Earnings summaries and quarterly performance for J&J SNACK FOODS.

Executive leadership at J&J SNACK FOODS.

Daniel Fachner

President and Chief Executive Officer

Lynwood Mallard

Senior Vice President & Chief Marketing Officer

Mary Lou Kehoe

Vice President, Human Resources

Michael Pollner

Senior Vice President, General Counsel & Secretary

Robert Cranmer

Senior Vice President, Operations

Shawn Munsell

Senior Vice President & Chief Financial Officer

Stephen Every

Chief Operating Officer, The ICEE Company

Board of directors at J&J SNACK FOODS.

Research analysts who have asked questions during J&J SNACK FOODS earnings calls.

Todd Brooks

The Benchmark Company

5 questions for JJSF

Scott Marks

Jefferies

4 questions for JJSF

Andrew Paul Wolf

CL King & Associates

3 questions for JJSF

Jon Andersen

William Blair & Company

3 questions for JJSF

John Anderson

Barclays

2 questions for JJSF

Robert Dickerson

Jefferies

2 questions for JJSF

Connor Rattigan

Consumer Edge Research

1 question for JJSF

David Shakno

William Blair & Company

1 question for JJSF

Recent press releases and 8-K filings for JJSF.

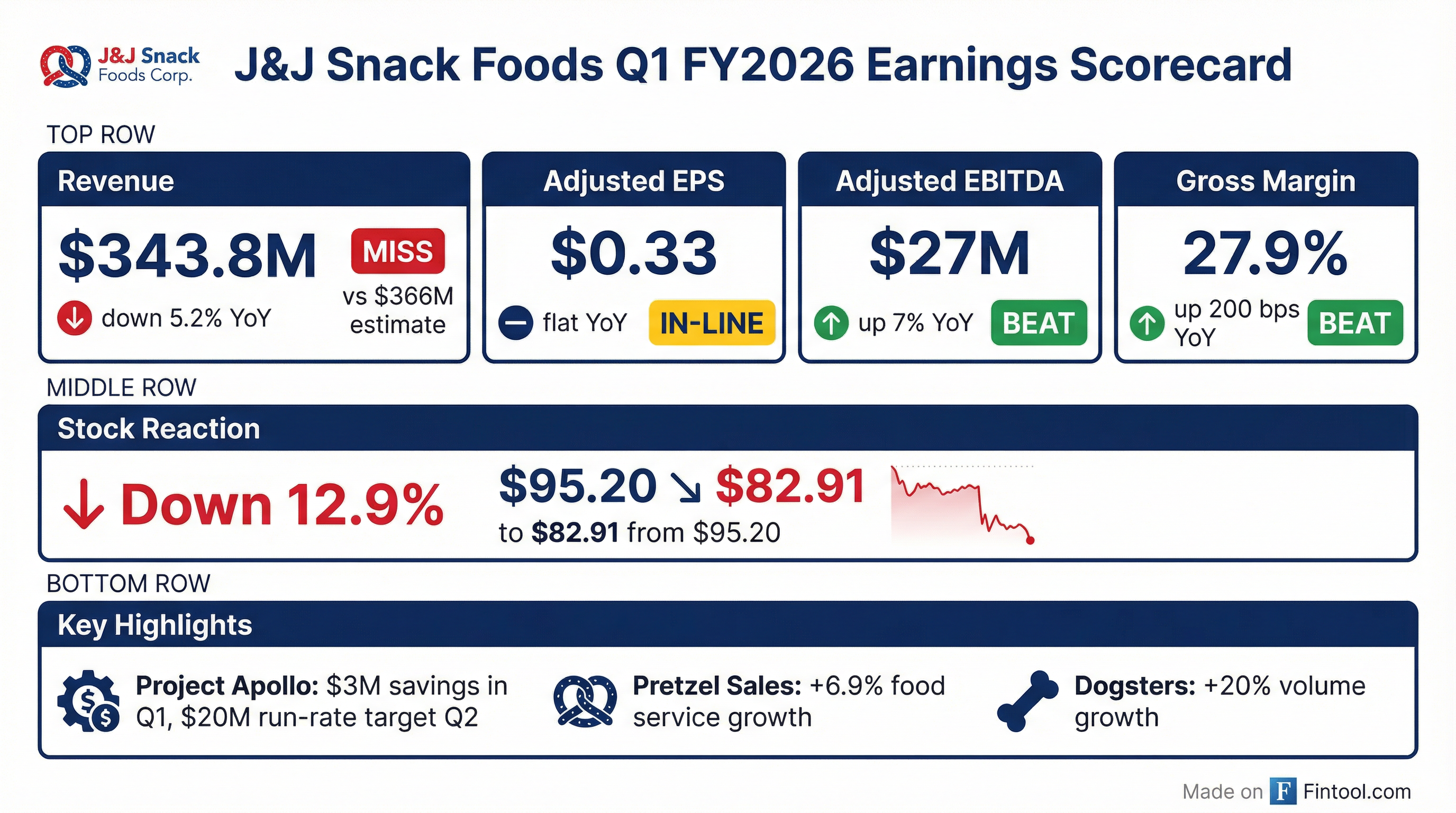

- J&J Snack Foods reported Q1 2026 adjusted EBITDA of $27 million, a 7% increase compared to the prior year, on net sales of $343.8 million, which declined 5.2%. Gross margin improved 200 basis points to 27.9%.

- The company realized over $3 million in net savings from Project Apollo in Q1, with plant consolidation on track to be fully implemented during Q2 2026, contributing to an expected $20 million run-rate operating income once all initiatives are activated.

- Sales were impacted by an $18 million decline in the bakery business, with $13 million related to SKU optimization efforts, and portfolio optimization is expected to represent an approximate 3% decline in sales for fiscal 2026.

- JJSF completed its share repurchase authorization by buying back $42 million of stock and announced a new $50 million repurchase authorization.

- The company anticipates low single-digits sales growth for the full fiscal year 2026, excluding the impact of SKU rationalization.

- J & J Snack Foods reported Q1 2026 adjusted EBITDA of $27 million, a 7% increase year-over-year, on net sales of $343.8 million, which declined 5.2%. Gross margin improved 200 basis points to 27.9%, driven by early Project Apollo savings and improved product mix.

- The 5.2% sales decline was largely attributed to the bakery business, including $13 million from SKU optimization efforts under Project Apollo, which is expected to cause an approximate 3% sales decline for fiscal 2026. However, the company anticipates low single-digit growth for the remaining portfolio for the full year.

- Project Apollo delivered over $3 million in net savings in Q1 and is expected to achieve a $20 million run-rate operating income once fully implemented, with plant consolidation on track for completion in Q2.

- The company completed its prior share repurchase authorization by buying back $42 million of stock and announced a new $50 million repurchase authorization.

- J&J Snack Foods reported Q1 2026 adjusted EBITDA of $27 million, a 7% increase year-over-year, and improved gross margin by 200 basis points to 27.9%.

- Net sales for Q1 2026 were $343.8 million, a 5.2% decline, primarily due to a focus on higher-margin opportunities and SKU optimization, which is expected to result in an approximate 3% sales decline for fiscal 2026.

- Project Apollo delivered over $3 million in net savings in Q1 and is on track to achieve $20 million in run-rate operating income, with plant consolidation fully implemented by Q2 and remaining savings by Q4 fiscal 2026.

- The company completed a $42 million share repurchase and announced a new $50 million authorization, while maintaining a strong balance sheet with $67 million in cash and no long-term debt.

- JJSF anticipates low single-digit sales growth for the full fiscal year 2026, excluding the impact of SKU rationalization.

- J&J Snack Foods Corp. reported fiscal first quarter 2026 net sales of $343.8 million, a 5.2% decrease from the prior year quarter, and net earnings of $0.9 million, an 82.8% decrease, for the period ended December 27, 2025.

- Despite the sales decline, Adjusted EBITDA increased 7.0% to $27.0 million, and gross margin improved from 25.9% to 27.9%, attributed to Project Apollo initiatives and favorable product mix.

- The company announced a new $50 million share repurchase authorization and completed its previous $50 million authorization by repurchasing $42 million of stock during the quarter.

- J&J Snack Foods Corp. reported net sales of $343.8 million for the first quarter ended December 27, 2025, representing a 5.2% decrease from the prior year quarter, primarily due to its bakery business and strategic portfolio rationalization efforts.

- Despite the sales decline, the company achieved a 7.0% increase in Adjusted EBITDA to $27.0 million and a 200 basis point expansion in gross margin to 27.9%, driven by Project Apollo initiatives and favorable product mix.

- GAAP operating income significantly decreased to $0.6 million (down 89.8%), and GAAP earnings per diluted share were $0.05 (down 80.8%), while adjusted earnings per diluted share remained flat at $0.33.

- The company repurchased $42 million of common stock during the quarter, completing a prior authorization, and announced a new $50 million share repurchase authorization.

- J&J Snack Foods reported Q4 2025 sales of $410.2 million, a 3.9% decline year-over-year, and full-year 2025 net sales of $1.58 billion, an increase of 0.5%. Adjusted EBITDA for Q4 was $57.4 million and $180.9 million for the full year.

- The company initiated Project Apollo, a business transformation program, projected to generate at least $20 million in annualized operating income, with $15 million expected from the closure of three facilities.

- JJSF maintains a strong financial position with $106 million in cash and no debt, and plans to accelerate share repurchases in the current quarter, with approximately $42 million remaining on the authorization.

- Management expressed optimism for fiscal 2026, citing benefits from Project Apollo, a robust innovation pipeline including new Dippin' Dots retail offerings, and an expected 9% increase in North America box office sales for the theater industry.

- J&J Snack Foods reported Q4 2025 sales of $410.2 million, a 3.9% decline year-over-year, and adjusted EBITDA of $57.4 million. For the full fiscal year 2025, net sales increased 0.5% to $1.58 billion, with adjusted EBITDA at $180.9 million.

- The company launched Project Apollo, a business transformation program, targeting at least $20 million of annualized operating income by 2026 through initiatives like three plant closures (expected to save $15 million annually by Q2 2026) and $3 million from distribution system improvements.

- For fiscal 2026, JJSF is rolling out new commercial initiatives, including a churros limited-time offer with a major QSR and new frozen beverage programs, alongside product innovations such as Protein Pretzels and Dippin' Dots for retail.

- JJSF maintains a strong balance sheet with $106 million in cash and no long-term debt , and plans to accelerate share repurchase activity in the current quarter, following $3 million in repurchases during Q4 2025.

- Management aims to improve gross margin to above 30% towards the mid-30s over the next few years, supported by Project Apollo and top-line growth.

- J & J Snack Foods reported Q4 2025 adjusted EBITDA of $57.4 million on sales of $410.2 million, representing a 3.9% decline in sales versus the prior year, primarily due to lower frozen beverage volumes. For the full fiscal year 2025, net sales increased 0.5% to $1.58 billion, with adjusted EBITDA of $180.9 million.

- The company initiated Project Apollo, a business transformation program expected to generate at least $20 million of annualized operating income savings. This includes the closure of three facilities for approximately $15 million in annualized savings, and $3 million from distribution system initiatives.

- JJSF maintains a strong financial position with $106 million in cash and no long-term debt as of quarter-end. The company intends to accelerate share repurchase activity in the current quarter, having repurchased $3 million in Q4.

- For fiscal 2026, JJSF is rolling out several new products, including a Protein Pretzel for retail, Super Pretzel Pizza Sticks and Queso Sticks, Luigi's Mini Pops, and Dippin' Dots for retail. They also anticipate commercial opportunities such as shipping churros to a major QSR and expanding frozen beverage distribution.

- J&J Snack Foods Corp. reported Net Sales of $410.2 million and Adjusted EBITDA of $57.4 million for the fourth quarter ended September 27, 2025.

- For the full fiscal year 2025, the company achieved Net Sales of $1,583.2 million and Adjusted EBITDA of $180.9 million.

- Fourth quarter net sales decreased 3.9% compared to the prior year, primarily due to headwinds in the Frozen Beverage business, while the pretzel business delivered strong results.

- The company initiated a business transformation program, expected to generate at least $20 million of annualized operating income, which led to approximately $24 million in non-recurring charges during Q4 2025.

- J&J Snack Foods Corp. maintains a strong balance sheet with $106 million in cash and no debt, and plans to execute its share repurchase authorization.

- On August 28, 2025, J&J Snack Foods Corp. committed to a plan to strategically optimize its manufacturing footprint through the closure of certain plants.

- The company expects to record total pre-tax plant closure and related asset impairment charges of between $12 million and $20 million in its fiscal fourth quarter of 2025 and into fiscal year 2026.

- These charges include non-cash asset write-downs of $4 million to $8 million, severance and benefit costs of $2 million to $3 million, and other exit and disposal costs of $6 million to $9 million.

- The closure activities are expected to be completed in fiscal year 2026 and are projected to generate approximately $15 million in annualized pre-tax cost savings.

Quarterly earnings call transcripts for J&J SNACK FOODS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more