Earnings summaries and quarterly performance for Option Care Health.

Executive leadership at Option Care Health.

John C. Rademacher

President and Chief Executive Officer

Christopher L. Grashoff

Chief Growth Officer

Collin G. Smyser

General Counsel and Corporate Secretary

Femi Adewunmi, M.D.

Chief Medical Officer

Luke Whitworth

Chief Operating Officer

Meenal Sethna

Chief Financial Officer

Michael Bavaro

Chief Human Resources Officer

Board of directors at Option Care Health.

Barbara W. Bodem

Director

David W. Golding

Director

Elizabeth D. Bierbower

Director

Elizabeth Q. Betten

Director

Eric K. Brandt

Director

Harry M. Jansen Kraemer, Jr.

Independent Board Chair

Natasha Deckmann, M.D.

Director

Norman L. Wright

Director

R. Carter Pate

Director

Timothy P. Sullivan

Director

Research analysts who have asked questions during Option Care Health earnings calls.

Joanna Gajuk

Bank of America

6 questions for OPCH

Brian Tanquilut

Jefferies

5 questions for OPCH

David Macdonald

Truist Securities

5 questions for OPCH

Lisa Gill

JPMorgan Chase & Co.

5 questions for OPCH

Constantine Davides

Citizens JMP

4 questions for OPCH

Pito Chickering

Deutsche Bank

4 questions for OPCH

Matthew Larew

William Blair & Company

3 questions for OPCH

A.J. Rice

UBS Group AG

2 questions for OPCH

Albert Rice

UBS

2 questions for OPCH

Charles Rhyee

TD Cowen

2 questions for OPCH

Erin Wright

Morgan Stanley

2 questions for OPCH

Jacob Johnson

Stephens Inc.

2 questions for OPCH

Philip Chickering

Deutsche Bank AG

2 questions for OPCH

Raj Kumar

Stephens

2 questions for OPCH

Sarah Conrad

Goldman Sachs

2 questions for OPCH

Jack Slevin

Jefferies Financial Group Inc.

1 question for OPCH

Jamie Perse

The Goldman Sachs Group, Inc.

1 question for OPCH

Recent press releases and 8-K filings for OPCH.

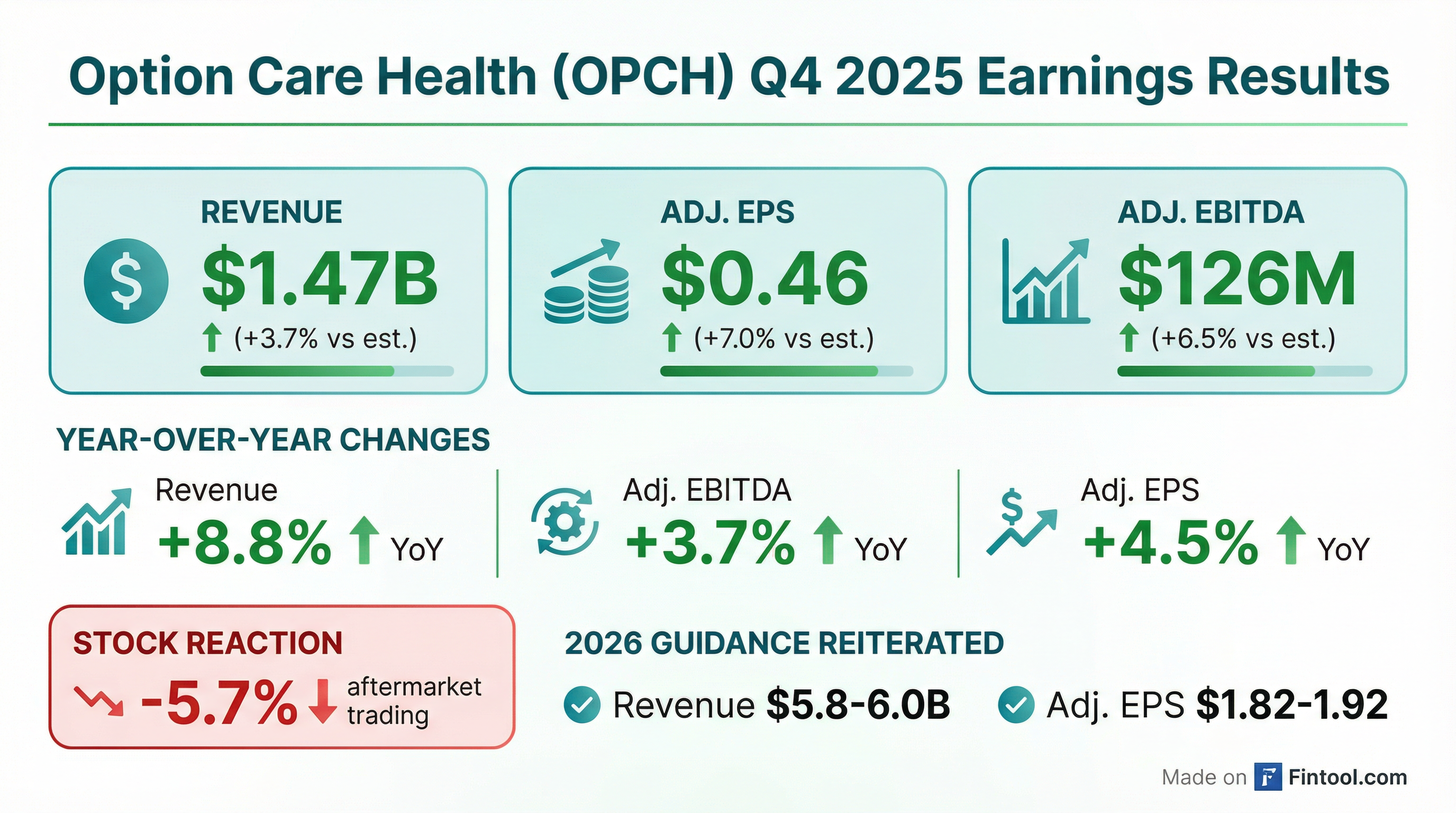

- Option Care Health reported full year 2025 net revenue of $5.6 billion, an increase of 13% over the prior year, with adjusted EBITDA of $471 million (up 6%) and adjusted diluted EPS of $1.72 (up 9%).

- The company reaffirmed its full year 2026 guidance, expecting revenue between $5.8 billion and $6 billion (4% growth at the midpoint), adjusted EBITDA between $480 million and $505 million, and adjusted diluted EPS between $1.82 and $1.92.

- In 2025, Option Care Health generated $258 million in cash flow from operations and repurchased over $300 million of shares, with the board expanding the share repurchase authorization by an additional $500 million. For 2026, operating cash flow is guided to be greater than $340 million.

- The company absorbed a 160 basis points revenue headwind in 2025 due to Stelara biosimilar adoption and anticipates a 400 basis point revenue growth headwind and a $25 million to $35 million gross profit headwind in 2026 from STELARA IRA and biosimilar conversion.

- Strategic investments in 2025 included adding over 80 infusion chairs, acquiring Intramed Plus, and deploying AI, which now processes approximately 40% of claims without human intervention.

- Option Care Health reported full year 2025 net revenue of $5.6 billion, a 13% increase over the prior year, with adjusted EBITDA of $471 million (up 6%) and adjusted diluted EPS of $1.72 (up 9%).

- For full year 2026, the company reaffirmed its guidance, projecting revenue of $5.8 billion-$6 billion, adjusted EBITDA of $480 million-$505 million, and adjusted diluted EPS of $1.82-$1.92. This guidance includes an anticipated 400 basis point revenue growth headwind and a $25 million-$35 million gross profit headwind from STELARA IRA and biosimilar conversion.

- OPCH generated $258 million in cash flow from operations in 2025 and expects over $340 million in 2026. The company repurchased over $300 million of shares in 2025 and expanded its share repurchase authorization by $500 million.

- Strategic investments in 2025 included the acquisition of Intramed Plus, which performed above expectations, and continued deployment of AI, resulting in approximately 40% of claims processed without human intervention. The company also expanded its advanced practitioner capabilities to over 25 centers.

- Option Care Health reported net revenue of $5.6 billion for full year 2025, a 13% increase over the prior year, with adjusted EBITDA of $471 million and adjusted diluted EPS of $1.72.

- For 2026, the company reaffirmed its guidance, projecting revenue between $5.8 billion and $6 billion, adjusted EBITDA of $480 million to $505 million, and adjusted diluted EPS of $1.82 to $1.92.

- The 2026 guidance anticipates a 400 basis point revenue growth headwind and a $25 million-$35 million gross profit headwind primarily due to STELARA IRA and biosimilars conversion.

- The company generated $258 million in cash flow from operations in 2025 and expects to generate greater than $340 million in 2026, reflecting over 30% growth.

- Option Care Health repurchased over $300 million of shares in 2025 and expanded its share repurchase program authorization by an additional $500 million.

- Option Care Health reported net revenue of $1,465.4 million and adjusted diluted earnings per share of $0.46 for the fourth quarter of 2025. For the full year 2025, net revenue was $5,649.5 million and adjusted diluted earnings per share was $1.72.

- The company repurchased $95 million of stock in the fourth quarter of 2025, contributing to a total of $307 million repurchased for the full year 2025.

- For the full year 2026, Option Care Health expects net revenue to be between $5.8 billion and $6.0 billion, with adjusted diluted earnings per share projected to be between $1.82 and $1.92.

- Option Care Health reported preliminary unaudited 2024 results, including approximately 13% revenue growth, 6% Adjusted EBITDA growth, and 10% Adjusted EPS growth at the midpoint, surpassing prior guidance.

- The company issued 2026 guidance, forecasting 4% revenue growth, 5% EBITDA growth, and 7% diluted EPS growth year-over-year at the midpoint.

- The 2026 guidance accounts for a 400 basis point revenue headwind and an estimated $25-$35 million EBITDA headwind from Stelara and related biosimilars, which are projected to constitute less than 1% of company revenue and gross profit in 2026.

- Strategic capital allocation for 2026 and beyond includes continued investment in the business, disciplined pursuit of adjacent and accretive M&A, and periodic share repurchases.

- The company highlighted its diversified portfolio, with no single therapy exceeding 4% of gross profit, and its extensive national network comprising over 190 locations and 750 infusion chairs.

- Option Care Health reported preliminary 2025 results, including 13% revenue growth, 6% adjusted EBITDA growth, and 10% adjusted EPS growth at the midpoint. The company served over 315,000 unique patients in 2025.

- For 2026, Option Care Health provided guidance for 4% revenue growth, 5% EBITDA growth, and 7% EPS growth at the midpoint. This guidance incorporates an estimated 400 basis point revenue headwind and a $25-$35 million gross profit/EBITDA headwind due to Stelara and related biosimilars.

- The company's capital allocation strategy prioritizes investing in the business, pursuing adjacent and accretive M&A opportunities, and conducting periodic share repurchases, with an announced expansion of its share repurchase authorization.

- Option Care Health emphasizes its national scale with local responsiveness, operating over 190 locations and 750 infusion chairs, with 96% coverage of the U.S. population through over 800 payer relationships. No single therapy represents more than 4% of the company's gross profit.

- Option Care Health reported preliminary unaudited FY 2025 results including 13% revenue growth, 6% Adjusted EBITDA growth, and 10% Adjusted EPS growth.

- The company provided FY 2026 guidance projecting 4% net revenue growth, 5% Adjusted EBITDA growth, and 7% Adjusted Diluted EPS growth, incorporating a ($25M) – ($35M) headwind from Stelara and Stelara biosimilars.

- Option Care Health repurchased $307 million of shares in FY 2025 and a total of $715 million from 2021 to Q3 2025.

- The company maintains a robust balance sheet with approximately $700 million in liquidity and a 1.9x Net Debt Leverage Ratio as of Q3 2025.

- Option Care Health reported preliminary unaudited 2024 results including approximately 13% revenue growth, 6% Adjusted EBITDA growth, and 10% Adjusted EPS growth at the midpoint. For 2026, the company provided guidance projecting 4% revenue growth, 5% EBITDA growth, and 7% diluted EPS growth at the midpoint, factoring in a 400 basis point revenue headwind from Stelara and related biosimilars.

- The company's capital allocation strategy prioritizes investing in the business, pursuing adjacent and accretive M&A opportunities (such as the acquisition of Intramed Plus), and executing periodic share repurchases, supported by an expanded share repurchase authorization and strong cash flow generation.

- Option Care Health served over 315,000 unique patients in 2024 and continues to leverage its national network of over 190 locations and 750 infusion chairs. The company expects higher growth in the chronic care segment in 2026 and is optimistic about legislative efforts like site neutrality that promote lower-cost home infusion care.

- Option Care Health announced preliminary unaudited net revenue for Q4 2025 is expected to be between $1.46 billion and $1.47 billion, and for full year 2025 between $5.645 billion and $5.655 billion.

- Preliminary unaudited adjusted diluted EPS for Q4 2025 is expected to be between $0.46 and $0.49, and for full year 2025 between $1.72 and $1.76.

- For full year 2026, the company provided preliminary financial guidance, expecting net revenue between $5.8 billion and $6.0 billion and adjusted diluted EPS between $1.82 and $1.92.

- On January 9, 2026, the Board of Directors approved an increase to the share repurchase program authorization from $500 million to $1.0 billion, following approximately $307 million in repurchases during the full year 2025.

- Option Care Health announced preliminary unaudited financial results for Q4 2025 and Full Year 2025, along with preliminary financial guidance for Full Year 2026.

- The company's Board of Directors approved an increase to its share repurchase program authorization from $500 million to $1.0 billion on January 9, 2026. Approximately $193 million of purchase capacity remained as of December 31, 2025.

| Metric | Q4 2025 | FY 2025 | FY 2026 |

|---|---|---|---|

| Net Revenue ($USD Billions) | $1.46 to $1.47 | $5.645 to $5.655 | $5.8 to $6.0 |

| GAAP Diluted EPS ($USD) | $0.37 to $0.39 | $1.27 to $1.29 | N/A |

| Adjusted Diluted EPS ($USD) | $0.46 to $0.49 | $1.72 to $1.76 | $1.82 to $1.92 |

| Adjusted EBITDA ($USD Millions) | $123.7 to $127.7 | $469.0 to $473.0 | $480 to $505 |

| Cash Flow from Operations ($USD Millions) | N/A | Below $320 | N/A |

Quarterly earnings call transcripts for Option Care Health.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more