Earnings summaries and quarterly performance for Orchid Island Capital.

Executive leadership at Orchid Island Capital.

Board of directors at Orchid Island Capital.

Research analysts who have asked questions during Orchid Island Capital earnings calls.

MG

Mikhail Goberman

Citizens JMP

8 questions for ORC

Also covers: ARR, BETR, CHMI +5 more

Eric Hagen

BTIG

6 questions for ORC

Also covers: AGNC, AOMR, ARR +21 more

JW

Jason Weaver

Unaffiliated Analyst

6 questions for ORC

Also covers: AGNC, ARR, BRSP +15 more

JS

Jason Stewart

Janney Montgomery Scott LLC

4 questions for ORC

Also covers: AGNC, AJX, AOMR +12 more

Recent press releases and 8-K filings for ORC.

Orchid Island Capital Announces Q4 2025 Financial Results

ORC

Earnings

Dividends

New Projects/Investments

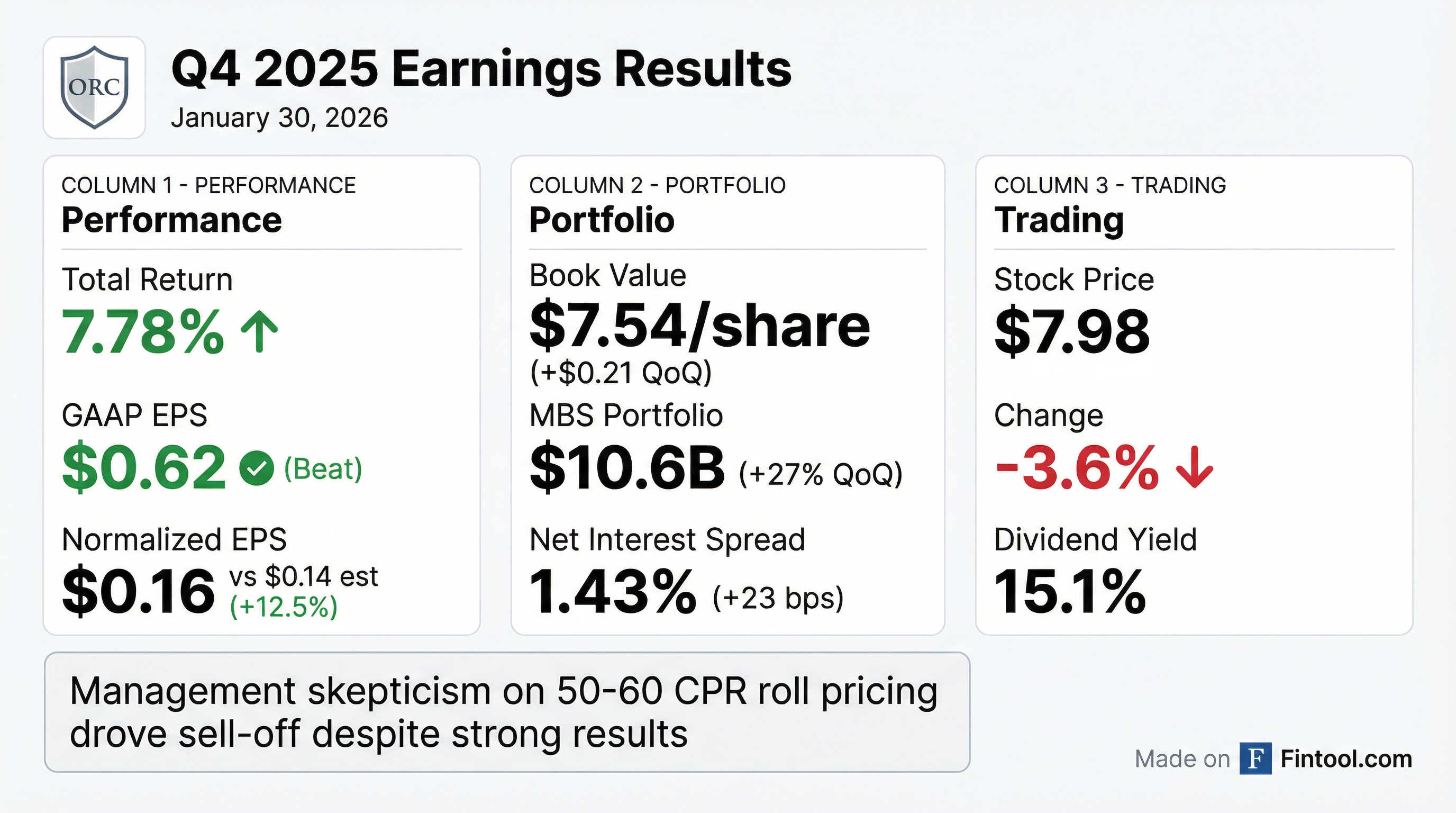

- Orchid Island Capital reported a net income of $0.62 per share and a total return of 7.8% for the fourth quarter of 2025, an increase from $0.53 per share and 6.7% in the prior quarter.

- The company's book value per share increased to $7.54 as of December 31, 2025, from $7.33 at the end of Q3 2025, with a dividend declared of $0.36 per common share for both quarters.

- Average MBS balances grew significantly to $9,492 million in Q4 2025 from $7,675 million in Q3 2025, reflecting the company's growth, which doubled in size over 2025.

- The weighted average coupon of the fixed-rate MBS portfolio increased to 5.64%, while the weighted average repo rate decreased to 3.98% in Q4 2025 from 4.33% in Q3 2025. Management anticipates continued tightening in the Agency RMBS market and subsiding funding pressures.

8 days ago

Orchid Island Capital Reports Q4 2025 Financial Results and Portfolio Growth

ORC

Earnings

Dividends

New Projects/Investments

- Orchid Island Capital reported net income of $103.4 million and earnings per share of $0.62 for Q4 2025, alongside a book value of $7.54 and a total return of 7.8% for the quarter. The company paid dividends of $0.36 per share during the quarter.

- The company achieved substantial growth in 2025, doubling its equity base and MBS portfolio, with $7.4 billion in acquisitions made when MBS spreads were wide, averaging 108 basis points. In Q4 2025, ORC purchased $3.2 billion in agency specified pools, primarily Fannie 5s, 5.5s, 6s, and 6.5s, all with call protection, and repositioned its portfolio by selling lower-yielding assets to enhance carry.

- Funding costs saw meaningful improvement, with the average repo rate declining from 4.33% to 3.98% by quarter-end, and the company maintained a stable hedge notional at 69% of outstanding repo. The portfolio duration remained low at 2.08, and while prepayment speeds trended higher in Q4, the company expects them to moderate due to its call-protected specified pools.

8 days ago

ORC Reports Strong Q4 2025 Financials and Significant Portfolio Growth

ORC

Earnings

Dividends

New Projects/Investments

- ORC reported net income of $103.4 million and EPS of $0.62 for Q4 2025, an increase from $0.53 in Q3 2025, with book value rising to $7.54.

- The company experienced substantial growth in 2025, doubling its equity base and MBS portfolio to $10.6 billion by year-end, with 75% of $7.4 billion in acquisitions made when MBS spreads were over 100 basis points.

- ORC strategically repositioned its portfolio by acquiring agency specified pools with call protection, primarily in the 5% to 6.5% coupon range, and saw its average repo rate decline from 4.33% to 3.98% during Q4 2025.

- The expense ratio, including management fees, decreased to 1.7% by the end of 2025, and the company maintained a consistent monthly dividend of $0.12, with 95.0% of 2025 dividends derived from taxable income.

8 days ago

Orchid Island Capital Reports Strong Q4 2025 Financial Results and Significant Portfolio Growth

ORC

Earnings

Dividends

New Projects/Investments

- Orchid Island Capital reported net income of $103.4 million and $0.62 earnings per share for Q4 2025, an increase from $0.53 in Q3 2025, with book value rising to $7.54 from $7.33.

- The company's MBS portfolio grew by approximately 27% during Q4 2025 to $10.6 billion at year-end, having doubled its equity base and MBS portfolio over the course of 2025. This growth included $3.2 billion in agency specified pool purchases in Q4, with a strategic shift towards higher coupon (5s-6.5s) and call-protected mortgages.

- Operational efficiency improved, with the expense ratio (inclusive of G&A and management fees) decreasing to a current run rate of 1.7% as of the end of 2025, down from over 5% during the prolonged Fed tightening cycle.

- The average repo rate declined from 4.33% at the beginning of Q4 2025 to 3.98% by quarter end. Orchid Island Capital paid $0.36 in dividends during Q4 2025, maintaining a rate of $0.12 per month for the year, with 95.0% of 2025 dividends derived from taxable income.

8 days ago

Orchid Island Capital Announces Fourth Quarter and Full-Year 2025 Results

ORC

Earnings

Dividends

- Orchid Island Capital reported net income of $103.4 million, or $0.62 per common share, for the fourth quarter of 2025, and $159.3 million, or $1.24 per common share, for the full year 2025.

- The company declared and paid total dividends of $0.36 per common share for the fourth quarter of 2025 and $1.44 per common share for the full year 2025. The total return was 7.78% for Q4 2025 and 11.00% for the full year 2025.

- As of December 31, 2025, book value per common share was $7.54 , and the company maintained a liquidity position of $791.8 million.

- The adjusted leverage ratio at December 31, 2025, was 7.4:1.

Jan 29, 2026, 9:40 PM

Orchid Island Capital Announces Estimated Q4 2025 Results

ORC

Earnings

Guidance Update

Dividends

- Orchid Island Capital announced an estimated book value per share of $7.54 as of December 31, 2025.

- The company reported estimated GAAP net income of $0.62 per share for the quarter ended December 31, 2025, which includes an estimated $0.43 per share of net realized and unrealized gains on RMBS and derivative instruments.

- The estimated total return on equity for the quarter ended December 31, 2025, was 7.8%, with total dividends declared during the quarter of $0.36 per share.

- As of January 14, 2026, the company had 183,345,932 shares of common stock outstanding.

Jan 14, 2026, 9:50 PM

Orchid Island Capital Announces Estimated Fourth Quarter 2025 Results

ORC

Earnings

Dividends

- Orchid Island Capital announced an estimated book value per share of $7.54 as of December 31, 2025, and an estimated 7.8% total return on equity for the quarter ended December 31, 2025.

- The company estimated GAAP net income of $0.62 per share for the quarter ended December 31, 2025, which included an estimated $0.43 per share of net realized and unrealized gains on RMBS and derivative instruments.

- As of December 31, 2025, Orchid Island Capital had 181,985,900 shares of common stock outstanding.

Jan 14, 2026, 9:27 PM

Orchid Island Capital Announces January 2026 Dividend and Q4 2025 Results Dates

ORC

Dividends

Earnings

- Orchid Island Capital, Inc. declared a monthly cash dividend of $0.12 per share for January 2026, which will be paid on February 26, 2026, to shareholders of record on January 30, 2026.

- The company is scheduled to release its estimated Fourth Quarter 2025 results and MBS portfolio characteristics on January 14, 2026.

- The full year-end and Fourth Quarter 2025 results are set to be released on January 29, 2026, with an earnings conference call scheduled for January 30, 2026.

Jan 7, 2026, 10:14 PM

Orchid Island Capital Announces December 2025 Dividend and November 2025 RMBS Portfolio Characteristics

ORC

Dividends

Debt Issuance

- Orchid Island Capital, Inc. declared a December 2025 monthly cash dividend of $0.12 per share, payable on January 29, 2026, to shareholders of record on December 31, 2025.

- As of December 9, 2025, the company had 179,058,553 shares of common stock outstanding.

- The fair value of the total mortgage assets in the RMBS portfolio was $9,885,355 thousand as of November 30, 2025.

- Total borrowings for the company amounted to $9,066,335 thousand with a weighted average repo rate of 4.12% as of November 30, 2025.

Dec 9, 2025, 10:33 PM

Orchid Island Capital Declares December 2025 Dividend and Provides November 2025 Portfolio Characteristics

ORC

Dividends

- Orchid Island Capital declared a December 2025 monthly cash dividend of $0.12 per share, payable on January 29, 2026, to shareholders of record on December 31, 2025.

- The company reported 179,058,553 shares of common stock outstanding as of December 9, 2025, and 174,548,004 shares as of November 30, 2025.

- Detailed RMBS portfolio characteristics as of November 30, 2025, including valuation, assets by agency, and risk measures, were provided.

- As a real estate investment trust (REIT), the company intends to make regular monthly cash distributions and must distribute at least 90% of its REIT taxable income annually.

Dec 9, 2025, 10:29 PM

Quarterly earnings call transcripts for Orchid Island Capital.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more