Earnings summaries and quarterly performance for Kimball Electronics.

Executive leadership at Kimball Electronics.

Ric Phillips

Chief Executive Officer

Adam Baumann

Chief Accounting Officer

Doug Hass

Chief Legal & Administrative Officer, Secretary

Jana Croom

Chief Financial Officer

Jessica DeLorenzo

Chief Human Resources Officer

Kathy Thomson

Chief Commercial Officer

Steven Korn

Chief Operating Officer

Board of directors at Kimball Electronics.

Research analysts who have asked questions during Kimball Electronics earnings calls.

Anja Soderstrom

Sidoti & Company, LLC

6 questions for KE

Derek Soderberg

Cantor Fitzgerald

5 questions for KE

Jaeson Schmidt

Lake Street Capital Markets

4 questions for KE

Michael Crawford

B. Riley Securities, Inc.

3 questions for KE

Mike Crawford

B. Riley Securities

3 questions for KE

Hendi Susanto

Gabelli Funds

2 questions for KE

Max Michaelis

Lake Street Capital

2 questions for KE

Recent press releases and 8-K filings for KE.

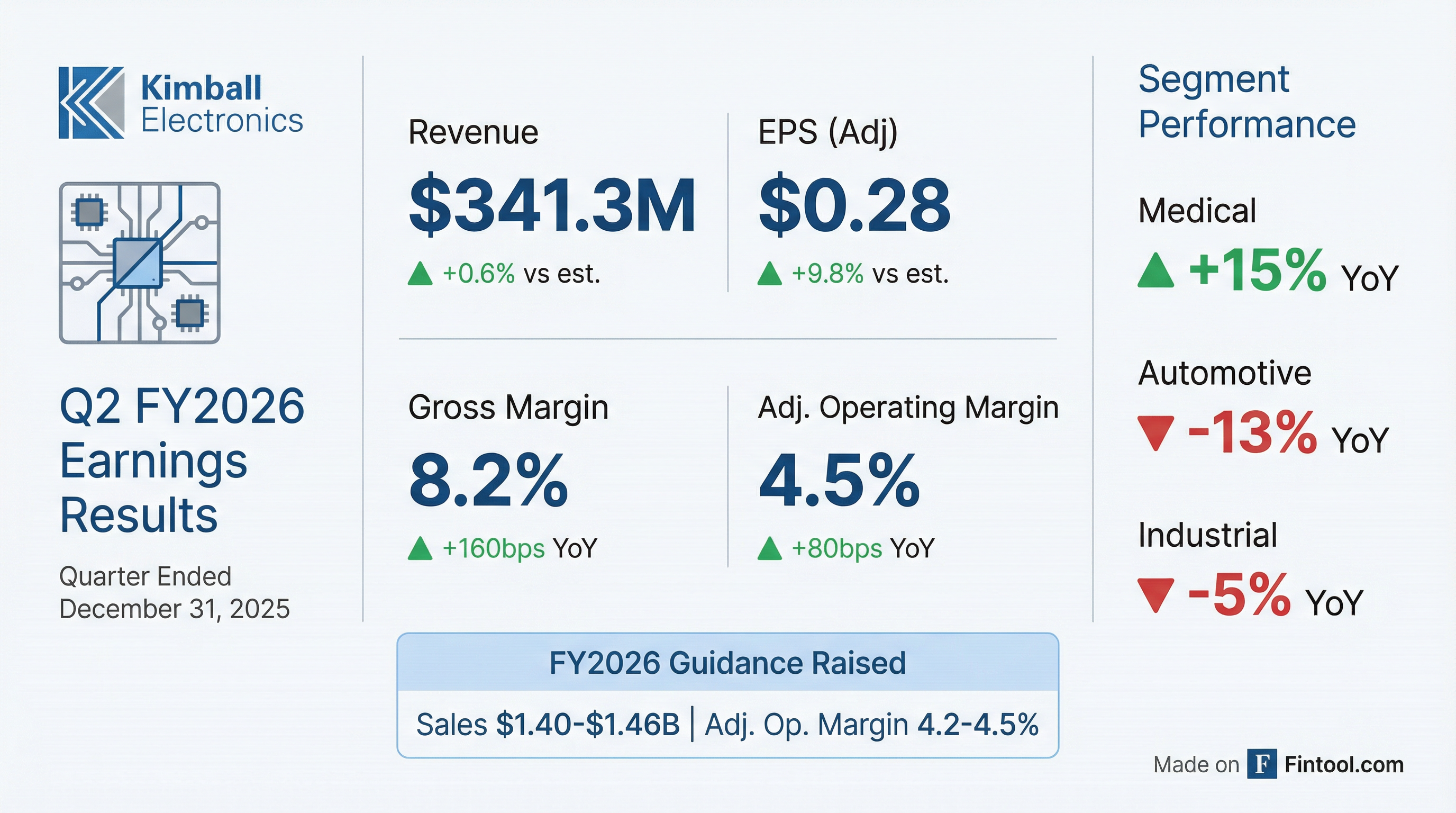

- Kimball Electronics reported Q2 fiscal 2026 net sales of $341 million, a 5% year-over-year decrease, with medical sales growing 15% to $96 million and automotive sales declining 13% to $162 million.

- The company raised its fiscal 2026 guidance, now expecting net sales between $1.4 billion and $1.46 billion (up from $1.35 billion to $1.45 billion) and adjusted operating income of 4.2% to 4.5% of net sales (up from 4.0% to 4.25%).

- Adjusted operating income for Q2 was $15.3 million, or 4.5% of net sales, an improvement from 3.7% in the prior year, driven by favorable mix, facility closure, and FX rates.

- Cash generated from operations was $6.9 million, marking the eighth consecutive quarter of positive cash flow, and $4.3 million was used to repurchase 149,000 shares.

- The company announced a rebranding to Kimball Solutions starting July 2026, reflecting an expanded portfolio, and highlighted the grand opening of its new medical manufacturing facility in Indianapolis.

- Kimball Electronics reported Q2 fiscal 2026 net sales of $341.3 million, a 5% decrease year-over-year, and adjusted net income of $6.9 million, or $0.28 per diluted share.

- The company raised its fiscal 2026 net sales guidance to $1.4-$1.46 billion and adjusted operating income guidance to 4.2%-4.5% of net sales, driven by strength in the medical vertical and ramp-up of automotive programs.

- In Q2 fiscal 2026, the medical vertical achieved 15% year-over-year sales growth to $96 million, while automotive sales declined 13% to $162 million and industrial sales decreased 5% to $83 million.

- Strategic developments include the upcoming rebranding to Kimball Solutions starting July 2026 and the grand opening of a new 300,000 sq ft medical manufacturing facility in Indianapolis.

- Kimball Electronics reported Q2 fiscal 2026 net sales of $341 million, a 5% year-over-year decrease, while the medical vertical grew 15% to $96 million. The gross margin rate improved to 8.2% (up 160 basis points), and adjusted operating income reached $15.3 million, or 4.5% of net sales.

- The company raised its fiscal 2026 guidance, now expecting net sales between $1.4 billion and $1.46 billion and adjusted operating income between 4.2% and 4.5% of net sales.

- Strategic initiatives include rebranding as Kimball Solutions and the grand opening of a new 300,000 sq ft medical manufacturing facility in Indianapolis, which is expected to be a near-term drag on margins but accretive long-term.

- Kimball Electronics generated $6.9 million in cash from operating activities, marking the eighth consecutive quarter of positive cash flow, and repurchased 149,000 shares for $4.3 million in Q2.

- Kimball Electronics reported Q2 fiscal 2026 revenue of $341.3 million, a 5% decrease compared to Q2 fiscal 2025, with diluted EPS of $0.15 and adjusted diluted EPS of $0.28.

- The company experienced strong sales growth in the medical vertical, increasing 15% year-over-year.

- Kimball Electronics raised its guidance for fiscal year 2026, now expecting net sales in the range of $1,400 - $1,460 million and adjusted operating income of 4.2% - 4.5% of net sales.

- The company generated $6.9 million in cash from operations and repurchased 149,000 shares of common stock for $4.3 million during the quarter.

- Kimball Electronics is undergoing a significant strategic shift, prioritizing its medical business, which is expected to become its most significant vertical over time. The company anticipates double-digit growth in medical for the foreseeable future, having achieved this for the last three quarters.

- A major investment is the new Indianapolis facility, a 300,000 square-foot site (with expansion options) for medical contract manufacturing (CMO), which is nearing completion. This focus on CMO, including the ability to handle drugs, is expected to drive higher EBITDA margins and secure larger programs.

- The company boasts a strong balance sheet with reduced inventory and debt, providing capital for organic and inorganic growth. Kimball is actively pursuing M&A opportunities in the medical CMO space, particularly in the US and Europe.

- Kimball Electronics maintains a long-term relationship with a major medical customer (Phillips), supporting 11 business units across all regions. The company is positioned for continued growth in this relationship, including absorbing business from a closed facility and seeing solid ex-US growth.

- Kimball Electronics (KE) is strategically shifting its focus to aggressively grow its medical contract manufacturing (CMO) business, which is expected to become its largest and most profitable vertical over time. This includes significant investments in new facilities, such as the 300,000 sq ft Indianapolis plant, and pursuing inorganic growth opportunities.

- The company differentiates itself in medical CMO with FDA qualification and the ability to handle drug delivery, enabling it to manufacture devices, insert drugs, and ship them directly. This capability targets high-value programs like auto injectors for GLP-1s, on-body devices, and insulin delivery.

- Kimball Electronics reported approximately $1.5 billion in revenue for fiscal 2025 and has achieved double-digit growth in its medical segment for the last three quarters. The medical CMO space is anticipated to offer higher EBITDA margins and be accretive to overall company margins, with cash flow from other segments redeployed to fund this growth.

- KE maintains a long-term relationship with a major medical customer (Philips), serving 11 business units globally. Despite a $100 million annual revenue impact from a past FDA issue, Kimball has taken on all business from Philips' closed Pittsburgh facility and anticipates continued growth, particularly in ex-US markets.

- Kimball Electronics, a global electronic manufacturing services provider, projects $1.5 billion in revenue for fiscal 2025.

- The company is strategically focusing on its medical business, which has seen double-digit growth in the last three quarters and is expected to continue strong growth.

- Significant investment is being made in the medical contract manufacturing organization (CMO) space, including a new 300,000 sq ft facility in Indianapolis, with expectations for higher EBITDA margins from this segment.

- Kimball is actively pursuing organic and inorganic growth in medical CMO, targeting areas like drug delivery (e.g., auto injectors for GLP-1s) and surgical devices, and views outsourcing in medtech as a "mega trend".

- The company aims to aggressively grow its medical and industrial verticals, while its automotive business is expected to remain relatively flat, with the goal of medical becoming its most significant vertical over time.

- Kimball Electronics reported Q1 fiscal 2026 net sales of $365.6 million, a 2% decrease year-over-year, with adjusted net income of $12.3 million and adjusted diluted EPS of $0.49, up 2X from the prior year.

- The company achieved a gross margin rate of 7.9%, a 160 basis point increase compared to Q1 fiscal 2025, driven by favorable product mix, the closure of its Tampa facility, and global restructuring efforts.

- The medical segment saw strong growth with sales up 13% to $102 million, while automotive sales declined 10% to $164 million and industrial sales decreased 1% to $100 million.

- Kimball Electronics reiterated its fiscal 2026 guidance, expecting net sales between $1.35 billion and $1.45 billion and adjusted operating income of 4%-4.25% of net sales.

- The company generated $8.1 million in cash from operations, marking its seventh consecutive quarter of positive cash flow, and reduced borrowings by $9.5 million from the previous quarter to $138 million. It also invested $1.5 million in share repurchases.

- Kimball Electronics reported net sales of $365.6 million, net income of $10.1 million, and diluted EPS of $0.40 for the first quarter ended September 30, 2025.

- The company reiterated its fiscal year 2026 guidance, projecting net sales between $1,350 million and $1,450 million and adjusted operating income of 4.0% to 4.25% of net sales.

- Operational highlights include $8.1 million in cash from operations for the seventh consecutive quarter and a reduction in debt to $138.0 million as of September 30, 2025.

- Sales in the medical vertical market increased by 13% year-over-year, while automotive sales decreased by 10% and industrial (excluding AT&M) decreased by 1%.

- During the quarter, the company repurchased 49,000 shares of common stock for $1.5 million.

- Kimball Electronics reported Q1 Fiscal 2026 revenue of $365.6 million and net income of $10.1 million, with adjusted diluted EPS of $0.49, which is more than double the adjusted EPS from Q1 Fiscal 2025.

- The company's operating income for Q1 Fiscal 2026 was $14.5 million (4.0% of net sales), and adjusted operating income reached 4.8%, representing a 140 basis point improvement year-over-year.

- Kimball Electronics generated $8.1 million in cash from operations for the seventh consecutive quarter, reduced its debt by $9.5 million to $138.0 million, and achieved its lowest Cash Conversion Days in three years at 83.

- The company reiterated its Fiscal Year 2026 guidance, projecting net sales in the range of $1,350 million to $1,450 million and adjusted operating income between 4.0% and 4.25% of net sales.

Quarterly earnings call transcripts for Kimball Electronics.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more