Earnings summaries and quarterly performance for LANDMARK BANCORP.

Executive leadership at LANDMARK BANCORP.

Board of directors at LANDMARK BANCORP.

AH

Angela Hurt

Detailed

Director

AS

Angelia Stanland

Detailed

Director

DS

David Snapp

Detailed

Director

JL

Jim Lewis

Detailed

Director

MK

Mark Kohlrus

Detailed

Director

PA

Patrick Alexander

Detailed

Chairman of the Board

SM

Sandra Moll

Detailed

Director

SH

Sarah Hill-Nelson

Detailed

Director

TP

Tom Page

Detailed

Director

WS

Wayne Sloan

Detailed

Lead Independent Director

Research analysts who have asked questions during LANDMARK BANCORP earnings calls.

Recent press releases and 8-K filings for LARK.

Landmark Bancorp Reports Strong Q4 and Full Year 2025 Financial Results

LARK

Earnings

Dividends

Revenue Acceleration/Inflection

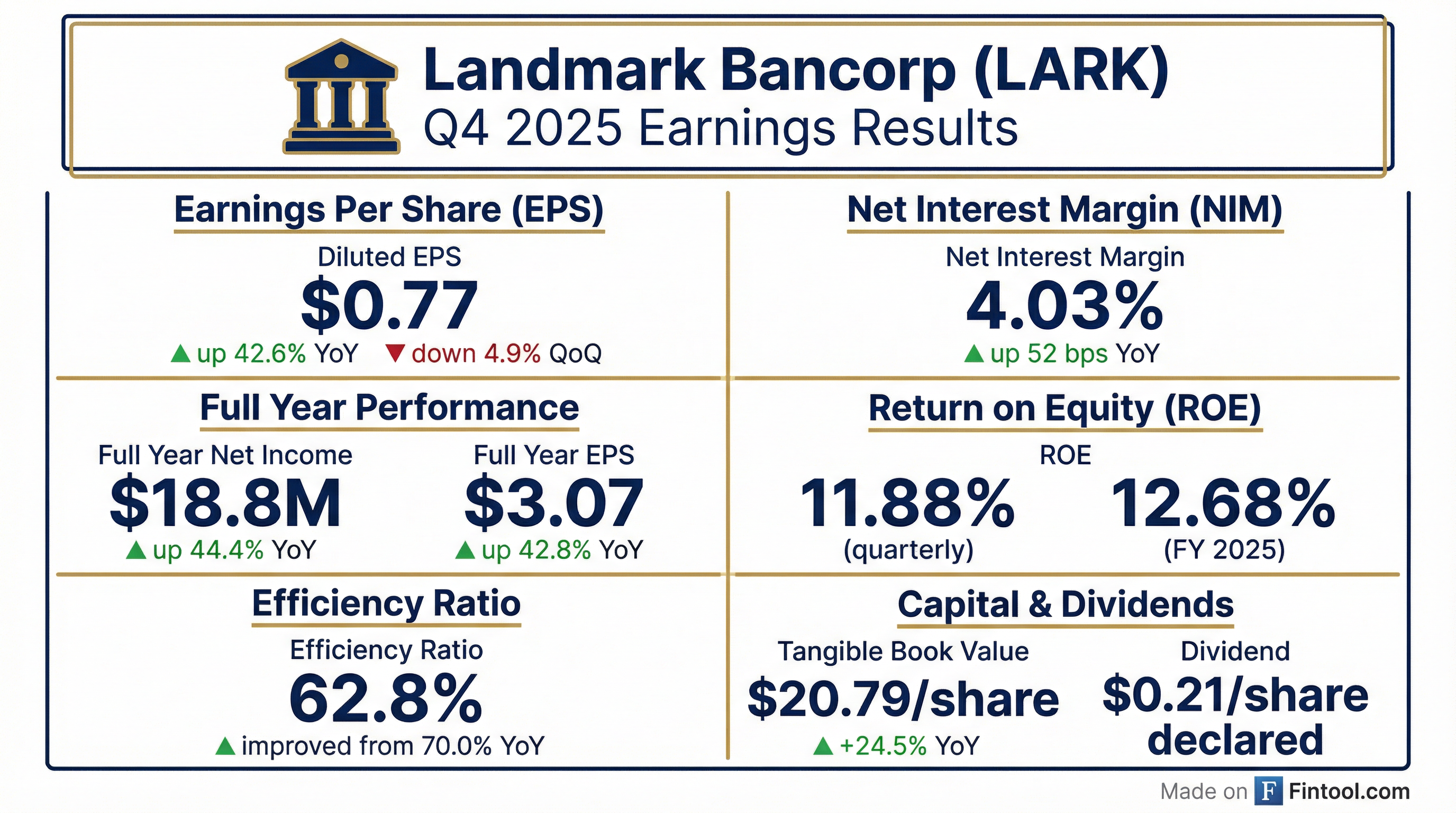

- Landmark Bancorp reported net income of $4.7 million and diluted earnings per share of $0.77 for Q4 2025. For the full year 2025, net income was $18.8 million and diluted EPS was $3.07, representing a 43% increase over 2024 earnings per share.

- The company achieved 17% revenue growth for the full year 2025, contributing to an improved efficiency ratio of 62.7% from 69.1% in 2024. The net interest margin (NIM) on a tax equivalent basis was 4.03% in Q4 2025 and 3.86% for the full year.

- Tangible book value increased to $20.79 per share , and book value per share reached $26.44 at December 31, 2025. The board of directors declared a cash dividend of $0.21 per share to be paid on February 26, 2026.

- Total deposits were $1.4 billion at December 31, 2025, with a loan-to-deposit ratio of 79.1%. Non-performing loans decreased to just under $10 million, or 0.90% of gross loans, at year-end 2025.

Jan 29, 2026, 4:00 PM

Landmark Bancorp Reports Strong Q4 and Full-Year 2025 Financial Performance

LARK

Earnings

Dividends

Revenue Acceleration/Inflection

- Landmark Bancorp reported net income of $4.7 million or $0.77 diluted earnings per share for Q4 2025, and $18.8 million or $3.07 diluted earnings per share for the full year 2025, representing a 43% increase in EPS over 2024.

- The company achieved 17% revenue growth and improved its efficiency ratio to 62.7% for the full year 2025, with the net interest margin increasing 58 basis points to 3.86%.

- Tangible book value increased to $20.79 per share at the end of Q4 2025, an increase of 24% over year-end 2024, and the board declared a cash dividend of $0.21 per share.

- Deposits totaled $1.4 billion at December 31, 2025, increasing by $63.4 million in the fourth quarter, while non-performing loans decreased by 24% compared to year-end 2024, totaling 0.90% of gross loans.

Jan 29, 2026, 4:00 PM

Landmark Bancorp Reports Strong Q4 and Full Year 2025 Financial Results

LARK

Earnings

Dividends

Revenue Acceleration/Inflection

- Landmark Bancorp reported net income of $4.7 million and diluted earnings per share of $0.77 for the fourth quarter of 2025. For the full year 2025, net income was $18.8 million or $3.07 per share, marking a 43% increase over 2024 earnings per share.

- The company achieved 17% revenue growth in 2025, which outpaced overhead expense growth, and improved its efficiency ratio to 62.7% from 69.1% in 2024. The net interest margin on a tax equivalent basis improved to 4.03% in Q4 2025, a 20 basis point increase from the prior quarter.

- Loans ended the year at $1.1 billion, reflecting 11.5% average total loan growth for 2025. Deposits totaled $1.4 billion at December 31, 2025, increasing by $63.4 million in the fourth quarter.

- Non-performing loans decreased by $3.1 million, or 24%, compared to year-end 2024, totaling just under $10 million or 0.90% of gross loans as of December 31, 2025.

- The Board of Directors declared a cash dividend of $0.21 per share, payable on February 26, 2026, to shareholders of record as of February 12, 2026.

Jan 29, 2026, 4:00 PM

Landmark Bancorp, Inc. Reports Strong Q4 and Full Year 2025 Results

LARK

Earnings

Dividends

Revenue Acceleration/Inflection

- Landmark Bancorp, Inc. reported net earnings of $4.7 million for the fourth quarter of 2025 and $18.8 million for the full year 2025, marking a 44.4% increase in annual net earnings compared to 2024.

- Diluted earnings per share (EPS) were $0.77 for Q4 2025 and $3.07 for the full year 2025, an increase of $0.92 from $2.15 in 2024.

- The company's Board of Directors declared a quarterly cash dividend of $0.21 per share, payable February 26, 2026.

- For the year ended December 31, 2025, key performance metrics included a return on average assets of 1.17%, return on average equity of 12.68%, and an improved efficiency ratio of 62.7%.

Jan 28, 2026, 9:15 PM

Landmark Bancorp, Inc. Reports Q4 and Full Year 2025 Results

LARK

Earnings

Dividends

Revenue Acceleration/Inflection

- Landmark Bancorp, Inc. reported net earnings of $4.7 million and diluted earnings per share of $0.77 for the fourth quarter of 2025. For the full year 2025, net earnings increased 44.4% to $18.8 million, with diluted earnings per share totaling $3.07.

- The net interest margin improved to 4.03% in Q4 2025, a 20-basis-point increase over the prior quarter, and the efficiency ratio was 62.8%.

- For the year ended December 31, 2025, return on average assets was 1.17% and return on average equity was 12.68%.

- The Board of Directors declared a quarterly cash dividend of $0.21 per share.

- As of December 31, 2025, total assets were $1.607 billion, and book value per share was $26.44.

Jan 28, 2026, 9:05 PM

Landmark Bancorp Inc. Reports Strong Q3 2025 Earnings

LARK

Earnings

Dividends

Revenue Acceleration/Inflection

- Net income for Q3 2025 totaled $4.9 million, or $0.85 per diluted share, representing a 24.1% increase in diluted EPS year-over-year, primarily driven by growth in net interest income and prudently managed expenses.

- The company reported an improved return on average assets of 1.21% and return on average equity of 13.0% for the quarter. The efficiency ratio improved to 60.7% in Q3 2025 compared to 66.5% in Q3 2024, and the net interest margin held steady at 3.83% compared to the prior quarter.

- Non-performing loans declined by almost $7 million, mostly from the resolution of a large commercial real estate loan. The allowance for credit losses stood at $12.3 million, or 1.10% of gross loans at September 30, 2025.

- Tangible book value per share increased to $20.96, up 6.6% on a linked quarter basis and 15.7% from the end of Q3 2024.

- The Board of Directors declared a cash dividend of $0.21 per share and a 5% stock dividend.

Oct 30, 2025, 3:00 PM

Landmark Bancorp, Inc. Announces Third Quarter 2025 Financial Results

LARK

Earnings

Dividends

Revenue Acceleration/Inflection

- Landmark Bancorp, Inc. reported diluted earnings per share of $0.85 and net earnings of $4.9 million for the third quarter of 2025, compared to $0.75 and $4.4 million, respectively, in the second quarter of 2025.

- The Board of Directors declared a cash dividend of $0.21 per share and a 5% stock dividend.

- For the third quarter of 2025, the annualized return on average assets was 1.21%, the annualized return on average equity was 13.00%, and the efficiency ratio improved to 60.7%.

- Net interest income increased $411,000, or 3.0%, compared to the previous quarter, and $2.5 million, or 21.5%, from the same quarter of 2024, with the net interest margin holding steady at 3.83%.

- Non-accrual loans declined $7.0 million in the third quarter of 2025, and book value per share was $26.92 as of September 30, 2025.

Oct 29, 2025, 8:05 PM

Quarterly earnings call transcripts for LANDMARK BANCORP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more