Earnings summaries and quarterly performance for NATIONAL RESEARCH.

Executive leadership at NATIONAL RESEARCH.

Board of directors at NATIONAL RESEARCH.

Research analysts covering NATIONAL RESEARCH.

Recent press releases and 8-K filings for NRC.

NRC Health Reports Q4 and Full Year 2025 Results

NRC

Earnings

Dividends

Share Buyback

- For the fourth quarter of 2025, NRC Health reported revenue of $35 million and adjusted EBITDA of $9 million. Total recurring contract value (TRCV) reached $144 million, an 8% increase year-over-year, marking the fifth consecutive quarter of sequential TRCV growth.

- Full-year 2025 revenue was $137.4 million, a 4% decrease from 2024, with adjusted EBITDA of $40.2 million, representing a 29% margin. Adjusted EPS for the full year was $0.93 per share.

- The company achieved its highest gross dollar retention rate in over seven years and saw full-year new sales increase 86% year-over-year.

- NRC Health's capital allocation strategy includes investing in the business and technology, returning capital to shareholders through dividends (a 12 cents per share dividend was paid in Q4 2025) and opportunistic share repurchases, and maintaining flexibility for strategic acquisitions.

- The company is focused on six growth catalysts for 2026, including scaling its go-to-market restructure, deepening adoption of enablement solutions, product innovation (including AI), cross-sell opportunities, retention upside, and new logo growth.

3 days ago

NRC Health Announces Q4 and Full Year 2025 Results

NRC

Earnings

Dividends

Revenue Acceleration/Inflection

- NRC Health reported Q4 2025 revenue of $35 million and Adjusted EBITDA of $9 million. For the full year 2025, revenue was $137.4 million and Adjusted EBITDA was $40.2 million.

- Total Recurring Contract Value (TRCV) reached $144 million, an 8% year-over-year increase, marking the fifth consecutive quarter of sequential TRCV growth, which is expected to drive revenue growth in 2026.

- The company achieved an 86% increase in full-year new sales year-over-year and its highest gross dollar retention rate in over seven years, supported by sales team reorganization and customer success initiatives.

- NRC Health paid a quarterly dividend of $0.12 per share and outlined a capital allocation strategy focusing on business investments, shareholder returns, and strategic acquisitions.

3 days ago

NRC Health Announces Q4 and Full Year 2025 Results

NRC

Earnings

Dividends

Revenue Acceleration/Inflection

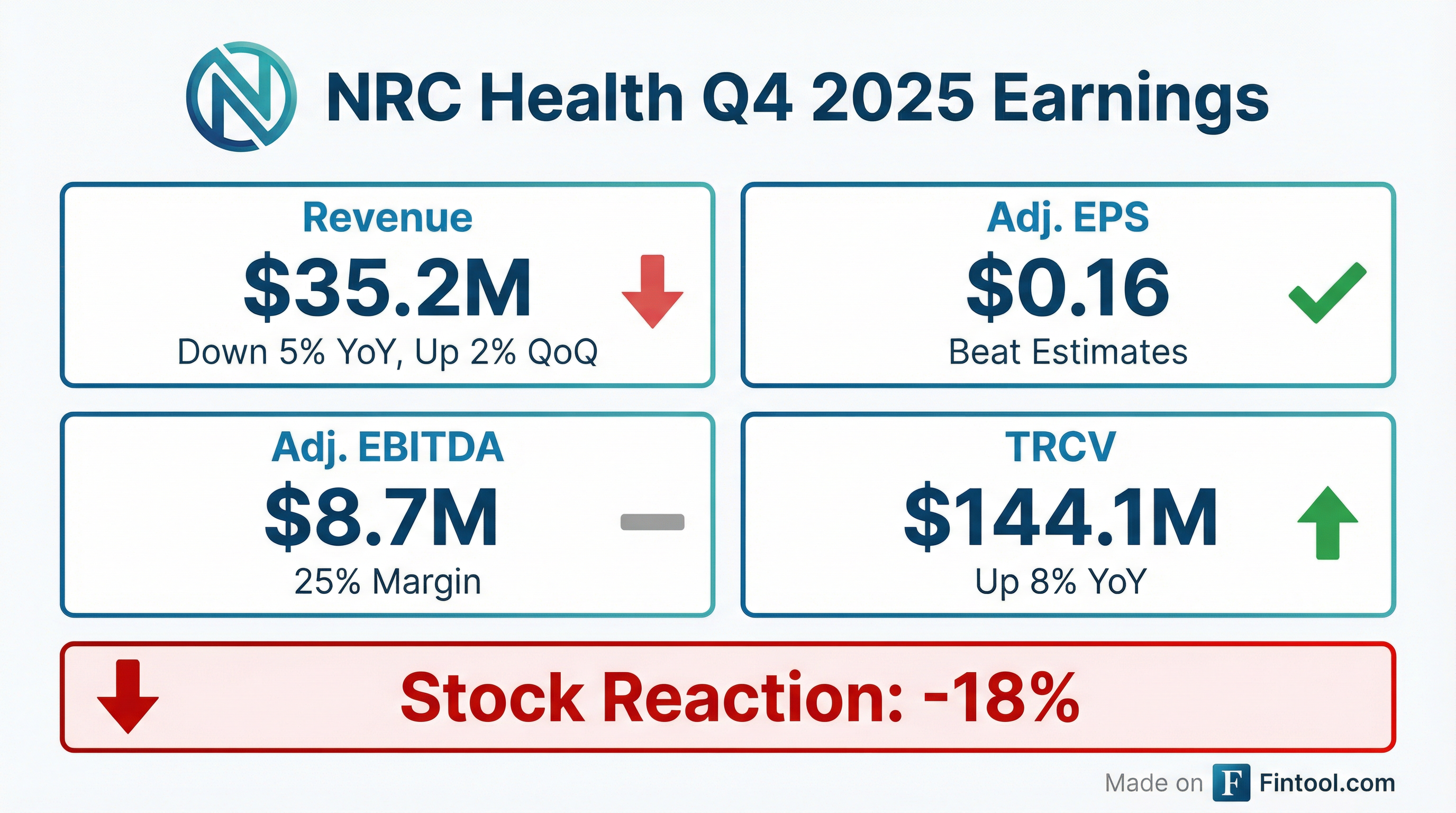

- NRC Health reported Q4 2025 revenue of $35.2 million and adjusted EBITDA of $8.7 million, with full-year 2025 revenue at $137.4 million and adjusted EBITDA at $40.2 million.

- Total Recurring Contract Value (TRCV) reached $144.1 million, marking an 8% year-over-year increase and the fifth consecutive quarter of sequential TRCV growth, with 99% of the company's revenue being recurring.

- Adjusted EPS for Q4 2025 was $0.16 per share, and for the full year 2025, it was $0.93 per share.

- The company anticipates revenue growth in 2026, driven by the 8% TRCV growth in 2025, and maintains a commitment to shareholder returns with a quarterly dividend of $0.12 per share.

3 days ago

National Research Corporation Announces Fourth Quarter and Full-Year 2025 Results

NRC

Earnings

Dividends

Revenue Acceleration/Inflection

- NRC Health reported fourth quarter 2025 revenue of $35.2 million and full-year 2025 revenue of $137.4 million.

- For Q4 2025, GAAP net income was $1.8 million with diluted GAAP EPS of $0.08, and Adjusted Net Income was $3.4 million with Adjusted diluted EPS of $0.16.

- Total Recurring Contract Value (TRCV) for Q4 2025 reached $144.1 million, an 8% increase year-over-year, and grew sequentially for the fifth consecutive quarter.

- The Board of Directors declared a quarterly cash dividend of $0.16 per share, payable on April 10, 2026, to shareholders of record as of March 27, 2026.

3 days ago

NRC Health Announces Fourth Quarter and Full-Year 2025 Results

NRC

Earnings

Dividends

- NRC Health reported total revenue of $35.2 million for the fourth quarter 2025, which was up 2% quarter-over-quarter, and $137.4 million for the full-year 2025.

- For the fourth quarter 2025, GAAP net income was $1.8 million and GAAP diluted earnings per share was $0.08.

- Adjusted EBITDA reached $8.7 million in the fourth quarter 2025 and $40.2 million for the full-year 2025.

- Total Recurring Contract Value (TRCV) increased 8% year-over-year to $144.1 million in the fourth quarter 2025.

- The Board of Directors declared a quarterly cash dividend of $0.16 per share, payable on April 10, 2026, to shareholders of record as of March 27, 2026.

3 days ago

EnergySolutions Submits Notice of Intent for Kewaunee Power Station New Nuclear Initiative

NRC

New Projects/Investments

- EnergySolutions submitted a Notice of Intent (NOI) to the U.S. Nuclear Regulatory Commission (NRC) on January 20, 2026, confirming plans to apply for a major licensing action for new nuclear generation at the Kewaunee Power Station (KPS) site in Wisconsin.

- This submittal is a key step in the ongoing exploration of new nuclear generation at the KPS site, a project being undertaken in partnership with WEC Energy Group.

- The project involves a structured, multi-phase approach, including initial planning, scoping activities, and in-depth studies to support the application for NRC approvals.

- Ken Robuck, President and CEO of EnergySolutions, emphasized the growing need for reliable, carbon-free power and the expertise of the team assembled for this initiative, which was first announced in May 2025.

Jan 21, 2026, 12:51 AM

LIS Technologies Announces $1.38 Billion Investment in New Uranium Enrichment Facility

NRC

New Projects/Investments

Hiring

- LIS Technologies Inc. (LIST) plans to invest $1.38 billion to establish a commercial laser-based uranium enrichment facility in Oak Ridge, Tennessee, creating 203 jobs.

- The facility will be located on the 206-acre Duct Island, which was acquired for $8 million and has been rebranded as "LIST Island".

- The company intends to break ground and begin site preparation and civil construction in 2026, targeting initial commercial operations before 2030.

- LIST, founded in 2023, utilizes its proprietary Laser Isotope Separation Technology (L.I.S.T), which is the only USA-origin and patented laser uranium enrichment technology, optimized for various enriched uranium types and stable isotopes.

- In December 2024, LIS Technologies was selected for the Low-Enriched Uranium (LEU) Enrichment Acquisition Program, securing a minimum contract of $2 million.

Jan 16, 2026, 3:08 PM

Constellation's Limerick Clean Energy Center Receives NRC Approval for Digital Modernization

NRC

New Projects/Investments

- The U.S. Nuclear Regulatory Commission (NRC) has approved Constellation's $167 million Digital Modernization Project for its Limerick Clean Energy Center.

- This project, a first-of-its-kind upgrade for major control and protection systems at an operating U.S. nuclear plant, aims to enhance reliability, diagnostic capability, and cyber resilience.

- The upgrade is part of Constellation's larger $5.1 billion investment across Pennsylvania to preserve and expand nuclear generation.

Jan 6, 2026, 3:23 PM

Hydreight Technologies Exceeds 2025 Product Order Target and License Goal

NRC

Guidance Update

Revenue Acceleration/Inflection

New Projects/Investments

- Hydreight Technologies Inc. exceeded its full-year 2025 guidance by surpassing 1.3 million product orders placed ahead of schedule.

- The company's platform now has approximately 2,500 licenses, significantly exceeding its 2025 target of 1,000, though most are still in onboarding or early activation stages.

- Formal 2026 guidance will be provided early in the new year, as Hydreight evaluates enterprise partnerships, M&A initiatives, and other strategic considerations.

Dec 18, 2025, 12:00 PM

Terra Innovatum Global Reports Third Quarter 2025 Financial Results and Operational Milestones

NRC

Earnings

M&A

New Projects/Investments

- Terra Innovatum Global reported $2.15 million in cash and cash equivalents as of September 30, 2025.

- The company generated $131 million in gross proceeds from its business combination with GSR III Acquisition Corp. and related equity financing on October 9, 2025, providing sufficient capital for the first-of-a-kind (FOAK) SOLO micro-modular reactor deployment by 2027.

- Terra Innovatum has secured total commercial commitments for 100 SOLO units under non-binding MOUs and selected its first deployment site in Illinois, with an option to purchase up to 50 commercial SOLO reactors.

- The company is on track for an operating license in 2027 and a commercial license in 2028, with the Safety Analysis Report (SAR) submittal expected by mid-2026.

Nov 17, 2025, 12:35 PM

Fintool News

In-depth analysis and coverage of NATIONAL RESEARCH.

Quarterly earnings call transcripts for NATIONAL RESEARCH.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more