Earnings summaries and quarterly performance for Magnera.

Research analysts who have asked questions during Magnera earnings calls.

Kevin McCarthy

Vertical Research Partners

5 questions for MAGN

Also covers: ALB, ALTM, APD +18 more

RS

Roger Spitz

Bank of America

4 questions for MAGN

Also covers: AMBP, GLT, MEOH +4 more

Edward Brucker

Barclays Capital

3 questions for MAGN

Also covers: MERC, TROX

Gabe Hajde

Wells Fargo & Company

3 questions for MAGN

Also covers: AMBP, AMCR, ATR +12 more

RC

Richard Carlson

Wells Fargo

2 questions for MAGN

Also covers: AMBP, BALL, GEF +1 more

ER

Edlain Rodriguez

Mizuho Securities

1 question for MAGN

Also covers: ALB, AXTA, BALL +8 more

EB

Edward Bricker

Barclays

1 question for MAGN

Recent press releases and 8-K filings for MAGN.

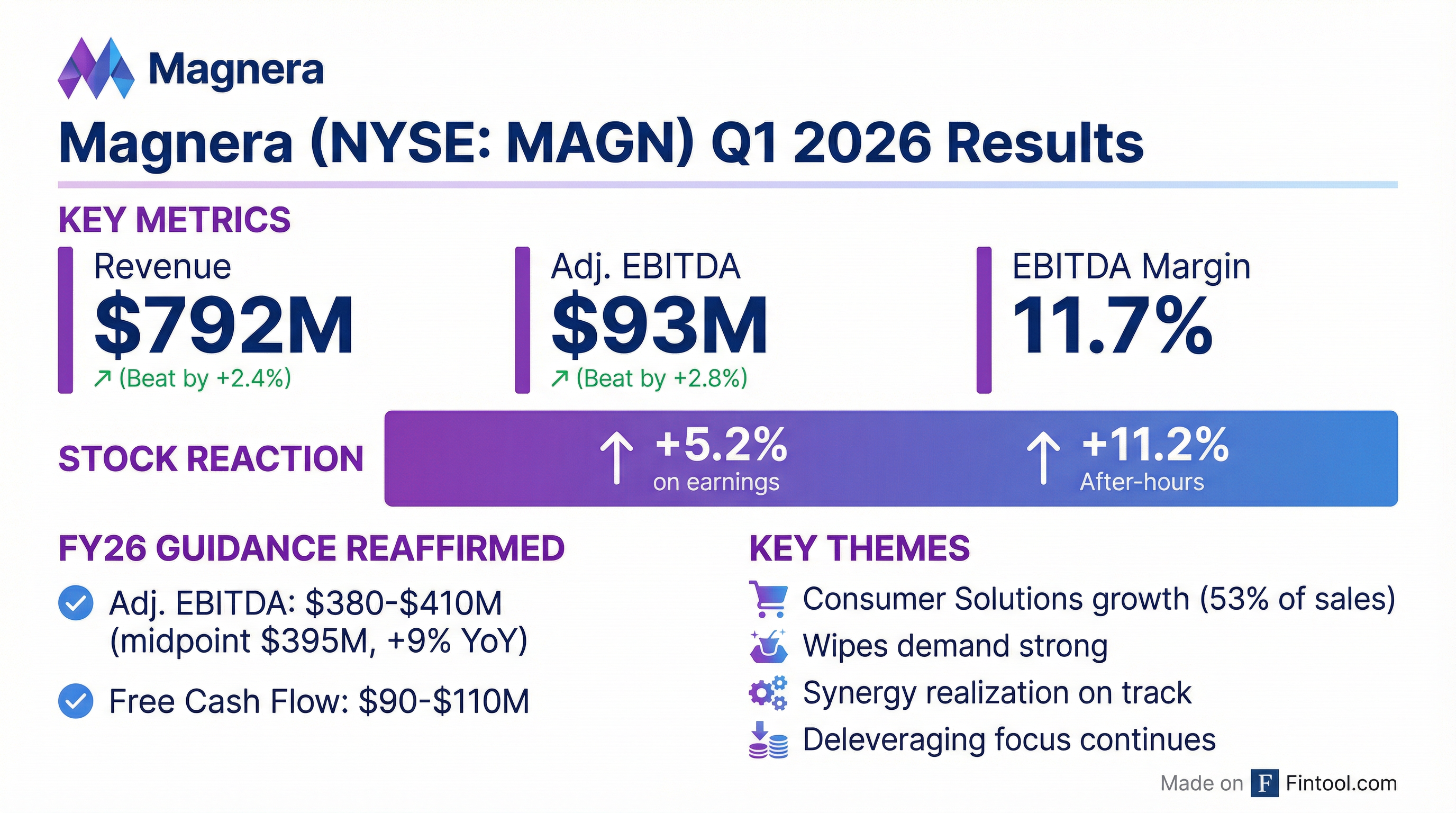

Magnera Announces Q1 2026 Results and Reaffirms Full-Year Guidance

MAGN

Earnings

Guidance Update

Debt Issuance

- Magnera reported Q1 2026 sales of $792 million and Adjusted EBITDA of $93 million, which was flat year-over-year on a constant currency basis. The company reaffirmed its 2026 Adjusted EBITDA guidance of 9% growth, expecting flat volumes for the fiscal year, primarily driven by synergy realization and Project Core initiatives.

- The company repaid $27 million of outstanding debt in Q1 2026 and plans to repay approximately $100 million over the fiscal year, targeting a 3x leverage ratio.

- Regional performance included 2% organic volume growth in the Americas and a 9% increase in Adjusted EBITDA for the Rest of World division to $35 million, despite continued market softness in Europe and competitive pressures in South America.

- Magnera highlighted innovation efforts, including a PFAS-free barrier protection for healthcare and an advanced material solution for battery life, with these innovative products expected to achieve margins in the mid-teens to twenty plus, above the company's average of 11%.

Feb 5, 2026, 3:00 PM

Magnera Reports Q1 2026 Results, Reaffirms Full-Year Guidance

MAGN

Earnings

Guidance Update

New Projects/Investments

- Magnera reported Q1 2026 sales of $792 million and Adjusted EBITDA of $93 million, which was flat year-over-year on a constant currency basis. Sequential earnings improvement over Q4 was in line with expectations.

- The company reaffirmed its 2026 Adjusted EBITDA guidance of 9% growth, primarily driven by synergy realization and Project Core initiatives. Project Core is expected to provide $15 million-$20 million of benefit.

- The Americas division delivered 2% organic volume growth, while the Rest of World division saw its Adjusted EBITDA increase by 9% to $35 million. Europe continues to experience broad-based market softness, and South American markets are stabilizing.

- Magnera repaid $27 million of outstanding debt in Q1 2026 and expects to repay approximately $100 million over the fiscal year, working towards a target leverage ratio of 3x.

Feb 5, 2026, 3:00 PM

Magnera Corporation Announces Q1 2026 Results and Fiscal Year 2026 Guidance

MAGN

Earnings

Guidance Update

Demand Weakening

- Magnera Corporation reported Q1 2026 revenue of $792 million, a decrease from $850 million in Q1 2025, while Adjusted EBITDA remained flat at $93 million, improving the Adjusted EBITDA margin to 12% from 11% in the prior year quarter.

- The company's performance was influenced by growth in Consumer Solutions being offset by the pass-through of lower raw material prices and softness in Personal Care in Europe and South America, with synergies and cost discipline mitigating negative price/cost impacts.

- Regionally, Americas revenue was $440 million with Adjusted EBITDA of $58 million, while Rest of World revenue was $352 million and Adjusted EBITDA increased to $35 million, benefiting from favorable price/cost due to synergies and cost reduction efforts.

- For Fiscal Year 2026, Magnera projects Adjusted EBITDA at a midpoint of $395 million and Free Cash Flow between $90 million and $110 million.

- The capital allocation strategy emphasizes deleveraging to approximately 3.0x, with a Capex outlook of 2-3% of sales and no near-term debt maturities.

Feb 5, 2026, 3:00 PM

Magnera Reports Q1 2026 Results and Reaffirms Full-Year Guidance

MAGN

Earnings

Guidance Update

New Projects/Investments

- Magnera reported Q1 2026 sales of $792 million and Adjusted EBITDA of $93 million, which was flat year-over-year on a constant currency basis.

- The company reaffirmed its 2026 Adjusted EBITDA guidance of 9% growth and expects to repay approximately $100 million of outstanding debt over the fiscal year, having already repaid $27 million in Q1.

- Project Core and synergy realization are progressing as planned and are the primary drivers for 2026 EBITDA growth, with $25 million in synergies targeted for 2026 and $15 million-$20 million in Project Core benefits expected.

- North America saw organic volume growth , offsetting expected year-over-year volume decline in South America due to competitive import pressure , while Europe continues to face broad-based market softness.

- Innovation efforts include a transformational breakthrough in barrier protection for healthcare (PFAS-free) and an advanced material solution for batteries, with these products expected to generate higher than average margins.

Feb 5, 2026, 3:00 PM

Magnera Reports First Quarter Results

MAGN

Earnings

Guidance Update

- Magnera Corporation reported net sales of $792 million and operating income of $14 million for the first quarter ended December 27, 2025.

- The company's Adjusted EBITDA for Q1 2026 was $93 million, representing an 11% increase compared to the prior year.

- Magnera reaffirmed its fiscal 2026 guidance, projecting Adjusted EBITDA between $380 million and $410 million and free cash flow between $90 million and $110 million.

- The company made $27 million in debt payments during the quarter, aligning with its commitment to debt reduction.

Feb 5, 2026, 2:17 PM

Magnera Discusses Fiscal 2026 Outlook and Strategic Initiatives

MAGN

Guidance Update

New Projects/Investments

Demand Weakening

- Magnera, a leader in non-wovens for consumer and personal care products, provided a 9% increase in its fiscal 2026 EBITDA guidance at the midpoint.

- The company anticipates $25 million in synergy capture and $15 million-$20 million in savings from Project CORE to contribute to 2026 results, alongside expected flattish global volumes.

- A primary capital allocation focus is deleveraging, with a recent $50 million debt reduction in its term loan.

- Fiscal 2025 pro forma volumes were down, mainly due to import pressure in South America, though North America experienced positive volumes.

Dec 2, 2025, 7:50 PM

Magnera Discusses 2026 Outlook and Deleveraging Strategy at BofA Conference

MAGN

Guidance Update

Debt Issuance

Demand Weakening

- Magnera, formed from the separation from Berry and merger with Glatfelter, is a leader in polypropylene and fiber-based nonwovens used in essential everyday products across various end markets, including wipes, diapers, tea bags, and coffee pods.

- The company is focused on deleveraging, having recently completed a $50 million debt reduction in its term loan, and aims to generate strong free cash flow.

- For fiscal 2026, Magnera's midpoint EBITDA guidance is up 9%, driven by $25 million in synergy capture and $15 million-$20 million in savings from Project Core, which involves capacity reduction and facility right-sizing.

- Magnera experienced import pressure in South America in fiscal 2025, particularly in the baby segment, which impacted overall pro forma volumes.

Dec 2, 2025, 7:50 PM

Magnera Corporation Presents 2026 Guidance and Operational Overview

MAGN

Guidance Update

New Projects/Investments

- Magnera Corporation (NYSE: MAGN) is a global leader in nonwovens, serving over 1,000 customers worldwide with 8,500+ employees across 45 global facilities.

- The company provided 2026 guidance for key financial metrics: | Metric | FY 2026 | |---|---| | Adjusted EBITDA ($ Millions) | $380 - $410 | | Free Cash Flow ($ Millions) | $90 - $110 | | Capital Expenditures ($ Millions) | $80 | | Interest Expense ($ Millions) | $135 | | Integration and Taxes ($ Millions) | $80

- Magnera's FY2025 pro-forma revenue was diversified, with 53% from Consumer Solutions and 47% from Personal Care, and geographically, 44% from North America and 39% from Asia.

- The company targets long-term global growth of 4-7% in Consumer Solutions and 2-3% in Personal Care, supported by FY25 innovation highlights including home compostable coffee capsule lidding and sustainable diaper materials.

Dec 2, 2025, 7:50 PM

Magnera Discusses Post-Merger Integration, 2026 Outlook, and Deleveraging at BofA Conference

MAGN

Guidance Update

Demand Weakening

M&A

- Magnera, formed on November 4, 2024, as a leader in polypropylene and fiber-based non-wovens, is focused on integrating its operations and realizing synergies.

- The company provided a 2026 EBITDA guidance up 9% at the midpoint, driven by an expected $25 million in synergy capture and $15 million to $20 million in savings from Project Core, which involves capacity reduction and facility right-sizing.

- Fiscal 2025 pro forma volumes were down approximately 4.5%, primarily due to significant import pressure in South America, though North America volumes were positive.

- Magnera is prioritizing deleveraging, having recently completed a $50 million debt reduction in its term loan, and emphasizes free cash flow generation.

Dec 2, 2025, 7:50 PM

Magnera Reports Q4 and Full-Year 2025 Results, Provides 2026 Outlook

MAGN

Earnings

Guidance Update

Demand Weakening

- Magnera reported Q4 2025 sales of $839 million and adjusted EBITDA of $90 million, contributing to full-year 2025 revenues of $3.2 billion and adjusted EBITDA of $362 million.

- For fiscal year 2025, the company generated $126 million of free cash flow, representing a yield exceeding 30%, and reduced its debt leverage to 3.8 times by year-end.

- Looking ahead to fiscal year 2026, Magnera forecasts an approximate 9% earnings improvement, with adjusted EBITDA at a $395 million midpoint and free cash flow projected between $90 million and $110 million.

- This anticipated growth is driven by synergy realization, Project CORE initiatives, and product mix advancements, despite a cautious macroeconomic outlook and a negative 3.5-4% total tonnage sold for FY 2025.

- The company has completed its stabilization phase and is now focused on optimization, operational excellence, and continued debt reduction.

Nov 20, 2025, 3:00 PM

Quarterly earnings call transcripts for Magnera.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more