Earnings summaries and quarterly performance for NATURAL HEALTH TRENDS.

Executive leadership at NATURAL HEALTH TRENDS.

Board of directors at NATURAL HEALTH TRENDS.

Research analysts covering NATURAL HEALTH TRENDS.

Recent press releases and 8-K filings for NHTC.

Natural Health Trends Corp. Announces Q4 2025 Financial Results

NHTC

Earnings

Dividends

Demand Weakening

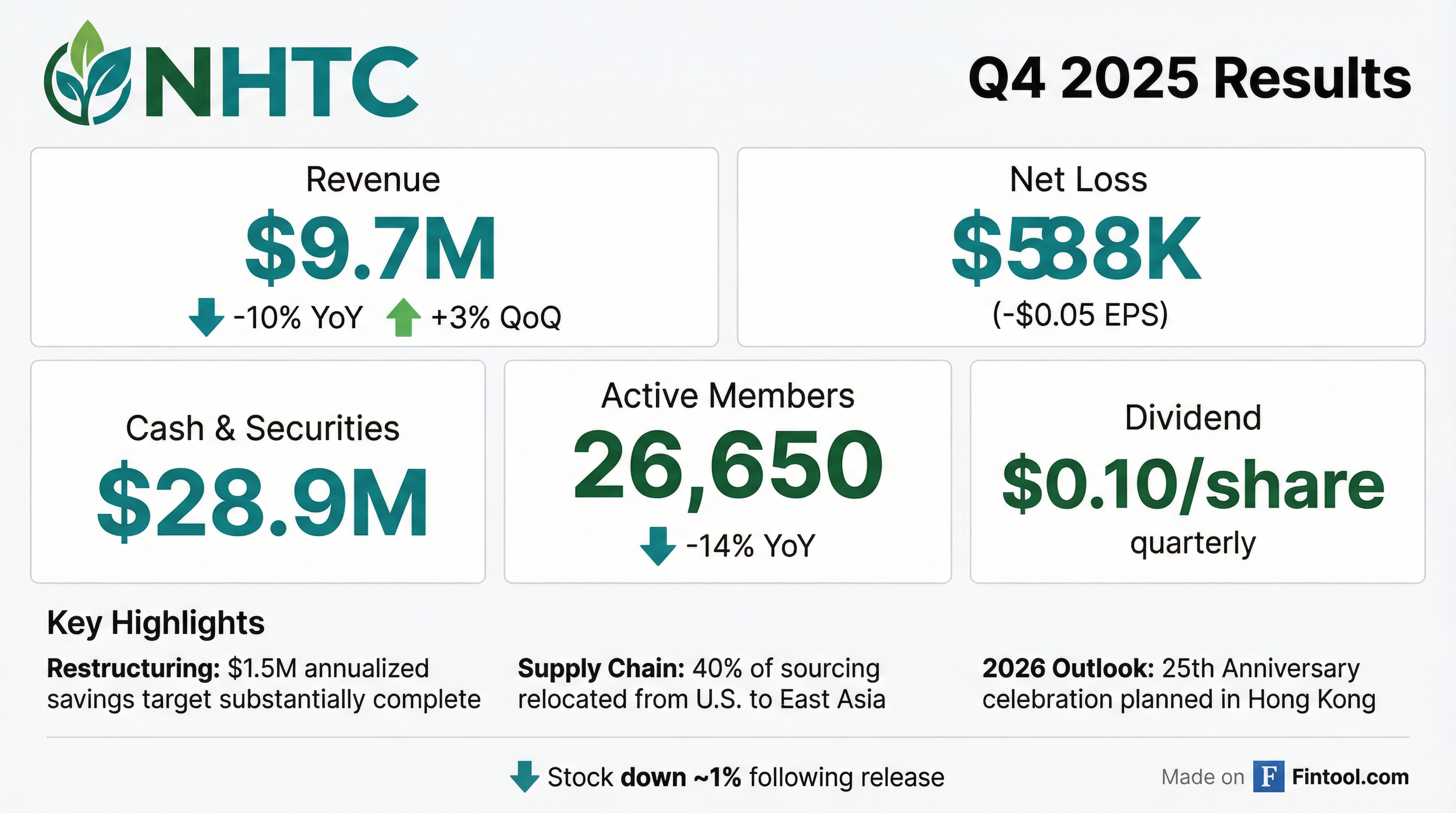

- Natural Health Trends Corp. (NHTC) reported Q4 2025 revenue of $9.7 million, representing a 3% sequential increase from Q3 2025 but a 10% decline compared to Q4 2024. The company posted a net loss of $588,000, or $0.05 per diluted share, for the quarter, contrasting with net income in the prior year period.

- Restructuring initiatives, which include relocating approximately 40% of product sourcing from America to East Asia and optimizing the workforce, are substantially complete. These actions are expected to generate approximately $1.5 million in annualized cost savings during 2026.

- Total cash, cash equivalents, and marketable securities stood at $28.9 million at December 31, 2025. The board of directors declared a quarterly cash dividend of $0.10 per share.

- The company experienced encouraging growth in Taiwan and Peru during Q4 2025, while Japan and Colombia achieved strong increases throughout the year. Reorders as a percentage of total orders in the primary market of Greater China also increased compared to 2024.

3 days ago

Natural Health Trends Corp. Announces Q4 2025 Results

NHTC

Earnings

Dividends

Guidance Update

- Natural Health Trends Corp. reported Q4 2025 revenue of $9.7 million, representing a 3% sequential increase from Q3 2025, but a 10% decline compared to Q4 2024.

- The company recorded a net loss of $588,000, or $0.05 per diluted share, for Q4 2025, a decrease from net income in the prior year period.

- Restructuring initiatives are substantially complete, with an anticipated $1.5 million in annualized cost savings expected to be realized during 2026.

- Total cash, cash equivalents, and marketable securities stood at $28.9 million as of December 31, 2025, and the board declared a quarterly cash dividend of $0.10 per share.

3 days ago

Natural Health Trends Corp. Reports Q4 and Full Year 2025 Financial Results

NHTC

Earnings

Dividends

Guidance Update

- Natural Health Trends Corp. (NHTC) reported Q4 2025 revenue of $9.7 million, representing a 3% sequential increase from Q3 2025 but a 10% decline compared to Q4 2024. The company recorded a net loss of $588,000, or $0.05 per diluted share, in Q4 2025, contrasting with net income of $176,000, or $0.02 per diluted share, in Q4 2024.

- The company's restructuring initiatives, which include relocating product sourcing and optimizing its workforce, are substantially complete. These actions are expected to generate a significant portion of $1.5 million in annualized cost savings during 2026.

- As of December 31, 2025, NHTC's total cash, cash equivalents, and marketable securities stood at $28.9 million. The board of directors declared a quarterly cash dividend of $0.10 per share, payable on February 27th.

- The gross profit margin for Q4 2025 was 72.9%, down from 74.2% in Q4 2024, primarily due to inventory write-offs. The operating loss for the quarter was $635,000.

3 days ago

Natural Health Trends Corp. Reports Q4 and Full Year 2025 Financial Results

NHTC

Earnings

Dividends

Demand Weakening

- Natural Health Trends Corp. reported a net loss of $588,000 ($0.05 per diluted share) for Q4 2025 and a full-year 2025 net loss of $882,000 ($0.08 per diluted share), contrasting with net income in the prior year periods.

- Net sales for Q4 2025 were $9.7 million, a 10% year-over-year decrease, and full-year 2025 net sales were $39.8 million, down 7% from 2024.

- The company declared a quarterly cash dividend of $0.10 per share and has substantially completed restructuring initiatives expected to yield $1.5 million in annualized savings.

- Active Members decreased to 26,650 at December 31, 2025, from 30,870 at December 31, 2024, and total cash, cash equivalents, and marketable securities were $28.9 million as of December 31, 2025, down from $32.0 million as of September 30, 2025.

3 days ago

Natural Health Trends Corp. Reports Q3 2025 Results and Announces Restructuring Plan

NHTC

Earnings

Dividends

Layoffs

- Natural Health Trends Corp. reported a net loss of $431,000, or $0.04 per diluted share, in Q3 2025, compared to net income of $35,000 (break-even per diluted share) in Q3 2024, with net sales decreasing 11% to $9.5 million.

- The company is implementing a major restructuring plan, including optimizing its workforce by approximately 10%, which is expected to generate $1.5 million in annualized savings by mid-2026. A one-time charge of approximately $250,000 is anticipated in Q4 2025 related to this plan.

- Cash, cash equivalents, and marketable securities totaled $32 million as of September 30, 2025, down from $43.9 million at December 31, 2024.

- While a cash dividend of $0.20 per share was declared for Q3 2025, the company anticipates reducing the quarterly cash dividend to $0.10 per share in Q1 2026.

Nov 5, 2025, 4:30 PM

Natural Health Trends Corp. Reports Q3 2025 Financial Results

NHTC

Earnings

Dividends

Demand Weakening

- Natural Health Trends Corp. reported revenue of $9.5 million for the third quarter of 2025, an 11% decrease compared to the third quarter of 2024, and a net loss of $431,000, or $0.04 per diluted share. For the first nine months of 2025, revenue was $30.0 million, a 7% decrease year-over-year, with a net loss of $294,000, or $0.03 per diluted share.

- The number of Active Members was 28,030 at September 30, 2025, a decrease from 30,870 at December 31, 2024. Total cash, cash equivalents, and marketable securities decreased to $32.0 million at September 30, 2025, from $43.9 million at December 31, 2024.

- The company is implementing restructuring initiatives projected to achieve $1.5 million in annualized savings by mid-2026, which will involve a one-time charge of approximately $250,000 in the fourth quarter of 2025. While a quarterly cash dividend of $0.20 per share was declared on November 3, 2025, payable on November 28, 2025, the company anticipates reducing the dividend to $0.10 per share starting in the first quarter of next year.

Nov 5, 2025, 2:10 PM

Natural Health Trends Reports Q3 2025 Financial Results

NHTC

Earnings

Dividends

Demand Weakening

- Natural Health Trends Corp. reported Q3 2025 revenue of $9.5 million, an 11% decrease year-over-year, and a net loss of $431,000 or $0.04 per diluted share, compared to net income in Q3 2024.

- Year-to-date 2025 revenue decreased 7% to $30.0 million, resulting in a net loss of $294,000 or $0.03 per diluted share.

- The company announced restructuring initiatives expected to generate $1.5 million in annualized savings by mid-2026, with a $250,000 one-time charge anticipated in Q4.

- A quarterly cash dividend of $0.20 per share was declared, but a reduction to $0.10 per share is expected starting in Q1 next year.

- Total cash, cash equivalents, and marketable securities decreased to $32.0 million at September 30, 2025, from $43.9 million at December 31, 2024.

Nov 5, 2025, 2:00 PM

Quarterly earnings call transcripts for NATURAL HEALTH TRENDS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more