Earnings summaries and quarterly performance for JUNIATA VALLEY FINANCIAL.

Executive leadership at JUNIATA VALLEY FINANCIAL.

Board of directors at JUNIATA VALLEY FINANCIAL.

Research analysts covering JUNIATA VALLEY FINANCIAL.

Recent press releases and 8-K filings for JUVF.

Juniata Valley Financial Corp. Announces Q4 and Full-Year 2025 Results

JUVF

Earnings

Dividends

Revenue Acceleration/Inflection

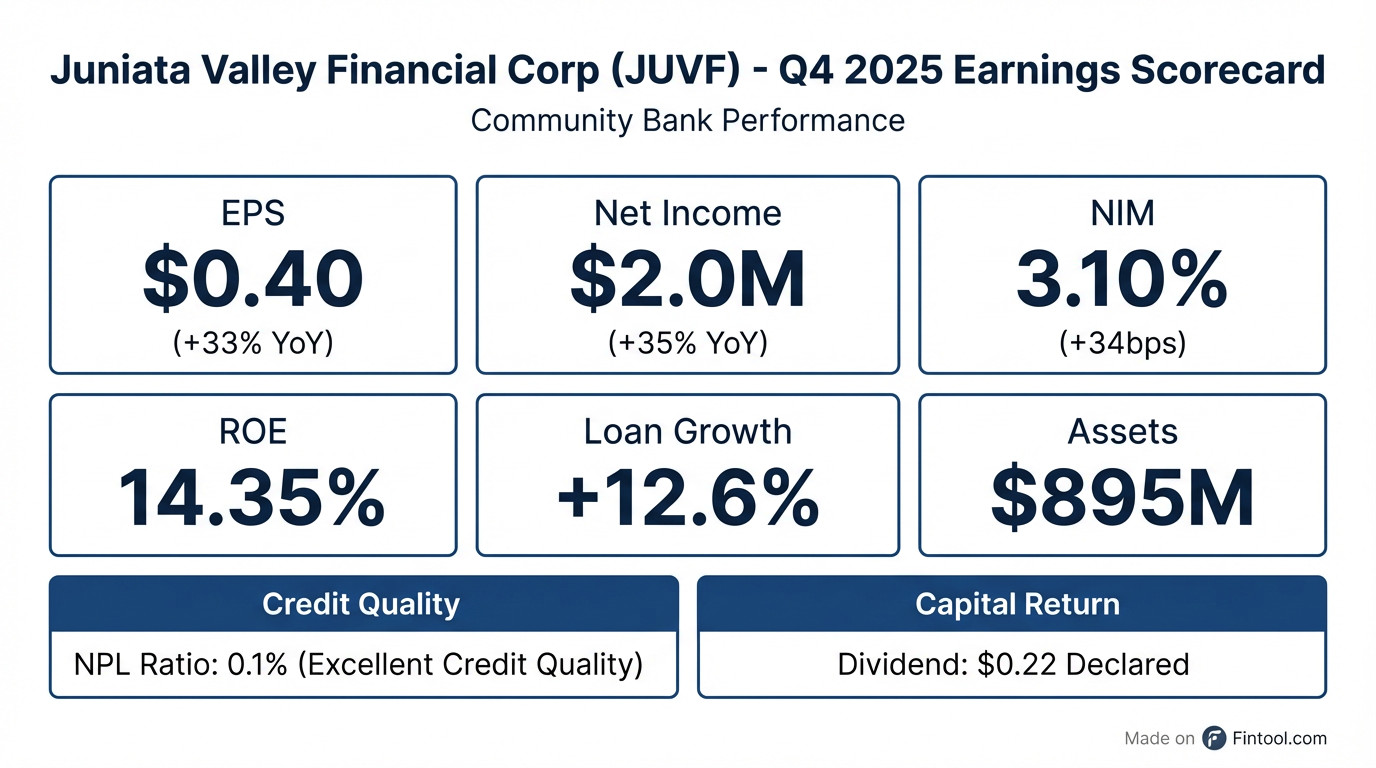

- **Juniata Valley Financial Corp. reported a net income of $2.0 million for the three months ended December 31, 2025, a 34.7% increase from $1.5 million in the prior year period. Full-year 2025 net income was $8.0 million, up 28.2% from $6.2 million in 2024. **

- **Earnings per share (basic and diluted) rose to $0.40 for Q4 2025, up from $0.30 in Q4 2024. For the full year 2025, EPS was $1.59, compared to $1.25 (basic) and $1.24 (diluted) in 2024. **

- **The company's net interest margin increased by 34 basis points over Q4 2024 and 27 basis points for the full year 2025, primarily driving the earnings growth, supported by a 12.6% increase in total loans to $601.4 million by year-end 2025. **

- **Total assets increased by 5.5% to $895.3 million, and total deposits grew by 4.5% to $781.8 million as of December 31, 2025, compared to December 31, 2024. **

- **A cash dividend of $0.22 per share was declared, payable on February 27, 2026, to shareholders of record on February 13, 2026. **

Jan 29, 2026, 3:17 PM

Juniata Valley Financial Corp. Announces Q4 and Full-Year 2025 Results

JUVF

Earnings

Dividends

Revenue Acceleration/Inflection

- Juniata Valley Financial Corp. reported a net income of $2.0 million for the three months ended December 31, 2025, a 34.7% increase from the prior year, and $8.0 million for the full year 2025, a 28.2% increase.

- Earnings per share (basic and diluted) for Q4 2025 were $0.40, up from $0.30 in Q4 2024, and $1.59 for the full year 2025, up from $1.25 (basic) / $1.24 (diluted) in FY 2024.

- The net interest margin (fully tax equivalent) improved by 34 basis points to 3.10% for Q4 2025 and by 27 basis points to 2.98% for FY 2025, primarily due to improved net interest income.

- Total assets increased by 5.5% to $895.3 million as of December 31, 2025, with total loans growing 12.6% to $601.4 million compared to year-end 2024.

- The Board of Directors declared a cash dividend of $0.22 per share on January 20, 2025, payable on February 27, 2026, to shareholders of record on February 13, 2026.

Jan 29, 2026, 2:52 PM

Juniata Valley Financial Corp. Announces Strong Q3 2025 Results with Increased Net Income and EPS

JUVF

Earnings

Dividends

Revenue Acceleration/Inflection

- Juniata Valley Financial Corp. reported a 25.6% increase in net income to $2.1 million for the three months ended September 30, 2025, with diluted earnings per share rising 24.2% to $0.41 compared to the same period in 2024.

- For the nine months ended September 30, 2025, net income increased 26.1% to $6.0 million, and diluted EPS rose 25.3% to $1.19 compared to the nine months ended September 30, 2024.

- The company's net interest margin, on a fully tax equivalent basis, improved to 3.04% for Q3 2025 from 2.73% in Q3 2024, and to 2.94% for the nine months ended September 30, 2025 from 2.70% in the comparable 2024 period.

- Total assets grew by 3.7% to $880.5 million as of September 30, 2025, driven by an 8.2% increase in total loans and a 3.7% increase in total deposits compared to December 31, 2024.

- The Board of Directors declared a cash dividend of $0.22 per share on October 21, 2025, to shareholders of record on November 17, 2025, payable on December 1, 2025.

Oct 22, 2025, 7:07 PM

Juniata Valley Financial Corp. Announces Q3 2025 Results

JUVF

Earnings

Dividends

Revenue Acceleration/Inflection

- Juniata Valley Financial Corp. reported a net income of $2.1 million for the three months ended September 30, 2025, representing a 25.6% increase compared to the same period in 2024, with diluted earnings per share rising 24.2% to $0.41.

- For the nine months ended September 30, 2025, net income increased 26.1% to $6.0 million, and diluted earnings per share grew 25.3% to $1.19.

- The net interest margin, on a fully tax equivalent basis, improved to 3.04% for the third quarter of 2025 and 2.94% for the nine months ended September 30, 2025.

- Total assets increased by 3.7% to $880.5 million as of September 30, 2025, compared to December 31, 2024, primarily driven by an 8.2% increase in total loans.

- The Board of Directors declared a cash dividend of $0.22 per share on October 21, 2025, payable on December 1, 2025.

Oct 22, 2025, 6:45 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more