Earnings summaries and quarterly performance for FIRST INTERSTATE BANCSYSTEM.

Executive leadership at FIRST INTERSTATE BANCSYSTEM.

James A. Reuter

President and Chief Executive Officer

David P. Della Camera

Executive Vice President and Chief Financial Officer

Kirk D. Jensen

Executive Vice President and General Counsel

Kristina R. Robbins

Executive Vice President and Chief Operations Officer

Lori A. Meyer

Executive Vice President and Chief Information Officer

Lorrie F. Asker

Executive Vice President and Chief Banking Officer

Board of directors at FIRST INTERSTATE BANCSYSTEM.

Alice S. Cho

Director

Daniel A. Rykhus

Director

David L. Jahnke

Director

Dennis L. Johnson

Director

James R. Scott, Jr.

Director

Jeremy P. Scott

Director

John M. Heyneman, Jr.

Director

Joyce A. Phillips

Director

Patricia L. Moss

Director

Stephen B. Bowman

Chair of the Board

Stephen M. Lacy

Director

Research analysts who have asked questions during FIRST INTERSTATE BANCSYSTEM earnings calls.

Andrew Terrell

Stephens Inc.

6 questions for FIBK

Matthew Clark

Piper Sandler

6 questions for FIBK

Timur Braziler

Wells Fargo

6 questions for FIBK

Jared Shaw

Barclays

4 questions for FIBK

Jeff Rulis

D.A. Davidson & Co.

4 questions for FIBK

Timothy Coffey

Janney Montgomery Scott LLC

4 questions for FIBK

Christopher McGratty

Keefe, Bruyette & Woods

2 questions for FIBK

Jeff Rulis

D.A. Davidson

2 questions for FIBK

Kelly Motta

Keefe, Bruyette & Woods

2 questions for FIBK

Jared David Shaw

Barclays Capital

1 question for FIBK

John Roy

Water Tower Research LLC

1 question for FIBK

Kelly Mota

KBW

1 question for FIBK

Nicholas Moutafakis

Keefe, Bruyette & Woods

1 question for FIBK

Samuel Varga

UBS

1 question for FIBK

Recent press releases and 8-K filings for FIBK.

- FIBK announced an incremental $150 million share repurchase authorization, bringing the total authorization to $300 million with approximately $180 million of capacity remaining, after repurchasing approximately 3.7 million shares for $118 million through year-end 2025.

- The company's fully tax-equivalent net interest margin (NIM) was 3.38% for Q4 2025, and management expects sequential NIM improvement every quarter, reaching north of 3.5% by year-end 2026.

- Credit quality improved in Q4 2025, with criticized loans decreasing by $112.3 million, or 9.6%, and non-performing assets decreasing by $47.3 million, or 26%.

- FIBK continued its branch network optimization, exiting Arizona and Kansas in Q4 2025, and plans further consolidations and sales in Nebraska, North Dakota, and Minnesota in Q1 and Q2 2026, reducing its footprint from 14 to 10 contiguous states.

- Total deposits decreased to $22.1 billion as of December 31, 2025, primarily due to branch sales, while loans decreased by $632.8 million in Q4 2025. For 2026, the company guides for roughly flat to slightly lower total loans and low single-digit deposit growth.

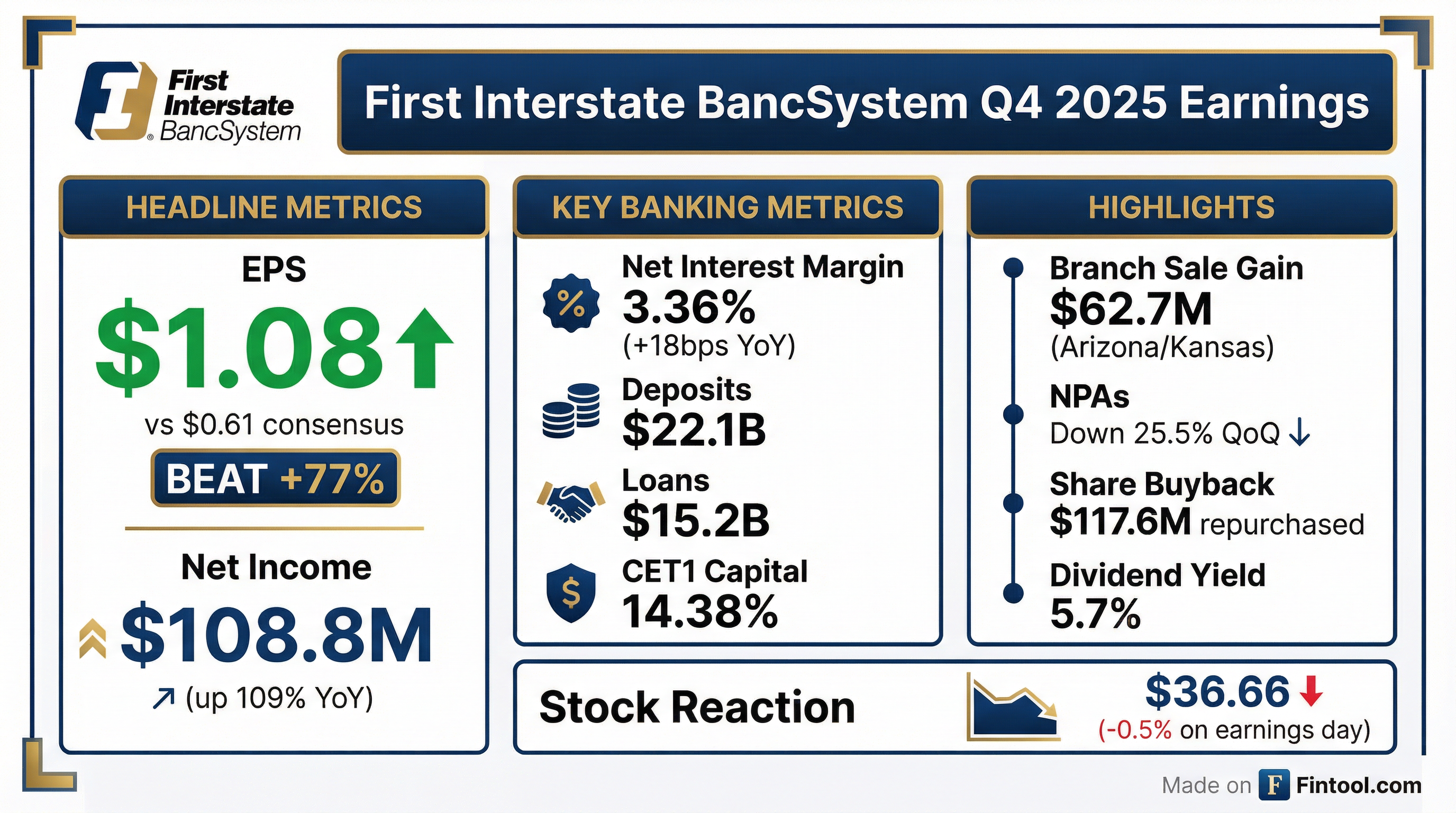

- First Interstate BancSystem, Inc. reported net income of $108.8 million, or $1.08 per share, for Q4 2025, with an adjusted FTE Net Interest Margin of 3.34%.

- As of December 31, 2025, the company maintained $26.6 billion in assets, $22.1 billion in deposits, and $15.2 billion in loans held for investment, while improving its CET1 ratio by 222bps from December 31, 2024. Non-performing loans decreased 26.0% from the prior quarter to $134.9 million.

- Strategic actions included the sale of Arizona and Kansas branches, which generated a $62.7 million gain, and the reduction of other borrowed funds to $0 from $1.6 billion in Q4 2024. The company also repurchased approximately 3.7 million shares and increased its authorized stock repurchase program by an additional $150 million on January 27, 2026.

- For 2026, the company anticipates full-year reported net interest income between $825-$845 million and non-interest expense between $630-$645 million, expecting continued margin expansion and assuming two 25 basis point rate cuts.

- First Interstate BancSystem (FIBK) reported net income of $108.8 million and diluted EPS of $1.08 for Q4 2025, a significant increase from Q3 2025, largely driven by a $62.7 million gain on sale associated with the divestiture of branches in Arizona and Kansas.

- The company's fully tax-equivalent net interest margin (FTE NIM) improved to 3.38% in Q4 2025, up from 3.36% in the prior quarter, while net interest income slightly decreased by 0.2% to $206.4 million.

- FIBK repurchased approximately 2.8 million shares for $90 million in Q4 2025, contributing to a total of $118 million in repurchases since the program's August initiation, and increased its share repurchase authorization by $150 million to $300 million.

- For 2026, the company anticipates low single-digit deposit growth and roughly flat to slightly lower total loans, with Q1 2026 net interest income projected to be approximately 3% lower than Q4 2025 levels due to seasonality and fewer accrual days.

- First Interstate BancSystem Inc. (FIBK) reported net income of $108.8 million or $1.08 per diluted share for Q4 2025, significantly boosted by a $62.7 million gain on sale from branch divestitures in Arizona and Kansas.

- The company's fully tax-equivalent net interest margin (NIM) improved to 3.38% in Q4 2025, with management projecting sequential improvement every quarter to reach north of 3.50% by year-end 2026.

- FIBK repurchased approximately 2.8 million shares for $90 million in Q4 2025, and the board approved an incremental $150 million share repurchase authorization, bringing the total to $300 million with $180 million remaining capacity.

- Strategic actions included a 9.6% decrease in criticized loans by $112.3 million in Q4 2025, further branch divestitures and closures planned for 2026, and an organizational redesign to streamline operations and drive organic growth.

- For 2026, the company anticipates low single-digit deposit growth and roughly flat to slightly lower total loans (excluding indirect portfolio runoff), with expenses expected to be approximately flat to slightly lower compared to full year 2025.

- First Interstate BancSystem, Inc. reported net income of $108.8 million, or $1.08 per diluted share, for the fourth quarter of 2025, a significant increase from $71.4 million, or $0.69 per diluted share, in the third quarter of 2025. For the full year 2025, net income was $302.1 million, or $2.94 per diluted share.

- The company completed the sale of its Arizona and Kansas branches on October 10, 2025, which resulted in a $62.7 million gain for the fourth quarter of 2025. This contributed to a 143.9% increase in total noninterest income from Q3 2025 to Q4 2025.

- The board of directors authorized an additional $150.0 million increase to the share repurchase program on January 27, 2026, bringing the total authorization to $300.0 million since August 2025. Through December 31, 2025, approximately 3.65 million shares were repurchased for about $117.6 million.

- Capital ratios improved, with the common equity tier 1 (CET1) capital ratio increasing 48 basis points to 14.38% in Q4 2025. Additionally, non-performing assets decreased $47.3 million, or 25.5%, to $138.3 million as of December 31, 2025.

- The net interest margin increased to 3.36% for the fourth quarter of 2025, a 2-basis point increase from the third quarter of 2025 and an 18-basis point increase from the fourth quarter of 2024.

- First Interstate BancSystem, Inc. reported net income of $108.8 million, or $1.08 per diluted share, for the fourth quarter of 2025, and $302.1 million, or $2.94 per diluted share, for the full year ended December 31, 2025.

- The company completed the sale of its Arizona and Kansas branches on October 10, 2025, which resulted in a gain of $62.7 million for the fourth quarter of 2025.

- The board of directors declared a dividend of $0.47 per common share on January 27, 2026, payable on February 20, 2026.

- Through December 31, 2025, the company repurchased approximately 3.65 million shares for $117.6 million under its stock repurchase program, and on January 27, 2026, the board authorized an additional $150.0 million for the program.

- Non-performing assets decreased by $47.3 million, or 25.5%, to $138.3 million as of December 31, 2025, compared to September 30, 2025.

- First Interstate BancSystem (FIBK) reported net income of $71.4 million and $0.69 per diluted share for the third quarter of 2025.

- The company is actively executing a share repurchase authorization and completed the divestiture of branches in Arizona and Kansas in October, anticipating a $60 million pre-tax gain in Q4 2025.

- Credit quality stabilized in Q3 2025, with non-performing assets decreasing 6% to $185.6 million and net charge-offs decreasing 60% to $2.3 million.

- For 2026, FIBK anticipates mid single-digit net interest income expansion and low single-digit expense growth.

- First Interstate BancSystem, Inc. reported net income of $71.4 million and $0.69 earnings per share for the third quarter of 2025, with the Net Interest Margin (FTE) increasing by 4 basis points to 3.36%.

- The company's balance sheet showed a decrease in Loans held for investment by $519.0 million and deposits by $25.6 million from the prior quarter, while other borrowed funds were reduced to $0 as of September 30, 2025.

- Capital ratios strengthened, with CET1 at 13.90% and Total Risk-Based Capital at 16.62% for Q3 2025. The company also repurchased approximately 1.8 million shares for $57.2 million through October 28, 2025.

- Asset quality improved, with net charge-offs of $2.3 million (or 6 basis points of average loans) and a 6.1% decrease in non-performing loans to $182.2 million.

- First Interstate BancSystem (FIBK) reported net income of $71.4 million, or $0.69 per diluted share, for Q3 2025, with a fully taxable equivalent net interest margin of 3.36%.

- Credit quality improved in Q3 2025, as non-performing assets decreased 6% to $185.6 million as of September 30, 2025, and net charge-offs decreased 60% to $2.3 million.

- The company is actively executing strategic initiatives, including a share repurchase authorization announced in August and branch divestitures in Arizona and Kansas (closed October 10th) and Nebraska (announced October 16th). The Arizona and Kansas divestiture is expected to result in an approximately $60 million pre-tax gain in Q4 2025.

- Regulatory capital ratios continued to increase, with the CET1 capital ratio ending Q3 2025 at 13.9%. Management stated they do not intend to hold excess capital and are considering additional returns to shareholders.

- For 2026, the company anticipates mid-single-digit net interest income expansion and expects to keep expense growth to a low single-digit increase over the full-year 2025 level.

- First Interstate BancSystem (FIBK) reported net income of $71.4 million and diluted earnings per share of $0.69 for the third quarter of 2025. The fully taxable equivalent net interest margin was 3.36%, an increase from 3.32% in the prior quarter.

- The company is actively executing a share repurchase authorization, having repurchased approximately 1.8 million shares, or about 1.7% of common shares outstanding, through October 28th. Share repurchases are considered the immediate capital allocation priority.

- FIBK completed the divestiture of its Arizona and Kansas branches on October 10th, anticipating an approximately $60 million pre-tax gain in Q4 2025 results. Additionally, the sale of 11 Nebraska branches, comprising roughly $280 million in deposits and $70 million in associated loans, was announced, with an anticipated closing in Q2 2026.

- Loan balances decreased by $519 million in Q3 2025, but management is optimistic about a return to loan growth in 2026. The Common Equity Tier 1 (CET1) capital ratio increased to 13.9%.

Quarterly earnings call transcripts for FIRST INTERSTATE BANCSYSTEM.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more