Earnings summaries and quarterly performance for New Mountain Finance.

Executive leadership at New Mountain Finance.

John R. Kline

President and Chief Executive Officer

Adam B. Weinstein

Executive Vice President and Chief Administrative Officer

Joseph W. Hartswell

Chief Compliance Officer

Kris Corbett

Chief Financial Officer and Treasurer

Laura C. Holson

Chief Operating Officer

Board of directors at New Mountain Finance.

Research analysts who have asked questions during New Mountain Finance earnings calls.

Robert Dodd

Raymond James

5 questions for NMFC

Finian O'Shea

Wells Fargo Securities

3 questions for NMFC

Ethan Kaye

Lucid Capital Markets

2 questions for NMFC

Finian O'Shea

Wells Fargo

2 questions for NMFC

Sean-Paul Adams

Not Provided in Transcript

2 questions for NMFC

Arthur Winston

Pilot Advisors

1 question for NMFC

Bryce Rowe

B. Riley Securities

1 question for NMFC

Paul Johnson

Keefe, Bruyette & Woods

1 question for NMFC

Recent press releases and 8-K filings for NMFC.

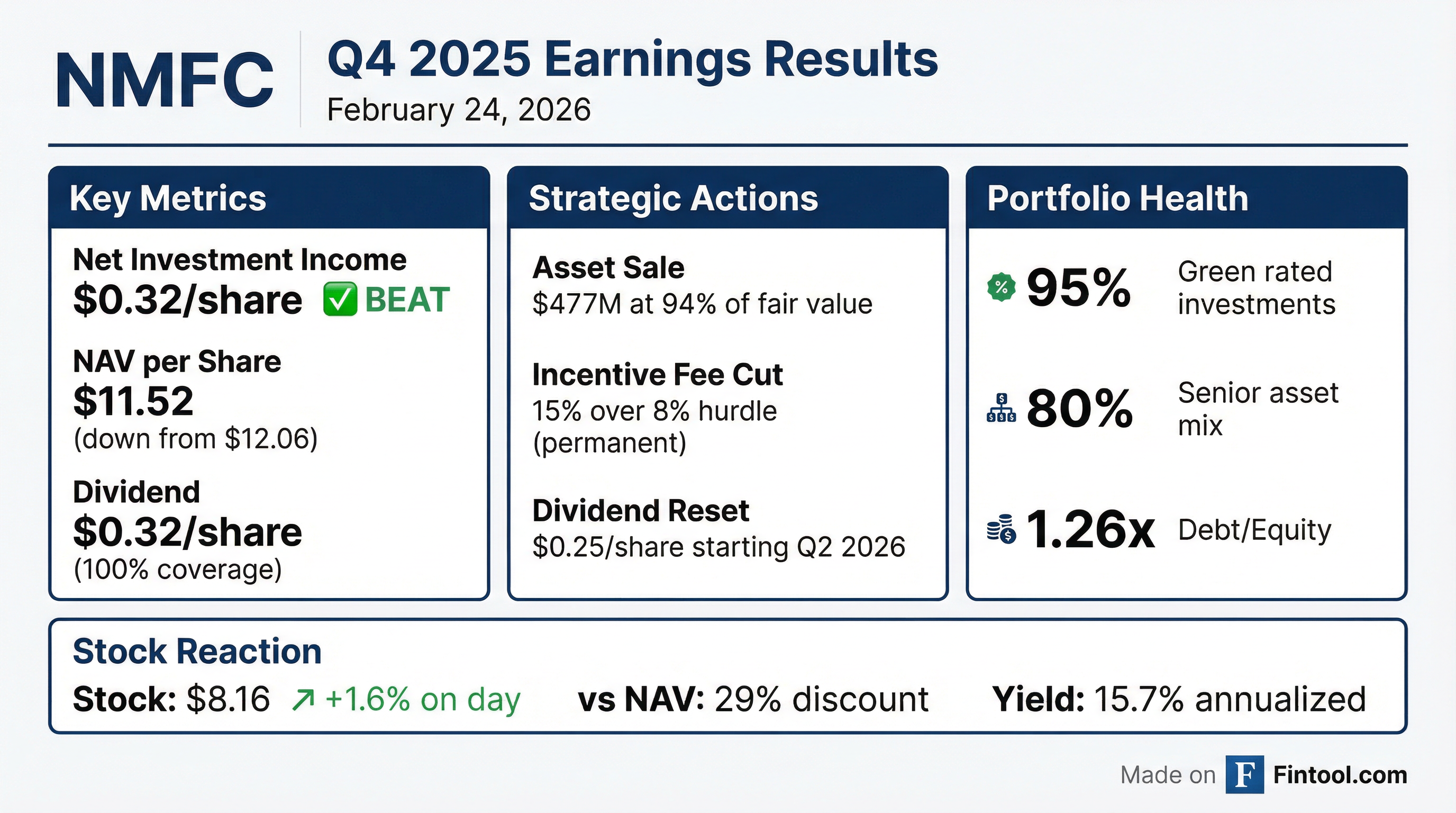

- New Mountain Finance Corporation reported adjusted net investment income of $0.32 per share for Q4 2025, fully covering its $0.32 per share dividend.

- The company's net asset value (NAV) declined to $11.52 per share as of December 31, 2025, primarily due to a lower valuation of the Edmentum common equity piece.

- NMFC signed an agreement to sell approximately $477 million of assets at 94% of their 12/31/2025 marks, which is expected to reduce book value by about $0.35 to $11.17 per share and decrease post-sale leverage to 0.9 times.

- The manager will permanently reduce its incentive fee to 15% after the Dividend Protection Program ends, and the long-term sustainable dividend rate is expected to be $0.25 per share per quarter starting Q2 2026.

- New Mountain Finance (NMFC) reported Q4 2025 adjusted net investment income (NII) of $0.32 per share, covering its dividend of $0.32 per share.

- The company's net asset value (NAV) per share decreased to $11.52 as of December 31, 2025, from $12.06 as of September 30, 2025, partly due to a $0.35/share headwind from a secondary asset sale.

- NMFC signed an agreement in February to sell $477 million of assets at 94% of fair value, which is expected to increase portfolio diversification and reduce PIK income by 20-25% over time.

- Starting Q2 2026, NMFC anticipates a quarterly dividend of $0.25 per share, and its incentive fee will be permanently reduced to 15% from 20% after the dividend protection program expires at the end of 2026.

- New Mountain Finance Corporation reported Adjusted Net Investment Income of $0.32 per share for Q4 2025, fully covering its $0.32 per share dividend paid on December 31st. The company also declared a $0.32 dividend payable on March 31st for Q1 2026.

- The company's Net Asset Value (NAV) declined to $11.52 per share as of December 31, 2025, from $12.06 per share, primarily due to a lower valuation of the common equity piece of Edmentum.

- NMFC signed an agreement to sell approximately $477 million of assets at 94% of their 12/31/2025 marks, which is expected to reduce book value by about $0.35 to $11.17 per share. This sale aims to diversify the portfolio, reduce PIK income by 20-25%, and lower the pro forma net debt-to-equity ratio to 0.9x from 1.21x.

- The manager will permanently reduce its incentive fee to 15% from 20% after the Dividend Protection Program ends in 2026. The long-term sustainable dividend rate is expected to be approximately $0.25 per share per quarter beginning in Q2 2026.

- The company repurchased approximately $52 million of shares in 2025 and $15 million thus far in 2026, with board authorization for approximately $80 million more.

- For Q4 2025, adjusted net investment income was $0.32 per share, fully covering the $0.32 per share dividend paid on December 31st. A $0.32 dividend was also announced for Q1 2026, payable on March 31st.

- Net Asset Value (NAV) declined to $11.52 per share as of December 31, 2025, primarily due to a lower valuation of the common equity piece of Edmentum.

- The company signed an agreement to sell approximately $477 million of assets at 94% of 12/31/2025 marks, which is expected to reduce book value by about $0.35 to $11.17 per share. Pro forma for this sale, the net debt-to-equity ratio will decrease from 1.21 to 1 to approximately 0.9 times.

- The manager will permanently reduce its incentive fee to 15% from 20% after the Dividend Protection Program ends in 2026. The long-term sustainable dividend rate is expected to be roughly $0.25 per share per quarter beginning in Q2 2026, supported by an expected quarterly net investment income of around $0.27 per share. NMFC repurchased approximately $52 million of shares in 2025 and $15 million in 2026 to date, with board authorization for $80 million more.

- New Mountain Finance Corporation reported Net Investment Income of $0.32 per share for Q4 2025 and declared a first quarter 2026 distribution of $0.32 per share, payable on March 31, 2026.

- The company announced plans to reduce the dividend to $0.25 per share starting in Q2 2026, citing continued base rate compression, lower market spreads, and an increasingly senior asset mix.

- Net asset value (NAV) was $11.52 per share as of December 31, 2025, a decrease from $12.06 per share as of September 30, 2025.

- A definitive agreement was signed to sell $477 million of assets at 94% of December 31, 2025 fair value, with the goal of increasing portfolio diversification, reducing PIK income, and enhancing financial flexibility.

- New Mountain Finance Corporation plans to permanently reduce its incentive fee to 15% over an 8% hurdle and has repurchased $30 million worth of shares since the end of Q3 2025, with continued repurchases expected in 2026.

- New Mountain Finance Corporation reported Net Investment Income of $0.32 per share for the fourth quarter ended December 31, 2025, and declared a first quarter 2026 distribution of $0.32 per share.

- The company's Net Asset Value per share decreased to $11.52 as of December 31, 2025, from $12.06 as of September 30, 2025.

- NMFC expects to reduce its dividend to $0.25 per share starting in Q2 2026 and plans to permanently reduce its incentive fee to 15% over an 8% hurdle.

- A definitive agreement was signed to sell $477 million of assets at 94% of December 31, 2025 fair value to increase portfolio diversification, and the company repurchased $30 million worth of shares since the end of Q3 2025.

- The portfolio quality remains strong with approximately 95% rated green on its internal heatmap and an improved senior-oriented asset mix of 80% as of December 31, 2025.

- New Mountain Finance Corporation (NMFC) reported adjusted net investment income of $0.32 per share for Q3 2025, fully covering its $0.32 per share dividend. A $0.32 dividend has also been declared for Q4 2025.

- The company's net asset value (NAV) per share declined by $0.15 from Q2 to $12.06 in Q3 2025, primarily due to declines in specific investments.

- NMFC fully utilized its $50 million stock repurchase program, repurchasing approximately $47 million in shares at an average price of $10, and its board approved a new $100 million share buyback program.

- The company is exploring a potential portfolio sale of up to $500 million of assets to enhance financial flexibility, reduce portfolio concentrations, and decrease PIK income.

- The portfolio's senior-oriented assets increased to 80%, and 95% of investments are green-rated, with non-accruals at 1.7% of the portfolio's fair value.

- New Mountain Finance Corporation (NMFC) reported adjusted net investment income of $0.32 per share for Q3 2025, fully covering its $0.32 per share dividend, and declared a $0.32 per share dividend for Q4 2025.

- Net Asset Value (NAV) per share declined by $0.15 from Q2 to $12.06 , although approximately 95% of the portfolio remains green-rated. The net debt to equity ratio was 1.23 to one, remaining within the target range.

- NMFC fully utilized its $50 million share repurchase program and the board approved a new $100 million share buyback program. The company is also exploring a potential portfolio sale of up to $500 million of assets to diversify the portfolio and reduce PIK income.

- NMFC reported Q3 2025 adjusted net investment income (NII) of $0.32 per share, which fully covered its $0.32 per share dividend.

- The company's net asset value (NAV) per share decreased to $12.06 as of September 30, 2025, from $12.21 as of June 30, 2025, representing a $0.15 per share decline.

- A new $100 million board-authorized share buyback program was announced, following the full utilization of the previous $50 million program through the repurchase of approximately $47 million of shares year to date at a weighted average price of $10.02 per share.

- The portfolio maintained strong credit performance, with approximately 80% of assets being senior in nature as of Q3 2025.

- New Mountain Finance Corporation reported Net Investment Income of $0.32 per weighted average share for the quarter ended September 30, 2025.

- The company declared a fourth quarter 2025 distribution of $0.32 per share, payable on December 31, 2025.

- Net asset value (NAV) per share was $12.06 as of September 30, 2025, a decrease from $12.21 per share as of June 30, 2025.

- A new stock repurchase plan authorizing up to $100 million worth of common shares was established, doubling the capacity of the original plan.

- NMFC is exploring a secondary portfolio sale of up to $500 million of assets to further strategic initiatives around reducing PIK income, diversifying the portfolio, and enhancing financial flexibility.

Quarterly earnings call transcripts for New Mountain Finance.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more