Earnings summaries and quarterly performance for JBG SMITH Properties.

Executive leadership at JBG SMITH Properties.

Board of directors at JBG SMITH Properties.

AS

Alan S. Forman

Detailed

Trustee

AM

Alisa M. Mall

Detailed

Trustee

CA

Carol A. Melton

Detailed

Trustee

DE

D. Ellen Shuman

Detailed

Trustee

MJ

Michael J. Glosserman

Detailed

Trustee

PR

Phyllis R. Caldwell

Detailed

Trustee

RA

Robert A. Stewart

Detailed

Independent Chairman of the Board

SA

Scott A. Estes

Detailed

Trustee

WJ

William J. Mulrow

Detailed

Trustee

Research analysts covering JBG SMITH Properties.

Recent press releases and 8-K filings for JBGS.

JBG SMITH Properties Announces Q4 and Full Year 2025 Results

JBGS

Earnings

Share Buyback

New Projects/Investments

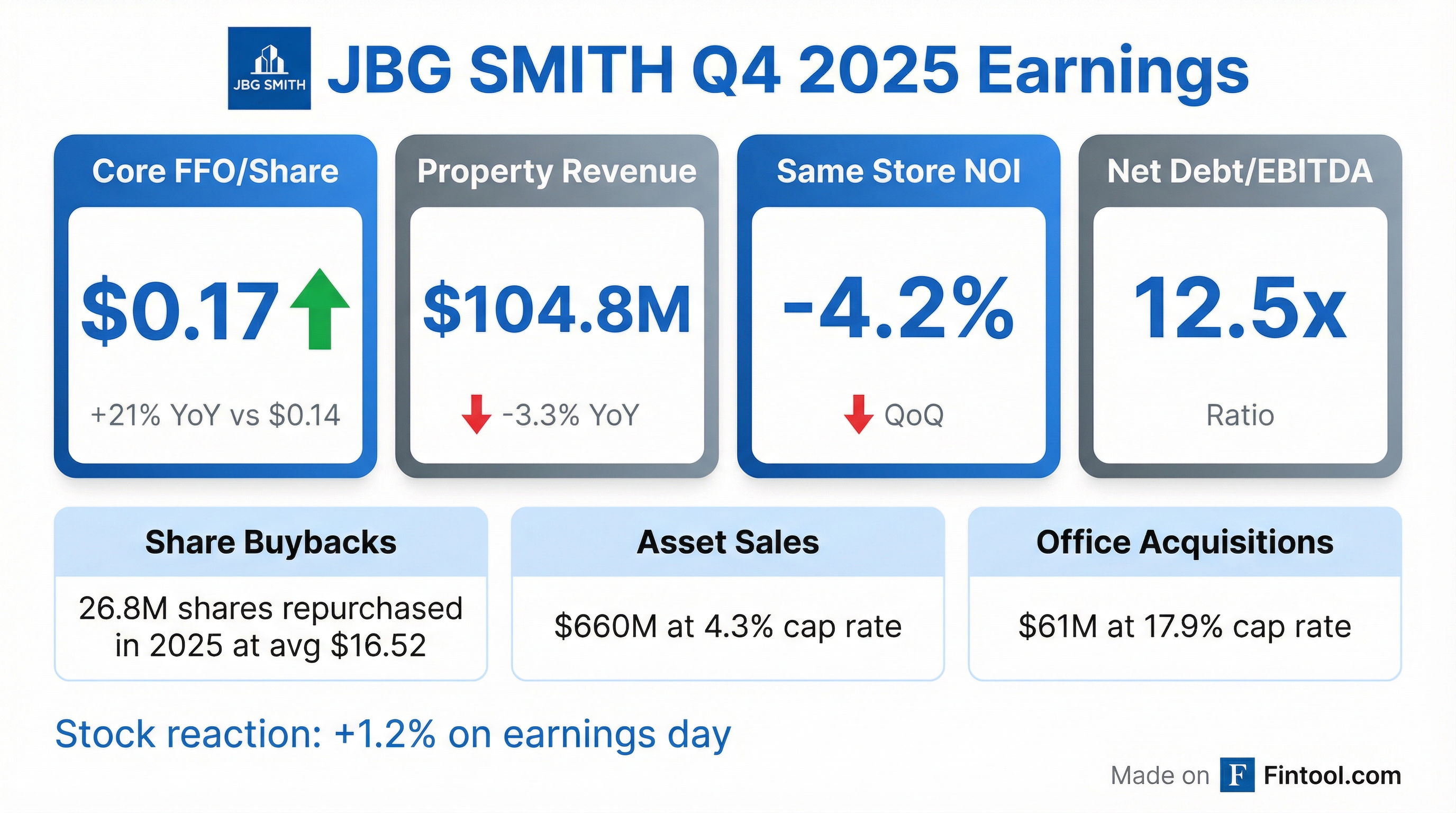

- JBG SMITH Properties reported a net loss attributable to common shareholders of $(45.5) million or $(0.78) per diluted share for the three months ended December 31, 2025.

- Core FFO attributable to common shares was $9.9 million or $0.17 per diluted share for the fourth quarter of 2025.

- The company's Same Store Net Operating Income (NOI) decreased by 4.2% for the three months ended December 31, 2025.

- During 2025, JBG SMITH repurchased 26.8 million shares for $443.1 million at an average price of $16.52 per share.

- As of December 31, 2025, Net Debt to Annualized Adjusted EBITDA was 12.5x, and the office portfolio was 77.5% leased.

Feb 17, 2026, 9:15 PM

JBG SMITH Announces Fourth Quarter and Full Year 2025 Results

JBGS

Earnings

Share Buyback

Dividends

- JBG SMITH reported a net loss of $(45.5) million and Core FFO of $9.9 million ($0.17 per diluted share) for the fourth quarter of 2025, and a net loss of $(139.1) million and Core FFO of $38.9 million ($0.58 per diluted share) for the full year 2025.

- As of December 31, 2025, the company's total enterprise value was approximately $3.7 billion, with Net Debt to annualized Adjusted EBITDA at 12.5x.

- The company repurchased and retired 383,758 common shares for $7.9 million during Q4 2025, and an additional 647,843 common shares for $10.6 million through February 13, 2026.

- A quarterly dividend of $0.175 per common share was declared on December 16, 2025, and paid on January 13, 2026.

Feb 17, 2026, 9:15 PM

JBG SMITH Properties Reports Q4 2025 Results

JBGS

Earnings

Demand Weakening

New Projects/Investments

- JBG SMITH reported Core FFO attributable to common shares of $0.17 per diluted share for the three months ended December 31, 2025.

- The company's Net Debt to Annualized Adjusted EBITDA was 12.5x as of December 31, 2025, with management expecting leverage to moderate as newly constructed multifamily assets lease up.

- Portfolio Same Store NOI decreased 4.2% for the three months ended December 31, 2025.

- The multifamily portfolio was 84.7% leased and the office portfolio was 77.5% leased at the end of the fourth quarter of 2025.

- Annualized NOI, excluding assets sold or recently acquired, increased 1.2% quarter over quarter, totaling $244.7 million.

Feb 17, 2026, 9:00 PM

JBG SMITH Properties Reports Q3 2025 Financial and Operational Results

JBGS

Earnings

New Projects/Investments

Share Buyback

- JBG SMITH reported a net loss attributable to common shareholders of $(28.6) million and Core FFO of $9.1 million, or $0.15 per diluted share, for the third quarter of 2025.

- The company completed construction of Valen, a 355-unit multifamily tower, and leased 182,000 square feet of office space during Q3 2025, including 108,000 square feet of new leases in National Landing.

- Annualized Net Operating Income (NOI) for Q3 2025 was $242.3 million, with a 6.7% decrease in Same Store NOI quarter-over-quarter.

- As of September 30, 2025, the multifamily portfolio was 89.1% leased and 87.2% occupied, while the office portfolio was 77.6% leased and 75.7% occupied.

- JBG SMITH repurchased 26.8 million shares at an average price of $16.52 per share, totaling $443.1 million year-to-date, and reported a Net Debt to Annualized Adjusted EBITDA of 12.6x.

Oct 28, 2025, 8:15 PM

JBG SMITH Announces Third Quarter 2025 Results

JBGS

Earnings

New Projects/Investments

Demand Weakening

- JBG SMITH reported a net loss of $(28.6) million or $(0.48) per diluted share for the third quarter ended September 30, 2025, compared to a net loss of $(27.0) million or $(0.32) per diluted share for the same period in 2024.

- Funds From Operations (FFO) attributable to common shareholders was $10.1 million or $0.17 per diluted share in Q3 2025, a decrease from $19.5 million or $0.23 per diluted share in Q3 2024. Core FFO attributable to common shareholders also decreased to $9.1 million or $0.15 per diluted share from $19.3 million or $0.23 per diluted share over the same period.

- Annualized Net Operating Income (NOI) for the three months ended September 30, 2025, was $242.3 million, down from $268.4 million for the three months ended June 30, 2025. Same Store NOI (SSNOI) at the company's share decreased 6.7% quarter-over-quarter to $54.1 million for Q3 2025.

- As of September 30, 2025, the operating multifamily portfolio was 89.1% leased and the operating commercial portfolio was 77.6% leased. The company executed approximately 182,000 square feet of office leases during Q3 2025, with second-generation leases generating an 11.1% rental rate increase on a cash basis.

- During the quarter, JBG SMITH completed the construction of Valen, a 355-unit multifamily asset, and as of September 30, 2025, had 19 assets in its development pipeline consisting of 8.7 million square feet of estimated potential development density at its share.

Oct 28, 2025, 8:15 PM

JBG SMITH Reports Q3 2025 Financial Results and Share Repurchases

JBGS

Earnings

Share Buyback

Dividends

- JBG SMITH reported a Net loss attributable to common shareholders of $(28.6) million, or $(0.48) per diluted share, and Core FFO of $9.1 million, or $0.15 per diluted share, for Q3 2025.

- As of September 30, 2025, the office portfolio was 77.6% leased and 75.7% occupied, while the multifamily portfolio was 89.1% leased and 87.2% occupied.

- Annualized Net Operating Income (NOI) decreased 3.8% quarter over quarter to $232.9 million, and Same Store NOI decreased 6.7% for the three months ended September 30, 2025.

- During Q3 2025, JBG SMITH repurchased and retired 3.1 million common shares for $62.9 million and declared a quarterly dividend of $0.175 per common share.

- The company's Net Debt to Annualized Adjusted EBITDA was 12.6x as of September 30, 2025, with management expecting leverage to moderate; however, the current government shutdown poses a risk to regional economic activity and leasing decisions.

Oct 28, 2025, 8:00 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more