Earnings summaries and quarterly performance for KEY TRONIC.

Executive leadership at KEY TRONIC.

Board of directors at KEY TRONIC.

Research analysts who have asked questions during KEY TRONIC earnings calls.

GM

George Melas

MKH Management

7 questions for KTCC

Also covers: CLRO, FCHS, ICCC +4 more

William Dezellem

Tieton Capital Management

4 questions for KTCC

Also covers: ACIC, ADTN, BGSF +15 more

MD

Matt Dane

Titan Capital Management

2 questions for KTCC

GM

George Melas-Kyriazi

MKH Management Company

1 question for KTCC

Also covers: BGSF, ICCC, ITMSF +3 more

Matthew Dhane

Tieton Capital Management

1 question for KTCC

Also covers: GEOS, SLNG

SG

Sheldon Grodsky

Grodsky Associates

1 question for KTCC

Also covers: GEOS

Recent press releases and 8-K filings for KTCC.

Key Tronic Reports Q2 2026 Results Amid Strategic Restructuring

KTCC

Earnings

Demand Weakening

New Projects/Investments

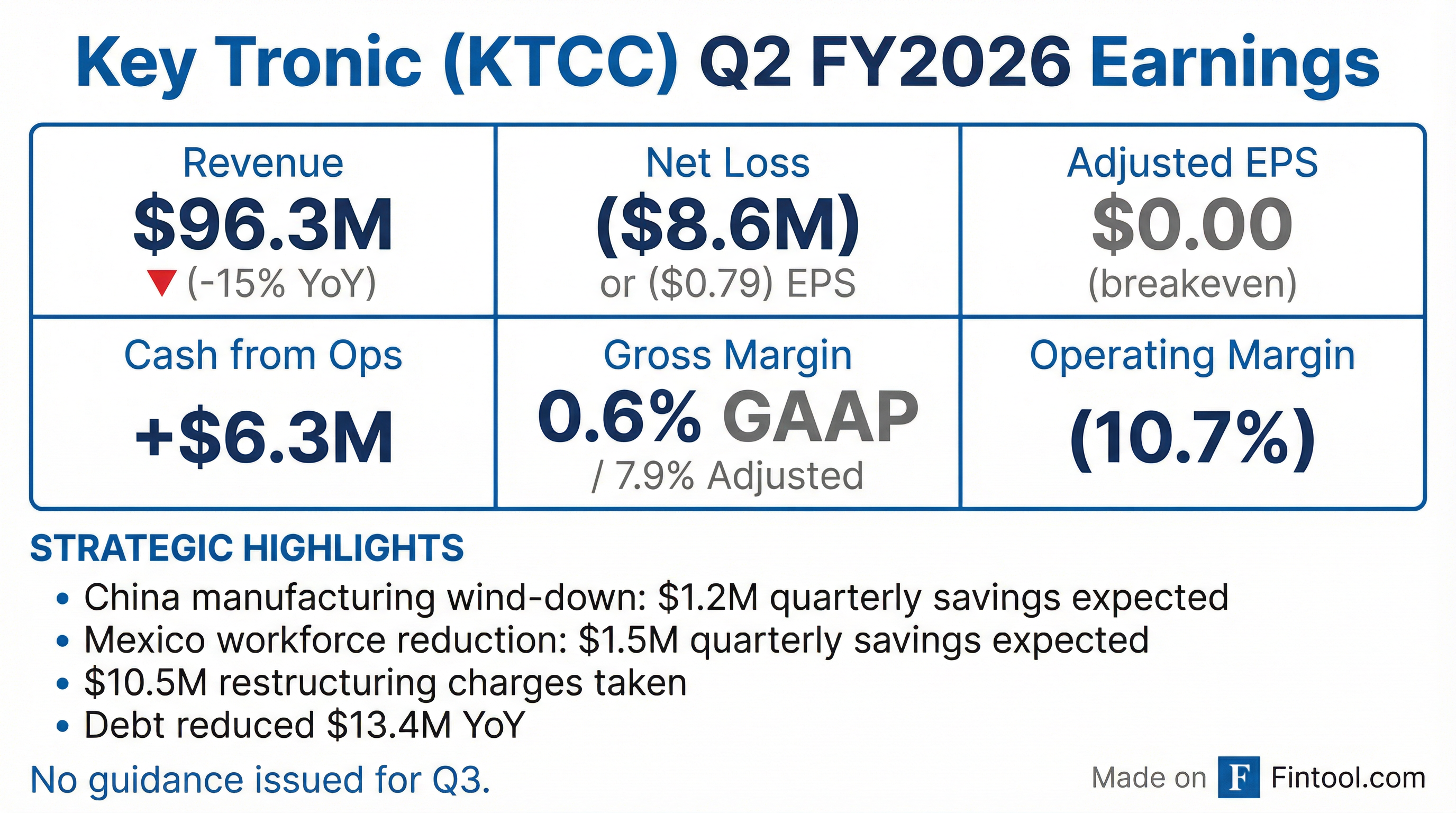

- Key Tronic reported total revenue of $96.3 million for Q2 fiscal year 2026, a decrease from $113.9 million in the prior year, attributed to reduced demand and an End-of-Life program.

- The company recorded a net loss of $8.6 million or $0.79 per share for Q2 fiscal year 2026, compared to a net loss of $4.9 million or $0.46 per share in the same period last year.

- Strategic initiatives, including the wind-down of China manufacturing and Mexico workforce reductions, resulted in approximately $10.5 million in charges for the quarter, significantly impacting margins.

- These restructuring efforts are projected to yield quarterly savings of approximately $1.2 million from China (by Q4 FY26) and $1.5 million from Mexico (by Q3 FY26).

- Despite not providing Q3 fiscal year 2026 guidance due to macroeconomic uncertainty, Key Tronic anticipates achieving break-even by the end of the fiscal year.

3 days ago

Key Tronic Reports Q2 FY2026 Results Amid Strategic Restructuring and Revenue Decline

KTCC

Earnings

Demand Weakening

New Projects/Investments

- Key Tronic reported total revenue of $96.3 million for Q2 FY2026, a decrease from $113.9 million in the same period of FY2025, primarily due to reduced demand from a longstanding customer and the transition of an End-of-Life program.

- The company posted a net loss of $8.6 million, or $0.79 per share, for Q2 FY2026, significantly impacted by approximately $10.5 million in charges related to strategic initiatives.

- Strategic actions include winding down manufacturing operations in China, expected to save $1.2 million per quarter, and further reducing the workforce in Mexico, anticipated to save $1.5 million per quarter once fully implemented.

- Key Tronic is investing in its U.S. and Vietnam facilities, has won new programs in automotive technology, pest control, and industrial equipment, and expects to achieve net income break-even by the end of the fiscal year.

- Due to continued macroeconomic uncertainty, the company is not providing forward-looking guidance for Q3 FY2026.

3 days ago

Key Tronic Reports Q2 FY2026 Results Amid Strategic Restructuring

KTCC

Earnings

Demand Weakening

New Projects/Investments

- Key Tronic reported total revenue of $96.3 million for the second quarter of fiscal year 2026, a decrease from $113.9 million in the same period of fiscal 2025, primarily due to reduced demand from a longstanding customer and the transition of an End-of-Life program.

- The company recorded a net loss of $8.6 million, or $0.79 per share, for Q2 FY26, significantly impacted by $10.5 million in charges related to strategic initiatives.

- Key Tronic is winding down its China manufacturing operations, expected to be completed by Q4 FY26, which is anticipated to save approximately $1.2 million per quarter. Additionally, workforce reductions in Mexico are expected to be fully implemented in Q3 FY26, saving approximately $1.5 million per quarter.

- Despite current challenges, the company won new programs in automotive technology, pest control, and industrial equipment, and a consigned materials program has the potential to grow to over $25 million in annual revenue.

- Key Tronic is not providing forward-looking guidance for Q3 FY26 due to macroeconomic uncertainty but expects to achieve net income break-even by the end of the fiscal year.

3 days ago

Key Tronic Announces Q2 FY2026 Results

KTCC

Earnings

Guidance Update

Layoffs

- Key Tronic reported total revenue of $96.3 million for the second quarter of fiscal year 2026, a decrease from $113.9 million in the same period of fiscal year 2025, and a net loss of $(8.6) million or $(0.79) per share.

- The company initiated a wind-down of its China manufacturing operations and further reduced its workforce in Mexico, resulting in approximately $10.5 million in charges for Q2 FY2026. These strategic initiatives are expected to generate quarterly savings of approximately $1.2 million from China operations and $1.5 million from Mexico workforce reductions.

- Gross margin for Q2 FY2026 was 0.6%, but the adjusted gross margin was 7.9% when excluding the restructuring charges. The company also generated approximately $6.3 million in cash flow from operations and reduced its debt by approximately $13.4 million year-over-year.

- Due to continued macroeconomic uncertainty, Key Tronic will not issue revenue or earnings guidance for the third quarter of fiscal year 2026, though it anticipates revenue to gradually rebound and a return to profitability by the end of fiscal 2026.

3 days ago

Key Tronic Corporation Announces Q2 Fiscal Year 2026 Results

KTCC

Earnings

Layoffs

Demand Weakening

- Key Tronic Corporation reported total revenue of $96.3 million for the second quarter of fiscal year 2026, a decrease from $113.9 million in the same period of fiscal year 2025, resulting in a net loss of $(8.6) million or $(0.79) per share and a gross margin of 0.6%.

- The company incurred approximately $10.5 million in charges during Q2 FY2026 due to the wind-down of its China manufacturing operations and further workforce reductions in Mexico, which are expected to generate future quarterly savings of $1.2 million and $1.5 million, respectively.

- Cash flow provided by operations significantly improved to approximately $6.3 million in Q2 FY2026, contributing to a year-over-year debt reduction of approximately $13.4 million. The company anticipates a return to profitability by the end of fiscal 2026 and expects approximately half of its manufacturing to be in its US and Vietnam facilities by that time.

3 days ago

Key Tronic Reports Q1 FY2026 Results Amid Revenue Decline and Strategic Initiatives

KTCC

Earnings

Demand Weakening

New Projects/Investments

- Key Tronic reported total revenue of $98.8 million for Q1 fiscal year 2026, a decrease from $131.6 million in the same period of fiscal year 2025, primarily due to reduced demand from a longstanding customer and delays in new program launches. The company recorded a net loss of $2.3 million, or $0.21 per share, for the quarter.

- Gross margin for Q1 fiscal year 2026 was 8.4%, an improvement from 6.2% in the previous quarter due to operational efficiencies, but down from 10.1% year-over-year, partly impacted by $1.6 million in reserves for inventory and accounts receivable due to a customer bankruptcy. The company expects to return to profitability by the end of fiscal year 2026.

- The company is expanding its manufacturing footprint, opening a new technology and R&D location in Arkansas and doubling capacity in Vietnam to address tariff impacts and customer demand for nearshoring. New program wins include medical technology (approximately $5 million) and industrial equipment (approximately $6 million combined).

- A new consigned manufacturing services contract, which generated about $1 million in Q1 fiscal year 2026 revenue, is expected to grow to over $20 million annually, considerably improving profitability.

- Key Tronic reduced total liabilities by $21.8 million (9%) year-over-year and decreased debt by approximately $12 million. Cash flow provided by operations for Q1 fiscal year 2026 was $7.6 million.

Nov 4, 2025, 10:00 PM

Key Tronic Corporation Announces First Quarter Fiscal Year 2026 Results

KTCC

Earnings

Demand Weakening

Guidance Update

- Key Tronic Corporation reported total revenue of $98.8 million for the first quarter of fiscal year 2026, a decrease from $131.6 million in the same period of fiscal year 2025, primarily due to reduced demand from a longstanding customer and delays in new program launches.

- The company posted a GAAP net loss of $(2.3) million, or $(0.21) per share, for Q1 FY2026, compared to net income in the prior year period.

- Gross margin sequentially increased to 8.4% in Q1 FY2026 from 6.2% in the previous quarter, attributed to operational efficiencies gained from recent workforce reductions, although it decreased year-over-year.

- Cash flow provided by operations was approximately $7.6 million for the quarter, which contributed to a year-over-year debt reduction of approximately $12.0 million.

- Due to continued uncertainty, Key Tronic will not be issuing revenue or earnings guidance for the second quarter of fiscal year 2026.

Nov 4, 2025, 9:03 PM

Key Tronic Corporation Announces Q1 Fiscal Year 2026 Results

KTCC

Earnings

Demand Weakening

Profit Warning

- Key Tronic Corporation reported total revenue of $98.8 million for the first quarter of fiscal year 2026, a decrease from $131.6 million in the same period of fiscal year 2025. This revenue decline was primarily due to reductions in demand from a longstanding customer and delays in new program launches.

- The company recorded a net loss of $(2.3) million, or $(0.21) per share, for Q1 fiscal year 2026, compared to net income of $1.1 million, or $0.10 per share, for the same period in fiscal year 2025. The adjusted net loss was $(1.1) million, or $(0.10) per share.

- Gross margin for Q1 fiscal year 2026 was 8.4%, representing a sequential increase from 6.2% in the previous quarter, but a decrease from 10.1% in the same period of fiscal year 2025. The sequential improvement was attributed to operational efficiencies from recent workforce reductions.

- Key Tronic generated approximately $7.6 million in cash flow from operations for the first quarter of fiscal year 2026, which contributed to a year-over-year debt reduction of approximately $12.0 million.

- The company will not be issuing revenue or earnings guidance for the second quarter of fiscal year 2026 due to uncertainty in the timing of new program ramps and potential tariffs.

Nov 4, 2025, 9:01 PM

Quarterly earnings call transcripts for KEY TRONIC.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more