Earnings summaries and quarterly performance for NETGEAR.

Executive leadership at NETGEAR.

Board of directors at NETGEAR.

Research analysts who have asked questions during NETGEAR earnings calls.

Adam Tindle

Raymond James

4 questions for NTGR

Also covers: ALRM, ARLO, CDW +15 more

Jay Goldberg

Seaport Research Partners

3 questions for NTGR

SW

Solomon Wang

Stifel

2 questions for NTGR

Also covers: AOSL

LK

Logan Katzman

Raymond James Financial

1 question for NTGR

Also covers: ARLO, SCSC, SONO

LK

Logan Katzmar

Raymond James

1 question for NTGR

Also covers: ARLO

Recent press releases and 8-K filings for NTGR.

NETGEAR Reports Q4 and Full Year 2025 Financial Results, Achieves First Revenue Growth Since 2020

NTGR

Earnings

Revenue Acceleration/Inflection

Share Buyback

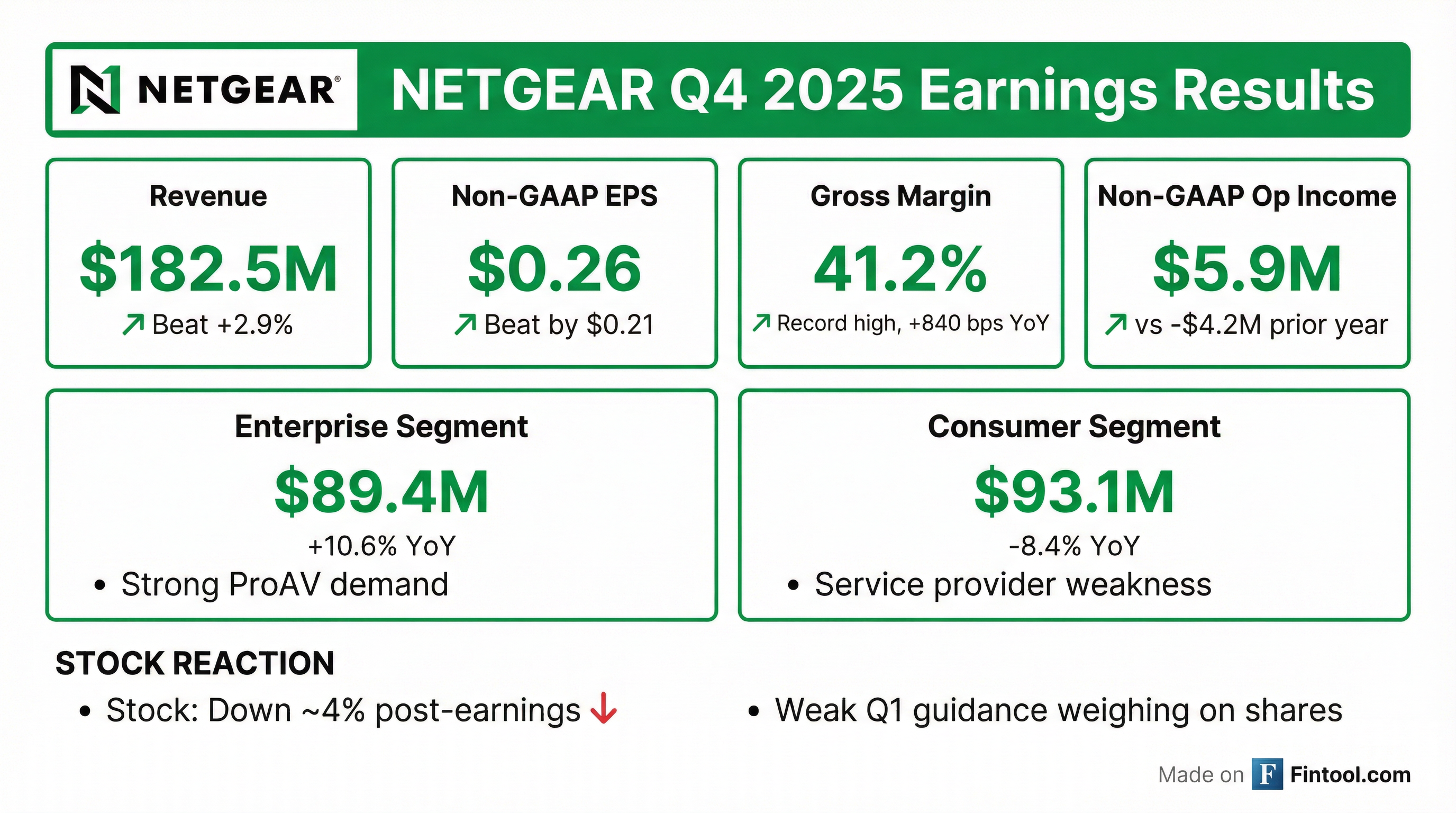

- NETGEAR reported Q4 2025 revenue of $182.5 million and achieved non-GAAP net income of $7.7 million ($0.26 per share).

- For the full year 2025, the company delivered $699.6 million in net revenues, marking the first year of revenue growth since 2020 with a 3.8% increase compared to the prior year.

- The company returned to non-GAAP profitability for the full year 2025, driven by 18.8% growth in the enterprise business and a 920 basis point improvement in non-GAAP gross margin for the year.

- NETGEAR repurchased approximately $50 million in shares during 2025, including $15 million in Q4 2025, and plans to continue opportunistic share repurchases.

- A memory shortage is expected to have a limited gross margin impact in the first half of 2026, but the impact in the second half is uncertain, potentially challenging 2026 goals for revenue, margin, and profitability.

Feb 4, 2026, 10:00 PM

NETGEAR Reports Q4 and Full-Year 2025 Financial Results

NTGR

Earnings

Revenue Acceleration/Inflection

Share Buyback

- NETGEAR reported Q4 2025 revenue of $182.5 million and full-year 2025 revenue of $699.6 million, marking the first year of revenue growth since 2020.

- The company achieved a record non-GAAP gross margin of 41.2% in Q4 2025, leading to non-GAAP net income of $7.7 million ($0.26 EPS) for the quarter and $13.3 million ($0.44 EPS) for the full year.

- The Enterprise segment saw significant growth, with revenue up 10.6% year-over-year in Q4 2025 and 18.8% for the full year 2025.

- Annual Recurring Revenue (ARR) grew 18% year-over-year to $40.4 million in Q4 2025, with 558,000 recurring subscribers.

- NETGEAR repurchased $15 million of shares in Q4 2025 and ended the quarter with $323 million in cash and short-term investments.

Feb 4, 2026, 10:00 PM

NETGEAR Reports Q4 and Full Year 2025 Results, Provides Q1 2026 Guidance

NTGR

Earnings

Guidance Update

Revenue Acceleration/Inflection

- NETGEAR achieved its first year of revenue growth since 2020 in 2025, delivering full-year non-GAAP profitability and record gross margins. Full year 2025 net revenues were $699.6 million, up 3.8% compared to the prior year, with non-GAAP net income of $13.3 million or $0.44 per share.

- For Q4 2025, the company reported $182.5 million in revenue and a record non-GAAP gross margin of 41.2%. The enterprise segment saw 10.6% year-over-year growth in Q4, while the consumer business declined 8.4%.

- The recurring subscriber base reached 558,000 by the end of Q4 2025, with Annual Recurring Revenue (ARR) growing 18% year-over-year to $40.4 million.

- For Q1 2026, NETGEAR expects net revenue to be in the range of $145 million-$160 million and non-GAAP operating margin between -6% and -3%, citing softer consumer demand and a 100 basis point headwind to gross margin from rising memory costs.

- The company ended Q4 2025 with $323 million in cash and short-term investments and repurchased $15 million of shares, with plans to continue opportunistic buybacks.

Feb 4, 2026, 10:00 PM

NETGEAR Reports Q4 and Full Year 2025 Results

NTGR

Earnings

Guidance Update

Share Buyback

- NETGEAR reported Q4 2025 net revenue of $182.5 million, flat year over year, and full year 2025 net revenue of $699.6 million, marking a 3.8% increase from the prior year, the first year of revenue growth in five years.

- The company achieved a record high GAAP gross margin of 40.4% and non-GAAP gross margin of 41.2% in Q4 2025, driven by continued strength in its higher margin Enterprise business, which saw 10.6% revenue growth year over year.

- Non-GAAP EPS for Q4 2025 was $0.26, compared to $(0.06) in the prior year, and non-GAAP operating income reached $5.9 million.

- NETGEAR repurchased $50 million of shares of common stock in 2025 and ended the quarter with a strong balance sheet, holding $323 million in cash and short-term investments.

- For Q1 2026, the company forecasts net revenue between $145 million and $160 million and a non-GAAP operating margin in the range of (6.0)% to (3.0)%, anticipating softening market demand in the Consumer segment and rising memory costs.

Feb 4, 2026, 9:24 PM

NETGEAR Discusses Business Transformation, Enterprise Growth, and Competitive Landscape

NTGR

Revenue Acceleration/Inflection

New Projects/Investments

Legal Proceedings

- NETGEAR is undergoing a significant business transformation, with its enterprise segment now accounting for about half of its revenue. Last quarter, this segment demonstrated strong performance with 16% year-over-year growth, 50% gross margin, and 25% contribution margin.

- The company is insourcing software development to enhance product differentiation and is actively addressing supply constraints in its ProAV product line, with expected resolution by Q1. NETGEAR also anticipates a 150 basis point headwind to gross margins in Q4 due to memory pricing.

- NETGEAR is closely monitoring media coverage regarding potential actions against competitor TP-Link, including reports of a possible ban by the Commerce Department and an FTC investigation for potentially misleading customers.

- The consumer subscription business currently generates approximately $36 million in Annual Recurring Revenue (ARR), with the company seeing a long-term opportunity for growth in this area.

- NETGEAR maintains a healthy cash balance of $326 million as of the document date and has repurchased $69 million in stock since the start of 2024, prioritizing organic investments, M&A, and shareholder returns.

Dec 9, 2025, 9:20 PM

NETGEAR Discusses Business Transformation, Supply Chain, and Financials

NTGR

New Projects/Investments

Share Buyback

Legal Proceedings

- NETGEAR is undergoing a significant business transformation, elevating its enterprise segment, which now accounts for about half of its revenue and grew 16% year-over-year last quarter with a 50% gross margin. A key part of this transformation involves insourcing software development to differentiate products and improve efficiency.

- The company is addressing supply constraints, particularly in its ProAV product line, with anticipated resolution by Q1 2025, while also facing a 150 basis point headwind to gross margins in Q4 due to memory pricing.

- NETGEAR reported resilient consumer behavior during the holiday season and is focused on growing its consumer subscription business, which currently has about $36 million in Annual Recurring Revenue (ARR).

- Financially, NETGEAR holds $326 million in cash and has actively returned capital to shareholders, repurchasing $69 million in stock over the past seven quarters. The company expects to convert cash at a rate of 85%-100% of non-GAAP net income.

- The company is closely monitoring the competitive situation with TP-Link, citing recent reports from the Washington Post and Bloomberg regarding a potential ban and an FTC investigation.

Dec 9, 2025, 9:20 PM

Netgear Discusses Business Transformation, Enterprise Growth, and Financial Outlook

NTGR

Revenue Acceleration/Inflection

New Projects/Investments

Share Buyback

- Netgear is undergoing a significant business transformation, with its enterprise segment now accounting for about half of its revenue and achieving a 50% gross margin, 25% contribution margin, and 16% year-over-year growth last quarter.

- The company is insourcing software development to enhance differentiation and address supply chain challenges, including a projected 150 basis point headwind to gross margins in Q4 due to memory pricing, partially offset by benefits from insourcing.

- Netgear maintains a strong financial position, with $326 million in cash (up from $285 million at the start of 2024, net of $69 million in stock repurchases) and expects to convert 85%-100% of non-GAAP net income into free cash flow.

- Management anticipates a ban on competitor TP-Link, which is currently under investigation by the Commerce Department and FTC, noting that TP-Link is a significant market leader in retail units and revenue.

- The consumer segment is performing well this holiday season, meeting or surpassing expectations, and the company sees a long-term opportunity to scale its consumer subscription business, which currently generates $36 million in Annual Recurring Revenue (ARR).

Dec 9, 2025, 9:20 PM

NETGEAR Outlines Transformation Strategy and Long-Term Financial Goals

NTGR

Guidance Update

Revenue Acceleration/Inflection

Share Buyback

- NETGEAR is undergoing a significant transformation, elevating its enterprise team to be equally weighted with its consumer team, supported by a leadership team reset and the insourcing of approximately 100 badged software developers over the last 18 months.

- For year-to-date 2025, NETGEAR reported 5% revenue growth, with enterprise revenues up 20% year-on-year, and non-GAAP gross margin expanded by 900 basis points to 37.5%.

- The company aims for long-term (2030 or beyond) double-digit total revenue growth and expects recurring services to constitute 20% or more of total revenues, up from the current 5%.

- Long-term gross margin targets are 50% or higher for the total company, driven by an increased mix of enterprise revenues (projected to grow to 65% or higher from 49% currently) and growth in recurring revenue streams.

- NETGEAR has repurchased just under $70 million worth of shares at under $20 a share over the last 18 months and plans to continue returning capital to shareholders.

Nov 17, 2025, 7:00 PM

NETGEAR Outlines Multi-Phase Transformation and Long-Term Financial Targets at 2025 Investor Day

NTGR

Guidance Update

New Projects/Investments

Share Buyback

- NETGEAR is undergoing a multi-phase transformation, shifting from low-margin hardware to differentiated platforms with software as a key differentiator, aiming to expand into larger, higher-margin markets.

- The company has set long-term financial targets for 2030+, including double-digit net revenue growth, 20%+ subscription and service revenue, and 50%+ gross margins.

- For 2025 YTD, NETGEAR reported 5% year-over-year revenue growth, a Non-GAAP gross margin of 37.5%, and Non-GAAP EPS of $0.19.

- NETGEAR is strategically shifting its business mix, targeting 65%+ Enterprise revenue long-term (up from 40% in 2023) and has repurchased $69 million in shares since the start of 2024 at an average price of $19.99.

Nov 17, 2025, 7:00 PM

NETGEAR Outlines Business Transformation and Long-Term Financial Goals

NTGR

Guidance Update

Revenue Acceleration/Inflection

Share Buyback

- NETGEAR is undergoing a business transformation, focusing on intelligent solutions, software experiences, and expanding subscription and services revenue across both enterprise and consumer segments.

- The company reported strong year-to-date 2025 financial performance, with revenue up 5%, gross margin expanding 900 basis points to 37.5%, and positive non-GAAP EPS of $0.19.

- NETGEAR outlined long-term financial targets (2030 or beyond) including double-digit total revenue growth, 50% or higher gross margins, and 15%-20% non-GAAP operating margins, driven by an increased mix of enterprise revenues and recurring revenue streams.

- The company plans to continue returning capital to shareholders, having repurchased 3.4 million shares for $69 million at $19.99 per share since the start of 2024.

Nov 17, 2025, 7:00 PM

Fintool News

In-depth analysis and coverage of NETGEAR.

Quarterly earnings call transcripts for NETGEAR.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more