Earnings summaries and quarterly performance for LCNB.

Executive leadership at LCNB.

Eric Meilstrup

Detailed

Chief Executive Officer

CEO

AW

Andrew Wallace

Detailed

Chief Financial Officer

BR

Bradley Ruppert

Detailed

Chief Investment Officer

JM

Jeff Meeker

Detailed

Chief Lending Officer

LM

Lawrence Mulligan Jr.

Detailed

Chief Operating Officer

MM

Michael Miller

Detailed

Executive Vice President, Trust Officer

PW

Patricia Walter

Detailed

Chief Risk Officer

RH

Robert Haines II

Detailed

President

SK

Susan Kelley

Detailed

SVP and Chief Accounting Officer

Board of directors at LCNB.

AK

Anne Krehbiel

Detailed

Director, Secretary

CJ

Craig Johnson

Detailed

Director

MB

Mary Bradford

Detailed

Director

MJ

Michael Johrendt

Detailed

Director

RH

Rhett Huddle

Detailed

Director

SC

Spencer Cropper

Detailed

Chairman of the Board

SW

Stephen Wilson

Detailed

Director

SF

Steve Foster

Detailed

Director

TL

Takeitha Lawson

Detailed

Director

WK

William Kaufman

Detailed

Director

Research analysts covering LCNB.

Recent press releases and 8-K filings for LCNB.

LCNB Corp. Announces Record Annual Net Income and Increased Tangible Book Value for 2025

LCNB

Earnings

Dividends

Guidance Update

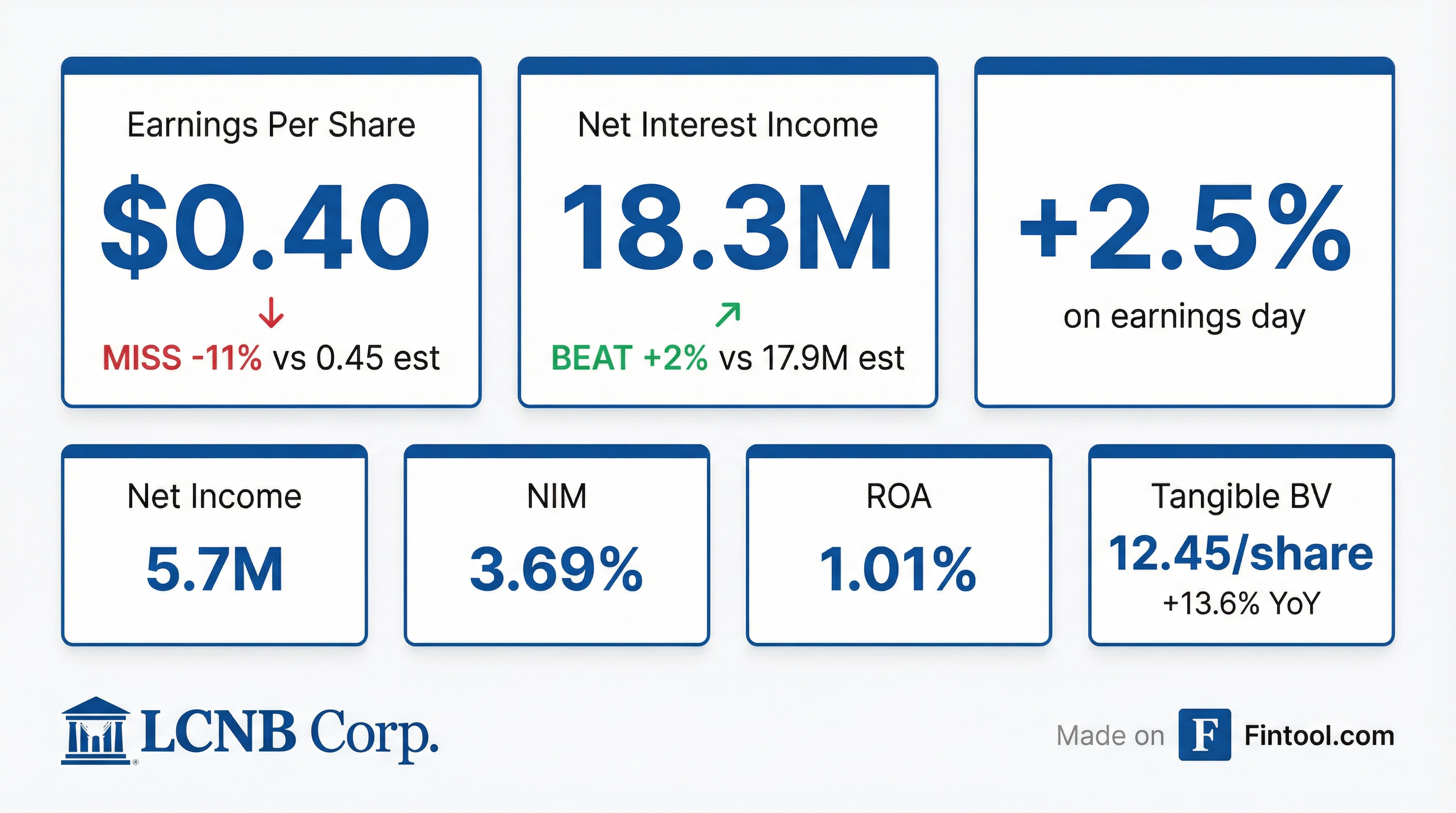

- LCNB Corp. reported record annual net income of $23.1 million for the full year ended December 31, 2025, an increase from $13.5 million in 2024, with diluted earnings per share rising to $1.63 from $0.97 in the prior year.

- Tangible book value per share increased by 13.6% year-over-year to $12.45 at December 31, 2025.

- LCNB Wealth Management assets reached a record $1.56 billion at December 31, 2025, up 12.9% year-over-year, contributing to record fiduciary income of $9.5 million for the 2025 full year.

- The company maintained strong asset quality with nonperforming loans to total loans at 0.14% as of December 31, 2025.

- For the full year 2025, the return on average assets was 1.02% and the tax-equivalent net interest margin was 3.50%.

Jan 29, 2026, 9:15 PM

LCNB Corp. Announces Record Annual Net Income and Strong Q4 2025 Results

LCNB

Earnings

Dividends

- LCNB Corp. reported record annual net income of $23.1 million and diluted earnings per common share of $1.63 for the full year ended December 31, 2025. For the fourth quarter of 2025, net income was $5.7 million and diluted EPS was $0.40.

- Tangible book value per share increased 13.6% year-over-year to $12.45 at December 31, 2025, and the company achieved a return on average assets of 1.02% for the full year.

- LCNB Wealth Management assets grew 12.9% year-over-year to a record $1.56 billion at December 31, 2025, driving record fiduciary income of $9.5 million for the year.

- Asset quality improved, with nonperforming loans to total loans decreasing to 0.14% at December 31, 2025, from 0.27% at December 31, 2024. The tax-equivalent net interest margin for the full year 2025 was 3.50%, up from 2.91% in 2024.

Jan 29, 2026, 9:01 PM

LCNB Corp Reports Strong Q3 2025 Earnings

LCNB

Earnings

Guidance Update

Revenue Acceleration/Inflection

- LCNB Corp reported strong Q3 2025 financial results, with earnings per share increasing 58.1% to $0.49 and its tax-equivalent net interest margin rising to 3.57% from 2.84% a year ago.

- The company's net interest income improved 20.7% year-over-year to $18.1 million, and its wealth management division saw fiduciary income grow 23.4%.

- The provision for credit losses significantly decreased to $211,000 in Q3 2025 from $660,000 in the same quarter last year.

- Despite these positive results, LCNB shares have underperformed the broader market year-to-date, declining 2.7% compared to a 14.5% gain in the S&P 500, with analysts maintaining a hold rating.

Oct 22, 2025, 11:48 PM

LCNB Corp. Reports Strong Q3 2025 Financial Results

LCNB

Earnings

Dividends

Revenue Acceleration/Inflection

- LCNB Corp. announced net earnings per diluted share of $0.49 for the third quarter of 2025, marking a 58.1% improvement from Q3 2024, with net income reaching $6.9 million for the quarter.

- The company's net interest margin expanded to 3.57% in Q3 2025, up from 2.84% in Q3 2024, and the return on average assets was 1.21% for the three months ended September 30, 2025.

- Book value per share increased to $19.02 at September 30, 2025, compared to $17.95 at September 30, 2024. Tangible shareholders' equity per share also rose to $12.15 from $10.97 over the same period.

- Asset quality improved, with total nonperforming loans decreasing to $2.0 million, or 0.12% of total loans, at September 30, 2025, down from $3.3 million, or 0.19% of total loans, at September 30, 2024.

- LCNB paid a dividend of $0.22 per share for the three months ended September 30, 2025.

Oct 22, 2025, 8:01 PM

LCNB Corp. Announces Leadership Promotions

LCNB

CFO Change

Management Change

- LCNB Corp. announced several leadership promotions on October 8, 2025, as part of its comprehensive succession plan.

- Robert Haines II was promoted to President, and Andrew Wallace was appointed Chief Financial Officer.

- Patricia Walter was promoted to Chief Risk Officer, and Susan Kelley was appointed SVP Chief Accounting Officer.

- These changes, which include the separation of the President and CEO roles with Eric Meilstrup continuing as CEO, are intended to enhance governance and support the company's growth, reflecting an increase in total assets managed by over $1 billion, or 34%, since December 31, 2022.

Oct 8, 2025, 5:00 PM

LCNB Corp. Announces Leadership Promotions and Succession Plan

LCNB

Management Change

CFO Change

- LCNB Corp. announced several leadership promotions as part of a comprehensive succession plan, aiming to enhance its leadership structure and support long-term strategic growth.

- Robert Haines II was promoted to President, having previously served as Chief Financial Officer from January 2008 to October 2025.

- Andrew Wallace was promoted to Chief Financial Officer, Patricia Walter to Chief Risk Officer, and Susan Kelley to SVP Chief Accounting Officer.

- The company's total assets managed have increased by over $1 billion, or 34% since December 31, 2022, reflecting the success of its multi-year growth plan.

Oct 8, 2025, 5:00 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more