Earnings summaries and quarterly performance for FIRST BANCORP /PR/.

Executive leadership at FIRST BANCORP /PR/.

Aurelio Alemán

President and Chief Executive Officer

Carlos Power

Executive Vice President & Consumer Lending Business Executive

Cassan Pancham

Executive Vice President & Business Group Executive

Ginoris López-Lay

Executive Vice President & Strategic Management Director

Jose Lacasa

Executive Vice President & Florida Business Director

Juan Carlos Pavía

Chief Operating Officer

Lilian Díaz-Bento

Executive Vice President & Business Group Director

Michael McDonald

Executive Vice President & Business Group Director

Nayda Rivera

Executive Vice President, Chief Consumer Officer and Chief of Staff

Orlando Berges

Executive Vice President & Chief Financial Officer

Sara Alvarez

Executive Vice President & General Counsel

Board of directors at FIRST BANCORP /PR/.

Research analysts who have asked questions during FIRST BANCORP /PR/ earnings calls.

Kelly Motta

Keefe, Bruyette & Woods

8 questions for FBP

Timur Braziler

Wells Fargo

7 questions for FBP

Steve Moss

Raymond James

6 questions for FBP

Brett Rabatin

Hovde Group, LLC

5 questions for FBP

Anya Pelshaw

Hovde Group

2 questions for FBP

Charlie Driscoll

KBW

2 questions for FBP

Frank Shiroti

Piper Sandler

2 questions for FBP

Stephen Moss

Raymond James Financial, Inc.

2 questions for FBP

Arren Cyganovic

Truist Securities

1 question for FBP

Arren Cyganovich

Truist

1 question for FBP

Frank Schiraldi

Piper Sandler

1 question for FBP

Recent press releases and 8-K filings for FBP.

- Orlando Berges, Executive Vice President and Chief Financial Officer of First BanCorp, will retire effective June 30, 2026, after nearly 17 years, and will be succeeded by Said Ortiz as Executive VP and CFO effective July 1, 2026.

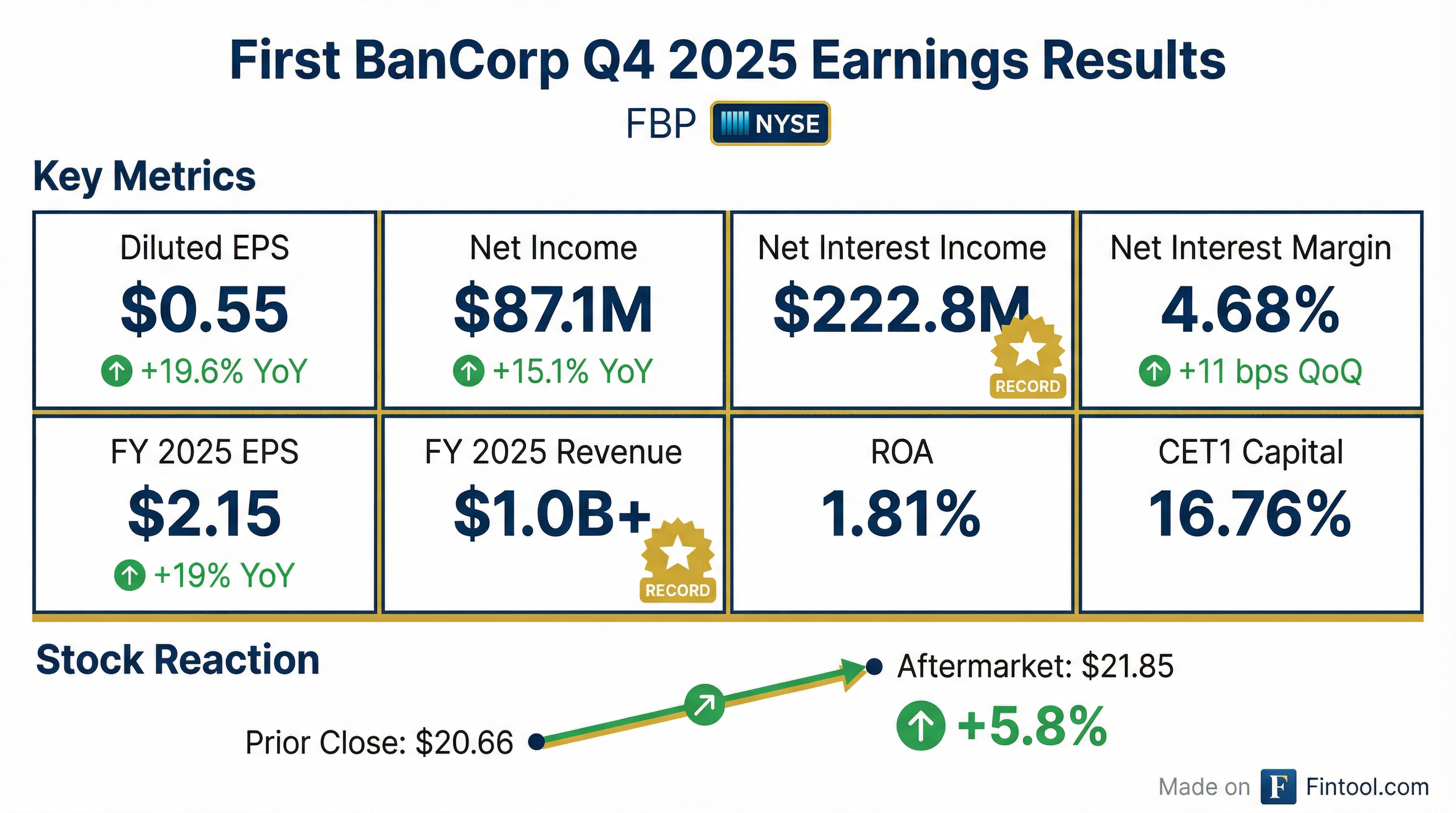

- First BanCorp reported GAAP EPS of $0.55, surpassing expectations of $0.51, and revenue of $257.17 million, which was in line with projections.

- Management reiterated targets including 3–5% organic loan growth and a full earnings-return strategy by 2026.

- First BanCorp. (FBP) reported strong Q4 2025 results, including net income of $87 million or $0.85 per share, a return on assets of 1.8%, and an efficiency ratio of 49%. For the full year 2025, the company achieved record net income of $345 million and total revenues exceeding $1 billion.

- The company demonstrated robust capital management, repurchasing $50 million in shares during Q4 2025 and $150 million for the full year. The board also approved an 11% increase to the quarterly common stock dividend, raising it to $0.20 per share starting in Q1 2026.

- FBP's asset quality remained stable, with non-performing assets to total assets reaching an all-time low of 60 basis points in Q4 2025, and core customer deposits increased by $267 million during the quarter.

- For 2026, the company projects 3%-5% organic loan growth, an efficiency ratio of 52% or better, and aims to return close to 100% of annual earnings to shareholders, with an assumption of repurchasing approximately $50 million in shares per quarter through the end of 2026.

- First BanCorp reported a strong Q4 2025 with $87 million in net income or $0.85 per share, achieving a 1.8% return on assets and a 49% efficiency ratio.

- For the full year 2025, the company crossed $1 billion in total revenues, generated a record net income of $345 million, and posted a strong 1.9% return on assets.

- The company demonstrated disciplined capital management, repurchasing $50 million in shares during Q4 2025 and $150 million for the full year. The board also approved an 11% increase to the quarterly common stock dividend to $0.20 per share, starting in Q1 2026.

- Management provided a positive outlook for 2026, expecting 3%-5% organic loan growth, sustaining a 52% or better efficiency ratio, and projecting net interest margin growth of 2-3 basis points per quarter.

- Asset quality remained strong, with the ratio of non-performing assets to total assets reaching an all-time low of 60 basis points during Q4 2025.

- First BanCorp. reported $87 million in net income or $0.85 per share for Q4 2025, achieving a 1.8% return on assets and a 49% efficiency ratio. For the full year 2025, the company recorded over $1 billion in total revenues, a net income of $345 million, and a 1.9% return on assets.

- In Q4 2025, the company repurchased $50 million in common stock and declared $28 million in dividends. The board approved an 11% increase to the quarterly common stock dividend to $0.20 per share, effective Q1 2026. For the full year, approximately 95% of earnings were returned to shareholders.

- For 2026, First BanCorp. expects 3%-5% organic loan growth, aims to sustain a 52% or better efficiency ratio, and plans to return close to 100% of annual earnings to shareholders, with asset quality expected to remain stable.

- FBP reported Q4 2025 net income of $87.1 million ($0.55 per diluted share) and full-year 2025 net income of $345 million ($2.15 per diluted share), marking a 15% year-over-year increase in net income.

- The company achieved record net interest income of $222.8 million in Q4 2025, a 2.2% increase from the prior quarter, and maintained an efficiency ratio of 49.3%.

- Total loans grew by $80.8 million to $13.1 billion in Q4 2025, with core deposits increasing by $266.5 million, while the non-performing assets ratio decreased to 0.60%.

- FBP's capital position remains strong with a CET1 ratio of 16.8% and tangible book value per share growing 4.2% to $12.29 in Q4 2025.

- For 2026, FBP anticipates 3% to 5% organic loan growth, aims to sustain a 52% efficiency ratio, and plans to return close to 100% of annual earnings to shareholders.

- First BanCorp. reported net income of $87.1 million, or $0.55 per diluted share, for the fourth quarter of 2025, and record net income of $344.9 million, or $2.15 per diluted share, for the full year ended December 31, 2025.

- For the full year 2025, the Corporation achieved total revenues exceeding $1.0 billion and grew earnings per share by 19%.

- Key financial metrics for Q4 2025 included a net interest margin of 4.68% and an efficiency ratio of 49.33%.

- The company's balance sheet showed total loans grew by 3% to $13.1 billion in 2025, and non-performing assets decreased by $5.3 million to $114.1 million in Q4 2025.

- In Q4 2025, First BanCorp. repurchased $50.0 million in common stock and declared $28.3 million in common stock dividends, while maintaining a strong CET1 ratio of 16.8%.

- First BanCorp's board approved an 11% raise to its quarterly dividend, increasing it to $0.20 per share.

- The dividend is payable on March 13, 2026, to shareholders of record on February 26, 2026.

- The company is a Puerto Rico-focused bank holding company with diversified segments including commercial, mortgage, consumer, treasury, U.S., and Virgin Islands operations.

- Third-party data indicates a market capitalization of approximately $3.26 billion, trailing-12-month revenue of around $944.8 million, a strong ROE of about 18.7%, and a conservative debt-to-equity ratio of approximately 0.15.

- First BanCorp. (FBP) has announced an 11% increase in its quarterly cash dividend on common stock, raising it to $0.20 per share.

- This new dividend represents an increase of $0.02 per common share compared to the $0.18 dividend paid in December 2025.

- The dividend is payable on March 13, 2026, to shareholders of record at the close of business on February 26, 2026.

- The increased quarterly dividend equates to an annualized dividend rate of $0.80 per common share.

- President and CEO Aurelio Alemán noted that this dividend increase, coupled with their share buyback program, highlights their commitment to enhancing long-term shareholder value and maintaining a solid capital position.

- First BanCorp reported net income of $100 million or $0.63 per share for Q3 2025, which included a $16.6 million reversal of valuation allowance on deferred tax assets. Adjusted for these items, non-GAAP earnings per share were $0.51.

- Total loans grew by $181 million (5.6% linked quarter annualized), surpassing $13 billion, primarily driven by commercial, construction, and residential mortgage lending. This growth mitigated a slowdown in consumer credit demand, particularly in the auto industry, where total retail sales are down 7% year-to-date as of September.

- Net interest income reached $217.9 million for the quarter, a $2 million increase from the prior quarter, with a net interest margin of 4.57%. The company expects the net interest margin for the fourth quarter to be "sort of flat".

- The company repurchased $50 million in common stock during the quarter. The board authorized an additional $200 million share buyback program through 2026, with an expected repurchase cadence of approximately $50 million per quarter.

- Full-year loan growth guidance was adjusted to 3%-4% from an original 5% due to the slowdown in auto lending.

- First BanCorp reported net income of $100 million for the third quarter of 2025, with adjusted earnings per share growing 13% compared to the prior year.

- Total loans grew by $181 million (5.6% linked quarter annualized) to surpass $13 billion for the first time since 2010; however, the full-year loan growth guidance was revised to 3% to 4% from an original mid-single-digit expectation due to a slowdown in consumer credit demand, particularly in the auto industry.

- The company repurchased $50 million in common stock during Q3 2025, and the board authorized an additional $200 million share buyback program expected to be executed through 2026, with a base assumption of repurchasing approximately $50 million per quarter.

- Expenses for Q3 2025 were $124.9 million, and the expense guidance for the next couple of quarters remains $125 million to $126 million, with the efficiency ratio for the quarter at 50% and expected to stay in the 50% to 52% range.

- The net interest margin is expected to be "sort of flat" for the fourth quarter of 2025, with increases in net interest income coming from loan portfolio growth.

Fintool News

In-depth analysis and coverage of FIRST BANCORP /PR/.

Quarterly earnings call transcripts for FIRST BANCORP /PR/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more