Earnings summaries and quarterly performance for GLADSTONE CAPITAL.

Research analysts who have asked questions during GLADSTONE CAPITAL earnings calls.

RD

Robert Dodd

Raymond James

7 questions for GLAD

Also covers: , ARCC, BBDC +24 more

Christopher Nolan

Ladenburg Thalmann

4 questions for GLAD

Also covers: EIC, GAIN, HTGC +8 more

Erik Zwick

Lucid Capital Markets

4 questions for GLAD

Also covers: , CCIF, CGBD +12 more

MS

Mickey Schleien

Ladenburg Thalmann

4 questions for GLAD

Also covers: , CCAP, CCIF +14 more

SA

Sean-Paul Adams

Not Provided in Transcript

3 questions for GLAD

Also covers: , ARCC, BXSL +17 more

EZ

Eric Zwick

Hovde Group

1 question for GLAD

Also covers: CION, GECC

JM

Justin Marca

Lucid Capital Markets LLC

1 question for GLAD

Also covers: CION, OXLC, SCM +1 more

Recent press releases and 8-K filings for GLAD.

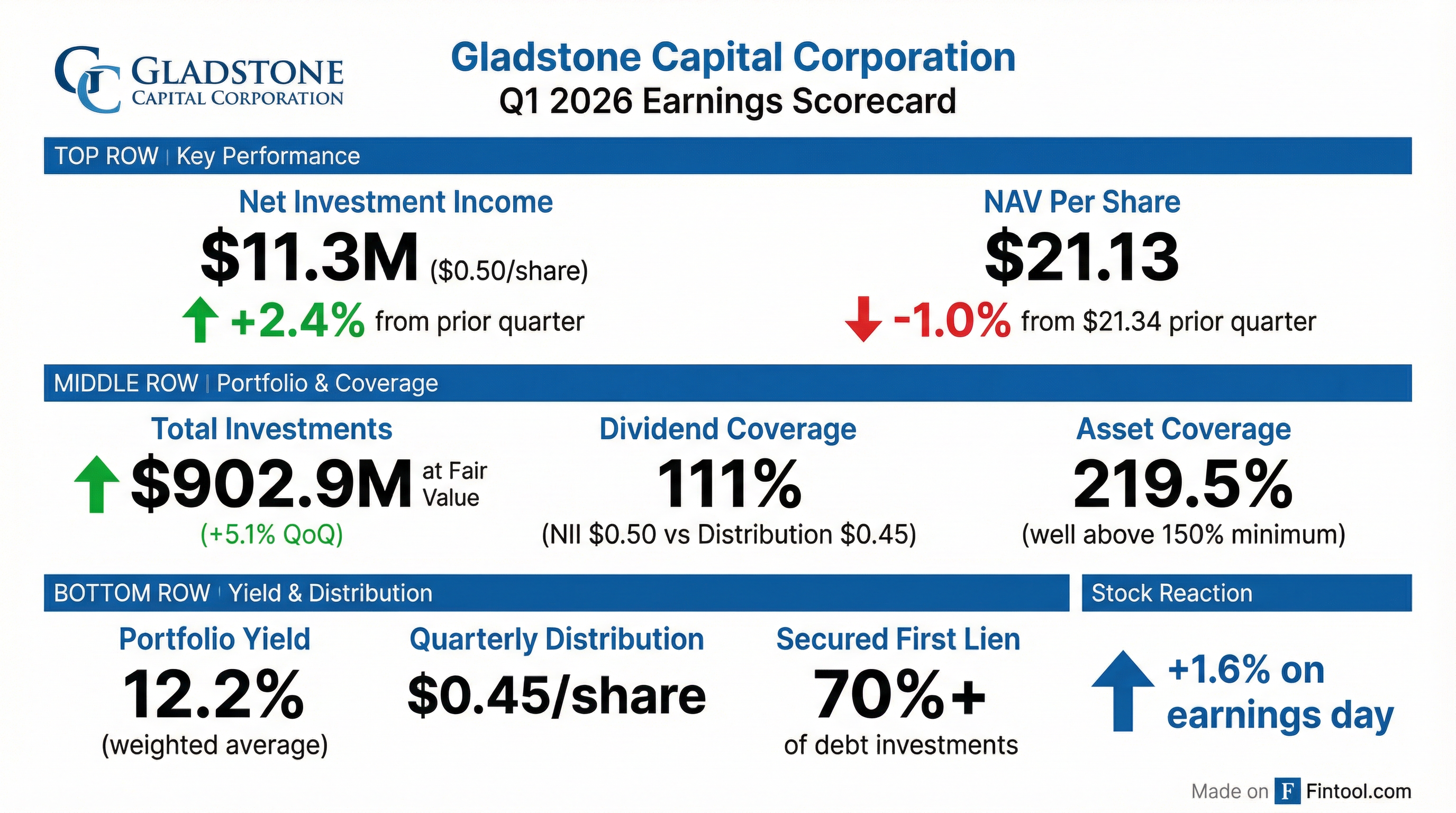

Gladstone Capital Corporation Reports Q1 2026 Earnings with $0.50 NII per Share and Robust Pipeline

GLAD

Earnings

Dividends

New Projects/Investments

- Gladstone Capital Corporation (GLAD) reported net investment income of $11.3 million, or $0.50 per share, for the quarter ended December 31, 2025.

- Net originations for the quarter were $46.3 million, with $99.1 million in fundings and $52.8 million in exits and prepayments.

- As of December 31, 2025, NAV per share declined to $21.13 from $21.34, and gross leverage increased to 93.3% of net assets.

- The company declared monthly distributions of $0.15 per common share for February and March 2026, representing an 8.8% annual yield based on the current stock price.

- Since the quarter-end, GLAD experienced a $42.8 million prepayment from Vet's Choice and maintains a robust pipeline of over $100 million in late-stage deals.

1 day ago

Gladstone Capital Corporation Reports Q1 2026 Results

GLAD

Earnings

Dividends

New Projects/Investments

- Gladstone Capital Corporation reported net investment income of $11.3 million or $0.50 per share for Q1 2026, with total investment income at $24.5 million.

- Net assets declined $4.7 million to $477 million, and NAV per share decreased from $21.34 to $21.13 as of December 31st.

- The company achieved net originations of $46.3 million in Q1 2026, with $99.1 million in fundings and $52.8 million in exits and prepayments.

- Monthly distributions for February and March are set at $0.15 per common share, representing an annual run rate of $1.80 per share and a yield of approximately 8.8%.

- The company maintains a robust pipeline of over $100 million in late-stage deals and has more than $150 million in borrowing availability from its $365 million line of credit facility.

1 day ago

Gladstone Capital Reports Q1 2026 Results with Increased Net Originations and Stable Dividend

GLAD

Earnings

Dividends

New Projects/Investments

- Gladstone Capital reported net investment income of $11.3 million or $0.50 per share for the quarter ended December 31, 2025. Interest income rose to $23.9 million, with a weighted average debt yield of 12.2% for the period.

- The company recorded fundings totaling $99.1 million and exits and prepayments of $52.8 million, resulting in net originations of $46.3 million. The current pipeline of late-stage deals is robust at over $100 million.

- As of December 31, 2025, total assets rose to $923 million, with investments at fair value of $903 million. Net assets declined $4.7 million to $477 million, and NAV per share decreased from $21.34 to $21.13.

- Gross leverage was 93.3% of net assets as of December 31, 2025. Monthly distributions for February and March 2026 are set at $0.15 per common share, an annual run rate of $1.80 per share, yielding approximately 8.8%.

- The company has a $365 million line of credit with over $150 million in borrowing availability and is positioned to absorb a 50 to 75 basis point decline in SOFR rates to sustain its dividend.

1 day ago

Gladstone Capital Corporation Reports Q1 2026 Financial Results

GLAD

Earnings

Dividends

New Projects/Investments

- Gladstone Capital Corporation reported net investment income of $11.3 million, or $0.50 per common share, for the first quarter ended December 31, 2025, with total investment income increasing by 2.4% to $24.5 million.

- The company's net asset value per common share was $21.13 as of December 31, 2025.

- During the quarter, $37.8 million was invested in two new portfolio companies and $61.3 million in existing ones.

- Subsequent to quarter-end, in January 2026, a $42.8 million debt investment paid off, and the revolving line of credit commitment was increased by $25.0 million on February 3, 2026.

- The Board of Directors declared distributions of $0.15 per common share for January, February, and March 2026, totaling $0.45 for the quarter.

2 days ago

Gladstone Capital Corporation Reports Q4 2025 Earnings and Strategic Refinancing

GLAD

Earnings

Debt Issuance

Dividends

- Gladstone Capital Corporation reported net investment income of $11.4 million, or $0.52 per share, for Q4 2025, with interest income increasing 14% to $23.8 million. The trailing twelve months return on equity (ROE) was 11.9%.

- In Q4 2025, fundings totaled $126.6 million, resulting in $103.1 million in net originations. For fiscal year 2025, total originations were $397 million. The portfolio's first lien debt increased to 72% of fair value.

- The company maintained a conservative leverage position with net debt at 82.5% of NAV and successfully refinanced its 2026 debt maturity with a $149 million convertible issue, also calling $57 million 7.75% 2028 notes.

- Monthly distributions for November and December 2025 are set at $0.15 per common share, equating to an annual run rate of $1.80 per share and a yield of approximately 9.6%. The quarterly dividend was reduced to $0.45 to set expectations for 2026 given anticipated rate declines. Management expects accelerating portfolio growth in fiscal 2026 and is considering share repurchases.

Nov 18, 2025, 1:30 PM

Gladstone Capital Corporation Reports Q4 2025 Results and Refinancing Activities

GLAD

Earnings

Debt Issuance

Dividends

- Gladstone Capital Corporation reported Q4 2025 net investment income of $11.4 million or $0.52 per share, with interest income rising 14% to $23.8 million. For fiscal year 2025, total originations reached $397 million, increasing the investment portfolio's fair value by $63 million. NAV per share increased to $21.34 as of September 30, 2025.

- The company maintains a conservative leverage position with net debt at 82.5% of NAV. Significant refinancing activities were completed, including a $149 million convertible issue and the calling of $57 million 7.75% 2028 notes and $150 million 5 1/8 notes due January 2026. Pro forma line of credit availability is approximately $130 million.

- Monthly distributions for November and December 2025 are set at $0.15 per common share, an annual run rate of $1.80 per share. The quarterly dividend for the fiscal first quarter was reduced to $0.45 to maintain financial flexibility amidst potential rate declines, with the possibility of future supplemental dividends.

- Management expressed cautious optimism for the lower middle market, expecting it to remain relatively insulated from spread erosion, and noted a healthy pipeline of deals with approximately $100 million of potential volume.

Nov 18, 2025, 1:30 PM

Gladstone Capital Corporation Reports Strong Q4 and Fiscal Year 2025 Results, Completes Refinancing, and Adjusts Dividend

GLAD

Earnings

Debt Issuance

Dividends

- For Q4 2025, Gladstone Capital Corporation reported net investment income of $11.4 million , with interest income rising 14% to $23.8 million. For fiscal year 2025, the company sourced $397 million in originations , contributing to a $63 million increase in the fair value of its investment portfolio.

- The company's portfolio saw first lien debt increase to 72% of fair value, with total debt holdings at 90%. NAV per share rose to $21.34 as of September 30, 2025 , and gross leverage was 84.3% of net assets.

- Gladstone Capital completed significant refinancing activities, including a $149 million convertible note issue and calling $57 million in 2028 notes , resulting in approximately $130 million in line of credit borrowings availability.

- Monthly distributions for November and December 2025 are set at $0.15 per common share , and the company anticipates accelerating portfolio growth in fiscal year 2026 , with a healthy pipeline of attractive investment opportunities. The quarterly dividend for the fiscal first quarter was reduced to $0.45 , with the potential for supplemental dividends.

Nov 18, 2025, 1:30 PM

Gladstone Capital Corporation Reports Q4 and Fiscal Year 2025 Results

GLAD

Earnings

Debt Issuance

Dividends

- Gladstone Capital Corporation reported net investment income of $11.4 million, or $0.52 per common share, for the fourth quarter ended September 30, 2025, and $45.2 million, or $2.02 per common share, for the fiscal year ended September 30, 2025.

- The company's net asset value per common share increased to $21.34 as of September 30, 2025, up from $21.25 in the prior quarter.

- During Q4 2025, GLAD invested $106.7 million in five new portfolio companies and $19.9 million in existing ones, and issued $149.5 million in 5.875% Convertible Notes due 2030.

- Subsequent to the quarter end, the company redeemed $57.0 million of 7.75% Notes due 2028 and $150.0 million of 5.125% Notes due 2026 in October 2025.

- The Board of Directors declared monthly common stock distributions of $0.15 per share for October, November, and December 2025, totaling $0.45 for the quarter.

Nov 17, 2025, 9:26 PM

Gladstone Capital Corporation Issues 5.875% Convertible Notes Due 2030

GLAD

Debt Issuance

Convertible Preferred Issuance

- Gladstone Capital Corporation announced the issuance and sale of $130,000,000 aggregate principal amount of 5.875% convertible notes due 2030.

- The notes have an initial conversion rate of 38.4394 shares of common stock per $1,000 principal amount, equivalent to an initial conversion price of approximately $26.02 per share.

- The company estimates net proceeds from the offering to be approximately $142.3 million, which it intends to use to repay a portion of its credit facility indebtedness and for general corporate purposes, including potentially redeeming outstanding 2026 and 2028 Notes.

- The notes will pay interest semi-annually starting April 1, 2026, and are not redeemable by the company prior to October 6, 2028.

Sep 12, 2025, 8:24 PM

Quarterly earnings call transcripts for GLADSTONE CAPITAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more