Earnings summaries and quarterly performance for F&M BANK.

Executive leadership at F&M BANK.

MW

Mike Wilkerson

Detailed

Chief Executive Officer

CEO

BB

Barton Black

Detailed

President

CD

Charles Driest

Detailed

Executive Vice President and Chief Experience Officer

JW

Jason Withers

Detailed

Executive Vice President and Chief Credit Officer

LC

Lisa Campbell

Detailed

Executive Vice President and Chief Financial Officer

ME

Melody Emswiler

Detailed

Executive Vice President and Chief Human Resources Officer

PE

Paul Eberly

Detailed

Executive Vice President and Chief Development Officer

Board of directors at F&M BANK.

AK

Anne Keeler

Detailed

Director

CR

Christopher Runion

Detailed

Director

DW

Dean Withers

Detailed

Vice Chairman of the Board

EB

Edward Burkholder

Detailed

Director

HH

Hannah Hutman

Detailed

Director

JW

John Willingham

Detailed

Director

MP

Michael Pugh

Detailed

Chairman of the Board

NH

Neil Houff

Detailed

Director

PW

Peter Wray

Detailed

Director

Research analysts covering F&M BANK.

Recent press releases and 8-K filings for FMBM.

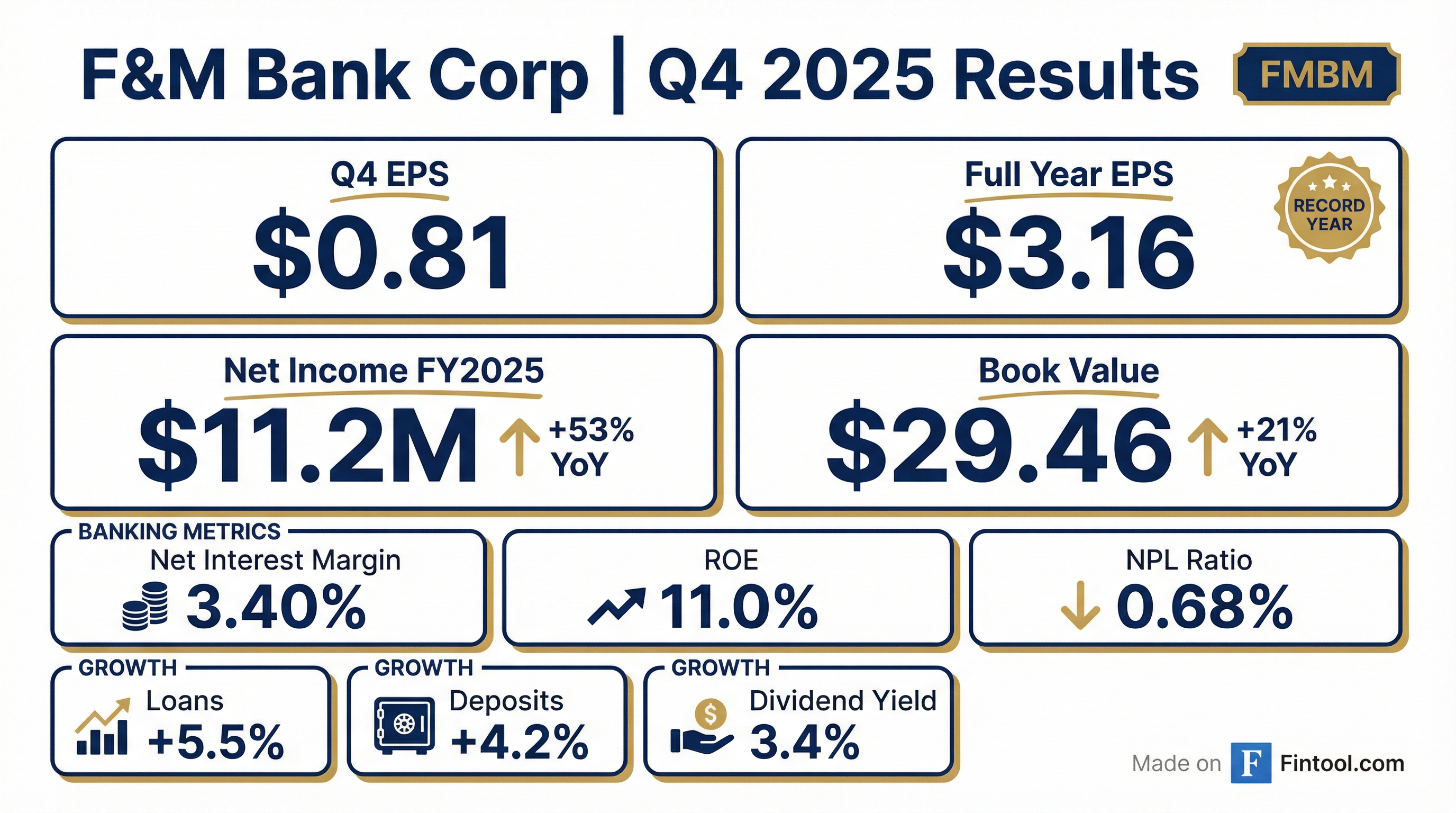

F&M Bank Corp. Reports Record Full-Year 2025 Earnings

FMBM

Earnings

Dividends

Revenue Acceleration/Inflection

- F&M Bank Corp. reported record net income of $11.2 million, or $3.16 per share, for the year ended December 31, 2025, an increase of $3.9 million from 2024.

- For the fourth quarter of 2025, net income was $2.88 million, or $0.81 per share.

- The company experienced significant growth in key balance sheet items as of December 31, 2025, with total assets reaching $1.37 billion (up 5.51%), total loans at $886.3 million (up 5.51%), and total deposits at $1.25 billion (up 4.19%) year-over-year.

- Book value per share increased by 20.6% or $5.03 to $29.46 as of December 31, 2025.

- The Board of Directors declared a quarterly dividend of $0.26 per share on January 27, 2026, representing an annualized yield of 3.40%.

4 days ago

Farmers & Merchants Bancorp Announces Increased Quarterly Dividend and Strong Q3 2025 Results

FMBM

Dividends

Earnings

- Farmers & Merchants Bancorp (FMCB) declared a quarterly cash dividend of $5.05 per share, payable on January 2, 2026, to shareholders of record on December 15, 2025. This declaration brings the total year-to-date cash dividends to $19.35 per share, an increase of 6.9% compared to 2024.

- For the third quarter ended September 30, 2025, FMCB reported net income of $23.7 million, or $33.92 per diluted common share, marking a 13.2% increase over the prior year.

- Diluted earnings per share over the trailing twelve months totaled $130.83, up 10.4% compared to the same trailing period a year ago.

- The company maintained strong financial health with an annualized return on average assets of 1.70% and return on average equity of 15.10% for Q3 2025, and its common equity tier 1 ratio was 14.26% as of September 30, 2025.

- FMCB is recognized as a "Dividend King," having paid cash dividends for 90 consecutive years and increased them for 60 consecutive years, ranking 17th among this select group of publicly traded companies.

Nov 12, 2025, 11:45 PM

F&M Bank Corp. Reports Q3 2025 Earnings and Issues Subordinated Notes

FMBM

Earnings

Debt Issuance

Dividends

- F&M Bank Corp. reported net income of $2.9 million or $0.82 per share for the third quarter of 2025, and $8.3 million or $2.35 per share for the nine months ended September 30, 2025, which is a $3.3 million or $0.91 per share increase over the same period in 2024.

- As of September 30, 2025, total assets reached $1.36 billion, total loans held for investment were $872.3 million, and total deposits stood at $1.24 billion, reflecting growth of 4.17%, 3.90%, and 3.30% respectively since December 31, 2024.

- On October 24, 2025, the company issued $10.0 million in aggregate principal amount of 7.55% fixed to floating rate subordinated notes due November 1, 2035, with proceeds intended to redeem existing subordinated debt and for general corporate purposes.

- The Board of Directors declared a quarterly dividend of $0.26 per share on October 22, 2025, payable on November 28, 2025, to shareholders of record as of November 14, 2025.

Oct 29, 2025, 8:00 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more