Earnings summaries and quarterly performance for JOHNSON OUTDOORS.

Executive leadership at JOHNSON OUTDOORS.

Board of directors at JOHNSON OUTDOORS.

EF

Edward F. Lang

Detailed

Director

ES

Edward Stevens

Detailed

Director

JM

Jeffrey M. Stutz

Detailed

Director

JM

John M. Fahey, Jr.

Detailed

Lead Independent Director and Vice Chairman

KB

Katherine Button Bell

Detailed

Director

LA

Liliann Annie Zipfel

Detailed

Director

PG

Paul G. Alexander

Detailed

Director

R(

Richard (Casey) Sheahan

Detailed

Director

Research analysts who have asked questions during JOHNSON OUTDOORS earnings calls.

Recent press releases and 8-K filings for JOUT.

Johnson Outdoors Reports Strong Q1 2026 Results

JOUT

Earnings

Revenue Acceleration/Inflection

Product Launch

- Johnson Outdoors reported double-digit growth in the first quarter of fiscal 2026, with the operating loss much improved compared to the prior-year quarter. The loss before income taxes was $1.3 million, a significant improvement from $18.9 million in the previous year.

- Gross margin for Q1 2026 improved to 36.6%, up 6.7 points from the prior year, driven by overhead absorption from higher volumes, price increases, and ongoing cost savings initiatives.

- The company's inventory balance at the end of the first quarter was $183.9 million, down $17.7 million from the previous year, and the balance sheet remains debt-free.

- Growth was primarily unit volume driven, with contributions from improved trade dynamics in fishing, digital and e-commerce investments in camping and watercraft, and innovation in diving. E-commerce is noted as the fastest-growing channel.

Feb 6, 2026, 4:00 PM

Johnson Outdoors Reports Strong Q1 2026 Results with Double-Digit Growth and Improved Profitability

JOUT

Earnings

Revenue Acceleration/Inflection

Dividends

- Johnson Outdoors reported a strong start to fiscal Q1 2026, achieving double-digit growth and significantly improving its operating loss compared to the prior year.

- The company's loss before income taxes improved to $1.3 million in Q1 2026, from $18.9 million in the previous year, with gross margin increasing by 6.7 points to 36.6%.

- Growth was primarily unit volume driven, with strong performance across all segments, supported by new product innovation and digital/e-commerce investments.

- The company maintains a debt-free balance sheet and reduced its inventory balance to $183.9 million, down $17.7 million from the prior year.

Feb 6, 2026, 4:00 PM

Johnson Outdoors Announces Strong Q1 2026 Results

JOUT

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- Johnson Outdoors reported double-digit growth in the first quarter of fiscal 2026, with the operating loss significantly improved compared to the prior year. The loss before income taxes narrowed to $1.3 million from $18.9 million in the previous year quarter, driven by revenue growth and an improved gross margin of 36.6%.

- The growth was primarily unit volume driven, supported by strong demand for new products across fishing, camping, watercraft, and diving segments, and the fastest-growing digital and e-commerce channels.

- The company's inventory balance decreased by $17.7 million to $183.9 million at the end of Q1 2026, and the balance sheet remains debt-free.

- Management is encouraged by the start of fiscal 2026, emphasizing continued focus on a robust innovation pipeline, growing digital and e-commerce channels, and ongoing cost savings initiatives.

Feb 6, 2026, 4:00 PM

Johnson Outdoors Inc. Reports Fiscal First Quarter Results

JOUT

Earnings

Revenue Acceleration/Inflection

Dividends

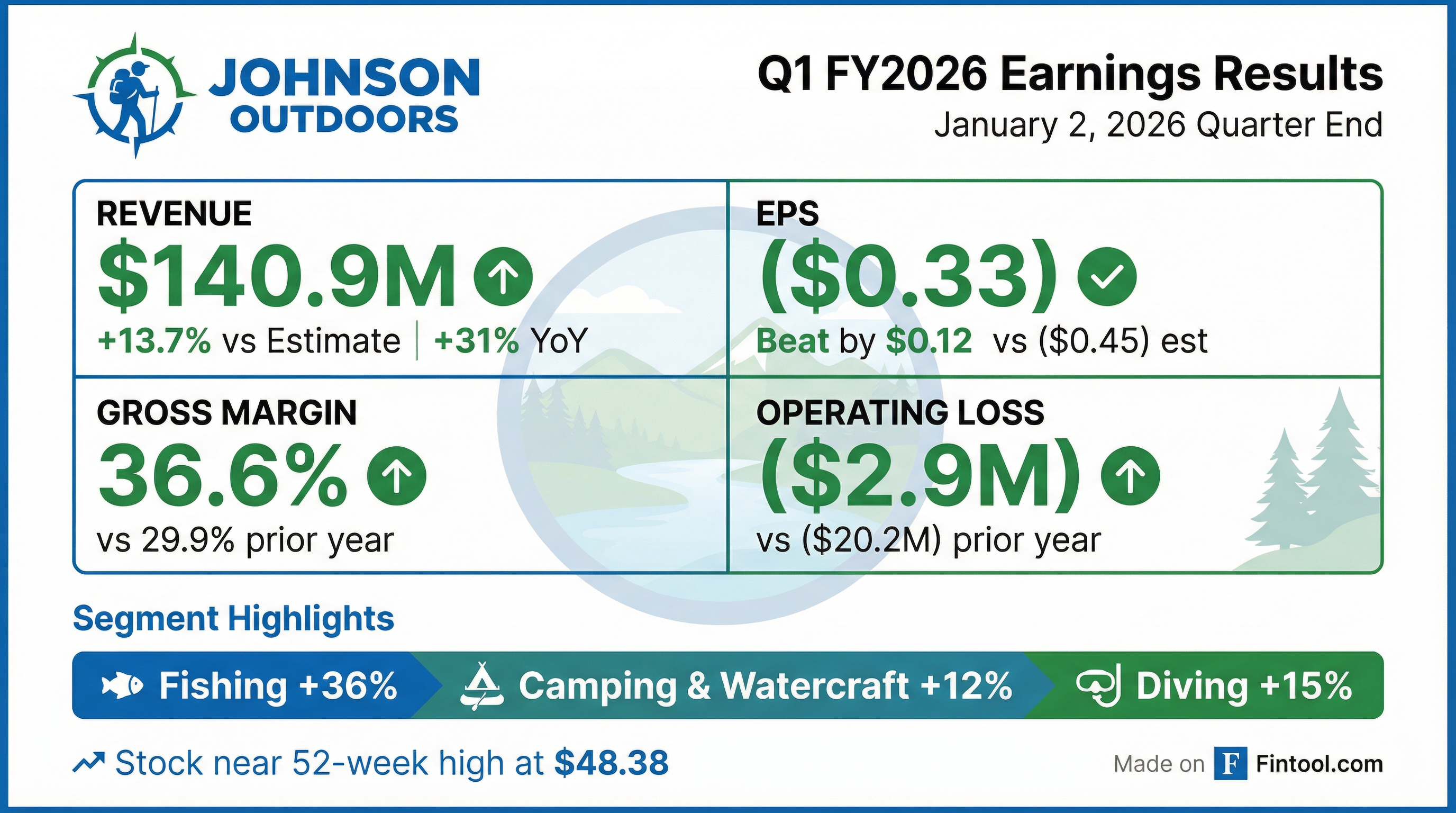

- Johnson Outdoors Inc. reported net sales of $140.9 million for the first fiscal quarter ended January 2, 2026, representing a 31 percent increase compared to the prior year's first fiscal quarter.

- The company's operating loss significantly improved to $(2.9) million from $(20.2) million in the prior year first quarter, and net loss was $(3.3) million, or $(0.33) per diluted share, compared to $(15.3) million, or $(1.49) per diluted share in the previous year.

- Gross margin improved to 36.6 percent from 29.9 percent in the prior year quarter, primarily due to improved overhead absorption and cost savings efforts.

- All business segments experienced sales growth, with Fishing revenue increasing 36 percent, Camping & Watercraft Recreation sales up 12 percent, and Diving sales rising 15 percent.

- As of January 2, 2026, the company held $130.7 million in cash and short-term investments.

Feb 6, 2026, 12:37 PM

Johnson Outdoors Reports Fiscal First Quarter Results

JOUT

Earnings

Revenue Acceleration/Inflection

Product Launch

- Johnson Outdoors Inc. reported a 31 percent increase in total company net sales for the first fiscal quarter ending January 2, 2026, reaching $140.9 million compared to $107.6 million in the prior year first fiscal quarter. This increase was mainly driven by success in new product launches and improved trade inventory levels in Fishing, new product success and e-commerce growth in Camping & Watercraft Recreation, and improvement across global markets in Diving.

- The company significantly reduced its operating loss to $(2.9) million for the first fiscal quarter, an improvement from $(20.2) million in the prior year.

- Net loss for the quarter was $(3.3) million, or $(0.33) per diluted share, a substantial improvement from a net loss of $(15.3) million, or $(1.49) per diluted share, in the previous year's first quarter.

- Gross margin improved to 36.6 percent from 29.9 percent in the prior year quarter, primarily due to improved overhead absorption and cost savings efforts.

- As of January 2, 2026, cash and short-term investments totaled $130.7 million.

Feb 6, 2026, 11:00 AM

Johnson Outdoors Announces Q4 2025 Results

JOUT

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- Johnson Outdoors reported flat total company sales for fiscal year 2025, with an operating loss of $16.2 million, an improvement compared to fiscal 2024.

- Gross margin improved to 35.1%, up 1.2 points from the prior year, driven by cost savings initiatives, higher volumes, and reduced inventory reserves. Operating expenses decreased by 8%, or $20.2 million, from the prior fiscal year.

- The company achieved positive cash flow from operations for the third consecutive year, reduced its inventory balance by approximately $39 million to $170.7 million, and remains debt-free.

- New product successes, particularly in fishing with Humminbird's Explore series and MEGA Live 2 fish finders, and Jetboil's fast boil cooking systems, drove double-digit growth in the second half of the year.

- For fiscal 2026, the company expects global macroeconomic challenges to continue but will focus on consumer-driven innovation, digital and e-commerce excellence, and operational efficiencies, anticipating a normal tax rate in the mid to high 20s.

Dec 12, 2025, 4:00 PM

Johnson Outdoors Reports Fiscal 2025 Results

JOUT

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- Johnson Outdoors reported flat total company sales for fiscal 2025, but experienced double-digit growth in the second half of the year driven by new product successes.

- The company significantly improved its financial performance, with an operating loss of $16.2 million and a pre-tax loss of $9.3 million in fiscal 2025, both improved from the prior year.

- Gross margin for fiscal 2025 improved by 1.2 points to 35.1%, attributed to cost savings, overhead absorption from higher volumes, and reduced inventory reserves.

- Operating expenses decreased by 8%, or $20.2 million, and the company achieved positive cash flow from operations for the third consecutive year, reducing inventory to $170.7 million.

- While global macroeconomic challenges are expected to persist, the company anticipates a normal tax rate in the mid to high 20s for fiscal 2026 and will continue to focus on innovation, digital excellence, and operational efficiencies.

Dec 12, 2025, 4:00 PM

Johnson Outdoors Reports Flat Fiscal 2025 Sales with Improved Profitability and Positive Momentum

JOUT

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- Johnson Outdoors reported flat total company sales for fiscal year 2025, but experienced double-digit growth in the second half, driven by new product successes in fishing, and a 2% growth in camping and watercraft excluding the Eureka brand exit.

- The company significantly improved profitability, with an operating loss of $16.2 million and a pre-tax loss of $9.3 million for fiscal 2025, alongside a 1.2 point increase in gross margin to 35.1% and an 8% ($20.2 million) decrease in operating expenses.

- Johnson Outdoors maintained a debt-free balance sheet with a healthy cash position, generated positive cash flow from operations for the third consecutive year, and reduced inventory by approximately $39 million to $170.7 million.

- For fiscal 2026, the company will continue to prioritize consumer-driven innovation, digital and e-commerce excellence, and operational efficiencies, expecting a "normal" effective tax rate in the mid to high 20s.

Dec 12, 2025, 4:00 PM

Johnson Outdoors Inc. Reports Fiscal Year 2025 Results

JOUT

Earnings

Demand Weakening

Dividends

- Johnson Outdoors Inc. reported fiscal year 2025 revenue of $592.4 million, which was essentially flat compared to the prior fiscal year's $592.8 million.

- The company's operating loss improved to $16.2 million in fiscal 2025, compared to a $43.5 million loss in the prior year, with gross margin increasing to 35.1 percent from 33.9 percent.

- The net loss for fiscal year 2025 was $34.3 million, or $3.35 per diluted share, significantly impacted by an income tax expense of $25.0 million, which included a $25.9 million non-cash reserve on U.S. deferred tax assets.

- As of October 3, 2025, the company maintained a strong financial position with $176.4 million in cash and investments and no debt on its balance sheet.

- In September 2025, the Board of Directors approved a quarterly cash dividend.

Dec 12, 2025, 12:00 PM

Johnson Outdoors Reports Fiscal Year 2025 Results

JOUT

Earnings

Dividends

Demand Weakening

- Johnson Outdoors reported total revenue of $592.4 million for fiscal year 2025, which was essentially flat compared to $592.8 million in fiscal year 2024.

- The company's operating loss improved to $16.2 million in fiscal 2025, from an operating loss of $43.5 million in the prior fiscal year.

- Net loss for fiscal year 2025 was $34.3 million, or $3.35 per diluted share, compared to a net loss of $26.5 million, or $2.60 per diluted share, in fiscal 2024, largely due to a $25.9 million non-cash reserve on U.S. deferred tax assets.

- As of October 3, 2025, cash and investments increased by $14.4 million to $176.4 million, and the company has no debt on its balance sheet.

- For the fourth quarter of fiscal 2025, net sales increased to $135.8 million from $105.8 million in the prior year's fourth quarter, and the operating loss improved to $8.2 million from $42.8 million.

Dec 12, 2025, 11:00 AM

Quarterly earnings call transcripts for JOHNSON OUTDOORS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more