Earnings summaries and quarterly performance for i3 Verticals.

Executive leadership at i3 Verticals.

Gregory Daily

Chief Executive Officer

Chris Laisure

President - Public Sector

Clay Whitson

Chief Strategy Officer

Geoff Smith

Chief Financial Officer

Paul Christians

Chief Revenue Officer

Paul Maple

General Counsel and Secretary

Rick Stanford

President

Board of directors at i3 Verticals.

Research analysts who have asked questions during i3 Verticals earnings calls.

Peter Heckmann

D.A. Davidson

6 questions for IIIV

Alexander Markgraff

KeyBanc Capital Markets

5 questions for IIIV

John Davis

Raymond James Financial

5 questions for IIIV

Charles Nabhan

Stephens Inc.

3 questions for IIIV

Madison Schurr

Raymond James & Associates

2 questions for IIIV

Shefali Tamaskar

Morgan Stanley

2 questions for IIIV

Alexander Markgraf

KeyBanc Capital Markets Inc.

1 question for IIIV

John Kimbrough Davis

Raymond James

1 question for IIIV

Mark Palmer

The Benchmark Company, LLC

1 question for IIIV

Rufus Hone

BMO Capital Markets

1 question for IIIV

Recent press releases and 8-K filings for IIIV.

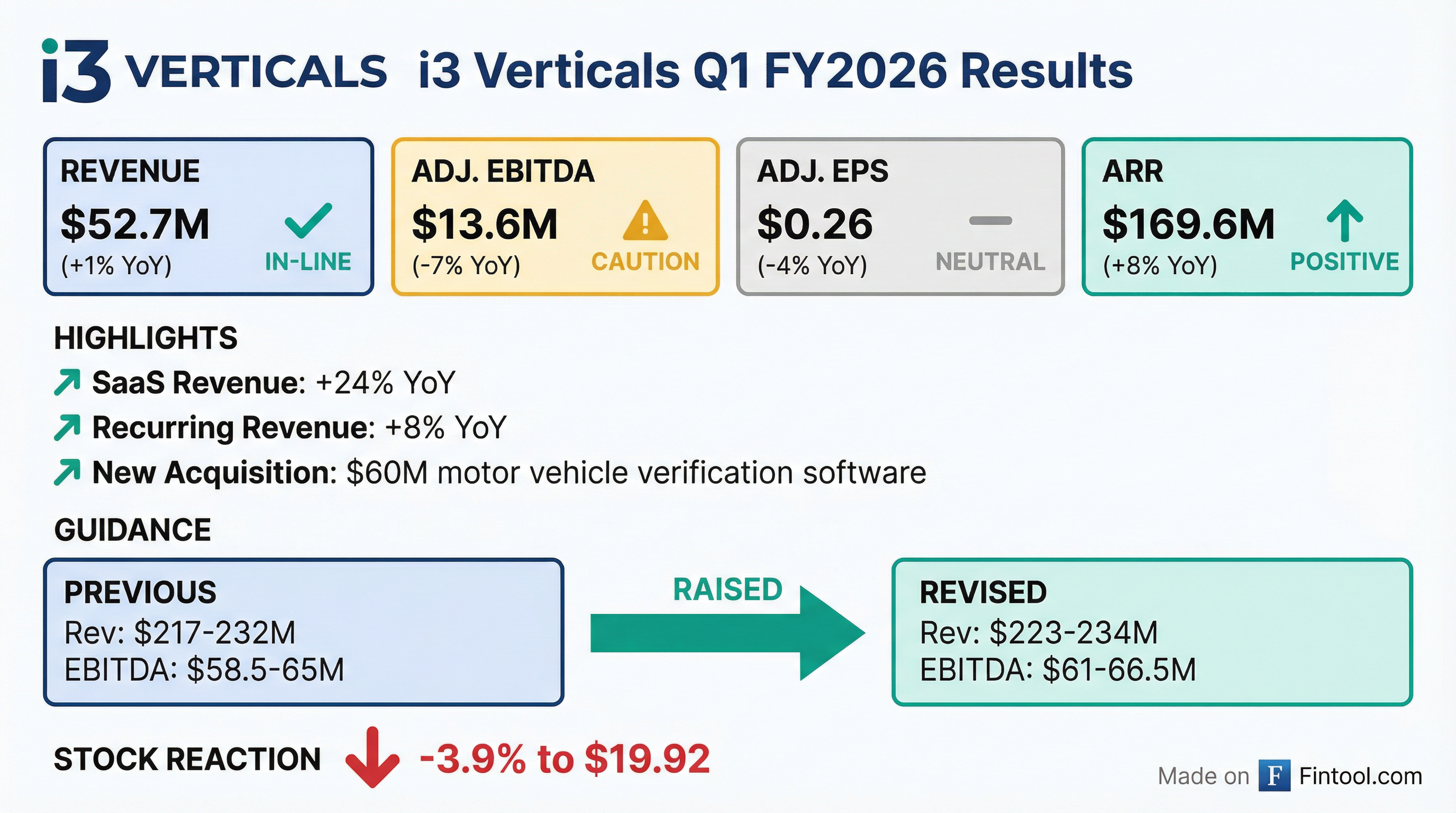

- i3 Verticals reported Q1 2026 revenue of $52.7 million, a 1% increase year-over-year, driven by 8% growth in recurring revenue and over 24% growth in SaaS revenue. Adjusted EBITDA for the quarter was $13.6 million, and adjusted diluted earnings per share was $0.26.

- Effective January 1, 2026, the company acquired a software provider for driver and motor vehicle insurance verification for $60 million in cash. This acquisition, valued at approximately 15x EBITDA, involves a company with over 20% growth and an EBITDA margin above 50%.

- The company provided FY 2026 guidance, expecting revenues between $223 million and $224 million, adjusted EBITDA between $61 million and $66.5 million, and adjusted diluted EPS between $1.08 and $1.16. Recurring revenues are projected to grow at a double-digit rate for the fiscal year, including the acquisition.

- i3 Verticals also conducted a significant share buyback during Q1 2026, maintaining an opportunistic approach to capital deployment.

- i3 Verticals reported Q1 2026 revenue of $52.7 million, a 1% increase year-over-year, with recurring revenue up 8% to $169.6 million and SaaS revenue growing over 24%. Adjusted EBITDA for the quarter declined $1 million to $13.6 million, and adjusted diluted earnings per share was $0.26.

- The company completed an acquisition of a driver and motor vehicle insurance verification software provider for $60 million in cash, effective January 1st, 2026, paying approximately 15x EBITDA for a company growing above 20% with over 50% EBITDA margins.

- For fiscal year 2026, i3 Verticals provided guidance of revenues between $223 million and $224 million, adjusted EBITDA between $61 million and $66.5 million, and adjusted diluted earnings per share between $1.08 and $1.16.

- As of December 31st, 2025, i3 Verticals had $37 million in cash and no debt, and it conducted significant share buybacks during Q1 2026.

- For Q1 2026, i3 Verticals reported revenues of $52.7 million, a 1% increase from Q1 2025, with recurring revenues growing 8% and SaaS revenue up over 24%. Adjusted EBITDA was $13.6 million, and adjusted diluted earnings per share was $0.26.

- The company provided FY 2026 guidance, projecting revenues between $223 million and $234 million, adjusted EBITDA between $61 million and $66.5 million, and adjusted diluted EPS between $1.08 and $1.16. Recurring revenues are expected to grow at a double-digit rate for the full year, including the recent acquisition.

- Effective January 1st, i3 Verticals completed an acquisition of a software provider for driver and motor vehicle insurance verification for $60 million in cash. This acquisition, which is growing above 20% with an EBITDA margin over 50%, was made at approximately 15x EBITDA.

- The company also indicated it bought back a significant number of shares in Q1 2026 and plans to continue an opportunistic approach to buybacks, supported by a strong balance sheet with $37 million in cash and no debt.

- i3 Verticals reported revenue from continuing operations of $52.7 million for the fiscal first quarter ended December 31, 2025, representing a 0.9% increase over the prior year's first quarter.

- Net income from continuing operations attributable to i3 Verticals, Inc. was $0.6 million, and diluted net income per share from continuing operations was $0.02 for Q1 2026. Adjusted EBITDA from continuing operations was $13.6 million.

- Annualized Recurring Revenue (ARR) from continuing operations for the three months ended December 31, 2025, was $169.6 million, showing an 8.4% growth rate compared to the prior year.

- Effective January 1, 2026, the Company acquired a motor vehicle insurance verification software company for $60.0 million in cash consideration.

- i3 Verticals revised its outlook for the fiscal year ending September 30, 2026, with projected revenue between $223.0 million and $234.0 million and Adjusted EBITDA between $61.0 million and $66.5 million.

- i3 Verticals reported Q4 2025 revenue growth of 7% to $54.9 million and fiscal year 2025 revenue growth of 11%, with 8% organic growth. The company has transitioned to a pure-play public sector software solutions provider after divesting its merchant services and healthcare RCM businesses.

- For Q4 2025, Adjusted EBITDA was $14.4 million and Adjusted Diluted EPS from continuing operations was $0.27. The net dollar retention for fiscal 2025 was 104%.

- The company provided fiscal year 2026 guidance for continuing operations, expecting revenues between $217 million and $232 million, Adjusted EBITDA between $58.5 million and $65 million, and Adjusted Diluted EPS between $1.06 and $1.16. Recurring revenues are anticipated to grow at 8%-10%.

- As of September 30, 2025, i3 Verticals held $67 million in cash with no debt and has $400 million in borrowing capacity for acquisitions and opportunistic stock repurchases. The company recently refreshed its buyback approval to $50 million and anticipates meaningful M&A activity.

- i3 Verticals reported Q4 2025 revenue of $54.9 million, a 7% increase year-over-year, contributing to fiscal year 2025 revenue growth of 11% (8% organic). Recurring revenues, now 75% of total revenues, grew 9% in Q4 2025, with SaaS revenues up 25%.

- For fiscal year 2025, Adjusted EBITDA margin was 27% and Adjusted diluted EPS was $1.05. The company's net dollar retention for fiscal 2025, including payments, was 104%.

- The company maintains a strong balance sheet with $67 million in cash and no debt as of September 30, 2025. It has $400 million in borrowing capacity and a refreshed $50 million buyback approval, with plans to deploy capital for acquisitions and opportunistic repurchases.

- i3 Verticals provided FY 2026 guidance, projecting revenues between $217 million and $232 million, Adjusted EBITDA between $58.5 million and $65 million, and Adjusted diluted EPS between $1.06 and $1.16. Recurring revenues are expected to grow 8%-10%, while non-recurring professional services are anticipated to decline.

- Following the divestiture of its merchant services and healthcare RCM businesses, i3 Verticals is now a pure-play software solutions provider for the public sector, with Justice representing approximately 25% of revenues. The company continues to invest in justice products, which is expected to impact margins in 2026.

- i3 Verticals reported Q4 2025 revenues of $54.9 million, a 7% increase year-over-year, with 4.5% organic growth, and recurring revenues growing 9% to $41.3 million.

- For fiscal year 2025, total revenue grew 11% with 8% organic growth, and the net dollar retention was 104%.

- The company ended Q4 2025 with a strong balance sheet, holding $67 million in cash and no debt, and has a refreshed $50 million share buyback approval.

- i3 Verticals provided FY 2026 guidance for continuing operations, projecting revenues between $217 million and $232 million, and adjusted diluted EPS between $1.06 and $1.16.

- The company expects recurring revenues to grow 8%-10% in FY 2026 but anticipates a decline in non-recurring professional services, particularly in Q1.

- For Q4 2025, IIIV reported total revenue from continuing operations of $54,901 thousand, an increase of 7% year-over-year.

- Adjusted EBITDA from continuing operations for Q4 2025 was $14,399 thousand, with an Adjusted EBITDA margin of 26%.

- Adjusted diluted earnings per share from continuing operations reached $0.27 in Q4 2025, while GAAP diluted net income per share from continuing operations was $0.04.

- The company's Annualized Recurring Revenue (ARR) grew 9% year-over-year to $165,260 thousand as of Q4 2025.

- These results reflect continuing operations following the sale of the Merchant Services Business in September 2024 and the Healthcare RCM Business in May 2025, with prior periods recast.

- i3 Verticals reported Q4 fiscal 2025 revenue of $54.9 million, exceeding expectations, and non-GAAP EPS of $0.27, beating estimates, despite a 9.8% year-over-year revenue decline.

- The company demonstrates strong financial stability with an Altman Z-Score of 4.57, a current ratio of 2.02, and a low debt-to-equity ratio of 0.01, but faces potential financial manipulation risks indicated by a Beneish M-Score of -1.31 and challenges in covering interest expenses with an interest coverage ratio of 0.97.

- i3 Verticals forecasts fiscal 2026 revenue between $217 million and $232 million and adjusted EBITDA ranging from $58.5 million to $65 million.

- Insider trading activity in the past six months included three sales by company insiders with no purchases, notably Paul Maple's sale of 2,500 shares for approximately $77,600.

- For the fiscal fourth quarter ended September 30, 2025, i3 Verticals reported revenue from continuing operations of $54.9 million, an increase of 7.0% over the prior year's fourth quarter. Full fiscal year 2025 revenue from continuing operations was $213.2 million, up 11.5% year-over-year.

- Adjusted diluted earnings per share from continuing operations for Q4 2025 was $0.27, compared to $0.12 in Q4 2024. For the full fiscal year 2025, adjusted diluted EPS was $1.05, up from $0.30 in the prior year.

- Adjusted EBITDA from continuing operations for Q4 2025 was $14.4 million, a decrease of 1.5% year-over-year, while the full fiscal year 2025 Adjusted EBITDA was $57.5 million, an increase of 14.0% over the prior year.

- Annualized Recurring Revenue (ARR) from continuing operations for Q4 2025 was $165.3 million, representing a 9.2% period-to-period growth rate.

- For the fiscal year ending September 30, 2026, the company provided an outlook with revenue between $217.0 million and $232.0 million, and Adjusted EBITDA between $58.5 million and $65.0 million.

Quarterly earnings call transcripts for i3 Verticals.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more