Earnings summaries and quarterly performance for HEALTHEQUITY.

Executive leadership at HEALTHEQUITY.

Scott Cutler

President and Chief Executive Officer

Delano Ladd

Executive Vice President and General Counsel

Elimelech Rosner

Executive Vice President and Chief Technology Officer

James Lucania

Executive Vice President and Chief Financial Officer

Michael Fiore

Executive Vice President and Chief Commercial Officer

Stephen Neeleman

Founder and Vice Chairman

Board of directors at HEALTHEQUITY.

Research analysts who have asked questions during HEALTHEQUITY earnings calls.

George Hill

Deutsche Bank

6 questions for HQY

Allen Lutz

Bank of America

5 questions for HQY

David Larsen

BTIG

5 questions for HQY

Mark Marcon

Baird

4 questions for HQY

Scott Schoenhaus

KeyBanc Capital Markets

4 questions for HQY

Anne McCormick

JPMorgan Chase & Co.

3 questions for HQY

C. Gregory Peters

Raymond James

3 questions for HQY

David Roman

Goldman Sachs Group Inc.

3 questions for HQY

Glen Santangelo

Jefferies

3 questions for HQY

Stanislav Berenshteyn

Wells Fargo

3 questions for HQY

Steven Valiquette

Mizuho

3 questions for HQY

Alan Lutz

Bank of America Corporation

2 questions for HQY

Charles Peters

Raymond James

2 questions for HQY

Stan Berenshteyn

Wells Fargo Securities

2 questions for HQY

Stan Berenstein

Wells Fargo

2 questions for HQY

Anne Samuel

JPMorgan Chase & Co.

1 question for HQY

Brian Tanquilut

Jefferies

1 question for HQY

Constantine Davides

Citizens JMP

1 question for HQY

Jamie Perse

The Goldman Sachs Group, Inc.

1 question for HQY

Matthew Inglis

RBC Capital Markets

1 question for HQY

Sam Hassan

Mizuho

1 question for HQY

Sean Dodge

RBC Capital Markets

1 question for HQY

Stephanie Davis

Barclays

1 question for HQY

Thomas Kelliher

RBC Capital Markets

1 question for HQY

Recent press releases and 8-K filings for HQY.

- Pindrop announced its expansion into the healthcare industry on February 26, 2026, introducing AI-powered deepfake detection and continuous identity verification for HIPAA-regulated environments.

- HealthEquity, a major health savings account administrator, collaborated with Pindrop to strengthen its voice channel security against AI-powered fraud.

- Through this partnership, HealthEquity achieved a 90%+ reduction in voice fraud year-over-year.

- Additionally, HealthEquity reported that its IVR profile match rates increased from 31% to 71% within the first month, and authentication rates exceeded 91%.

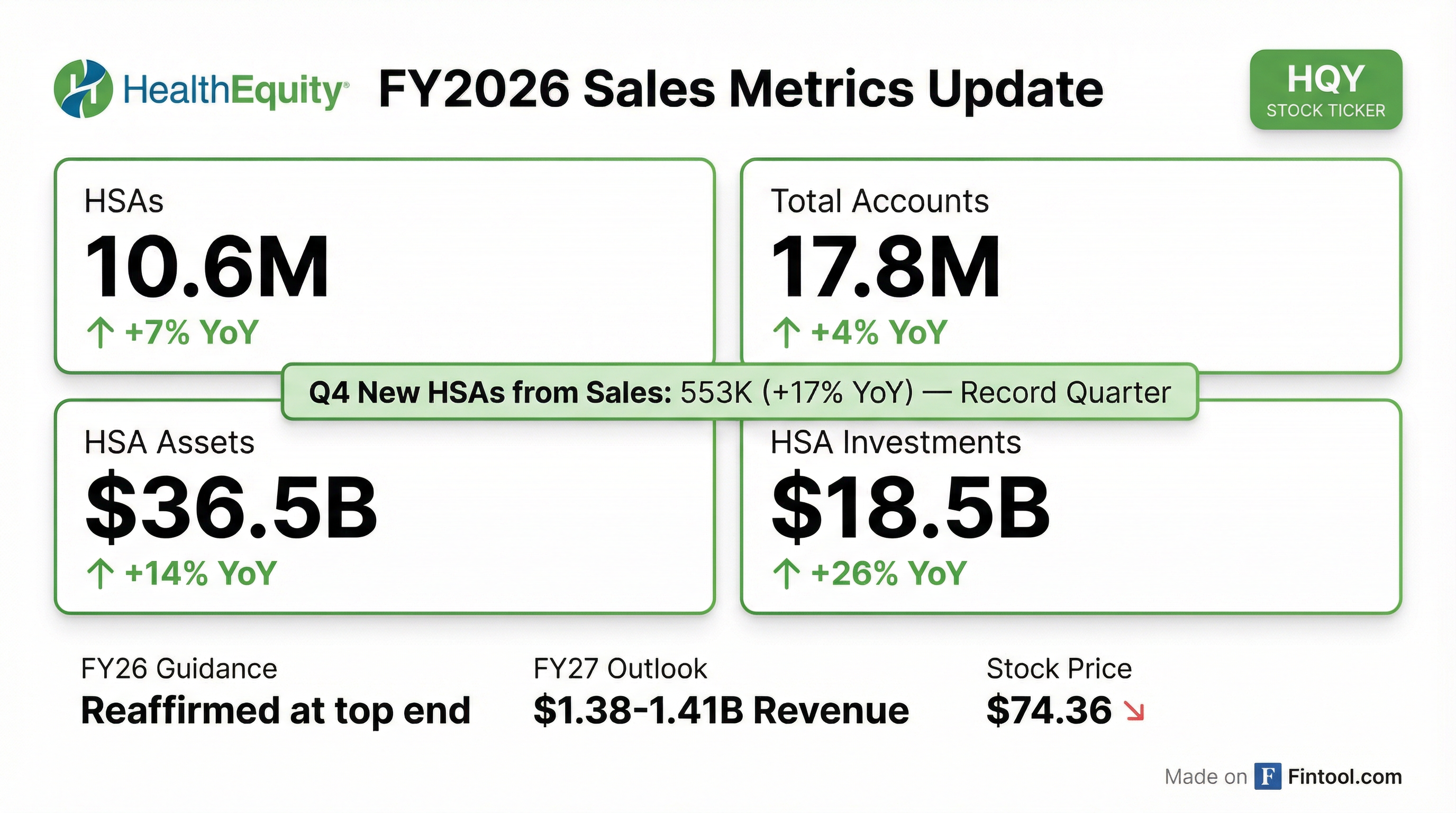

- HealthEquity, Inc. reported record Q4 and standout fiscal 2026 sales metrics, with total HSAs reaching 10.6 million and HSA Assets growing to $36.5 billion as of January 31, 2026.

- The company achieved a 7% year-over-year increase in total HSAs and a 14% increase in HSA Assets, driven by a 26% rise in HSA investments to $18.5 billion.

- New HSAs from sales in the fourth quarter increased by 17% year over year, contributing to over one million new HSA accounts added from sales in fiscal 2026.

- HealthEquity reaffirmed its guidance for fiscal 2026 and 2027, anticipating fiscal 2026 results to be near the top end of previously provided ranges.

- HealthEquity reported significant growth in its key metrics for fiscal year 2026, with total Health Savings Accounts (HSAs) reaching 10.6 million (up 7% year-over-year) and total HSA Assets growing 14% to $36.5 billion as of January 31, 2026.

- The company achieved a record fiscal 2026 sales year, adding over one million new HSA accounts from sales, and saw fourth-quarter new HSAs from sales increase 17% year over year.

- HealthEquity reaffirmed its fiscal 2026 and 2027 guidance, anticipating fiscal 2026 results to be near the top end of previously provided ranges.

- HealthEquity, the #1 HSA provider, reported 10.1 million HSAs and $34.4 billion in HSA assets as of October 31, 2025, reflecting 6% and 15% year-over-year growth, respectively.

- For the third quarter of fiscal year 2026 (ended October 31, 2025), the company achieved $322.2 million in revenue, a 7% year-over-year increase, and $141.8 million in Adjusted EBITDA, a 20% year-over-year increase.

- HealthEquity provided Fiscal Year 2026 guidance (as of December 3, 2025) with revenue projected between $1,302 million and $1,312 million and Adjusted EBITDA between $555 million and $565 million.

- The company also issued an outlook for Fiscal Year 2027 (as of January 12, 2026), forecasting revenue between $1,380 million and $1,410 million and Adjusted EBITDA as a percentage of revenue between 43.8% and 44.3%.

- Net cash flows provided by operating activities for the first nine months of Fiscal Year 2026 reached $339 million.

- HealthEquity operates a leading HSA platform, managing over 17 million consumer-directed benefit accounts and $34 billion in HSA assets, with $17.5 billion in invested assets growing 29% year-over-year.

- The company is focused on modernizing its platform through a mobile-first digital experience and integrating AI across all functional areas to enhance member engagement, improve operational efficiency, and reduce costs.

- HealthEquity provided 2027 guidance implying approximately 7% revenue growth at the midpoint, driven by account growth, increased contributions, investment balance expansion, and greater platform spending.

- A new growth vector for the company is the expansion of its marketplace, connecting members to health-related products and services such as GLP-1s and HRT, which generates new revenue streams.

- HealthEquity operates the leading HSA platform in the US, serving over 17 million consumer-directed benefit accounts and managing over $34 billion in HSA assets.

- The company provided guidance for 2027, implying approximately 7% revenue growth at the midpoint, driven by account growth, increased contributions, growing investment balances, and greater platform spending, including a new growth vector from its marketplace.

- HealthEquity is expanding its market reach by targeting ACA Bronze plan members who are now eligible for HSAs due to recent policy changes, with early signs indicating these members are funding their accounts.

- The company is implementing AI across its business to improve member experience, lower costs, and expand margins, and has surpassed 3 million member app downloads.

- Key operational metrics include members spending approximately $15 billion annually on the platform, with $16.9 billion in HSA cash and $17.5 billion in invested assets, the latter growing 29% year over year.

- HealthEquity operates the leading HSA platform in the US, managing over 17 million consumer-directed benefit accounts and over $34 billion in HSA assets.

- The company provided 2027 guidance implying approximately 7% revenue growth at the midpoint, driven by account expansion, increased contributions, investment balance growth, and a new marketplace revenue stream.

- Operational highlights include $16.9 billion in HSA cash and $17.5 billion in invested assets, with invested assets growing 29% year over year.

- HealthEquity is actively returning capital to shareholders through a $600 million share purchase authorization and is deleveraging debt.

- The company is focused on digital transformation, including a mobile-first experience and AI integration, to enhance member engagement and operational efficiency.

- HealthEquity, Inc. (HQY) announced its initial outlook for the fiscal year ending January 31, 2027, on January 12, 2026.

- The company projects revenues for FY 2027 to be in the range of $1.38 billion to $1.41 billion.

- Management expects an Adjusted EBITDA margin of 43.8% to 44.3% and a yield on HSA Cash of approximately 3.75% for FY 2027.

- HealthEquity also reaffirmed its previously provided guidance for the fiscal year ending January 31, 2026.

- HealthEquity, Inc. announced its initial outlook for the fiscal year ending January 31, 2027, projecting revenues between $1.38 billion and $1.41 billion.

- For FY2027, the company anticipates an Adjusted EBITDA margin of 43.8% to 44.3% and a yield on HSA Cash of approximately 3.75%.

- HealthEquity also reaffirmed its previously provided guidance for the fiscal year ending January 31, 2026.

- Management will discuss these estimates and expectations at the 44th Annual J.P. Morgan Healthcare Conference on January 13, 2026.

- HealthEquity reported strong Q3 fiscal year 2026 financial results, with revenue up 7% year-over-year and adjusted EBITDA increasing 20% to $141.8 million. Net income grew 806% to $51.7 million, though non-GAAP net income, which excludes a prior-year legal settlement, increased 26% to $87.7 million.

- The company raised its fiscal year 2026 guidance, now projecting revenue between $1.302 billion and $1.312 billion and adjusted EBITDA between $555 million and $565 million.

- Key metrics showed continued growth, with HSA assets up 15% year-over-year to over $34 billion and HSA invested assets growing 29% to $17.5 billion. Total accounts exceeded 17 million, including over 10 million HSAs.

- Strategic initiatives include the launch of a new direct HSA enrollment platform for ACA bronze plan participants and continued investment in security and AI capabilities. The company also repurchased approximately $94 million of its shares during the quarter, with $259 million remaining on its authorization.

Quarterly earnings call transcripts for HEALTHEQUITY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more