Earnings summaries and quarterly performance for Finwise Bancorp.

Executive leadership at Finwise Bancorp.

Kent Landvatter

Chief Executive Officer

James Noone

President

Michael O'Brien

Chief Compliance & Risk Officer

Natasha Clayton

Chief Operating Officer

Richard Thiessens

Chief Technology Officer

Robert Keil

Chief FinTech Officer

Robert Wahlman

Chief Financial Officer

Board of directors at Finwise Bancorp.

Research analysts who have asked questions during Finwise Bancorp earnings calls.

Andrew Terrell

Stephens Inc.

6 questions for FINW

Andrew Liesch

Piper Sandler

3 questions for FINW

Joseph Yanchunis

Raymond James

3 questions for FINW

Anya Pelshaw

Hovde Group

2 questions for FINW

Brett Rabatin

Hovde Group, LLC

2 questions for FINW

Joe Yanchunas

Raymond James

2 questions for FINW

Recent press releases and 8-K filings for FINW.

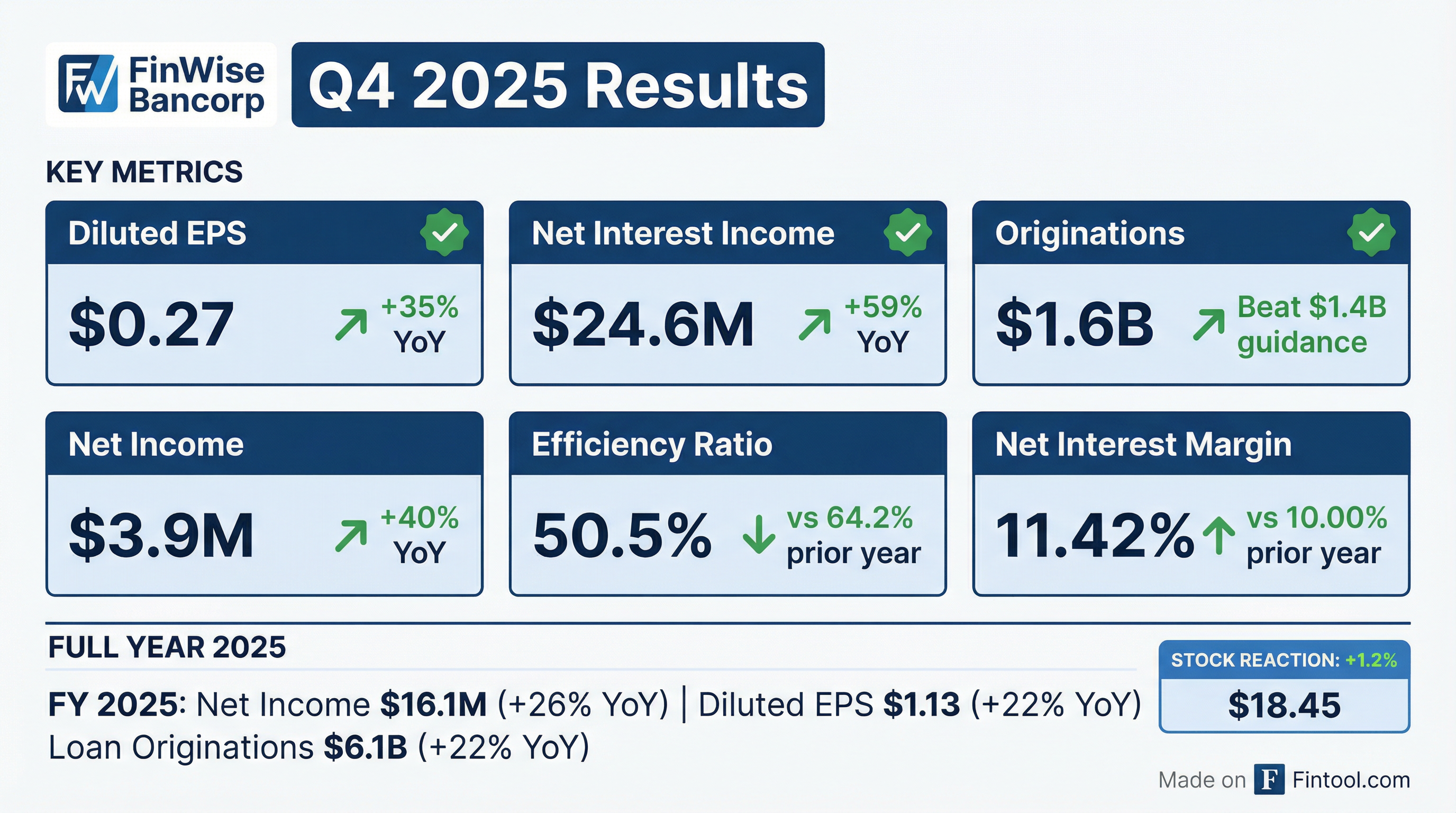

- FinWise Bancorp reported net income of $3.9 million and diluted earnings per share of $0.27 for Q4 2025, contributing to a 26% growth in net income for the full year 2025.

- Loan originations reached $1.6 billion in Q4 2025, surpassing initial guidance, and totaled $6.1 billion for the full year, marking a 22% year-over-year increase.

- Net interest income grew to $24.6 million and net interest margin increased to 11.42% in Q4 2025, primarily driven by the expansion of the credit-enhanced loan portfolio.

- The company provided a Q1 2026 loan origination outlook of $1.4 billion and projected $8 million-$10 million average monthly organic growth in credit-enhanced balances for FY 2026.

- Q4 2025 net charge-offs were $6.7 million, with a $1.1 million after-tax negative impact on net income from refined servicing standards, which is considered a one-time event.

- FinWise Bancorp reported net income of $3.9 million and diluted EPS of $0.27 for Q4 2025, contributing to 26% net income growth for the full year 2025.

- Loan originations totaled $1.6 billion in Q4 2025, exceeding guidance, and $6.1 billion for the full year, a 22% year-over-year increase. Credit-enhanced balances reached $118 million.

- The company experienced an increase in net charge-offs to $6.7 million and provision for loan losses to $17.7 million in Q4 2025, partly due to updated servicing standards, which had a $1.1 million after-tax negative impact on net income (or $0.08 per share) and is considered a one-time event.

- For 2026, FinWise anticipates quarterly loan originations of $1.4 billion as a baseline with a 5% growth rate for the full year, and organic growth in credit-enhanced balances of $8 million-$10 million per month.

- FinWise Bancorp reported net income of $3.9 million and diluted earnings per share of $0.27 for Q4 2025, contributing to 26% net income growth for the full year 2025.

- Loan originations reached $1.6 billion in Q4 2025, surpassing initial guidance, and totaled $6.1 billion for the full year 2025, marking 22% year-over-year growth.

- Net interest income grew to $24.6 million with a net interest margin of 11.42% in Q4 2025, primarily driven by a $76.5 million increase in credit-enhanced balances, which ended the quarter at $118 million.

- The company anticipates $1.4 billion in quarterly loan originations (annualized with a 5% growth rate) and $8 million-$10 million per month organic growth in credit-enhanced balances for 2026.

- Q4 2025 net charge-offs were $6.7 million, with $1.2 million attributed to updated servicing standards, which negatively impacted Q4 net income by $1.1 million after taxes or $0.08 per share and is considered a one-time event.

- FinWise Bancorp reported net income of $3.9 million and diluted EPS of $0.27 for the fourth quarter of 2025, with full-year 2025 net income reaching $16.1 million and diluted EPS of $1.13.

- Loan originations totaled $1.6 billion in Q4 2025, contributing to a full-year total of $6.1 billion, representing 22% year-over-year growth compared to 2024.

- The company's efficiency ratio was 50.5% for Q4 2025, an improvement from 64.2% in the prior year period.

- As of December 31, 2025, nonperforming loan balances were $43.7 million, which was 7.3% of total loans held-for-investment.

- FinWise Bancorp reported net income of $16.1 million and diluted earnings per share of $1.13 for the full year 2025, representing a 26% increase in net income compared to 2024.

- For the fourth quarter of 2025, net income was $3.9 million and diluted EPS was $0.27.

- Loan originations for 2025 totaled $6.1 billion, reflecting 22% year-over-year growth, with $1.6 billion originated in the fourth quarter.

- The company's efficiency ratio improved to 50.5% in Q4 2025 from 64.2% in Q4 2024, and net interest margin increased to 11.42% in Q4 2025 from 10.00% in Q4 2024.

- Nonperforming loan balances rose to $43.7 million as of December 31, 2025, compared to $36.5 million as of December 31, 2024, primarily due to an increase in the SBA 7(a) loan portfolio being classified as nonaccrual.

- ConnectM Technology Solutions, Inc. reduced its convertible debt by retiring approximately $8.4 million of principal and accrued interest through the issuance of approximately 39.5 million shares of common stock.

- The company expanded its capital providers, securing new funding arrangements with multiple lenders, including a $250,000 business loan with FinWise Bank.

- In the fourth quarter of 2025, ConnectM completed strategic acquisitions of Amperics and Geo Impex, issuing 2.7 million shares and 33.3 million shares of common stock, respectively, for these transactions.

- As of December 15, 2025, ConnectM had 151,812,318 shares of its common stock issued and outstanding.

- FinWise Bancorp reported net income of $4.9 million and diluted earnings per share of $0.34 for Q3 2025, representing a 19% and 17% increase respectively from the prior quarter.

- The company achieved robust loan originations of $1.8 billion in Q3 2025, a 21% increase quarter-over-quarter, and credit-enhanced balances reached $41 million. Projections indicate credit-enhanced balances will grow to approximately $115 million by the end of Q4 2025, with $50 million expected from the new Tally Technologies agreement.

- The Net Interest Margin (NIM) expanded to 9.01% in Q3 2025, up from 7.81% in the prior quarter, though some compression is expected in Q4 2025 due to the onboarding of the Tally Technologies program.

- Tangible book value per share increased to $13.84 from $13.51 in the prior quarter, reflecting continued value creation for shareholders.

- Net income for Q3 2025 was $4.9 million, marking a 19% increase from the prior quarter and a 42% increase year-over-year.

- Diluted earnings per share reached $0.34 for the quarter, up from $0.29 in Q2 2025 and $0.25 in Q3 2024.

- Loan originations totaled $1.8 billion in Q3 2025, an increase from $1.5 billion in the prior quarter and $1.4 billion in the prior year.

- The efficiency ratio improved to 47.6% in Q3 2025, compared to 59.5% in Q2 2025 and 67.5% in Q3 2024.

- Total assets grew to $899.9 million as of September 30, 2025, reaching nearly $900 million for the first time in the Company's history.

- FinWise Bancorp reported net income of $4.9 million for the third quarter of 2025, representing a 19% increase from the prior quarter and a 42% increase year-over-year.

- Diluted earnings per share (EPS) for the quarter were $0.34, compared to $0.29 for the quarter ended June 30, 2025, and $0.25 for the third quarter of the prior year.

- Loan originations totaled $1.8 billion in Q3 2025, an increase from $1.5 billion in the prior quarter and $1.4 billion in the third quarter of the prior year.

- The company's efficiency ratio improved to 47.6% for Q3 2025, compared to 59.5% for the quarter ended June 30, 2025, and 67.5% for the third quarter of the prior year.

- Total end-of-period assets reached nearly $900 million for the first time, specifically $899.9 million as of September 30, 2025.

- FinWise Bancorp has entered into an agreement with Tallied Technologies, Inc. to deliver credit card products and processing solutions to Fintechs.

- The partnership includes the launch of two Mastercard co-branded credit card programs (Consumer Rewards World Elite Mastercard and Business Rewards World Elite Mastercard) in November 2025.

- FinWise will serve as the issuing bank, providing compliance, risk management oversight, and Credit Enhanced balance sheet support for these programs.

- This collaboration is expected to expand FinWise's cards sponsor business and diversify its revenue through interest and fee-related income.

Quarterly earnings call transcripts for Finwise Bancorp.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more