Earnings summaries and quarterly performance for InnovAge Holding.

Executive leadership at InnovAge Holding.

Board of directors at InnovAge Holding.

Andrew Cavanna

Director

James Carlson

Chair of the Board

John Ellis Bush

Director

Marilyn Tavenner

Director

Patricia Fontneau

Director

Richard Zoretic

Director

Ted Kennedy, Jr.

Director

Teresa Sparks

Director

Thomas Scully

Director

Research analysts who have asked questions during InnovAge Holding earnings calls.

Jared Haase

William Blair & Company

9 questions for INNV

Jamie Perse

The Goldman Sachs Group, Inc.

6 questions for INNV

Benjamin Rossi

JPMorgan Chase & Co.

4 questions for INNV

Matthew Gillmor

KeyCorp

4 questions for INNV

Matthew Gilmore

KeyBanc Capital Markets

4 questions for INNV

Jason Cassorla

Guggenheim Partners

1 question for INNV

John Stansel

JPMorgan Chase & Co.

1 question for INNV

Recent press releases and 8-K filings for INNV.

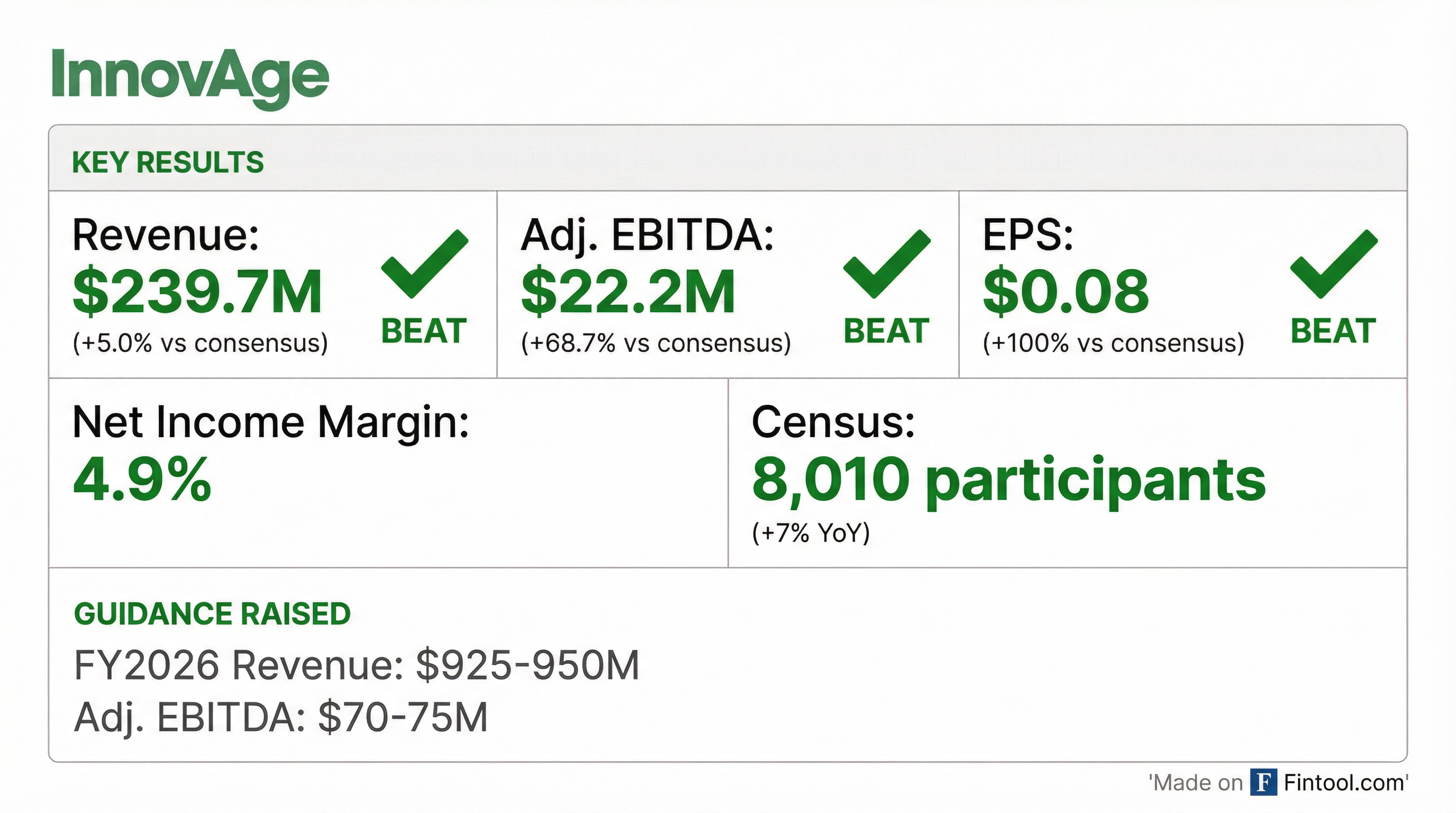

- For the second quarter of fiscal year 2026, InnovAge reported total revenues of $239.7 million, Adjusted EBITDA of $22.2 million, and net income of $11.8 million. The company achieved an Adjusted EBITDA margin of 9.2%, exceeding its intermediate-term target for the first time.

- The Adjusted EBITDA of $39.8 million in the first half of fiscal year 2026 surpassed the full-year fiscal 2025 Adjusted EBITDA of $34.5 million.

- InnovAge raised its full-year fiscal 2026 guidance, now projecting total revenue between $925 million and $950 million and Adjusted EBITDA between $70 million and $75 million. Member months are expected to be between 92,900 and 95,700.

- The strong performance was driven by meaningful progress in strengthening revenue integrity, particularly concerning Medicaid eligibility and redeterminations, and strong medical cost management.

- Tom Scully returned to the role of Chairman of the Board, and Pavithra Mahesh and Sean Traynor rejoined the board, effective January 28th, strengthening the company's governance structure.

- InnovAge reported strong fiscal Q2 2026 results, with total revenues of $239.7 million, net income of $11.8 million, and adjusted EBITDA of $22.2 million, achieving a 9.2% adjusted EBITDA margin. This compares to a net loss of $13.5 million and adjusted EBITDA of $5.9 million in Q2 fiscal year 2025.

- The company raised its full-year fiscal 2026 guidance, now projecting total revenue between $925 million and $950 million and adjusted EBITDA between $70 million and $75 million.

- Operational metrics showed growth, with 8,010 participants served as of December 31, 2025, marking a 7.1% increase compared to Q2 fiscal year 2025, and 23,960 member months in Q2, an increase of 7.9% year-over-year.

- Effective January 28th, Tom Scully returned to the role of Chairman of the Board, and Pavithra Mahesh and Sean Traynor rejoined the Board.

- InnovAge reported strong Q2 fiscal year 2026 results, with total revenues of $239.7 million and Adjusted EBITDA of $22.2 million, achieving an Adjusted EBITDA margin of 9.2% for the first time, exceeding their 8%-9% target.

- The company raised its full-year fiscal 2026 guidance, now expecting total revenue between $925 million and $950 million and Adjusted EBITDA between $70 million and $75 million.

- This improved performance is attributed to strengthening revenue integrity (especially Medicaid eligibility and redeterminations), strong medical cost management, and increased operational efficiency.

- Board leadership changes were announced, with Tom Scully returning as Chairman and two other members rejoining the board, effective January 28th.

- InnovAge reported total revenues of $239.7 million for the fiscal second quarter ended December 31, 2025, marking an approximate 14.7% increase compared to the prior year.

- The company achieved net income attributable to InnovAge Holding Corp. of $10.618 million, or $0.08 per share, a significant improvement from a net loss of $(13.221) million, or $(0.10) per share, in the second quarter of fiscal year 2025.

- Adjusted EBITDA for Q2 2026 was $22.151 million, an increase of $16.3 million compared to $5.869 million in Q2 2025, with the Adjusted EBITDA margin rising to 9.2% from 2.8%.

- As of December 31, 2025, InnovAge served approximately 8,010 participants, an increase from 7,480 participants in the second quarter of fiscal year 2025.

- InnovAge raised its full fiscal year 2026 financial guidance, now expecting total revenues between $925 million and $950 million and Adjusted EBITDA between $70 million and $75 million.

- InnovAge reported total revenues of $239.7 million for the fiscal second quarter ended December 31, 2025, representing a 14.7% increase compared to the prior year, and achieved net income attributable to InnovAge Holding Corp. of $10.6 million, or $0.08 per share, a significant improvement from a net loss in the same period last year.

- Adjusted EBITDA for Q2 FY2026 was $22.2 million, an increase of $16.3 million compared to $5.9 million in the second quarter of fiscal year 2025.

- The company's participant census grew to approximately 8,010 in Q2 FY2026, up from 7,480 participants in the second quarter of fiscal year 2025.

- InnovAge is raising its full fiscal year 2026 financial guidance, with projected total revenues between $925 million and $950 million and Adjusted EBITDA between $70 million and $75 million.

- InnovAge operates as a scaled, vertically integrated payer-provider platform delivering personalized value-based care to nearly 8,000 medically and socially complex dual eligibles across 20 centers in six states, with two additional centers under development.

- In the first quarter of fiscal year 2026, the company delivered a 7.5% adjusted EBITDA margin and generated positive operating cash flow on a trailing 12-month basis, with long-term potential for Adjusted EBITDA margins around 10%.

- The company's strategy focuses on optimizing its platform for responsible growth and margin expansion, leveraging existing center capacity, pursuing De Novo development, and forming joint ventures with health systems.

- InnovAge sees a significant and underpenetrated market opportunity for its PACE model, supported by growing bipartisan recognition and ongoing regulatory interest from CMS and CMMI.

- InnovAge operates as a scaled, vertically integrated payor-provider platform focused on enabling medically and socially complex frail seniors to live independently and avoid nursing homes.

- The company reported a Revenue Growth CAGR of +17.4% (1QFY26 vs 1QFY23), an AEBITDA margin of 7.5% (1QFY26), and $44.3 million in Cash Flow from Operations (TTM) as of September 30, 2025.

- InnovAge operates 20 care centers (plus 2 under development) across 6 states, serving approximately 7,890 participants as of September 30, 2025, distinguishing itself as the only scaled multi-state PACE platform.

- For Fiscal Year 2026, InnovAge provides guidance for Total Revenue between $900 million and $950 million and Adjusted EBITDA between $56 million and $65 million.

- InnovAge operates a scaled, vertically integrated payer-provider platform delivering value-based care to nearly 8,000 medically and socially complex dual eligibles across 20 centers in six states.

- Following a multi-year internal transformation, the company has achieved consistent revenue growth, expanding margins, and positive cash flow, driven by investments in scalable technology like Epic EMR and Oracle financial platform.

- For Q1 FY2026, InnovAge reported a 7.5% adjusted EBITDA margin and positive operating cash flow on a trailing 12-month basis, with a target of high single-digit intermediate-term Adjusted EBITDA margins and 10% long-term potential.

- The company is focused on optimizing its platform by driving responsible growth, leveraging excess capacity, and pursuing De Novo expansion and bolt-on acquisitions, including joint ventures with health systems, in the underpenetrated PACE market.

- InnovAge is actively preparing for the phased implementation of V28 for Medicare rates, adopting a conservative approach in its forecasts, while noting strong support for PACE programs in the Medicaid rate environment.

- InnovAge reported a 7.5% adjusted EBITDA margin and generated positive operating cash flow on a trailing 12-month basis in Q1 of fiscal year 2026, with guidance for continued growth and margin expansion in fiscal year 2026.

- The company has made significant investments in best-in-class technology solutions including Oracle financial platform, Salesforce, and Epic EMR, and insourced key clinical functions, which are now translating into margin expansion and improved efficiency.

- InnovAge plans to drive growth by leveraging excess capacity in existing centers, pursuing de novo market entry, and considering bolt-on acquisitions in a large, underpenetrated market with strong policy support.

- Management expressed confidence in the Medicare and Medicaid rate environment and is proactively preparing for the phased implementation of V28 on the Medicare side, taking a conservative approach in its forecasts.

- InnovAge Holding Corp. is hosting an investor conference via live webcast on January 12, 2026, to present its business and financial outlook.

- As of September 30, 2025, the company operated 20 care centers and served approximately 7,890 participants.

- For the three months ended September 30, 2025 (1QFY26), InnovAge reported an Adjusted EBITDA margin of 7.5%.

- The company provided FY2026 guidance, projecting 8,100 participants, $950 million in total revenues, and $65 million in Adjusted EBITDA.

Quarterly earnings call transcripts for InnovAge Holding.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more