Earnings summaries and quarterly performance for INTELLIGENT BIO SOLUTIONS.

Executive leadership at INTELLIGENT BIO SOLUTIONS.

Board of directors at INTELLIGENT BIO SOLUTIONS.

Research analysts who have asked questions during INTELLIGENT BIO SOLUTIONS earnings calls.

Recent press releases and 8-K filings for INBS.

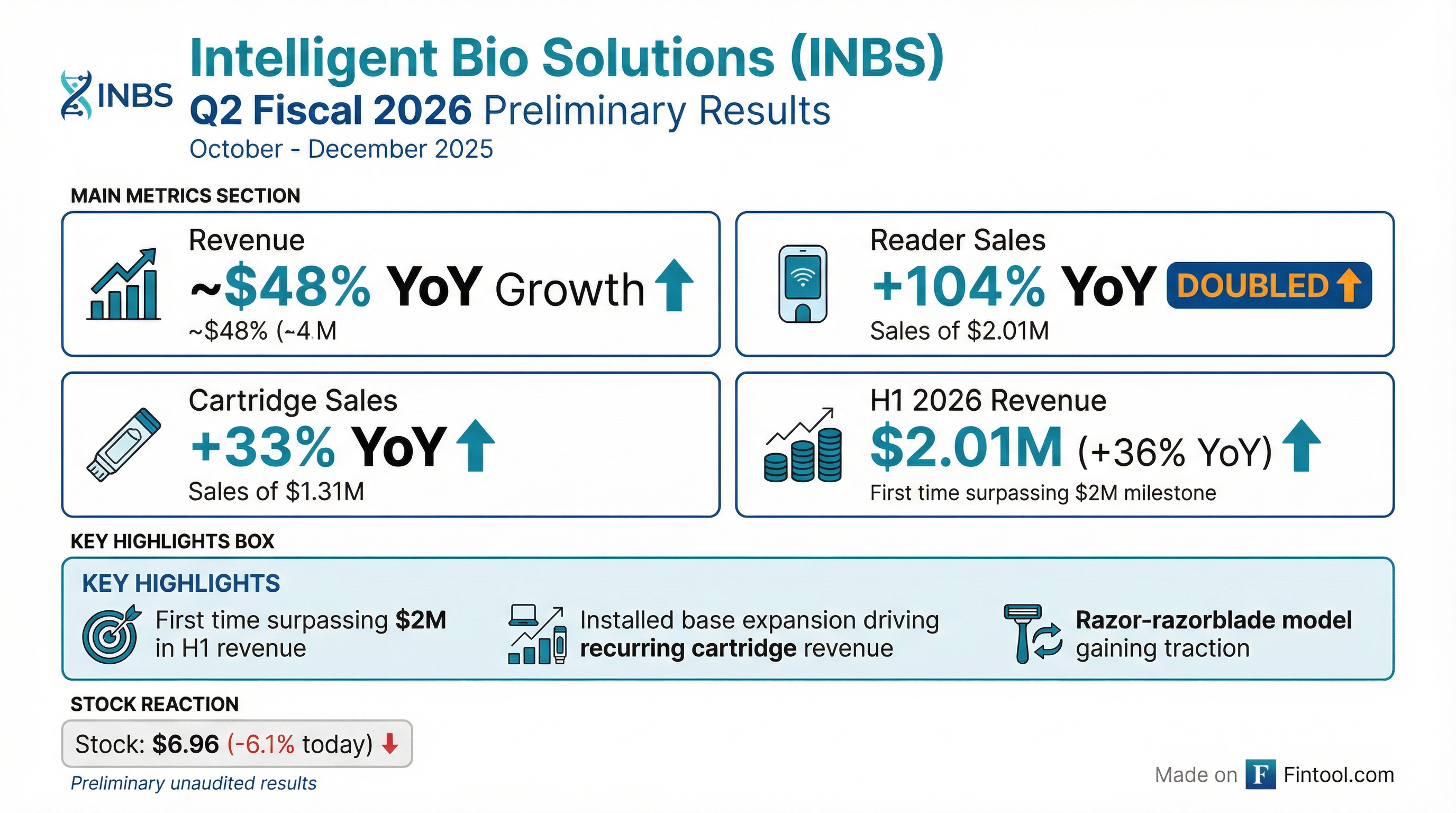

Intelligent Bio Solutions Expects Strong Fiscal Q2 2026 and H1 2026 Revenue Growth

INBS

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Intelligent Bio Solutions Inc. (INBS) expects fiscal second quarter 2026 revenue to increase approximately 48% year-over-year, contributing to an anticipated $2.01 million in total revenue for the first half of fiscal year 2026, a 36% year-over-year increase.

- This growth is driven by strong performance across all product categories, with reader sales expected to increase by over 100% in fiscal Q2 2026 and cartridge sales by approximately 33% year-over-year.

- These revenue results are preliminary and unaudited, based on information available as of February 5, 2026.

1 day ago

Intelligent Bio Solutions Initiates Clinical Studies for FDA 510(k) Submission

INBS

New Projects/Investments

Product Launch

- Intelligent Bio Solutions Inc. (INBS) commenced clinical studies on January 28, 2026, to support its FDA 510(k) submission for U.S. market clearance of its Intelligent Fingerprinting Drug Screening System for codeine detection.

- The company anticipates full data analysis by the end of March 2026, which will be incorporated into the FDA submission package.

- This initiative is a pivotal step for the company's planned entry into the multi-billion dollar U.S. drug screening market, leveraging its non-invasive fingerprint-based technology.

- The Intelligent Fingerprinting technology has already demonstrated performance with over 500,000 tests sold and used outside the U.S..

Jan 28, 2026, 10:15 PM

Intelligent Bio Solutions Announces Closing of $10.0 Million Private Placement

INBS

New Projects/Investments

- Intelligent Bio Solutions Inc. (INBS) closed a private placement on January 2, 2026, generating approximately $10.0 million in gross proceeds.

- The placement included the issuance of 2,298,850 shares of common stock (or pre-funded warrants), Series K-1 warrants, and Series K-2 warrants, at a combined purchase price of $4.35 per share. The Series K-1 and K-2 warrants have an exercise price of $4.10 per share.

- The net proceeds are designated for working capital and general corporate purposes, specifically mentioning funding the 510(k) submission with the FDA for its drug screening system and international market expansion.

- Following the closing, 1,216,142 shares of common stock were issued and outstanding, after accounting for the 105,000 shares and 2,193,850 pre-funded warrants issued at closing.

Jan 2, 2026, 10:10 PM

Intelligent Bio Solutions Closes $10.0 Million Private Placement

INBS

New Projects/Investments

- Intelligent Bio Solutions Inc. (INBS) announced the closing of a private placement on January 2, 2026, which is expected to generate approximately $10.0 million in gross proceeds.

- The placement included the sale of 2,298,850 shares of common stock (or pre-funded warrants) and associated Series K-1 and Series K-2 warrants, at a combined purchase price of $4.35 per share.

- The company intends to use the proceeds for working capital and general corporate purposes, including funding its 510(k) submission with the FDA for its Intelligent Fingerprinting Drug Screening System and furthering international market expansion.

Jan 2, 2026, 10:00 PM

Intelligent Bio Solutions Announces New Manufacturing Partnership

INBS

New Projects/Investments

Guidance Update

- Intelligent Bio Solutions Inc. (INBS) announced a new strategic manufacturing partnership with Syrma Johari MedTech Ltd. on December 31, 2025, to support and scale the production of its Intelligent Fingerprinting Drug Screening Reader.

- This collaboration is expected to deliver annual production cost savings of more than 40% and an improvement of approximately 20 percentage points in gross margin compared with its previous manufacturing arrangement.

- Syrma Johari's manufacturing capacity is approximately four times INBS' current capacity, positioning the company to efficiently support anticipated demand and its planned U.S. market entry in 2026.

- The partnership aims to strengthen INBS' global manufacturing strategy, reduce reliance on a single supplier, and build greater resilience into its supply chain.

Dec 31, 2025, 9:30 PM

Intelligent Bio Solutions Announces New Manufacturing Partnership

INBS

New Projects/Investments

- Intelligent Bio Solutions (INBS) has formed a new strategic manufacturing partnership with Syrma Johari MedTech Ltd. to support and scale the production of its Intelligent Fingerprinting Drug Screening Reader.

- This collaboration is anticipated to deliver annual production cost savings of more than 40%, leading to an expected improvement of approximately 20 percentage points in gross margin.

- Syrma Johari's manufacturing capacity is approximately four times INBS' current capacity, which is expected to efficiently support anticipated demand and the company's planned U.S. market entry in 2026.

- The partnership strengthens INBS' global manufacturing strategy by reducing reliance on a single supplier, building supply chain resilience, and broadening capacity for future demand.

Dec 31, 2025, 1:45 PM

Intelligent Bio Solutions Inc. Announces 1-for-10 Reverse Stock Split

INBS

Delisting/Listing Issues

Proxy Vote Outcomes

- Intelligent Bio Solutions Inc. will effect a 1-for-10 reverse stock split of its common stock, which will become effective at 11:59 p.m. Eastern Time on December 15, 2025.

- Trading of the company's common stock on a split-adjusted basis on The Nasdaq Capital Market will begin on December 16, 2025.

- Following the reverse stock split, the company will have approximately 959,533 shares of common stock issued and outstanding.

- Stockholders will receive a cash payment in lieu of any fractional shares resulting from the reverse stock split.

Dec 12, 2025, 10:05 PM

Intelligent Bio Solutions Announces Reverse Stock Split

INBS

Delisting/Listing Issues

Proxy Vote Outcomes

- Intelligent Bio Solutions Inc. (INBS) will effect a 1-for-10 reverse stock split, which was approved by stockholders on October 16, 2025.

- The reverse split becomes effective at 11:59 pm (Eastern Time) on December 15, 2025, with trading on a split-adjusted basis commencing on December 16, 2025 under the existing trading symbol "INBS".

- As a result, every 10 shares of common stock will be automatically combined into one share, and the company will have approximately 959,533 shares issued and outstanding immediately after the split.

- Stockholders who would otherwise be entitled to a fractional share will receive a cash payment in lieu thereof.

Dec 12, 2025, 3:30 PM

INBS Reports Record Q1 2026 Revenue and Margin Expansion

INBS

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- Intelligent Bio Solutions Inc. reported record quarterly revenue of $1.11 million for the fiscal first quarter ended September 30, 2025, representing a 32% sequential increase and 28% year-over-year growth.

- Gross profit margins increased to 46.6% from 39.68% in the fiscal first quarter of 2025, reflecting improved operational efficiency and a more favorable product mix from higher-margin cartridge sales.

- Cartridge sales reached $640,300, accounting for 57.59% of total revenue, demonstrating the strength of the company's recurring revenue model.

- The company expanded its customer base by adding 33 new accounts, bringing the total to 492 active accounts across more than 24 countries, and secured a major contract with a London public transport operator.

- The net loss attributable to Intelligent Bio Solutions Inc. was $(2,983,006), resulting in a net loss per share of $(0.35) for the quarter ended September 30, 2025.

Nov 12, 2025, 10:15 PM

Intelligent Bio Solutions Inc. Announces Preliminary Record Q1 2026 Revenue

INBS

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Intelligent Bio Solutions Inc. (INBS) expects to report record fiscal first quarter 2026 revenue of over $1 million for the period ended September 30, 2025.

- This projected revenue signifies an approximate 32% sequential increase and 28% year-over-year growth.

- The revenue increase is attributed to new customer accounts and strong sales of cartridges (up approximately 43% year-over-year) and readers (up approximately 23% year-over-year).

- This marks the third consecutive quarter of revenue growth for the company.

Nov 7, 2025, 10:20 PM

Quarterly earnings call transcripts for INTELLIGENT BIO SOLUTIONS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more