Earnings summaries and quarterly performance for International General Insurance Holdings.

Research analysts who have asked questions during International General Insurance Holdings earnings calls.

Michael Phillips

Oppenheimer & Co. Inc.

4 questions for IGIC

Also covers: ACIC, AII, CINF +10 more

NI

Nicolas Iacoviello

Dowling & Partners Securities, LLC

2 questions for IGIC

Also covers: UVE

RM

Roland Meyer

RBC Capital Markets

2 questions for IGIC

Also covers: ACGL, BOW, THG

SH

Scott Heleniak

RBC Capital Markets

2 questions for IGIC

Also covers: BOW, BRO, FRFHF +8 more

Recent press releases and 8-K filings for IGIC.

International General Insurance Holdings Reports Q4 and Full Year 2025 Financial Results

IGIC

Earnings

Dividends

Share Buyback

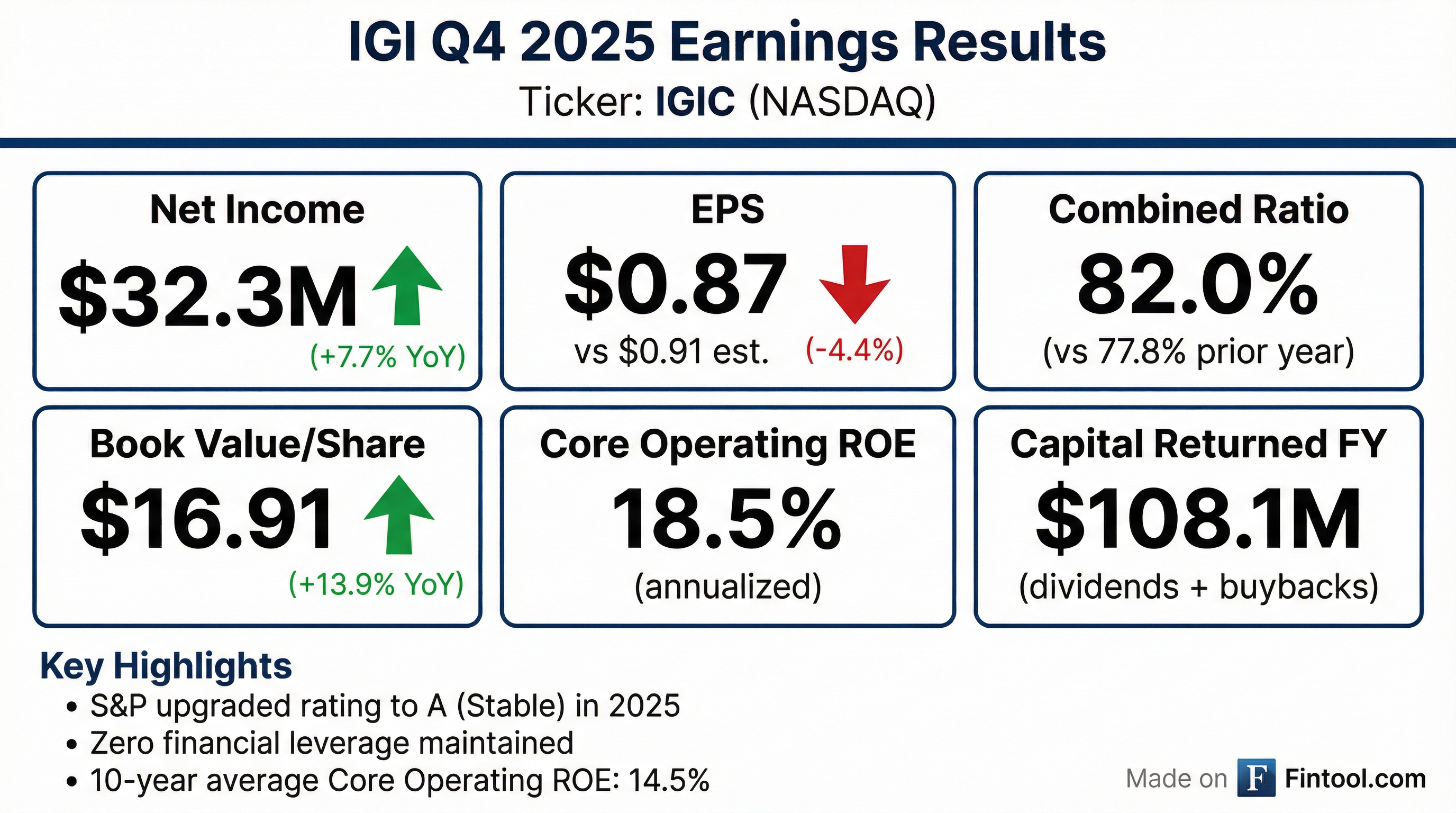

- International General Insurance Holdings (IGIC) reported net income of $127.2 million or $2.89 per share for the full year 2025, achieving a Return on Average Equity of 18.6% and Book Value Per Share growth of almost 14% to $16.91.

- The company's underwriting income for 2025 was $161 million, leading to a combined ratio of just under 86%. Gross premiums written for the full year decreased by $33.4 million, or 4.8%, primarily due to the non-renewal of a large professional indemnity binder.

- IGIC returned more than $108 million to shareholders in 2025 through dividends and share repurchases, including an extraordinary special cash dividend of $1.15 per common share for Q4 2025. In Q4 2025, the company repurchased 344,000 common shares at an average price of $23.51.

- Management noted elevated competitive pressure across the market, particularly in property and energy lines, but stated that rates remain adequate in many lines of business, with competition expected to persist in the near term.

4 days ago

International General Insurance Holdings Reports Strong Full-Year 2025 Results and Announces Special Dividend

IGIC

Earnings

Dividends

Share Buyback

- International General Insurance Holdings (IGIC) reported strong full-year 2025 results, including a combined ratio of just under 86%, a Return on Average Equity of 18.6%, and Book Value Per Share growth of almost 14% to $16.91.

- For Q4 2025, the company recorded net income of $32.3 million or $0.76 per share and a combined ratio of 82%.

- IGIC returned more than $108 million to shareholders in 2025 through dividends and share repurchases, and announced a special cash dividend of $1.15 per common share for the third consecutive year.

- The company noted elevated competitive pressure in the market, particularly in property and energy lines, and anticipates some contraction in top line in certain areas due to strict underwriting discipline, while prioritizing organic growth over M&A.

4 days ago

International General Insurance Holdings Reports Strong Full-Year 2025 Results and Announces Special Dividend

IGIC

Earnings

Dividends

Share Buyback

- International General Insurance Holdings reported full-year 2025 net income of $127.2 million or $2.89 per share, achieving a combined ratio of just under 86% and a Return on Average Equity of 18.6%.

- The company grew Book Value Per Share by almost 14% to $16.91 and returned more than $108 million to shareholders in 2025 through dividends and share repurchases, including a special dividend of $0.15 per share.

- Gross premiums written for the full year 2025 decreased by $33.4 million, or 4.8 percentage points, primarily due to the non-renewal of a large professional indemnity binder.

- Management noted elevated competitive pressure in the market, with rate declines averaging around 10% at 1/1, but stated that rates remain adequate in many lines and the company will maintain underwriting discipline, potentially leading to some top-line contraction in certain areas.

4 days ago

International General Insurance Holdings Reports Q4 and Full Year 2025 Results

IGIC

Earnings

Dividends

Share Buyback

- International General Insurance Holdings (IGIC) reported net income of $32.3 million for Q4 2025 and $127.2 million for the full year 2025.

- The company achieved an annualized Return on Equity (ROE) of 18.5% in Q4 2025 and 18.6% for the full year 2025, with a combined ratio of 82.0% for Q4 2025 and 85.9% for the full year.

- Book value per share increased by 13.9% to $16.91 as of December 31, 2025.

- For the full year 2025, IGIC returned $108.1 million to shareholders, comprising $46.2 million in common share dividends (including a $0.85 special dividend) and $61.9 million in share repurchases. The quarterly common share dividend was also increased to $0.05 in 2025.

- S&P raised IGIC's financial strength rating to A (Stable) in 2025.

4 days ago

IGI Reports Fourth Quarter and Full Year 2025 Financial Results

IGIC

Earnings

Dividends

Share Buyback

- International General Insurance Holdings Ltd. (IGI) reported net income of $32.3 million for the fourth quarter of 2025, an increase of 7.7% over the fourth quarter of 2024, and $127.2 million for the full year 2025.

- The company achieved a combined ratio of 85.9% and a return on average equity of 18.6% for the full year 2025.

- Diluted earnings per share were $0.76 for the fourth quarter of 2025 and $2.89 for the full year 2025.

- Book value per share grew by 13.9% to $16.91 at December 31, 2025, compared to $14.85 at December 31, 2024.

- IGI returned over $108 million to shareholders in share repurchases and dividends during 2025, and declared an ordinary common share dividend of $0.05 per share for the fourth quarter of 2025.

4 days ago

International General Insurance Holdings Ltd. Reports Q4 and Full Year 2025 Financial Results

IGIC

Earnings

Dividends

Share Buyback

- International General Insurance Holdings Ltd. reported a Net Income of $127.2 million for the full year 2025 and $32.3 million for Q4 2025.

- The company's Book Value per Share increased by 13.9% to $16.91 as of December 31, 2025.

- The Combined Ratio for FY 2025 was 85.9% and for Q4 2025 was 82.0%.

- In FY 2025, IGIC returned $108.1 million to shareholders, comprising $46.2 million in dividends (including a $0.85 special dividend and an increased quarterly dividend to $0.05) and $61.9 million in share repurchases.

- The company maintains a strong financial position with $2.1 billion in Total Assets and a $710 million capital base as of December 31, 2025, alongside A A Stable Outlook Financial Strength Ratings.

4 days ago

International General Insurance Reports Q4 and Full-Year 2025 Results

IGIC

Earnings

Share Buyback

Dividends

- International General Insurance (IGI) reported Q4 2025 net income of $32.3 million, an increase of 7.7% year-over-year, with full-year net income reaching $127.2 million.

- Gross written premiums (GWP) for the full year 2025 decreased to $666.7 million due to the deliberate non-renewal of a $50 million professional indemnity binder.

- Despite the GWP decline, underwriting income remained solid at approximately $46.9 million in Q4 and $161.1 million for the year, with a combined ratio of 85.9% for the full year.

- The company's book value per share rose to $16.91, and it returned over $108 million to shareholders through buybacks and dividends.

- IGI achieved a return on average equity (ROAE) of 18.6% for 2025, outperforming its decade-long average.

4 days ago

IGI Reports Fourth Quarter and Full Year 2025 Financial Results

IGIC

Earnings

Dividends

Share Buyback

- International General Insurance Holdings Ltd. reported net income of $127.2 million for the full year 2025.

- The company achieved a combined ratio of 85.9% and an annualized return on average equity of 18.6% for the full year 2025.

- Book value per share grew by 13.9% to $16.91 at December 31, 2025.

- IGI declared an ordinary common share dividend of $0.05 per share for the fourth quarter of 2025, payable on March 31, 2026.

- For the full year 2025, the company repurchased 2,635,510 common shares for $61.9 million.

4 days ago

International General Insurance Holdings Ltd. Highlights Strong Financials and Capital Management

IGIC

Dividends

Share Buyback

Earnings

- International General Insurance Holdings Ltd. (IGIC) reported total assets of $2.1 billion and a capital base of $687 million as of September 30, 2025, maintaining an A (Stable Outlook) financial strength rating.

- The company demonstrated a 10-year average core Return on Equity (ROE) of 14.0% and a 10-year average combined ratio of 87.0% for the period 2015-2024, with its specialist underwriting strategy providing a ~4 point combined ratio advantage relative to the industry.

- IGIC has a history of returning capital to shareholders, including a quarterly common share dividend of $0.05 as of 2024 , and a new 5 million share repurchase authorization announced in October 2025, following the repurchase of 7.5 million common shares between 2022 and September 30, 2025.

- The company manages a diversified portfolio of global specialty risks and a $1.316 billion investment portfolio (as of September 30, 2025) primarily composed of 79% fixed income securities with an average credit quality of A and a duration of 3.7 years.

Nov 19, 2025, 9:40 PM

IGIC Discusses Disciplined Growth Strategy and Financial Performance at Southwest Ideas Conference

IGIC

Guidance Update

Share Buyback

- International General Insurance Holdings (IGIC) is a global specialist insurance and reinsurance company that has grown from $25 million in capital in 2002 to a $700 million capital base with 470-480 employees across eight worldwide offices.

- The company emphasizes a disciplined, methodical growth strategy, prioritizing profitability over top-line growth and actively managing market cycles by shifting focus across its 25 diverse lines of business (reinsurance, short tail, long tail).

- IGIC targets a combined ratio in the mid-to-high 80s and a Return on Equity (ROE) of low-to-mid teens over a 10-year cycle, consistently outperforming peers and recently receiving an S&P financial rating upgrade from A minus to a full A.

- The company maintains a conservative investment philosophy with a plain vanilla fixed income portfolio and has been actively engaged in capital management, including a share buyback program that has repurchased 7.5 million shares since 2022, with a new authorization for an additional 5 million shares, as management believes the stock is undervalued.

Nov 19, 2025, 3:15 PM

Quarterly earnings call transcripts for International General Insurance Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more