Earnings summaries and quarterly performance for LOEWS.

Executive leadership at LOEWS.

Benjamin J. Tisch

Detailed

President and Chief Executive Officer

CEO

AH

Alexander H. Tisch

Detailed

Vice President

JJ

Jane J. Wang

Detailed

Senior Vice President and Chief Financial Officer

KI

Kenneth I. Siegel

Detailed

Senior Vice President

MA

Marc A. Alpert

Detailed

Senior Vice President, General Counsel and Secretary

RW

Richard W. Scott

Detailed

Senior Vice President and Chief Investment Officer

Board of directors at LOEWS.

AE

Ann E. Berman

Detailed

Director

AW

Anthony Welters

Detailed

Director

CD

Charles D. Davidson

Detailed

Director

CM

Charles M. Diker

Detailed

Director

JS

James S. Tisch

Detailed

Chairman of the Board

JC

Jonathan C. Locker

Detailed

Director

PJ

Paul J. Fribourg

Detailed

Lead Independent Director

SP

Susan P. Peters

Detailed

Director

WL

Walter L. Harris

Detailed

Director

Research analysts covering LOEWS.

Recent press releases and 8-K filings for L.

Loews Corporation issues $500M 4.94% senior notes due 2036

L

Debt Issuance

- On February 18, 2026, Loews completed a public offering of $500 million aggregate principal amount of 4.940% Senior Notes due 2036.

- Interest is payable semi-annually April 1 and October 1, commencing October 1, 2026; settlement is T+5 on February 18, 2026.

- Notes were priced at 99.920% of par, yielding 4.949%, with a spread of +80 bps over the 4.000% U.S. Treasury due November 15, 2035; rated A3/A (Stable) by Moody’s/S&P.

- Redemption terms include a make-whole call prior to January 1, 2036 at Treasury rate + 12.5 bps and a par call at 100% of principal on or after January 1, 2036.

Feb 18, 2026, 9:31 PM

Loews reports Q4 2025 net income of $402 million

L

Earnings

Share Buyback

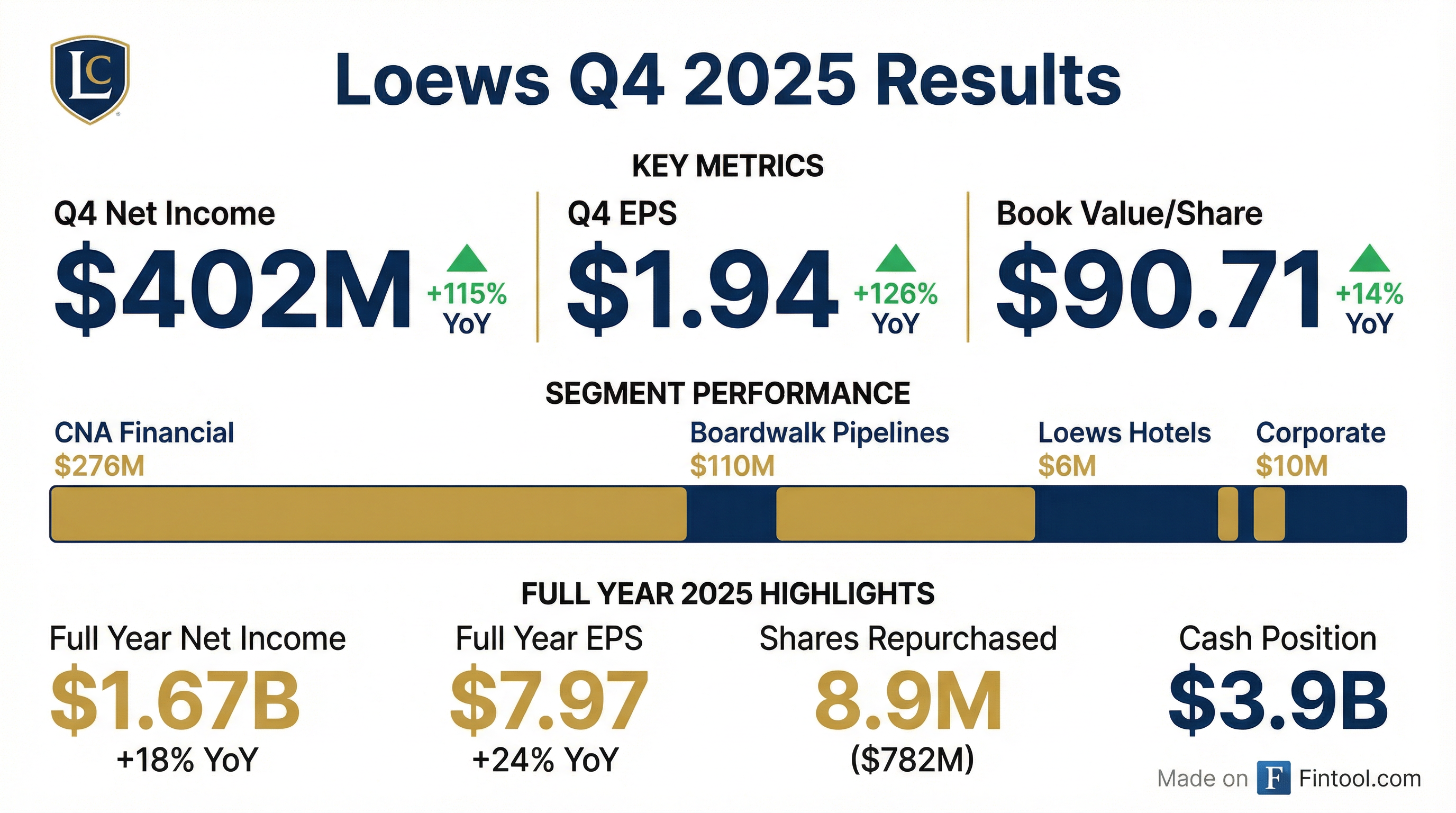

- Loews reported Q4 net income of $402 million, or $1.94 per share, up from $187 million, or $0.86 per share, in Q4 2024.

- Full-year 2025 net income was $1.667 billion, or $7.97 per share, compared to $1.414 billion, or $6.41 per share, in 2024.

- Book value per share rose to $90.71 (or $95.89 excluding AOCI) as of December 31, 2025, from $79.49 (or $88.18 excluding AOCI) a year earlier.

- Loews repurchased 1.0 million common shares in Q4 at a cost of $98 million, bringing total 2025 buybacks to 8.9 million shares for $782 million.

- In Q4, CNA’s net income contribution was $276 million, Boardwalk’s was $110 million, Loews Hotels’ was $6 million, and Corporate’s was $10 million.

Feb 9, 2026, 11:05 AM

Loews reports Q4 2025 and full-year net income

L

Earnings

Share Buyback

- Loews reported Q4 net income of $402 million, or $1.94 per share, up from $187 million, or $0.86 per share, in Q4 2024.

- Full-year net income was $1,667 million, or $7.97 per share, versus $1,414 million, or $6.41 per share, in 2024.

- Share repurchases totaled 8.9 million shares for $782 million in 2025, including 1.0 million shares for $98 million in Q4.

- Book value per share rose to $90.71 (from $79.49), and excluding AOCI to $95.89 (from $88.18) as of December 31, 2025.

Feb 9, 2026, 11:00 AM

Loews announces Q4 2025 earnings results

L

Earnings

Dividends

Share Buyback

- Loews reported Q4 2025 revenue of $4,734 million and net income of $402 million, or $1.94 per share, versus $187 million, or $0.86 per share in Q4 2024.

- The company paid a Q4 dividend of $0.0625 per share and repurchased 1.0 million shares at a cost of $98 million since September 30, 2025.

- Book value per share rose to $90.71 (excluding AOCI $95.89) as of December 31, 2025, and the parent held $3.9 billion in cash and investments against $1.8 billion of debt.

- Subsidiary contributions in Q4 included net income of $276 million from CNA, $110 million from Boardwalk, and $6 million from Hotels, with $389 million in dividends distributed.

Feb 9, 2026, 11:00 AM

Loblaw Companies announces $500 million senior unsecured notes offering

L

Debt Issuance

- Loblaw will privately place $500 million aggregate principal amount of senior unsecured notes, maturing June 16, 2035, at a 4.387% annual interest rate.

- The notes are being sold at par to qualified accredited investors in Canada, with closing expected on December 16, 2025.

- Net proceeds will be used to repay borrowings under its syndicated revolving credit facility and for general corporate purposes.

- The offering requires a minimum rating of “BBB (high)” with a positive trend from Morningstar DBRS and “BBB+” from Standard & Poor’s; notes will rank equally with all existing and future unsecured debt.

Dec 11, 2025, 10:48 PM

Loews reports Q3 2025 net income of $504 million

L

Earnings

Share Buyback

New Projects/Investments

- Loews reported net income of $504 million, or $2.43 per share, in Q3 2025, up from $401 million, or $1.82 per share in Q3 2024.

- CNA Financial contributed $371 million of net income (+43% YoY) and Boardwalk Pipelines net income was $94 million (+22% YoY).

- Book value per share rose to $88.39 (from $79.49 at YE 2024) and, excluding AOCI, to $94.00 (from $88.18).

- The company repurchased 0.6 million shares for $56 million during the quarter.

- Boardwalk executed a precedent agreement for the Texas Gateway project, adding 1.5 Bcf/d capacity, bringing total announced growth to 4.2 Bcf/d at an anticipated cost of $3 billion.

Nov 3, 2025, 11:08 AM

Loews reports Q3 2025 results

L

Earnings

Share Buyback

Dividends

- Loews reports Q3 2025 revenues of $4.671 billion (up 4.6% y/y) and net income of $504 million ($2.43/share) vs $401 million ($1.82/share) in Q3 2024.

- Book value per share rose to $88.39 as of September 30, 2025 from $79.49 at year-end 2024, and parent cash & investments totaled $3.588 billion.

- CNA segment net income increased 43% to $371 million, Boardwalk contributed $94 million (+22%), while Loews Hotels incurred a $3 million loss in Q3 2025.

- Since June 30, 2025, Loews repurchased 0.9 million shares for $85 million and paid a $0.0625 dividend per share; subsidiaries distributed $189 million in dividends.

Nov 3, 2025, 11:00 AM

Loews Corporation reports Q3 2025 results

L

Earnings

Share Buyback

New Projects/Investments

- Net income of $504 million, or $2.43 per share, in Q3 2025 vs. $401 million, or $1.82 per share, in Q3 2024

- Book value per share increased to $88.39 (excluding AOCI: $94.00) as of Sept 30, 2025, from $79.49 (excluding AOCI: $88.18) at Dec 31, 2024

- CNA Financial net income rose 43% to $371 million and Boardwalk Pipelines net income climbed 22% to $94 million year-over-year

- Repurchased 0.6 million shares for $56 million in Q3 2025; held $3.6 billion of cash and investments against $1.8 billion of debt at Sept 30, 2025

- Boardwalk Pipelines agreed a precedent deal for the Texas Gateway Project, adding 1.5 Bcf/d capacity—bringing total announced growth to 4.2 Bcf/d at an estimated cost of $3.0 billion

Nov 3, 2025, 11:00 AM

Loews Corp reports Q2 2025 results

L

Earnings

Share Buyback

Dividends

- Revenues of $4.555 billion in Q2 2025, up from $4.267 billion in Q2 2024; net income of $391 million, or $1.87 per share, vs $369 million, or $1.67 per share in Q2 2024.

- Book value per share rose to $84.42 as of June 30, 2025 (from $79.49 at December 31, 2024); excluding AOCI, it increased to $91.66 vs $88.18.

- Cash and investments of $3.4 billion with parent debt of $1.8 billion at June 30, 2025; repurchased 3.0 million shares for $260 million since March 31, 2025; dividend maintained at $0.0625 per share.

- Net income by segment: CNA $274 million, Boardwalk $88 million, Hotels $28 million and Corporate $1 million in Q2 2025.

Aug 4, 2025, 11:00 AM

Loews Corp Reports Q1 2025 Earnings, Share Buyback, and Segment Updates

L

Earnings

Dividends

Share Buyback

- Loews Corp reported Q1 2025 net income of $370 million and EPS of $1.74, compared to Q1 2024 figures of $457 million and $2.05 per share, driven by lower underwriting income from CNA and reduced earnings from hotels and parent investments

- The company repurchased 5.1 million common shares for $429 million since December 31, 2024, underscoring active capital allocation and a reduction in outstanding shares

- Segment performance revealed CNA’s net income dropping from $310 million to $252 million, while Boardwalk Pipelines delivered $152 million in net income with improved EBITDA of $346 million supported by higher re-contracting rates and growth projects

- Subsidiaries provided $686 million in dividends in Q1 2025, reinforcing a consistent dividend policy

- The firm maintained robust liquidity with $3.5 billion in cash and investments

- Book value per share, excluding AOCI, increased to $89.74 as of March 31, 2025, highlighting enhanced financial strength

May 5, 2025, 11:00 AM

Quarterly earnings call transcripts for LOEWS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more