Earnings summaries and quarterly performance for ESCO TECHNOLOGIES.

Research analysts who have asked questions during ESCO TECHNOLOGIES earnings calls.

JT

Jonathan Tanwanteng

CJS Securities

12 questions for ESE

Also covers: APG, ATRO, CMCO +16 more

Tommy Moll

Stephens Inc.

7 questions for ESE

Also covers: CARR, CGNX, DGII +12 more

Joshua Sullivan

The Benchmark Company

3 questions for ESE

Also covers: ACHR, AIR, ATI +13 more

Thomas Moll

Stephens Inc.

3 questions for ESE

Also covers: CARR, CGNX, DGII +13 more

Z

Zack

Stephens

2 questions for ESE

John Franzreb

Sidoti & Company

1 question for ESE

Also covers: AZZ, CSV, CTS +10 more

Recent press releases and 8-K filings for ESE.

ESCO Technologies Reports Strong Q1 2026 Results and Raises Full-Year Guidance

ESE

Earnings

Guidance Update

M&A

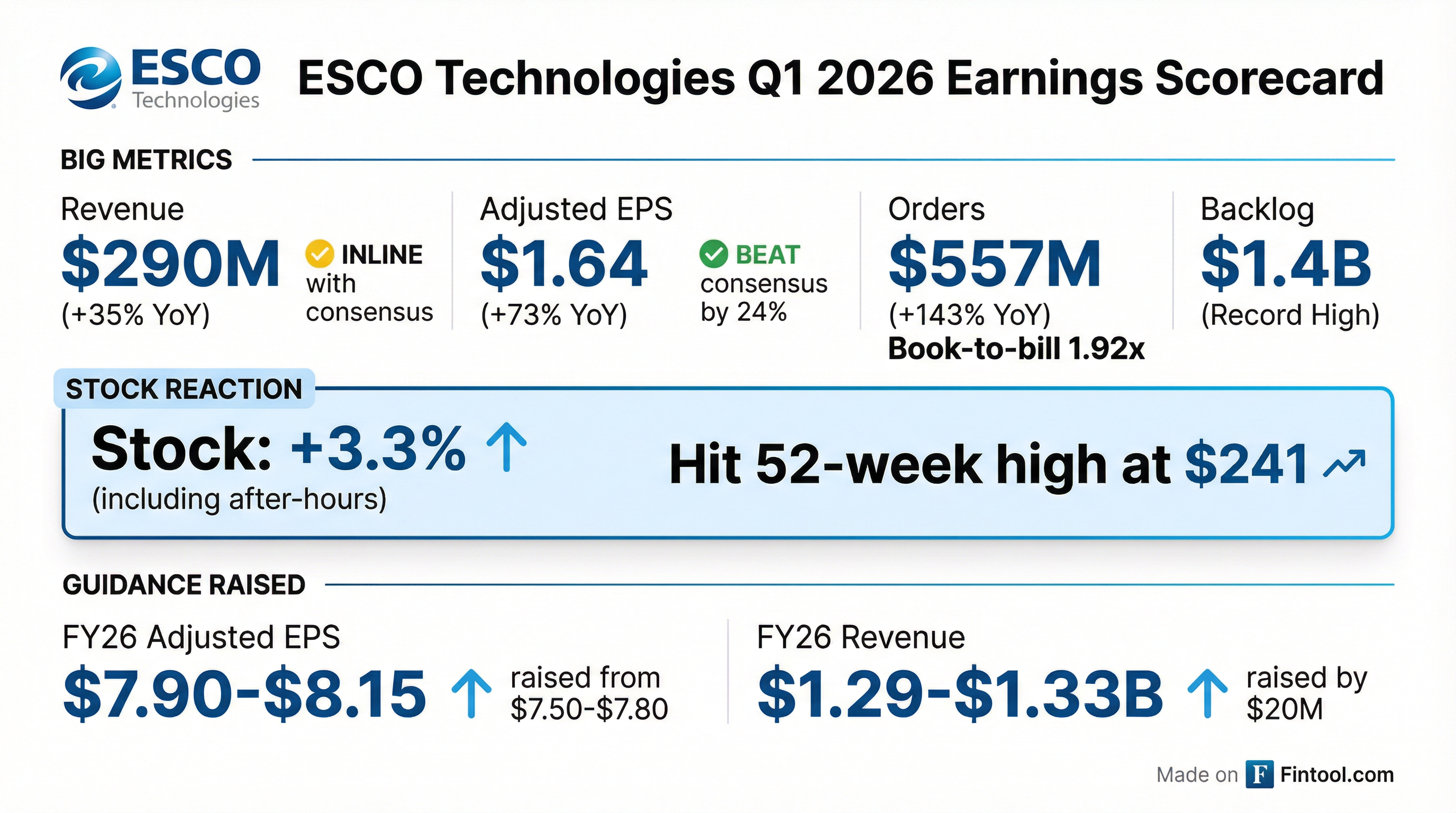

- ESCO Technologies reported strong Q1 2026 results, with orders increasing 143% to over $550 million and sales growing 35%, contributing to a 73% year-over-year increase in adjusted earnings per share to $1.64.

- All three business segments saw double-digit organic orders growth, with the Aerospace and Defense segment receiving $238 million in orders from Maritime and $30 million for Virginia-class Block VI orders.

- The company raised its full-year 2026 sales guidance by $20 million at the midpoint to a range of $1.29 billion-$1.33 billion, and adjusted EPS guidance to $7.90-$8.15 per share, an increase of $0.38 at the midpoint.

- Management is actively rebuilding its M&A pipeline, with a primary focus on strategic acquisitions in the utility, aircraft components, and Navy segments.

1 day ago

ESCO Technologies Reports Strong Q1 2026 Results and Raises Full-Year Guidance

ESE

Earnings

Guidance Update

Revenue Acceleration/Inflection

- ESCO Technologies reported a strong first quarter 2026, with orders up 143% to over $550 million and sales up 35%. Adjusted earnings per share (EPS) increased 73% year-over-year to a Q1 record of $1.64 per share, driven by 380 basis points of adjusted EBIT margin expansion to 19.4%.

- The Aerospace and Defense segment saw orders over $380 million and sales of $144 million with 14% organic growth, while the Test business had sales up nearly 27%. The Utility Solutions Group experienced modest sales growth of 1%, with Doble's 6% growth largely offset by declines in the renewables business.

- Due to the strong start, ESCO Technologies raised its full-year 2026 sales guidance by $20 million at the midpoint to a range of $1.29 billion-$1.33 billion. Full-year adjusted EPS guidance was also increased by $0.38 per share at the midpoint to a range of $7.90-$8.15 per share, representing 31%-35% growth over 2025.

- The company is actively rebuilding its M&A pipeline, focusing on strategic acquisitions in its utility, aircraft components, and Navy segments, with potential for deals this year. The renewables market weakness is expected to revert to normal growth in the second half of 2026 or Q1 2027.

1 day ago

ESCO Technologies Announces Strong Q1 2026 Results and Raises FY 2026 Guidance

ESE

Earnings

Guidance Update

Revenue Acceleration/Inflection

- ESCO Technologies reported robust Q1 FY 2026 results, with total entered orders increasing 143% to $557.2 million and sales growing 35% to $289.7 million. Adjusted EPS for the quarter was $1.64, a 73% increase.

- The company's backlog reached $1.4 billion, up 24% from September 30, 2025, and achieved a book-to-bill ratio of 1.92.

- For fiscal year 2026, ESCO Technologies raised its sales guidance to an increase of 18% to 21%, projecting a range of $1.29 billion to $1.33 billion. This represents a $20 million increase from its initial November guidance.

- The Adjusted EPS guidance for FY 2026 was also raised to a range of $7.90 to $8.15 per share, reflecting 31% to 35% growth. The midpoint increased by $0.38 from the initial guidance.

- Operating cash flow for Q1 2026 improved to $68.9 million, and the company maintained a strong financial position with an EBITDA leverage ratio of 0.4X.

1 day ago

ESCO Technologies Reports Strong Q1 2026 Results and Raises Full-Year Guidance

ESE

Earnings

Guidance Update

Revenue Acceleration/Inflection

- ESCO Technologies reported strong Q1 2026 results, with orders increasing 143% over the prior year to over $550 million, and sales growing 35%, including 11% organic growth.

- Adjusted earnings per share (EPS) for Q1 2026 increased by nearly 73% year-over-year to a record $1.64 per share, while adjusted EBIT margins expanded by 380 basis points to 19.4%.

- The company raised its full-year 2026 guidance, increasing sales by $20 million at the midpoint to a range of $1.29 billion to $1.33 billion, and adjusted EPS by $0.38 per share at the midpoint to a range of $7.90 to $8.15 per share.

- The Test business had a robust start to the year, with orders up over 17% and sales up nearly 27%, leading to an updated full-year revenue growth forecast of 9% to 11% for the segment.

- Operating cash flow in Q1 2026 more than doubled to $68.9 million, and the company is actively rebuilding its M&A pipeline, focusing on strategic acquisitions in its utility, aircraft components, and Navy segments.

1 day ago

ESCO Technologies Inc. Reports Strong Q1 2026 Results and Raises Full-Year Guidance

ESE

Earnings

Guidance Update

Dividends

- ESCO Technologies Inc. reported Q1 2026 sales increased 35% to $290 million and Adjusted EPS from Continuing Operations rose 73% to $1.64 compared to Q1 2025.

- Q1 2026 Entered Orders increased 143% to $557 million, resulting in a record backlog of $1.4 billion.

- The company raised its full-year FY 2026 revenue guidance to a range of $1.29 to $1.33 billion and Adjusted EPS guidance to $7.90 - $8.15 per share.

- The Aerospace & Defense segment's Q1 2026 sales increased 75.7% to $144 million, driven by organic growth and the Maritime contribution.

- A quarterly cash dividend of $0.08 per share will be paid on April 17, 2026, to stockholders of record on April 2, 2026.

1 day ago

ESCO Technologies Reports Strong First Quarter Fiscal 2026 Results and Raises Full-Year Guidance

ESE

Earnings

Guidance Update

Dividends

- ESCO Technologies reported a 35.0 percent increase in Q1 2026 Sales to $290 million, and Adjusted EPS from Continuing Operations rose 72.6 percent to $1.64 per share compared to Q1 2025.

- Q1 2026 Entered Orders increased 143.0 percent to $557 million, resulting in a record backlog of $1.4 billion.

- The company raised its full-year FY 2026 revenue guidance to a range of $1.29 to $1.33 billion and Adjusted EPS guidance to $7.90 - $8.15 per share.

- A quarterly cash dividend of $0.08 per share will be paid on April 17, 2026.

1 day ago

ESCO Technologies Reports Strong Q4 and Full-Year 2025 Results, Provides Optimistic 2026 Guidance

ESE

Earnings

Guidance Update

M&A

- ESCO Technologies reported a strong Q4 2025, with adjusted earnings per share increasing 30% year-over-year to a record $2.32 and 8% organic sales growth.

- For the full fiscal year 2025, the company achieved record performance, with adjusted earnings per share of $6.03, up 26%, and reported sales of nearly $1.1 billion, a 19% increase.

- The Maritime acquisition significantly impacted results and is performing ahead of original expectations, having already booked over $200 million in orders in the first month of fiscal year 2026.

- The company issued fiscal year 2026 guidance, projecting reported sales growth of 16%-20% and adjusted earnings per share between $7.50-$7.80, representing 24%-29% growth.

- With a strong balance sheet (EBITDA to net debt ratio of 0.56 times), ESCO is actively pursuing M&A opportunities focused on its core aerospace, navy, or utility end markets.

Nov 20, 2025, 10:00 PM

ESCO Technologies Reports Record Q4 and Full-Year 2025 Results, Issues Strong FY2026 Guidance

ESE

Earnings

Guidance Update

M&A

- ESCO Technologies reported a record adjusted earnings per share of $2.32 for Q4 2025, a 30% year-over-year increase, contributing to a full fiscal year 2025 record of $6.03 adjusted EPS (up 26%) and nearly $1.1 billion in reported sales (up 19%).

- The Maritime acquisition significantly impacted Q4 2025 results, with the business performing ahead of original expectations and booking over $200 million in orders in the first month of fiscal year 2026.

- For fiscal year 2026, the company issued strong guidance, forecasting reported sales growth of 16%-20% and adjusted earnings per share between $7.50 and $7.80, representing 24%-29% growth.

- ESCO achieved a breakout year in operating cash flow, delivering just over $200 million from continuing operations, and is actively pursuing M&A in its core aerospace, navy, or utility markets.

Nov 20, 2025, 10:00 PM

ESCO Technologies Reports Strong Q4 and Full-Year 2025 Results, Provides 2026 Guidance

ESE

Earnings

Guidance Update

M&A

- ESCO Technologies reported a strong Q4 2025, with adjusted earnings per share increasing 30% year-over-year to a record $2.32 and 8% organic sales growth.

- For the full year 2025, the company achieved record adjusted earnings per share of $6.03, representing 26% growth, and reported sales of nearly $1.1 billion, up 19%.

- The Maritime acquisition significantly contributed to performance, while the VACO divestiture was a pivotal step in portfolio evolution.

- Operating cash flow for 2025 was $200 million, and the company ended the year with a strong EBITDA to net debt ratio of 0.56 times.

- ESCO provided fiscal 2026 guidance with expected reported sales growth of 16%-20% and adjusted earnings per share in the range of $7.50-$7.80, representing 24%-29% growth.

Nov 20, 2025, 10:00 PM

ESE Reports Strong Q4 and Full Year 2025 Results, Provides Positive FY 2026 Guidance

ESE

Earnings

Guidance Update

Revenue Acceleration/Inflection

- ESE reported Q4 2025 sales of $352.7 million, a 29% increase, and Adjusted EPS of $2.32, up 30%.

- For the full fiscal year 2025, sales grew 19.2% to $1,095.4 million, with Adjusted EPS reaching $6.03, a 26.4% increase.

- The company's ending backlog significantly increased by 71% to $1.13 billion in Q4 2025.

- Operating cash flow from continuing operations for FY 2025 was $200.4 million, a substantial improvement from $121.6 million in FY 2024.

- ESE issued positive FY 2026 guidance, expecting sales to increase 16% to 20% (ranging from $1.27 billion to $1.31 billion) and Adjusted EPS to be in the range of $7.50 to $7.80 per share.

Nov 20, 2025, 10:00 PM

Quarterly earnings call transcripts for ESCO TECHNOLOGIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more