERSIFIED HEALTHCARE TRUST (DHC) reported total revenues of $379.6 million and a net loss of $(21.2) million for Q4 2025, with Normalized FFO of $21.8 million. For the full year 2025, total revenues were $1.54 billion and the net loss was $(285.9) million, with Normalized FFO of $64.4 million.

- DHC executed significant capital recycling, generating $604.9 million in gross proceeds from asset sales in 2025, contributing to $1.1 billion in gross proceeds from 64 properties sold since 2023, primarily for debt repayment. An additional $100 million in gross proceeds from 13 SHOP communities is expected in 1Q26.

- The company achieved substantial balance sheet improvement in 2025, reducing leverage from 11.2x to 8.1x and raising nearly $1.5 billion from diversified funding sources. This led to credit rating upgrades from Moody's (to Caa1) and S&P Global (to B-) in 3Q25.

- DHC's Life Science portfolio maintained 97% occupancy across 926,000 SF, while its NNN Senior Living and NNN Wellness Centers segments both reported 100% occupancy.

4 days ago

Diversified Healthcare Trust Reports Strong Q4 and Full-Year 2025 Results, Provides 2026 Guidance

DHC

Earnings

Guidance Update

New Projects/Investments

- Diversified Healthcare Trust (DHC) reported a successful 2025, achieving full-year consolidated NOI growth of 31.3% and ending the year as the best performing REIT in the U.S. by share price appreciation and total shareholder return.

- For Q4 2025, DHC delivered total revenue of $379.6 million, Adjusted EBITDAre of $72.4 million, and Normalized FFO of $21.8 million or $0.09 per share.

- Strategic initiatives in 2025 included $605 million in asset sales and the wind down of AlerisLife, leading to a reduction in Net Debt to Adjusted EBITDA from 11.2x at year-end 2024 to 8.1x at the end of 2025, with no debt maturities until 2028.

- DHC issued 2026 guidance, projecting Adjusted EBITDAre between $290 million and $305 million and Normalized FFO of $0.52-$0.58 per share, with expected recurring capital expenditures ranging from $100 million-$115 million.

4 days ago

DIVERSIFIED HEALTHCARE TRUST Reports Strong 2025 Performance and Issues 2026 Guidance

DHC

Earnings

Guidance Update

Debt Issuance

- DIVERSIFIED HEALTHCARE TRUST (DHC) achieved 113% total shareholder returns in 2025, ranking #1 among U.S. listed REITs, and improved its Senior Housing Operating Portfolio (SHOP) performance with 81.6% occupancy and a 45.2% increase in SHOP Net Operating Income (NOI).

- The company advanced its capital recycling strategy with $605 million of non-core property sales completed in 2025, with an additional $23 million expected in Q1 2026.

- DHC raised approximately $868 million of debt and fully redeemed its 2026 zero coupon senior secured notes on December 29, 2025, extending its debt maturity runway to 2028.

- For the full year 2026, DHC provided guidance for Normalized FFO between $125,000 and $140,000 (thousands) and Total NOI between $297,000 and $313,000 (thousands).

- In Q3 2025, Moody's and S&P Global upgraded DHC's credit ratings to Caa1 and B-, respectively, as the company targets leverage of 6.5x to 7.5x.

4 days ago

DIVERSIFIED HEALTHCARE TRUST Reports Significant Capital Recycling, Deleveraging, and Portfolio Performance in 2025

DHC

Debt Issuance

M&A

Earnings

- DIVERSIFIED HEALTHCARE TRUST (DHC) has actively engaged in capital recycling, selling 64 properties for gross proceeds of $1.1 billion since 2023, including $604.9 million in 2025, and anticipates selling an additional 13 SHOP communities for approximately $100 million in 1Q26.

- The company significantly improved its balance sheet in 2025, reducing leverage from 11.2x to 8.1x and achieving 94.3% fixed rate debt. DHC also raised nearly $1.5 billion from diversified funding sources.

- DHC's Medical Office and Life Science portfolios demonstrated strong performance, with the Medical Office segment generating $67 million in annual cash NOI and the Life Science segment generating $30 million in annual cash NOI as of Q4 2025. The Outpatient Medical portfolio also reported 4.9% YoY NOI growth for Q4 2025.

- For the full year ended December 31, 2025, DHC reported total revenues of $1,537,853 thousand and Normalized FFO of $64,421 thousand.

4 days ago

Diversified Healthcare Trust Announces Strong Fourth Quarter 2025 Results and Positive 2026 Guidance

DHC

Earnings

Guidance Update

Dividends

- Diversified Healthcare Trust (DHC) reported a net loss of $21.2 million, or $0.09 per share, and Normalized FFO of $21.8 million, or $0.09 per share, for the fourth quarter ended December 31, 2025.

- The company achieved significant operational improvements, with same property SHOP Net Operating Income (NOI) increasing 27.6% to $38.3 million in Q4 2025, and full year SHOP NOI growing 31.3% to $139.3 million.

- DHC completed strategic dispositions, selling 37 non-core properties for approximately $250.0 million in Q4 2025, using the proceeds to repay debt and improve its balance sheet, resulting in net debt to annualized Adjusted EBITDAre decreasing to 8.1x from 11.2x as of December 31, 2024.

- The company provided full year 2026 financial guidance, expecting SHOP NOI growth of 26% to 33%, with Normalized FFO per common share projected between $0.52 and $0.58.

- DHC declared a quarterly distribution of $0.01 per share on January 15, 2026, which was paid on February 19, 2026.

5 days ago

Diversified Healthcare Trust Provides Business Update on Property Sales, Debt Repayment, and Operator Transitions

DHC

New Projects/Investments

Debt Issuance

- Diversified Healthcare Trust (DHC) completed the sale of 69 non-core properties for approximately $605 million in gross proceeds during 2025.

- DHC fully repaid its 2026 zero coupon senior secured notes on December 29, 2025, using cash on hand and proceeds from asset sales, resulting in no debt maturities until 2028.

- The company completed the transition of all 116 Senior Housing Operating Portfolio (SHOP) communities from AlerisLife Inc. to new operators as of December 31, 2025.

Jan 5, 2026, 1:00 PM

Diversified Healthcare Trust Reports Q3 2025 Results and Updates 2025 Guidance

DHC

Earnings

Guidance Update

New Projects/Investments

- Diversified Healthcare Trust reported total revenues of $388.7 million and a net loss of $164.0 million, or $0.68 per share, for Q3 2025, with Normalized FFO of $9.7 million, or $0.04 per share.

- The company projects total Net Operating Income (NOI) between $265 million and $285 million for the full year 2025.

- DHC expects to complete $625 million to $635 million in dispositions for 2025, with $414 million completed year-to-date as of December 5, 2025, and $192 million anticipated by year-end.

- The company maintains a strong liquidity position of $351 million as of September 30, 2025.

- 109 of 116 planned Senior Housing Operating Portfolio (SHOP) community operator transitions have been completed as of December 5, 2025, with all 116 on track for completion by year-end.

Dec 8, 2025, 9:24 PM

Quarterly earnings call transcripts for DIVERSIFIED HEALTHCARE TRUST.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more