Earnings summaries and quarterly performance for MAXIMUS.

Executive leadership at MAXIMUS.

Board of directors at MAXIMUS.

Research analysts who have asked questions during MAXIMUS earnings calls.

CS

Charles Strauzer

CJS Securities

6 questions for MMS

Also covers: CMCO, DFIN, DLX +2 more

BG

Brian Gesuale

Raymond James & Associates, Inc.

4 questions for MMS

Also covers: AMTM, MRCY

WG

Will Gildea

CJS Securities

2 questions for MMS

Also covers: EPAC, HLIO, JBI +7 more

BS

Bert Subin

Stifel Financial Corp.

1 question for MMS

Also covers: HEI, SAIC, VVX

Recent press releases and 8-K filings for MMS.

Maximus Reports Q1 2026 Results and Raises Earnings Guidance

MMS

Earnings

Guidance Update

New Projects/Investments

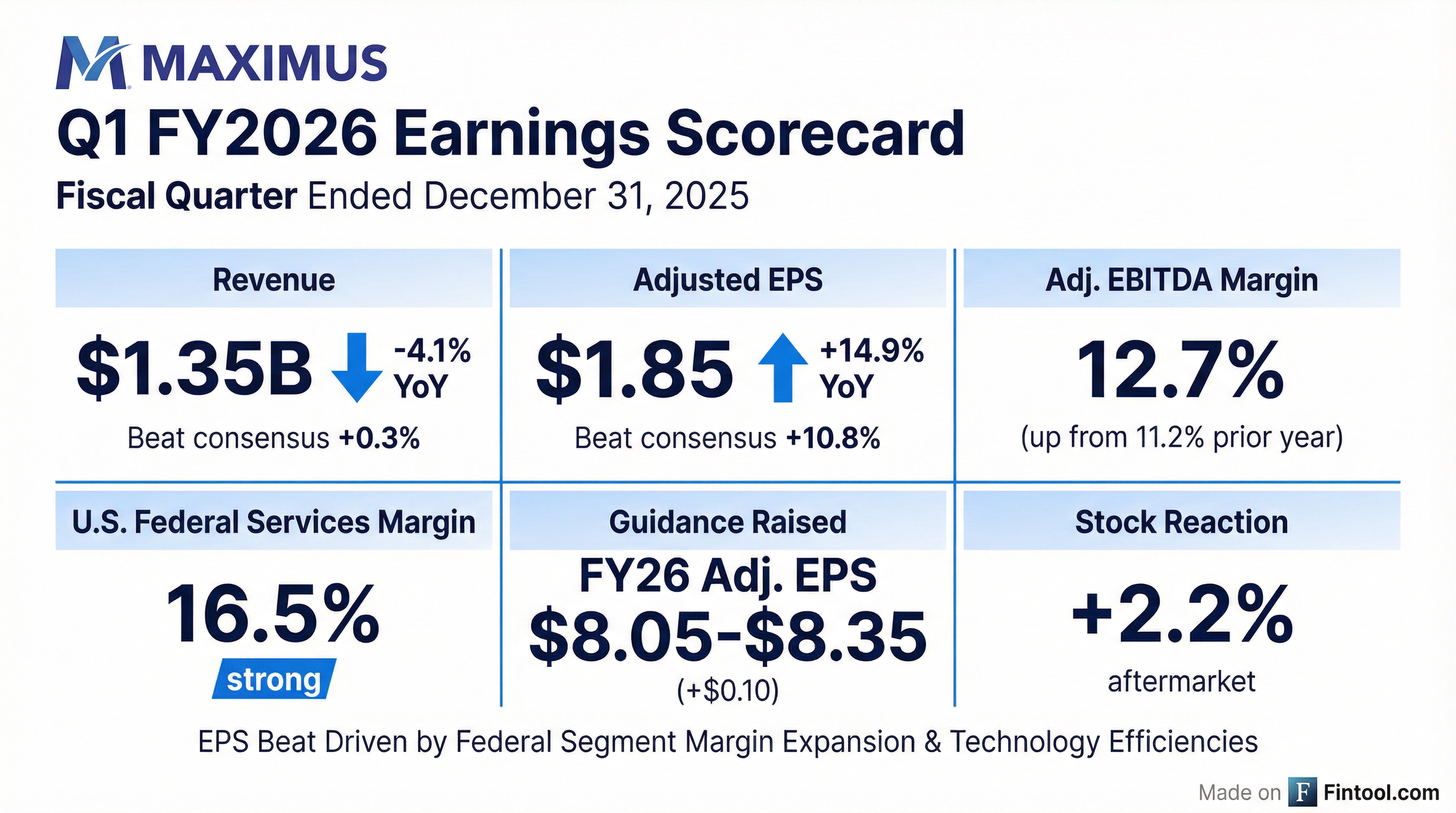

- Maximus reported Q1 2026 revenue of $1.35 billion, a 4.1% decline year-over-year, with an adjusted EPS of $1.85 and an adjusted EBITDA margin of 12.7%.

- For fiscal year 2026, the company raised its adjusted EPS guidance to a range of $8.05 to $8.35 and narrowed revenue guidance to $5.2 billion to $5.35 billion, while reiterating free cash flow guidance of $450 million to $500 million.

- The quarter included a $25 million child support business divestiture and a $9 million gain, but also a low Q1 book-to-bill ratio of 0.2x due to government shutdown impacts on award activity. The sales pipeline, however, grew to $59.1 billion at December 31, 2025.

- Maximus launched an AI-powered Accuracy Assistant tool for the SNAP program and anticipates significant growth opportunities in Medicaid and SNAP in fiscal years 2027 and 2028. Cash flow from operations was a net outflow of $244 million, leading to a Days Sales Outstanding (DSO) of 78 days.

1 day ago

Maximus Reports Q1 FY2026 Results and Raises Full-Year Earnings Guidance

MMS

Earnings

Guidance Update

New Projects/Investments

- Maximus reported Q1 FY2026 revenue of $1.35 billion, representing a 4.1% decline over the prior year period, with adjusted EPS of $1.85 and an adjusted EBITDA margin of 12.7%.

- For fiscal year 2026, the company raised its adjusted EPS guidance to a range of $8.05 to $8.35 per share and adjusted EBITDA margin guidance to approximately 14%, while narrowing revenue guidance to $5.2 billion to $5.35 billion. This revenue adjustment includes a $25 million reduction for the recently divested child support business and a $50 million reduction at the top end due to delays in new work revenue assumptions.

- The pipeline of sales opportunities increased to $59.1 billion at December 31, 2025, from $51.3 billion at September 30, 2025, though the Q1 Book-to-Bill Ratio was 0.2x due to light award activity.

- Maximus is strategically expanding its use of AI and automation, exemplified by the launch of its Accuracy Assistant tool for SNAP programs and its selection as the single awardee for the U.S. General Services Administration's (GSA) Government Experience Contact Center (gXCC) services transformation Blanket Purchase Agreement.

1 day ago

Maximus Reports Q1 FY26 Results and Updates Full-Year Guidance

MMS

Earnings

Guidance Update

New Projects/Investments

- Maximus reported Q1 FY26 revenue of $1.35 billion, a 4.1% decline year-over-year, with adjusted EPS of $1.85 and an adjusted EBITDA margin of 12.7%.

- For fiscal year 2026, the company raised its adjusted EPS guidance to between $8.05 and $8.35 per share and narrowed its revenue guidance to between $5.2 billion and $5.35 billion, while maintaining Free Cash Flow guidance of $450 million to $500 million.

- The US Federal Services segment achieved positive organic growth and improved operating margin, contrasting with anticipated revenue contraction in the US Services segment and an operating loss in the Outside the US segment.

- Cash flow from operating activities was a net outflow of $244 million, and Free Cash Flow was a net outflow of $251 million for the quarter, with Days Sales Outstanding (DSO) at 78 days due to expected seasonality and temporary collection delays.

- The pipeline of sales opportunities increased to $59.1 billion at December 31, 2025, and Maximus was recently selected as the single awardee for the U.S. GSA Blanket Purchase Agreement for Government Experience Contact Center services.

1 day ago

Maximus Announces Q1 FY26 Results and Updates FY26 Guidance

MMS

Earnings

Guidance Update

New Projects/Investments

- Maximus reported Q1 FY26 total revenue of $1,345.0 million, a 4.1% decrease from the prior year, with Adjusted EBITDA of $170.4 million and Adjusted Diluted EPS of $1.85.

- The company updated its Fiscal Year 2026 guidance, narrowing revenue to $5.2 billion - $5.35 billion, while increasing Adjusted EBITDA margin to approximately 14.0% and Adjusted diluted EPS to $8.05 - $8.35.

- Free cash flow was negative $(250.7) million in Q1 FY26 due to seasonality and collection delays, but the FY26 free cash flow guidance of $450 million - $500 million remains unchanged.

- The total pipeline of sales opportunities reached $59.1 billion as of December 31, 2025, though the Q1 FY26 book-to-bill ratio was impacted by a government shutdown.

- Maximus is leveraging AI innovation, including an AI-based solution achieving 45% autonomous dispute resolution, and sees new opportunities in Medicaid and SNAP program administration.

1 day ago

Maximus Reports Q1 FY26 Results and Raises Earnings Guidance

MMS

Earnings

Guidance Update

Dividends

- Maximus reported Q1 FY26 revenue of $1.35 billion and adjusted diluted earnings per share of $1.85, compared to $1.40 billion and $1.61, respectively, for the prior year period.

- The company raised its full-year fiscal year 2026 adjusted diluted earnings per share guidance to $8.05 to $8.35 per share and increased the adjusted EBITDA margin expectation to approximately 14%.

- Full-year fiscal year 2026 revenue guidance was narrowed to $5.2 billion to $5.35 billion, while free cash flow guidance was maintained at $450 million to $500 million.

- A quarterly cash dividend of $0.33 per share is payable on March 2, 2026.

2 days ago

Maximus Reports Q1 Fiscal Year 2026 Results and Raises FY2026 Earnings Guidance

MMS

Earnings

Guidance Update

Dividends

- Maximus reported Q1 fiscal year 2026 revenue of $1.35 billion and adjusted diluted earnings per share of $1.85, compared to $1.40 billion and $1.61, respectively, in the prior year period.

- The company raised its fiscal year 2026 adjusted diluted earnings per share guidance to a range of $8.05 to $8.35 and increased the adjusted EBITDA margin expectation to approximately 14%, while narrowing revenue guidance to $5.2 billion to $5.35 billion.

- A quarterly cash dividend of $0.33 per share was declared, payable on March 2, 2026.

- The sales pipeline stood at $59.1 billion as of December 31, 2025.

2 days ago

Titan Mining Files Base Shelf Prospectus and Establishes ATM Program

MMS

- Titan Mining Corporation filed a base shelf prospectus in Canada and a registration statement in the U.S. on January 27, 2026, to provide the flexibility to raise up to US$150 million over a 25-month period.

- The company also established an "at-the-market" (ATM) equity program, allowing it to issue and sell up to US$50 million of common shares from treasury at prevailing market prices.

- The financing framework is intended to support growth initiatives, advance its U.S. graphite strategy, and strengthen its balance sheet.

- Sales under the ATM Program will be at Titan's discretion, with timing and volume determined by market conditions and funding needs, facilitated by a syndicate of sales agents including BMO Capital Markets Corp. and Cantor Fitzgerald & Co..

Jan 29, 2026, 12:00 PM

Signing Day Sports Closes Public Offering

MMS

- Signing Day Sports, Inc. (SGN) announced the closing of its public offering on January 14, 2026.

- The offering consisted of 9,483,500 shares of common stock and warrants to purchase 14,225,250 shares of common stock.

- The public offering price was $0.5905 per share and accompanying warrant.

- The company received approximately $5.6 million in gross proceeds from the offering.

- Warrants are initially exercisable at $0.7086 per share and will expire on the earlier of full exercise, five years from the initial exercise date, or the closing date of transactions contemplated by the Business Combination Agreement.

Jan 14, 2026, 8:45 PM

Maxus Mining Announces Positive Results from 2025 Exploration Program at Penny Copper Project

MMS

New Projects/Investments

- Maxus Mining Inc. announced positive results from its 2025 Exploration Program at the Penny Copper Project in British Columbia.

- The program's Airborne Mobile Magnetotelluric (MobileMT) Survey identified laterally continuous conductive horizons, suggesting potential for stratabound copper-silver mineralization.

- Field sampling confirmed copper anomalism across the project, with an outcrop sample (326313) assaying 0.34% Cu.

- Maxus Mining Inc. also increased its advertising budget with RMK Marketing Inc. by an additional $250,000 CDN, bringing the total for the existing term to $500,000 CDN.

Dec 9, 2025, 1:00 PM

Maximus Reports Q4 Earnings and FY2026 Guidance

MMS

Earnings

Guidance Update

Dividends

- Maximus reported Q4 earnings of $1.62 per share and revenues of $1.32 billion, contributing to a fiscal 2025 revenue of $5.43 billion.

- For fiscal 2026, the company projects revenue between $5.23 billion and $5.43 billion, with adjusted earnings per share expected to be higher than analyst estimates.

- The U.S. Federal Services segment was a key driver, with revenue growth of 12.1% year-over-year to $3.07 billion and an improved operating margin of 15.3%.

- Maximus demonstrated strong financial health, generating $366 million in full-year free cash flow and maintaining a leverage ratio of 1.5x.

- The company declared a quarterly cash dividend of $0.30 per share, payable on December 1, 2025.

Nov 20, 2025, 4:59 PM

Quarterly earnings call transcripts for MAXIMUS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more