Earnings summaries and quarterly performance for Oxford Lane Capital.

Executive leadership at Oxford Lane Capital.

Board of directors at Oxford Lane Capital.

Research analysts who have asked questions during Oxford Lane Capital earnings calls.

Recent press releases and 8-K filings for OXLC.

OXLC Announces Q3 2026 Results

OXLC

Earnings

New Projects/Investments

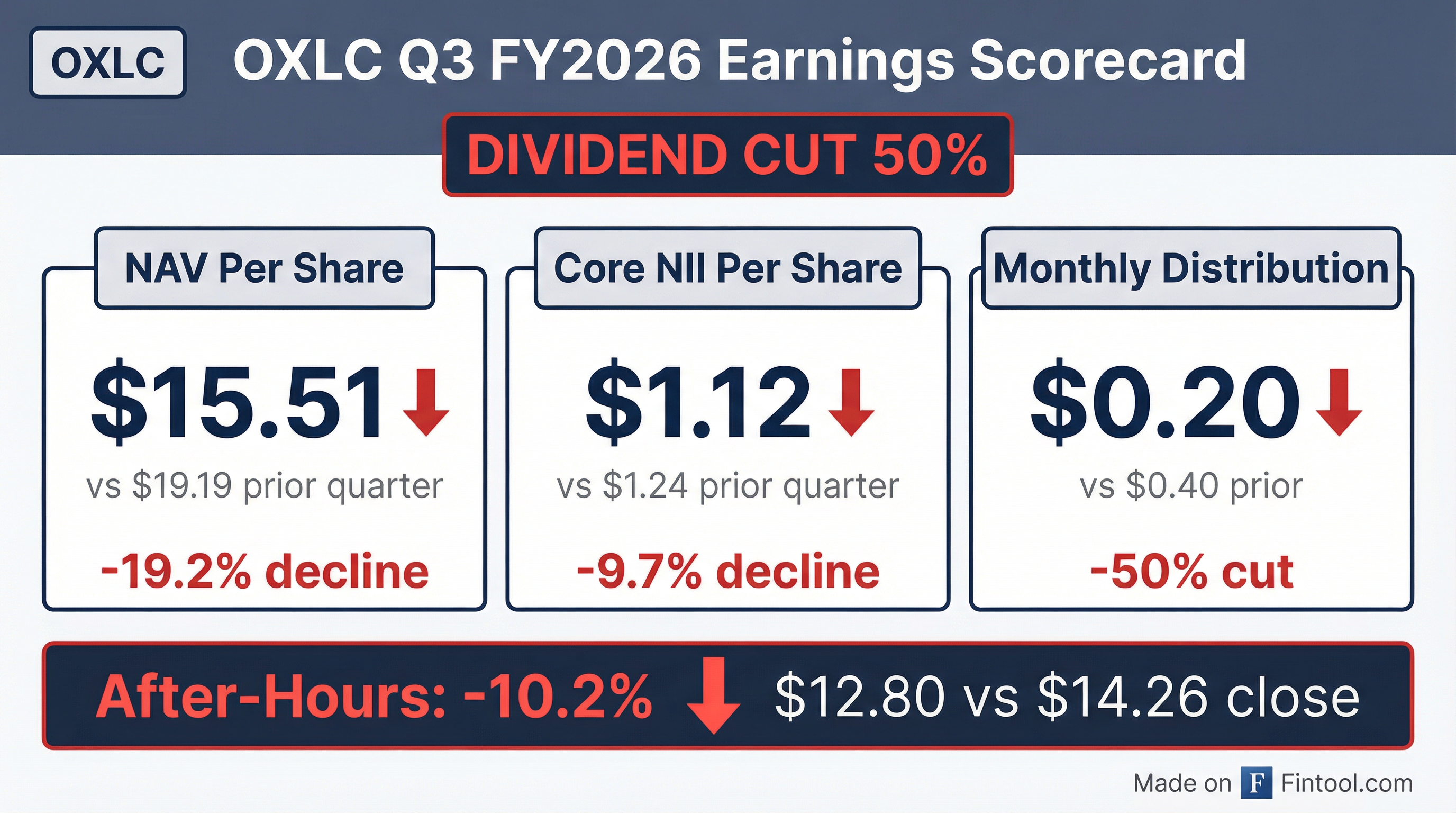

- For Q3 2026, OXLC reported GAAP net investment income of $0.74 per share and core net investment income of $1.12 per share.

- The company's net asset value (NAV) was $15.51 per share as of Q3 2026, with distributions paid of $1.20 per share.

- The total fair value of investments stood at $2,261.0 million , with 99% of the portfolio in CLO equity and 1% in CLO debt.

- During Q3 2026, OXLC made new investments totaling $97.2 million and had sales/repayments of $85.5 million, resulting in net investment activity of $11.7 million.

- As of December 31, 2025, total preferred stock and debt was $719.0 million, with total equity at $1,510.1 million, leading to a preferred stock and debt-to-equity ratio of 0.48x and a debt-to-equity ratio of 0.33x.

Jan 30, 2026, 2:00 PM

Oxford Lane Capital Corp. Reports Q3 2026 Results and Reduces Monthly Distributions

OXLC

Earnings

Dividends

New Projects/Investments

- Oxford Lane Capital Corp. reported a net asset value per share of $15.51 as of December 31, 2025, a decrease from $19.19 in the prior quarter.

- For the quarter ended December 31, 2025, the company recorded GAAP net investment income of $71.8 million ($0.74 per share) and core net investment income of $108.9 million ($1.12 per share).

- The board declared monthly common stock distributions of $0.20 per share for April, May, and June of 2026, a reduction aimed at providing additional capital for deployment in CLO equity and junior debt tranche markets and supporting net asset value.

- The company invested $97.2 million in additional CLO investments and received $85.5 million from sales and repayments, while actively participating in over 10 resets and refinancings during the quarter.

- Management highlighted strong opportunities in the secondary market for CLO investments and anticipates a very active year for resets and refinancings in 2026.

Jan 30, 2026, 2:00 PM

Oxford Lane Capital Corp. Announces Q3 2026 Earnings and Dividend Reduction

OXLC

Earnings

Dividends

New Projects/Investments

- For the quarter ended December 31, 2025, Oxford Lane Capital Corp. reported a net asset value per share of $15.51, down from $19.19 in the prior quarter.

- The company recorded GAAP total investment income of approximately $117.8 million and GAAP net investment income of approximately $71.8 million or $0.74 per share for the quarter ended December.

- Core net investment income was approximately $108.9 million or $1.12 per share for the quarter ended December.

- The board of directors declared monthly common stock distributions of $0.20 per share for each of the months ending April, May, and June of 2026, a reduction intended to support net asset value and provide additional capital for deployment in CLO equity and junior debt tranche investments.

- Oxford Lane Capital Corp. remained active, investing over $97 million in CLO equity and warehouses during the quarter, and sees strong opportunities in the secondary market.

Jan 30, 2026, 2:00 PM

Oxford Lane Capital Corp. Announces Q3 Fiscal Year Results and Common Stock Distributions

OXLC

Earnings

Dividends

- Oxford Lane Capital Corp. declared monthly distributions of $0.20 per share for common stock for the months ending April, May, and June 2026.

- The company's Net Asset Value (NAV) per share was $15.51 as of December 31, 2025, a decrease from $19.19 on September 30, 2025.

- For the quarter ended December 31, 2025, GAAP Net Investment Income (NII) was approximately $71.8 million, or $0.74 per share, and Core NII was approximately $108.9 million, or $1.12 per share.

- A net decrease in net assets resulting from operations of approximately $240.7 million, or $2.47 per share, was recorded for the quarter ended December 31, 2025.

Jan 30, 2026, 1:00 PM

Oxford Lane Capital Corp. Announces Q2 2026 Results and Distributions

OXLC

Earnings

Dividends

Share Buyback

- Oxford Lane Capital Corp. reported a net asset value per share of $19.19 as of September 30, 2025, a decrease from $20.60 in the prior quarter. For Q2 2026, GAAP net investment income was $81.4 million ($0.84 per share), and core net investment income was $120 million ($1.24 per share), both increasing from the previous quarter.

- The company recorded net unrealized depreciation of $68.5 million and net realized losses of $18.1 million for the quarter, primarily attributed to loan spread compression.

- During the quarter, Oxford Lane Capital invested $145.2 million in CLO investments and received $173.5 million from sales and repayments. As of September 30, $366 million in newly issued or acquired CLO equity investments had not yet made initial distributions.

- The board declared monthly common stock distributions of $0.40 per share for January, February, and March 2026. The company also repurchased 1.2 million shares for $20.5 million and issued 700,000 shares for $14.5 million through an at-the-market offering.

- Management indicated a willingness to operate at a higher leverage to capitalize on market opportunities, despite not publishing a specific target leverage ratio.

Nov 3, 2025, 2:00 PM

OXLC Reports Q2 2026 Financial and Portfolio Highlights

OXLC

Earnings

Dividends

- For Q2 2026, GAAP net investment income was $0.84 per share, and core net investment income was $1.24 per share.

- The net asset value as of Q2 2026 was $19.19 per share, with distributions paid totaling $1.35 per share.

- The total fair value of investments reached $2,599.6 million in Q2 2026, with 99% of the portfolio invested in CLO equity.

- As of September 30, 2025, the weighted average effective yield of CLO equity investments was 14.6%, and the weighted average cash distribution yield of cash income producing CLO equity investments was 19.4%.

- A 1-for-5 reverse stock split became effective on September 5, 2025.

Nov 3, 2025, 2:00 PM

Oxford Lane Capital Provides September 8, 2025 NAV Update

OXLC

Guidance Update

- Oxford Lane Capital Corp. (OXLC) provided an unaudited estimate of its Net Asset Value (NAV) per share of common stock as of September 8, 2025, in the range of $20.02 to $20.22.

- This NAV estimate is presented following a 1-for-5 reverse stock split that became effective on September 5, 2025.

- The company explicitly states that this estimate is unaudited, was not approved by its board, and the actual NAV for the quarter ending September 30, 2025, may differ materially.

- Furthermore, the fair value of portfolio investments could be materially impacted by unforeseen events after September 8, 2025.

Sep 12, 2025, 12:00 PM

Quarterly earnings call transcripts for Oxford Lane Capital.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more