Earnings summaries and quarterly performance for Hanover Bancorp, Inc. /MD.

Executive leadership at Hanover Bancorp, Inc. /MD.

MP

Michael P. Puorro

Detailed

Chairman and Chief Executive Officer

CEO

JP

John P. Vivona

Detailed

First Senior Vice President and Chief Risk Officer

JF

Joseph F. Burns

Detailed

Executive Vice President and Chief Lending Officer

KC

Kevin Corbett

Detailed

Executive Vice President and Chief Credit Officer

LP

Lance P. Burke

Detailed

Executive Vice President and Chief Financial Officer

LA

Lisa A. Diiorio

Detailed

First Senior Vice President and Chief Accounting Officer

MW

McClelland Wilcox

Detailed

President

Board of directors at Hanover Bancorp, Inc. /MD.

Research analysts covering Hanover Bancorp, Inc. /MD.

Recent press releases and 8-K filings for HNVR.

Hanover Bancorp, Inc. Reports Q4 and Full Year 2025 Results, Declares Dividend

HNVR

Earnings

Dividends

Share Buyback

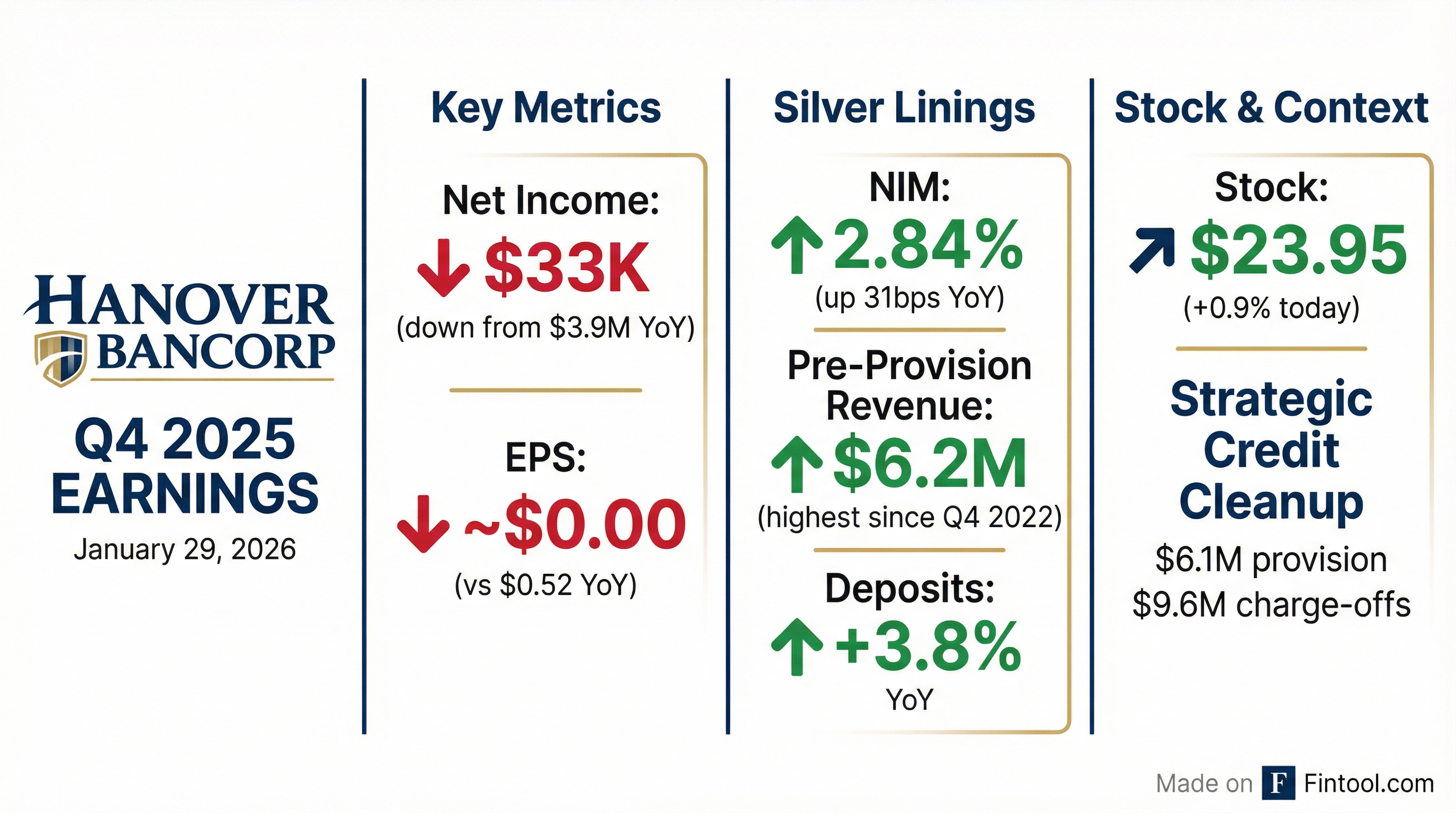

- Hanover Bancorp, Inc. reported net income of $33 thousand for the quarter ended December 31, 2025, a decrease from $3.9 million in the comparable 2024 quarter, primarily due to a $6.1 million provision for credit losses. For the full year ended December 31, 2025, net income was $7.5 million or $1.00 per diluted share.

- The company's net interest income increased to $15.8 million in Q4 2025, a 14.64% increase from Q4 2024, and the net interest margin expanded to 2.84% from 2.53% in the comparable prior year quarter.

- Total deposits increased by $53.6 million (2.71%) from September 30, 2025, and demand deposits grew by $14.8 million (6.35%) in the same period, contributing to a loan to deposit ratio of 99% at December 31, 2025.

- During Q4 2025, Hanover Bancorp, Inc. initiated a strategic credit cleanup, removing $9.6 million of non-performing loans (NPLs) from the balance sheet, resulting in gross NPLs of $21.6 million, or 1.08% of total loans outstanding.

- The Board of Directors approved a $0.10 per share cash dividend on both common and Series A preferred shares, payable on February 26, 2026. Additionally, the company repurchased 56,711 shares of its common stock at a weighted average price of $22.60 per share during the quarter.

Jan 29, 2026, 9:00 PM

Hanover Bancorp Reports Q4 and Full Year 2025 Results, Declares Cash Dividend

HNVR

Earnings

Dividends

Share Buyback

- Hanover Bancorp reported net income of $33 thousand for the quarter ended December 31, 2025, a significant decrease from $3.5 million in the prior linked quarter and $3.9 million in the fourth quarter of 2024, primarily due to a $6.1 million provision for credit losses. For the full year 2025, net income was $7.5 million, down from $12.3 million in 2024.

- Despite the decrease in net income, the company demonstrated operational improvements with net interest income of $15.8 million in Q4 2025, an increase of 3.99% from the prior quarter and 14.64% from Q4 2024. The net interest margin expanded to 2.84% in Q4 2025 , and pre-provision net revenue reached $6.2 million or 1.08% of average assets, the highest level since Q4 2022. The operating efficiency ratio also improved to 66.46% in Q4 2025, the lowest since Q1 2024.

- Total deposits increased by $53.6 million (2.71%) from September 30, 2025, and $74.1 million (3.79%) from December 31, 2024, with demand deposits growing by 17.07% year-over-year. The loan to deposit ratio improved to 99% at December 31, 2025. The company also initiated a strategic credit cleanup in Q4 2025, removing $9.6 million of non-performing loans and recording $9.6 million in net charge-offs.

- The Board of Directors approved a $0.10 per share cash dividend on both common and Series A preferred shares. Additionally, the company repurchased 56,711 shares of its common stock in Q4 2025 at a weighted average price of $22.60 per share, with 284,075 shares remaining available under the repurchase program as of December 31, 2025.

Jan 29, 2026, 9:00 PM

Hanover Bancorp, Inc. Reports Q3 2025 Financial Results and Strategic Updates

HNVR

Earnings

New Projects/Investments

Delisting/Listing Issues

- For the quarter ended September 30, 2025, Hanover Bancorp, Inc. reported net income of $3.5 million and diluted EPS of $0.47. As of September 30, 2025, the company's Total Assets were $2.33 billion, Total Loans were $1.99 billion, and Total Deposits were $1.98 billion.

- The company maintained strong asset quality with non-accrual loans at $17.2 million, or 0.86% of total loans, and net charge-offs of $0.6 million or 0.03% of average loans for the quarter ended September 30, 2025. The CRE concentration ratio improved to 362% of total capital at September 30, 2025.

- Hanover Bancorp, Inc. was added to the Russell 2000 index in late June 2025 and completed its core system conversion to FIS Horizon in February 2025. The company also opened a new Port Jefferson Branch on June 25, 2025, which contributed to $24.1 million in Q3 2025 originations tied to new locations.

- Liquidity remains strong with 86% of total deposits insured and collateralized and $712.2 million in undrawn sources, covering 253% of uninsured deposits as of September 30, 2025.

Nov 11, 2025, 12:23 AM

Hanover Bancorp, Inc. Reports Strong Q3 2025 Results and Declares Quarterly Dividend

HNVR

Earnings

Dividends

Revenue Acceleration/Inflection

- Hanover Bancorp, Inc. reported net income of $3.5 million, or $0.47 per diluted share, for the quarter ended September 30, 2025, an increase from $2.4 million or $0.33 per diluted share in the prior linked quarter.

- The company's Board of Directors approved a $0.10 per share cash dividend payable on November 20, 2025.

- Net interest income reached $15.2 million for the quarter ended September 30, 2025, marking a 16.19% increase from the same quarter in 2024, with the net interest margin expanding to 2.74% from 2.37%.

- Total loans grew to $1.99 billion and total deposits increased by $23.5 million (1.21%) from June 30, 2025, while book value per share rose to $27.03 and tangible book value per share to $24.43 at September 30, 2025.

Oct 30, 2025, 8:01 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more