Earnings summaries and quarterly performance for PIPER SANDLER COMPANIES.

Executive leadership at PIPER SANDLER COMPANIES.

Chad R. Abraham

Chief Executive Officer

James P. Baker

Global Co-Head of Investment Banking and Capital Markets

Jonathan J. Doyle

Vice Chairman and Head of Financial Services

Katherine P. Clune

Chief Financial Officer

Michael R. Dillahunt

Global Co-Head of Investment Banking and Capital Markets

Board of directors at PIPER SANDLER COMPANIES.

Research analysts who have asked questions during PIPER SANDLER COMPANIES earnings calls.

Brendan O'Brien

Wolfe Research

6 questions for PIPR

Devin Ryan

Citizens JMP

6 questions for PIPR

Mike Grondahl

Lake Street Capital Markets

6 questions for PIPR

James Yaro

Goldman Sachs

5 questions for PIPR

Daniel Cocchiara

Bank of America

2 questions for PIPR

James Edwin Yarrow

Goldman Sachs

1 question for PIPR

Recent press releases and 8-K filings for PIPR.

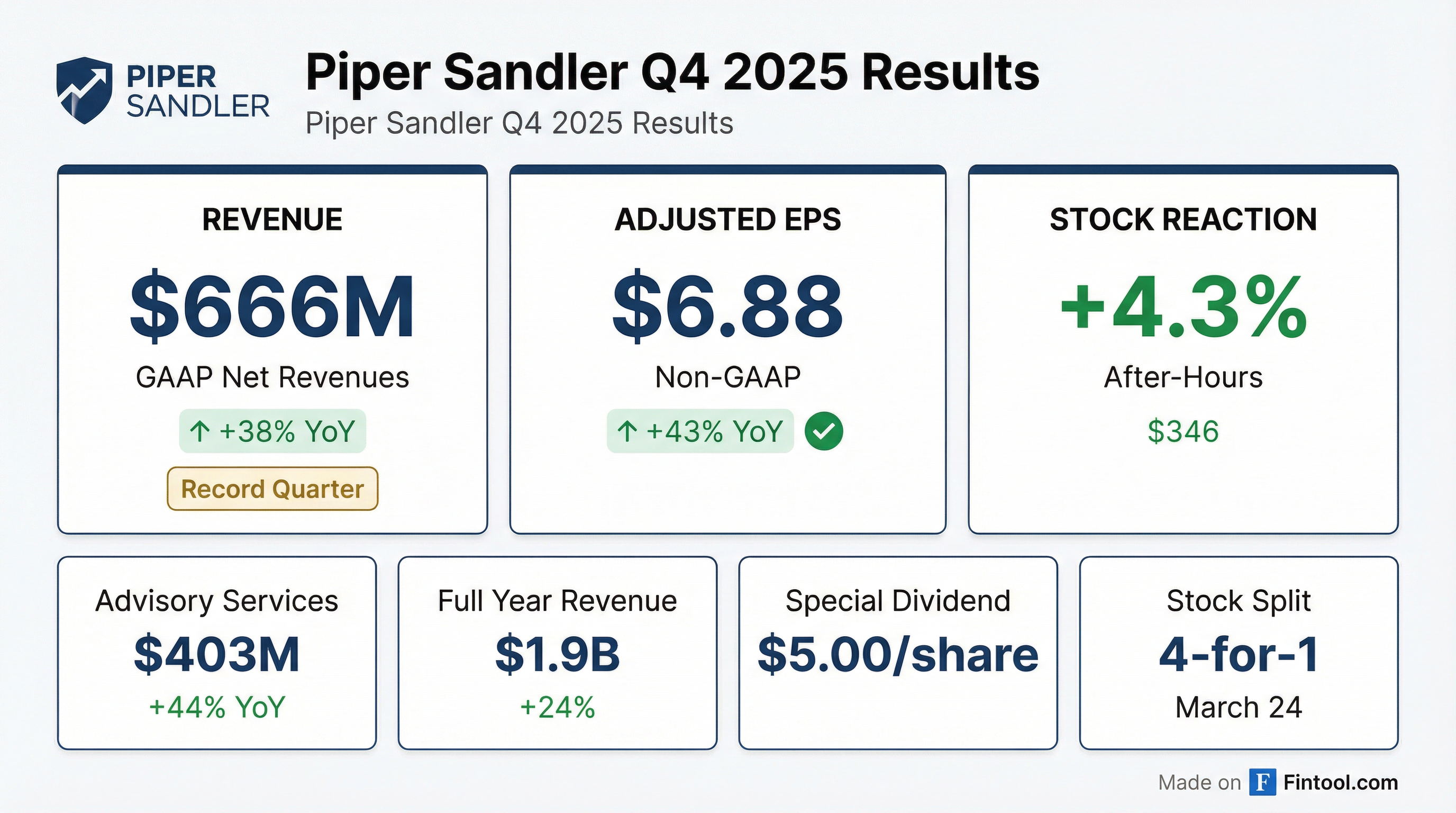

- Piper Sandler Companies reported record-adjusted net revenues of $635 million for Q4 2025 and $1.9 billion for the full year 2025, with adjusted EPS of $6.88 for Q4 and $17.74 for the full year.

- The company achieved a record year in advisory with over $1 billion in revenues, representing 55% of total net revenues, and saw 28% growth in advisory revenues from 2024.

- For 2025, Piper Sandler returned an aggregate of $239 million to shareholders through share repurchases and dividends, including a total dividend of $7.70 per share.

- The board approved a 4-for-1 forward stock split of common stock, which will begin trading on a split-adjusted basis on March 24, 2026.

- Management anticipates another strong year for advisory revenue in 2026 and has a medium-term goal of growing annual corporate investment banking revenues to $2 billion+.

- Piper Sandler Companies reported record-adjusted net revenues of $635 million for Q4 2025 and $1.9 billion for the full year 2025, with adjusted EPS of $6.88 for Q4 and $17.74 for the full year.

- The company achieved a record year in advisory with over $1 billion of revenues, representing 55% of total net revenues, and record revenues of $230 million in equity brokerage for the full year 2025.

- In 2025, Piper Sandler returned $239 million to shareholders through share repurchases and dividends, including a special cash dividend of $5 per share for full-year 2025, totaling $7.70 per share.

- The board approved a 4-for-1 forward stock split of common stock, with trading on a split-adjusted basis beginning March 24, 2026, to enhance liquidity and accessibility.

- Management anticipates the 2026 compensation ratio to be similar to 2025 and expects a modest increase in non-compensation expenses for 2026.

- Piper Sandler reported record adjusted net revenues of $635 million for Q4 2025 and $1.9 billion for the full year 2025, with adjusted EPS of $6.88 for Q4 and $17.74 for the full year, reflecting a 22% increase in adjusted net revenues compared to 2024.

- The company achieved a record year in advisory with over $1 billion in revenues, representing 55% of total net revenues, and saw 28% growth in advisory revenues from 2024, driven by robust M&A activity and solid debt capital markets advisory.

- Piper Sandler returned an aggregate of $239 million to shareholders in 2025 through share repurchases and dividends. The board approved a 4-for-1 forward stock split of common stock, with trading on a split-adjusted basis beginning March 24, 2026, and a special cash dividend of $5 per share related to 2025 results, in addition to a quarterly cash dividend of $0.70 per share.

- Management anticipates another strong year of advisory revenue in 2026 and expects public finance market conditions to remain favorable with similar issuance volumes to 2025. The 2026 compensation ratio and full-year non-compensation expense ratio are expected to be similar to 2025 levels.

- Piper Sandler Companies reported record fourth quarter revenues and full year 2025 revenues of $1.9 billion, which grew over 20% compared to the prior year.

- For the fourth quarter of 2025, U.S. GAAP diluted earnings per common share were $6.40, and adjusted diluted earnings per common share were $6.88.

- The Board of Directors approved a four-for-one forward stock split of common stock on February 6, 2026, which will be effective March 23, 2026, with trading on a split-adjusted basis beginning March 24, 2026.

- A special cash dividend of $5.00 per share related to fiscal year 2025 and a quarterly cash dividend of $0.70 per share were declared, both payable on March 13, 2026.

- The company repurchased 59 thousand shares of common stock for $19.8 million in Q4 2025 and a total of 421 thousand shares for $125.0 million in full year 2025.

- Lineage Inc. is addressing financial challenges by having its subsidiary, Lineage Europe Finco B.V., issue euro-denominated senior notes through a private placement.

- The proceeds from these notes will primarily be used to repay amounts outstanding under the company's revolving credit facility and support general corporate and working capital needs.

- Despite significant revenue growth, Lineage Inc. faces profitability challenges, reflected in a negative net margin of around -3.3% and a distress-level Altman Z-Score.

- Analysts have issued a 'Sell' rating for LINE stock, citing challenges such as a negative P/E ratio and increased interest expenses.

- Total Sand Solution (TSS) has acquired Sand Revolution, a Midland, Texas-based provider of trucking, logistics, and delivery solutions.

- This strategic combination materially expands TSS’s market share and geographic coverage in the Permian and Eagle Ford Basins, positioning TSS as the largest independent logistics provider in the country with the capacity to deliver over 25 million tons of proppant per year.

- Piper Sandler Companies served as the exclusive financial advisor to TSS for this acquisition.

- Xeris Biopharma reported a 40% year-over-year increase in total product revenue, reaching $74 million for the third quarter of 2025.

- Recorlev® revenue significantly grew by 109% year-over-year to $37 million in Q3 2025.

- The company updated its full-year 2025 total revenue guidance to $285-$290 million, an increase from the previous guidance of $280-$290 million.

- For Q3 2025, Xeris Biopharma achieved a net income of $0.6 million, a substantial improvement from a net loss of $15.7 million in the prior year period.

- Adjusted EBITDA for the third quarter of 2025 was $17.4 million, marking a $20.1 million improvement compared to Q3 2024.

- Piper Sandler reported LTM 3Q 2025 adjusted net revenues of $1.7 billion and adjusted diluted EPS of $14.00, demonstrating an 11% compound annual growth rate (CAGR) in net revenues since 2015 and an increase in operating margin from 10% in 2015 to 22% LTM 3Q 2025.

- The company has returned $522 million through share repurchases and $492 million through dividends paid since 2019, maintaining a 38% dividend payout ratio over the last five years.

- Strategic growth initiatives include 10 acquisitions since 2015 and significant expansion in Investment Banking, with revenues growing from $310 million in 2015 to $1.1 billion LTM 3Q 2025, representing a 13% CAGR.

- Piper Sandler emphasizes a diversified platform across business lines, sectors, products, and clients, with a focus on market leadership and expanding non-M&A capabilities such as Equity Capital Markets, Debt Capital Markets Advisory, Private Capital & GP Advisory, and Restructuring & Special Situations.

- Piper Sandler Companies reported strong Q3 2025 adjusted net revenues of $455 million, an increase of 29% year-over-year, with an operating margin of 21.2% and adjusted EPS of $3.82.

- Corporate Investment Banking revenues were $292 million, including $212 million in advisory (up 13% year-over-year) and $80 million in corporate financing, the strongest quarterly result since 2021. This performance was driven by strong financial services and healthcare franchises, with the company advising on the largest U.S. bank M&A deal closed in 2025.

- For Q4 2025, advisory revenues are expected to be similar to last year's fourth quarter, while corporate financing revenues are anticipated to moderate from the strong third quarter. Public finance revenues for Q3 2025 were $39 million (up 8% year-over-year) and fixed income revenues were $56 million (up 15% year-over-year).

- The company returned $16 million to shareholders in Q3 2025 and $204 million year-to-date, and the board approved a quarterly cash dividend of $0.70 per share.

- Piper Sandler Companies reported strong third quarter 2025 adjusted net revenues of $455 million, an operating margin of 21.2%, and adjusted EPS of $3.82, all representing year-over-year increases.

- Corporate Investment Banking revenues reached $292 million in Q3 2025, with advisory revenues up 13% year-over-year to $212 million and corporate financing revenues at $80 million, marking its strongest quarterly result since 2021.

- Other business segments also performed well, with Public Finance revenues at $39 million (up 8% year-over-year) and Fixed Income revenues at $56 million (up 15% from the year-ago period) for Q3 2025.

- For the fourth quarter of 2025, the company expects advisory revenues to be similar to last year's fourth quarter, while corporate financing revenues are anticipated to moderate from the strong third quarter, and public finance revenues are projected to be similar to Q3.

- The company returned $16 million to shareholders in Q3 2025 and a total of $204 million year-to-date, including $105 million in share repurchases and $99 million in dividends, with a new quarterly cash dividend of $0.70 per share approved.

Quarterly earnings call transcripts for PIPER SANDLER COMPANIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more