Earnings summaries and quarterly performance for DHT Holdings.

Research analysts who have asked questions during DHT Holdings earnings calls.

FM

Frode Morkedal

Clarksons Securities AS

6 questions for DHT

Also covers: CLCO, CMBT, ECO +4 more

JC

Jonathan Chappell

Evercore ISI

6 questions for DHT

Also covers: ASC, CHRW, CNI +20 more

Omar Nokta

Jefferies

4 questions for DHT

Also covers: AMKBY, ASC, CCEC +21 more

GS

Geoffrey Scott

Scott Asset Management

3 questions for DHT

Also covers: FRO, PCYO

EH

Eirik Haavaldsen

Pareto Securities

2 questions for DHT

Also covers: BWLP, CMBT

GL

Greg Lewis

BTIG

2 questions for DHT

Also covers: BLBD, BORR, CLSK +9 more

GL

Gregory Lewis

BTIG, LLC

2 questions for DHT

Also covers: BLBD, BTDR, CIFR +26 more

PH

Petter Haugen

ABG Sundal Collier

1 question for DHT

Also covers: BWLP, CLCO, ECO +3 more

SE

Sherif Elmaghrabi

BTIG

1 question for DHT

Also covers: BE, FIP, FRO +12 more

Recent press releases and 8-K filings for DHT.

DHT announces Q4 2025 results and dividend

DHT

Earnings

Dividends

New Projects/Investments

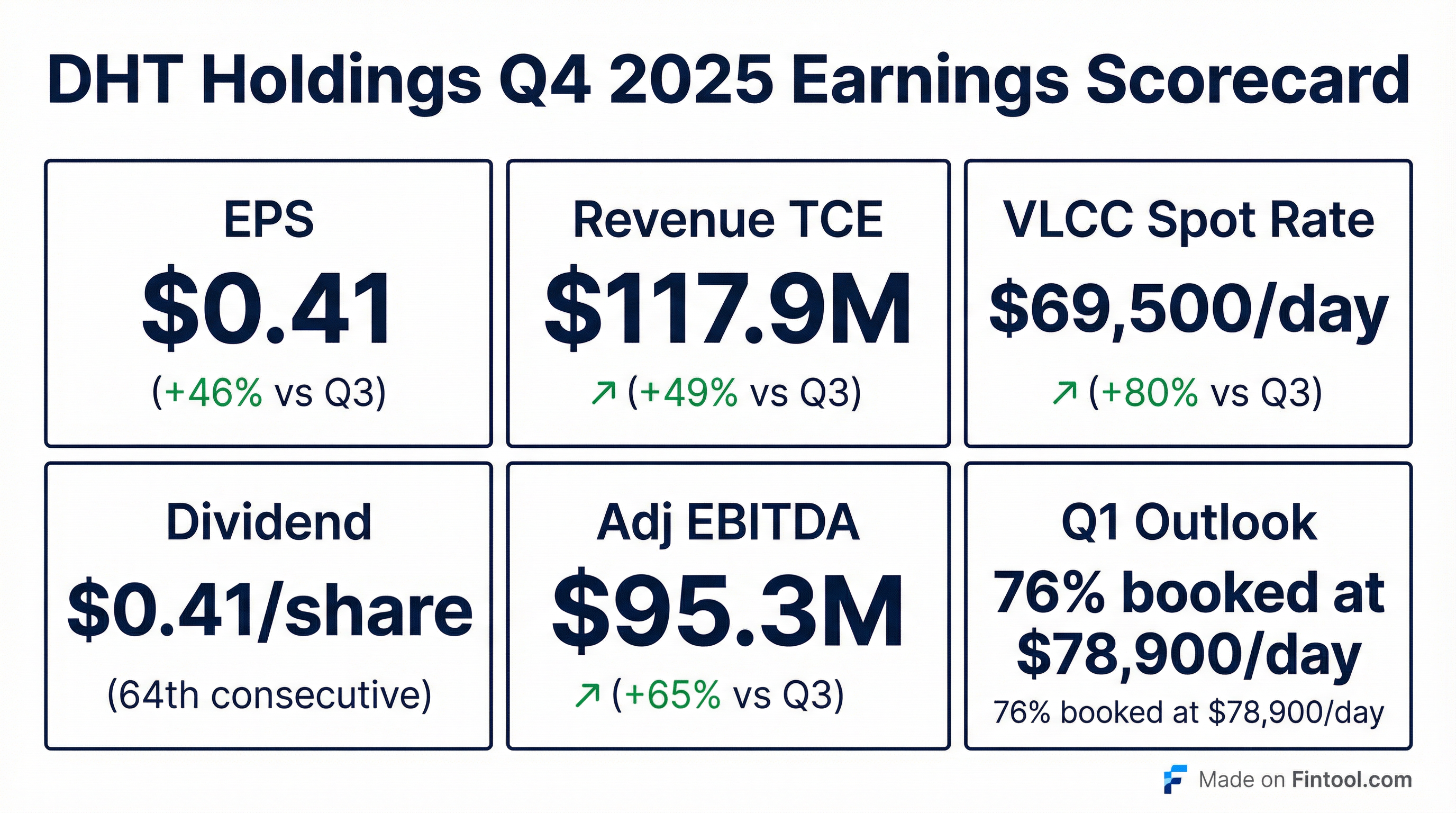

- DHT reported Q4 2025 revenues on a TCE basis of $117,850 thousand, with net income after tax of $66,074 thousand and EPS of $0.41.

- A cash dividend of $0.41 per share was declared for Q4 2025, representing the 64th consecutive quarterly cash dividend.

- Fleet updates include the November 2025 delivery of DHT Nokota, the sale of DHT China and DHT Europe for $101.6 million, and the January 2, 2026 delivery of the newbuilding DHT Antelope.

- For Q1 2026, 76% of total spot days have been booked at an average spot rate of $78,900/d.

1 day ago

DHT Holdings Reports Q4 and Full-Year 2025 Results, Details Fleet Modernization and Market Outlook

DHT

Earnings

Dividends

New Projects/Investments

- DHT Holdings reported Q4 2025 revenues on a TCE basis of $118 million and net income of $66 million ($0.41 per share), with full-year 2025 revenues reaching $369 million and net income $211 million ($1.31 per share).

- The company approved a cash dividend of $0.41 per share for Q4 2025, consistent with its policy of distributing 100% of ordinary net income.

- DHT is actively modernizing its fleet by acquiring the 2018-built VLCC DHT Nokota in November 2025 and taking delivery of the first of four newbuildings, DHT Antelope, in January 2026, with the remaining three expected by June 2026.

- Concurrently, DHT is divesting its three oldest 2007-built vessels, having sold DHT China and DHT Europe for a combined $101.6 million and agreeing to sell DHT Virginia for $51.5 million.

- For Q1 2026, 76% of spot days are booked at an average rate of $78,900 per day, and time charter days are covered at an average rate of $43,300 per day. The company plans to increase its spot market exposure to approximately three-quarters of its capacity by Q2 2026.

1 day ago

DHT Holdings Reports Strong Q4 and Full-Year 2025 Results, Declares Dividend, and Updates Fleet Strategy

DHT

Earnings

Dividends

New Projects/Investments

- DHT Holdings reported Q4 2025 revenues of $118 million and Adjusted EBITDA of $95 million, leading to net income of $66 million or $0.41 per share. For the full year 2025, revenues were $369 million and Adjusted EBITDA was $278 million, with net income of $211 million or $1.31 per share.

- The company's board approved a cash dividend of $0.41 per share for Q4 2025, representing its 64th consecutive quarterly cash dividend.

- DHT is actively modernizing its fleet, having sold three older vessels and taking delivery of four newbuilds, with the first, DHT Antelope, delivered on January 2nd, and the remaining three expected by June 2026.

- The company is increasing its spot market exposure to approximately three-quarters of its capacity by Q2 2026, with 76% of Q1 2026 spot days already booked at an average rate of $78,900 per day.

1 day ago

DHT Holdings Inc. Reports Strong Q4 and Full-Year 2025 Results, Details Fleet Modernization and Positive Market Outlook

DHT

Earnings

Dividends

New Projects/Investments

- DHT Holdings Inc. reported Q4 2025 revenues of $118 million and Adjusted EBITDA of $95 million, with net income of $66 million or $0.41 per share. For the full year 2025, revenues were $369 million and Adjusted EBITDA was $278 million, resulting in net income of $211 million or $1.31 per share.

- The company continued its fleet modernization, acquiring the 2018-built VLCC DHT Nokota in November and taking delivery of its first new building, DHT Antelope, on January 2nd, with three more new buildings expected by June. Concurrently, DHT agreed to sell its three oldest vessels (2007-built) for a combined price of $153.1 million, anticipating total gains of $94.2 million.

- A cash dividend of $0.41 per share was approved for Q4 2025, marking the 64th consecutive quarterly cash dividend. Total liquidity at the end of Q4 2025 stood at $189 million, including $79 million in cash.

- For Q1 2026, 76% of spot days have been booked at an average rate of $78,900 per day, and time charter dates are covered at an average rate of $43,300 per day. The company plans to increase its spot market exposure to approximately three-quarters of its capacity during Q2 2026, driven by a constructive market outlook due to an aging global fleet and ongoing fleet consolidation.

1 day ago

DHT Holdings Announces Strong Q4 and Full-Year 2025 Results

DHT

Earnings

Dividends

New Projects/Investments

- DHT Holdings, Inc. reported shipping revenues of $143.9 million, Adjusted EBITDA of $95.3 million, and profit after tax of $66.1 million for Q4 2025, leading to $0.41 basic EPS. For the full year 2025, shipping revenues reached $497.2 million, Adjusted EBITDA $278.4 million, and profit after tax $211.0 million, with basic EPS of $1.31.

- The company declared a $0.41 per share cash dividend for Q4 2025, representing its 64th consecutive quarterly cash dividend and consistent with its policy to pay out 100% of ordinary net income.

- In Q4 2025, DHT Holdings agreed to sell DHT Europe and DHT China for a combined $101.6 million, expecting gains of approximately $30.4 million and $29.6 million in Q1 2026. The company also took delivery of the new VLCC DHT Antelope in January 2026, the first of four newbuildings, and extended a time charter for DHT Harrier for five years at $47,500 per day. For Q1 2026, 76% of available VLCC spot days have been booked at an average rate of $78,900 per day.

1 day ago

DHT Holdings announces sale of DHT Bauhinia

DHT

- DHT Holdings, Inc. has entered into an agreement to sell the DHT Bauhinia, a vessel built in 2007, for a price of $51.5 million.

- The vessel is debt-free.

- The delivery of the vessel to the new owner is anticipated during June/July 2026.

- The company expects to record a gain of $34.2 million related to this sale.

8 days ago

DHT Holdings, Inc. Reports Q4 2025 Estimates and Q1 2026 Bookings

DHT

Guidance Update

New Projects/Investments

- DHT Holdings, Inc. provided a business update, including estimated Q4 2025 time charter equivalent earnings and Q1 2026 booking rates.

- The company extended its time charter agreement for the DHT Harrier for five years at a daily rate of $47,500, with options for two additional years at higher rates.

- President & CEO Svein Moxnes Harfjeld noted a rebound in the spot market and increasing demand for time charter contracts, expecting the market balance to tighten further.

| Metric | Q4 2025 | Q1 2026 (thus far) |

|---|---|---|

| Fleet Time Charter Equivalent Earnings ($USD per day) | $60,300 | N/A |

| VLCC Spot Market Earnings ($USD per day) | $69,500 | $66,300 |

| VLCC Time Charter Earnings ($USD per day) | $49,400 | N/A |

| Spot Days Booked (%) | N/A | 45% |

| Total Revenue Days Booked (%) | N/A | 66% |

| Average Rate for Total Revenue Days Booked ($USD per day) | N/A | $51,500 |

Jan 15, 2026, 9:18 PM

DHT Holdings Provides Business Update and Q4 2025 Estimates

DHT

Earnings

Guidance Update

New Projects/Investments

- DHT Holdings estimates its Q4 2025 fleet time charter equivalent (TCE) earnings at $60,300 per day, with VLCCs in the spot market earning $69,500 per day and those on time charter earning $49,400 per day.

- For Q1 2026 thus far, 45% of available spot days have been booked at an average rate of $66,300 per day, and 66% of total available revenue days (spot and time-charter combined) are booked at $51,500 per day.

- The company extended the time charter agreement for the DHT Harrier for five years at a daily rate of $47,500, with two optional one-year extensions at higher rates.

- The President & CEO noted a rebound in the spot market after a late Q4 2025 dive and expects the market balance to tighten further.

Jan 14, 2026, 9:15 PM

DHT Holdings, Inc. takes delivery of new VLCC

DHT

New Projects/Investments

- DHT Holdings, Inc. took delivery of the DHT Antelope, a VLCC newbuilding, on January 2, 2026.

- This vessel is the first of a series of four VLCC newbuildings scheduled for delivery to the company during the first half of 2026, with the next expected in early March 2026.

- The newbuildings are fully funded and are anticipated to increase the company's customer offerings and earnings power.

Jan 2, 2026, 10:54 AM

DHT Holdings Announces Sale of Two VLCCs

DHT

M&A

Guidance Update

- DHT Holdings, Inc. has entered into an agreement to sell two Very Large Crude Carriers (VLCCs), the DHT China and the DHT Europe.

- The combined sale price for both vessels is $101.6 million.

- After the repayment of $5.6 million in existing debt on the vessels, the transaction is expected to generate approximately $95.0 million in net cash proceeds.

- The company anticipates recording gains of $30.4 million and $29.7 million respectively from these sales.

- The vessels are expected to be delivered to the new owner during the first quarter of 2026.

Dec 29, 2025, 11:57 AM

Quarterly earnings call transcripts for DHT Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more