Earnings summaries and quarterly performance for Great Elm Group.

Executive leadership at Great Elm Group.

Board of directors at Great Elm Group.

Research analysts covering Great Elm Group.

Recent press releases and 8-K filings for GEG.

Great Elm Group Reports Q2 2026 Net Loss Amidst Challenging Market Conditions

GEG

Earnings

Share Buyback

New Projects/Investments

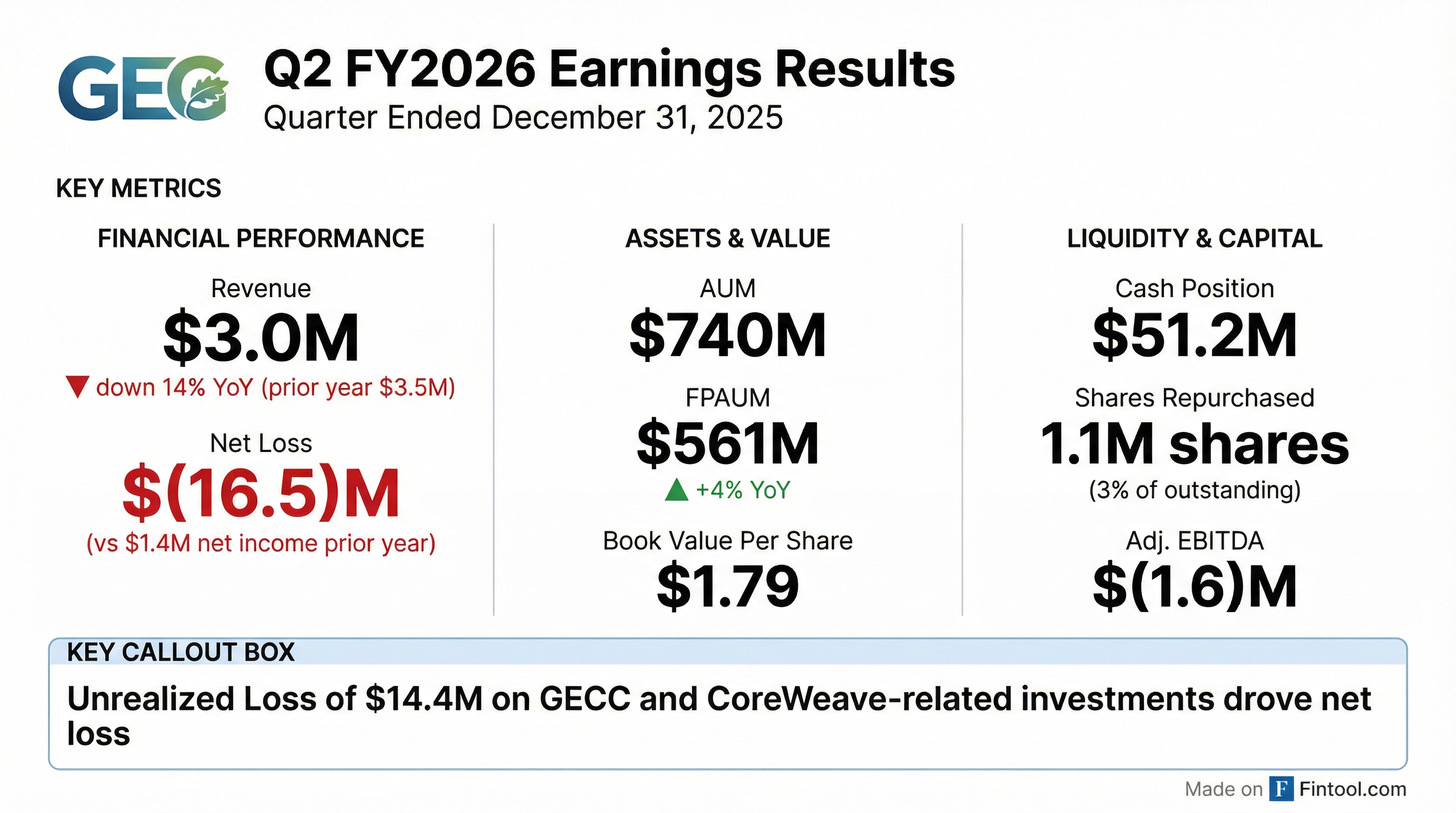

- Great Elm Group reported a net loss of $16.5 million for Q2 2026, primarily driven by $14.4 million in unrealized losses from investments, including $6.7 million related to its CoreWeave-related investment and $7 million from GECC Common Stock and related special-purpose vehicles.

- Revenue for the quarter was $3 million, and Adjusted EBITDA was a loss of $1.6 million.

- Estimated fee-paying assets under management (AUM) grew 4% year-over-year to approximately $561 million, with total estimated AUM at $740 million.

- The company repurchased approximately 1.1 million shares of GEG stock at an average price of $2.47 per share during the quarter, contributing to a total of 6.4 million shares repurchased since the program's inception, representing nearly 20% of shares outstanding.

- Great Elm Group maintained a strong liquidity position with $51.2 million in cash on its balance sheet as of December 31, 2025.

1 day ago

Great Elm Group Reports Q2 2026 Net Loss Driven by Unrealized Investment Losses

GEG

Earnings

Share Buyback

New Projects/Investments

- Great Elm Group reported a net loss of $16.5 million for fiscal Q2 2026, primarily due to $14.4 million in unrealized losses from investments, including $6.7 million related to its CoreWeave-related investment, $4 million from GECC Common Stock, and $3 million from related SPV investments.

- Revenue for the quarter was $3 million, a decrease from $3.5 million in the prior year period, mainly attributed to $0.6 million in property sales and $0.5 million of incentive fees not recognized in the current quarter, partially offset by $0.4 million in new construction management revenue.

- Estimated fee-paying assets under management (AUM) grew 4% year-over-year to approximately $561 million, with total estimated AUM at $740 million as of December 31, 2025.

- During the quarter, the company repurchased approximately 1.1 million shares at an average price of $2.47 per share, contributing to a total of 6.4 million shares repurchased since the program's inception, representing nearly 20% of shares outstanding.

- Great Elm Group maintained a strong liquidity position with $51.2 million in cash on its balance sheet as of December 31, 2025.

1 day ago

Great Elm Group Reports Fiscal Q2 2026 Net Loss Driven by Unrealized Investment Losses

GEG

Earnings

Share Buyback

New Projects/Investments

- Great Elm Group reported a net loss of $16.5 million for Fiscal Q2 2026, primarily due to $14.4 million in unrealized losses from investments, including $6.7 million from its CoreWeave-related investment and $7 million from GECC Common Stock and related SPVs.

- Revenue for the quarter was $3 million, a decrease from the prior year, while estimated fee-paying assets under management (AUM) grew 4% year-over-year to approximately $561 million.

- The company maintained strong liquidity with $51.2 million in cash as of December 31, 2025, and repurchased approximately 1.1 million shares of GEG stock at an average price of $2.47 per share during the quarter.

1 day ago

GEG Reports Q2 2026 Financial Results with Net Loss and Share Repurchases

GEG

Earnings

Share Buyback

New Projects/Investments

- GEG reported a net loss of $(16.5) million for Fiscal 2Q26, primarily driven by a $14.4 million unrealized loss on investments, compared to a net income of $1.4 million in the prior-year period. Revenue for the quarter was $3.0 million.

- As of December 31, 2025, Assets Under Management (AUM) were $740 million, and Fee-Paying AUM (FPAUM) was $561 million, reflecting a 4% year-over-year growth in FPAUM.

- The company repurchased approximately 1.1 million shares at an average price of $2.47 per share during the quarter, representing over 3% of shares outstanding. As of February 3, 2026, $12.3 million of program capacity remained for share repurchases.

- GEG ended the quarter with $51.2 million of cash and continued progress in its Real Estate segment, including the substantial completion of a Monomoy BTS property for sale in the second half of fiscal 2026.

1 day ago

Great Elm Group, Inc. Reports Fiscal Q2 2026 Financial Results

GEG

Earnings

Share Buyback

New Projects/Investments

- Great Elm Group, Inc. reported a net loss of $(16.5) million for the fiscal second quarter ended December 31, 2025, compared to net income of $1.4 million in the prior-year period, primarily driven by $14.4 million in unrealized losses from investments.

- Total revenue for the quarter was $3.0 million, down from $3.5 million in the prior-year period, and Adjusted EBITDA was $(1.6) million.

- Fee-paying assets under management (FPAUM) grew 4% year-over-year to $561 million, while total assets under management (AUM) decreased 2% to $740 million as of December 31, 2025.

- The company repurchased approximately 1.1 million shares (over 3% of shares outstanding) at an average price of $2.47 per share during the quarter.

- Operationally, Monomoy BTS substantially completed its third build-to-suit development property in Florida, and the Great Elm Credit Income Fund began an orderly wind-down.

2 days ago

Great Elm Group Reports Fiscal Q2 2026 Financial Results

GEG

Earnings

Share Buyback

- Great Elm Group reported a net loss of $(16.5) million and total revenue of $3.0 million for its fiscal second quarter ended December 31, 2025, primarily driven by $14.4 million in unrealized losses on investments.

- Fee-paying assets under management (FPAUM) grew 4% year-over-year to approximately $561 million as of December 31, 2025.

- The company repurchased approximately 1.1 million shares in the second quarter, representing over 3% of shares outstanding, at an average price of $2.47 per share.

- As of December 31, 2025, Great Elm Group had approximately $51.2 million in cash and cash equivalents on its balance sheet.

2 days ago

Great Elm Group, Inc. Reports Financial Results and Segment Realignment

GEG

Earnings

New Projects/Investments

Accounting Changes

- Great Elm Group, Inc. (GEG) reported net income from continuing operations of $15,550 thousand for the twelve months ended June 30, 2025, a significant improvement from a net loss of $(942) thousand in the prior year, despite total revenues decreasing to $16,316 thousand.

- The Alternative Credit segment experienced a 31% increase in revenues, reaching $10,323 thousand for the twelve months ended June 30, 2025, and achieved a net income of $2,351 thousand for the segment, compared to a net loss of $(9,595) thousand in the prior year.

- As of June 30, 2025, GEG's combined assets under management (AUM) were approximately $758.5 million, and the company maintained an unrestricted cash balance of $30.6 million.

- Effective for the quarter ended September 30, 2025, GEG realigned its financial reporting into two segments: Alternative Credit and Real Estate.

Jan 7, 2026, 10:12 PM

Great Elm Group Reports Q1 2026 Results with Increased Revenue and Strategic Investments

GEG

Earnings

New Projects/Investments

Share Buyback

- Great Elm Group (GEG) reported Fiscal 1Q26 revenue of $10.8 million, a significant increase from $4.0 million in the prior-year period, primarily driven by the $7.4 million sale of a Monomoy BTS property. However, the company recorded a net loss of $(7.9) million and Adjusted EBITDA of $(0.5) million for the quarter, largely due to unrealized losses on investments.

- As of September 30, 2025, GEG grew pro forma Fee-Paying Assets Under Management (FPAUM) by 10% to $601 million and pro forma Assets Under Management (AUM) by 7% to $792 million year-over-year.

- In July 2025, GEG closed a strategic partnership with Kennedy Lewis Investment Management (KLIM), which included KLIM purchasing ~1.4 million shares of GEG common stock at $2.11 per share and providing up to $150 million in leverageable capital for real estate platform expansion. Additionally, in August 2025, Woodstead Value Fund invested $9 million in GEG by purchasing 4.0 million shares at $2.25 per share, and Booker Smith was appointed to the GEG Board.

- GEG ended the quarter with a robust balance sheet, including $53.5 million in cash as of September 30, 2025. The Board also authorized an additional $5 million for stock repurchases, bringing the total program to $25 million, with approximately $14.1 million remaining capacity as of November 11, 2025.

Nov 13, 2025, 1:30 PM

Great Elm Group Reports Q1 2026 Results with Increased Revenue and AUM Growth

GEG

Earnings

Debt Issuance

Share Buyback

- Great Elm Group (GEG) reported Q1 2026 revenue of $10.8 million, a significant increase from $4 million in the prior year period, primarily driven by $7.4 million from the sale of a Monomoy BTS built-to-suit property. However, the company posted a net loss of $7.9 million, mainly due to unrealized losses on investments in GECC common stock and CoreWeave-related holdings.

- Fee-paying Assets Under Management (AUM) grew 9% year-over-year to approximately $594 million, or 10% on a pro forma basis to approximately $601 million. This growth was supported by raising nearly $250 million in debt and equity capital across its credit and real estate platforms, including a transformative partnership with Kennedy Lewis Investment Management.

- The company maintained a solid balance sheet with approximately $53.5 million in cash as of September 30, 2025 , and expanded its stock repurchase program by $5 million to a total of $25 million, having already repurchased 5.6 million shares for $10.9 million at an average price of $1.93 per share through November 11, 2025.

- Despite strong capital formation and balance sheet optimization, GECC's operating results were negatively impacted by the bankruptcy of First Branch, leading to a negative NAV impact.

Nov 13, 2025, 1:30 PM

Great Elm Group, Inc. Reports Fiscal Q1 2026 Financial Results and Strategic Capital Raises

GEG

Earnings

Share Buyback

New Projects/Investments

- Great Elm Group, Inc. reported a net loss of $(7.9) million and Adjusted EBITDA of $(0.5) million for the fiscal first quarter ended September 30, 2025, compared to net income of $3.0 million and Adjusted EBITDA of $1.3 million in the prior-year period. Total revenue for the quarter was $10.8 million, primarily driven by $7.4 million from the sale of a Monomoy build-to-suit development property.

- The company raised nearly $250 million in capital during the quarter for GEG and its managed funds, including a strategic partnership with Kennedy Lewis Investment Management (KLIM) which provided up to $150 million in term loans to Monomoy REIT and purchased 1.4 million shares of GEG common stock.

- Pro Forma Fee-Paying Assets Under Management (FPAUM) and Assets Under Management (AUM) grew 10% and 7% year-over-year, respectively, reaching approximately $601 million and $792 million as of September 30, 2025.

- GEG's Board authorized an additional $5 million for its stock repurchase program in July 2025, bringing the total program to $25 million with approximately $14.1 million remaining capacity. Through November 11, 2025, the company repurchased approximately 5.6 million shares for $10.9 million at an average price of $1.93 per share.

Nov 12, 2025, 9:17 PM

Quarterly earnings call transcripts for Great Elm Group.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more