Earnings summaries and quarterly performance for PCB BANCORP.

Executive leadership at PCB BANCORP.

Henry Kim

Detailed

President and Chief Executive Officer

CEO

AC

Andrew Chung

Detailed

Executive Vice President and Chief Risk Officer

BB

Brian Bang

Detailed

Executive Vice President and Chief Credit Officer

DW

David W. Kim

Detailed

Executive Vice President and Chief Banking Officer

TC

Timothy Chang

Detailed

Executive Vice President and Chief Financial Officer

Board of directors at PCB BANCORP.

Research analysts covering PCB BANCORP.

Recent press releases and 8-K filings for PCB.

PCB Bancorp Reports Q4 and Full Year 2025 Earnings

PCB

Earnings

Dividends

Share Buyback

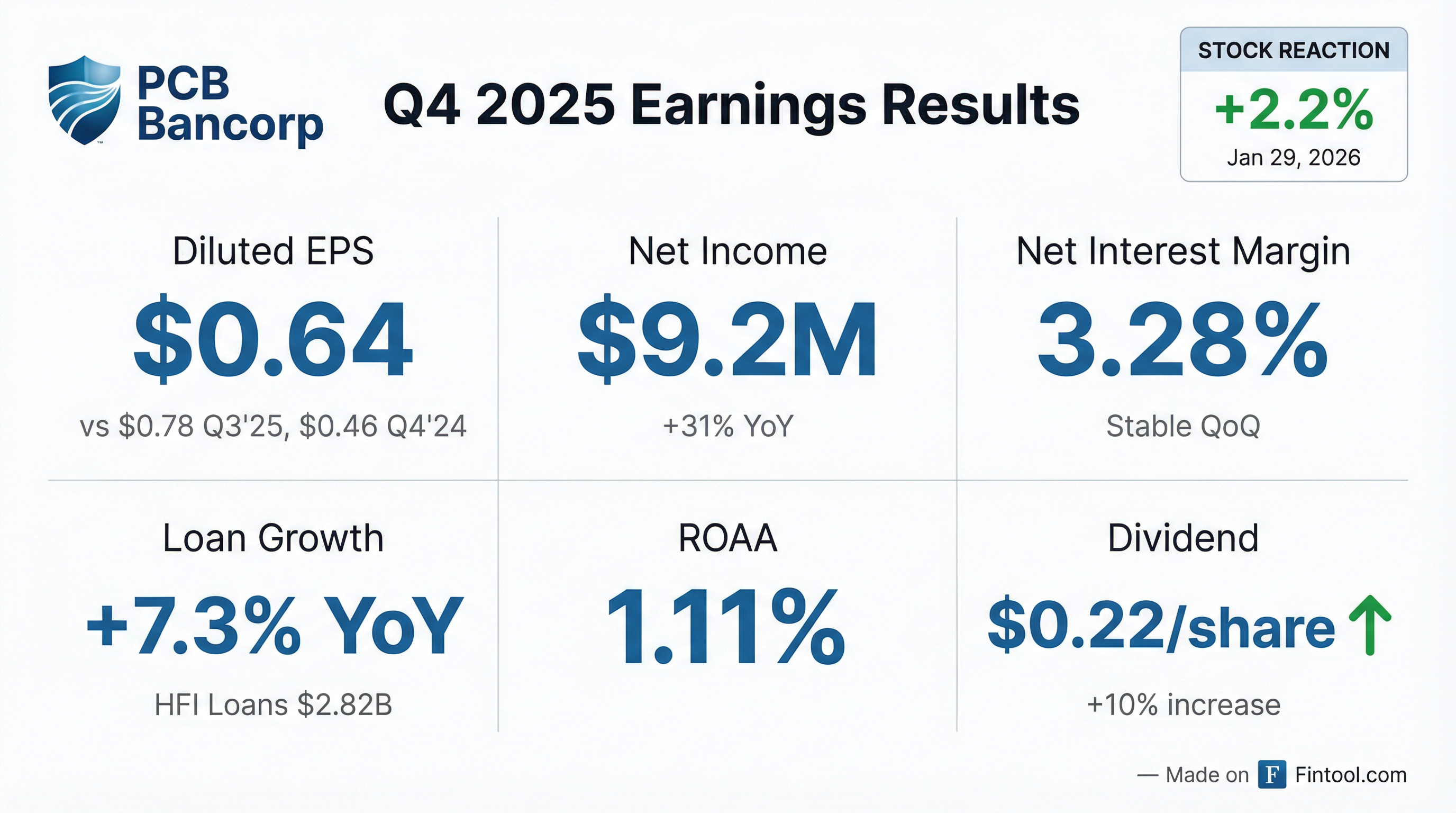

- PCB Bancorp reported net income available to common shareholders of $9.1 million, or $0.64 per diluted common share, for the fourth quarter of 2025, compared with $11.3 million, or $0.78 per diluted common share, for the previous quarter.

- For the full year 2025, net income available to common shareholders was $37.2 million, or $2.58 per diluted common share, an increase from $25.0 million, or $1.74 per diluted common share, for the previous year.

- Net interest income was $26.6 million for Q4 2025, a decrease from $27.0 million in the previous quarter, but an increase from $23.2 million in the year-ago quarter.

- Total assets were $3.28 billion at December 31, 2025, a decrease of 2.4% from $3.36 billion at September 30, 2025, while total deposits decreased by 4.1% to $2.80 billion over the same period.

- The company declared and paid a quarterly cash dividend of $0.20 per share and repurchased 102,484 shares as of December 31, 2025.

Jan 29, 2026, 9:15 PM

PCB Bancorp Increases Quarterly Cash Dividend

PCB

Dividends

- PCB Bancorp's Board of Directors declared a quarterly cash dividend of $0.22 per common share on January 28, 2026.

- This dividend represents a 10% increase from the previous $0.20 per common share.

- The dividend is scheduled for payment on or about February 20, 2026, to shareholders of record as of February 13, 2026.

Jan 29, 2026, 9:10 PM

PCB Bancorp Reports Q4 and Full Year 2025 Earnings

PCB

Earnings

Share Buyback

- PCB Bancorp reported net income available to common shareholders of $9.1 million, or $0.64 per diluted common share, for Q4 2025, and $37.2 million, or $2.58 per diluted common share, for the full year 2025.

- Net interest income for Q4 2025 was $26.6 million, with a net interest margin of 3.28%, which was maintained despite recent interest rate cuts and elevated deposit rates.

- Total assets decreased by 2.4% to $3.28 billion at December 31, 2025, from the previous quarter, while loans held-for-investment increased by 2.5% to $2.82 billion.

- Total deposits decreased by 4.1% to $2.80 billion at December 31, 2025, primarily due to a $100 million reduction in brokered deposits.

- During 2025, the company repurchased and retired 358,251 shares of common stock for $7.1 million.

Jan 29, 2026, 9:05 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more