Earnings summaries and quarterly performance for FIRST FINANCIAL BANKSHARES.

Executive leadership at FIRST FINANCIAL BANKSHARES.

F. Scott Dueser

Chairman and Chief Executive Officer

Brian Goodrich

Executive Vice President and General Counsel

David Bailey

President

John Ruzicka

Executive Vice President and Chief Information Officer

Kyle McVey

Executive Vice President, Chief Accounting Officer and Investor Relations Director

Lon Biebighauser

President, First Financial Trust & Asset Management Company

Luke Longhofer

Executive Vice President and Chief Credit Officer

Michelle Hickox

Executive Vice President and Chief Financial Officer

Randy Roewe

Executive Vice President and Chief Risk Officer

Ronald Butler

Executive Vice President and Chief Administrative Officer

Board of directors at FIRST FINANCIAL BANKSHARES.

Blake Poutra

Director

David Copeland

Director

Eli Jones

Director

Geoff Haney

Director

Johnny Trotter

Director

Kade Matthews

Director

Mike Denny

Director

Murray Edwards

Lead Independent Director

Robert Nickles

Director

Sally Pope Davis

Director

Tim Lancaster

Director

Vianei Lopez Braun

Director

Research analysts covering FIRST FINANCIAL BANKSHARES.

Recent press releases and 8-K filings for FFIN.

- F. Scott Dueser will transition from Chief Executive Officer to Executive Chairman of First Financial Bankshares, Inc. and First Financial Bank, effective February 1, 2026.

- David Bailey has been promoted to President and Chief Executive Officer of both entities, also effective February 1, 2026.

- Dueser's tenure as Executive Chairman will last until the Company's 2028 annual shareholders' meeting, with his duties being advisory and non-operational.

- His compensation package as Executive Chairman includes annualized base salaries of $1,105,000 in 2026, $772,500 in 2027, and $400,000 in 2028 (prorated), along with eligibility for annual incentive plans in 2026 and 2027, and a $900,000 equity award in 2026.

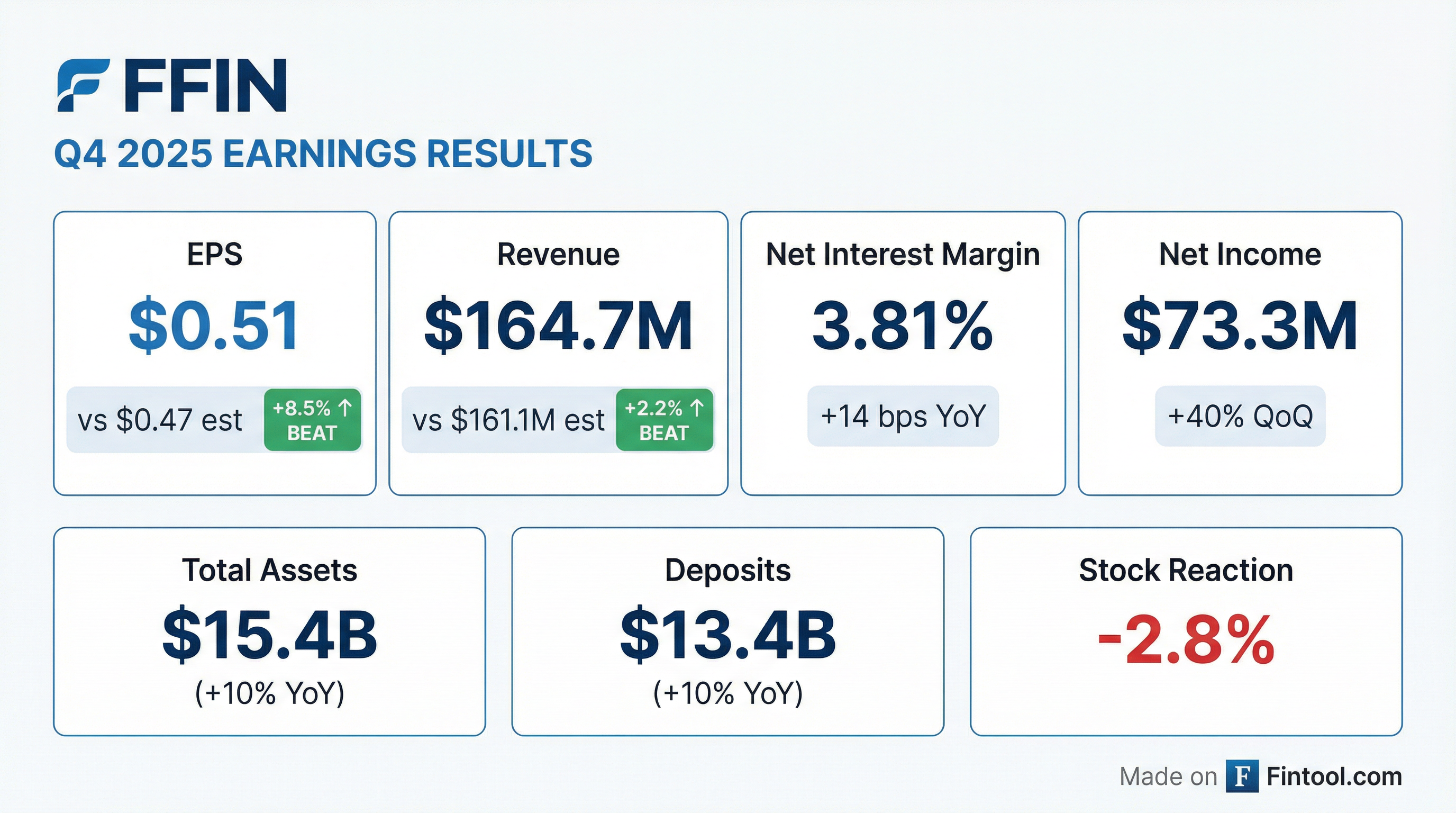

- First Financial Bankshares, Inc. (FFIN) reported record net income of $73.31 million and diluted earnings per share of $0.51 for the fourth quarter of 2025, an increase from $52.27 million and $0.36, respectively, in the prior quarter.

- For the full year ended December 31, 2025, net income rose 13.45 percent to $253.58 million, or $1.77 per diluted share, compared to $223.51 million, or $1.56 per diluted share, in 2024.

- Net interest income for Q4 2025 was $131.37 million with a net interest margin of 3.81 percent, and the company recorded a credit provision reversal of $2.49 million for the quarter.

- The company's total assets grew to $15.446 billion and total deposits reached $13.346 billion as of December 31, 2025.

- First Financial Bankshares reported net income of $73.31 million and diluted earnings per share of $0.51 for the fourth quarter of 2025, an increase from $62.32 million and $0.43, respectively, in the fourth quarter of 2024. For the full year 2025, net income was $253.58 million, or $1.77 per diluted share, compared to $223.51 million, or $1.56 per diluted share, for 2024.

- Net interest income for Q4 2025 was $131.37 million, up from $116.12 million in Q4 2024, with the net interest margin on a tax-equivalent basis at 3.81 percent for Q4 2025, compared to 3.67 percent in Q4 2024.

- The company's total assets reached $15.45 billion as of December 31, 2025, an increase from $13.98 billion at December 31, 2024. Deposits and Repurchase Agreements also grew to $13.41 billion at December 31, 2025, from $12.16 billion a year prior.

- The efficiency ratio improved to 46.10 percent for the fourth quarter of 2025, down from 46.81 percent in the fourth quarter of 2024.

- Chairman and CEO F. Scott Dueser noted a "strong finish to 2025" with record quarterly net income and significant deposit growth, which is expected to support loan and securities growth in 2026.

- First Financial Bankshares, Inc. (FFIN) reported net income of $52.27 million and diluted earnings per share of $0.36 for the third quarter of 2025, a decrease from $66.66 million and $0.47, respectively, in the second quarter of 2025.

- The company's third-quarter results were significantly affected by a $21.55 million credit loss stemming from fraudulent activity with a commercial borrower, resulting in a provision for credit losses of $24.44 million.

- Despite this setback, net interest income rose to $127.00 million for Q3 2025, up from $123.73 million in Q2 2025, with a net interest margin of 3.80%.

- CEO F. Scott Dueser indicated that the credit loss is considered isolated and that core earnings trends remain positive, with year-to-date earnings growth of nearly 12 percent compared to 2024.

Fintool News

In-depth analysis and coverage of FIRST FINANCIAL BANKSHARES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more