Earnings summaries and quarterly performance for PJT Partners.

Executive leadership at PJT Partners.

Board of directors at PJT Partners.

Emily K. Rafferty

Nominating/Corporate Governance Committee Chair

Grace R. Skaugen

Director

James Costos

Director

K. Don Cornwell

Director

Kenneth C. Whitney

Audit Committee Chair

Peter L.S. Currie

Director

Thomas M. Ryan

Lead Independent Director

Research analysts who have asked questions during PJT Partners earnings calls.

Brendan O'Brien

Wolfe Research

8 questions for PJT

Devin Ryan

Citizens JMP

7 questions for PJT

James Yaro

Goldman Sachs

7 questions for PJT

Alex Bond

Keefe, Bruyette & Woods (KBW)

5 questions for PJT

Brennan Hawken

UBS Group AG

5 questions for PJT

James Mitchell

Seaport Global Holdings LLC

3 questions for PJT

Aidan Hall

KBW

2 questions for PJT

Alexander Jenkins

JMP Securities

1 question for PJT

Ben Rubin

UBS

1 question for PJT

Brennan Hawkin

Bank of Montreal

1 question for PJT

James Mitchell

Seaport Global Securities

1 question for PJT

Jim Mitchell

Seaport Global

1 question for PJT

Michael Brown

Wells Fargo Securities

1 question for PJT

Mike Brown

UBS

1 question for PJT

Sulan Jones

Goldman Sachs

1 question for PJT

Recent press releases and 8-K filings for PJT.

- A U.S. federal bankruptcy court approved Multi-Color Corporation's (MCC) first-day motions on February 5, 2026, allowing immediate access to $125 million of its $250 million debtor-in-possession (DIP) financing as part of its prepackaged Chapter 11 reorganization.

- MCC will continue normal global operations, ensuring full payment to trade suppliers and vendors, and maintaining employee compensation and benefits throughout the reorganization process.

- The reorganization plan, supported by approximately 72% of MCC's first lien secured creditors and equity sponsor CD&R, is projected to significantly reduce net debt from approximately $5.9 billion to about $2.0 billion.

- Upon exiting reorganization, MCC expects to have over $550 million in liquidity reserves, bolstered by $889 million in new common and preferred equity investments from CD&R and existing secured lenders.

- PJT Partners serves as a financial advisor to the ad hoc group of interim secured creditors in this reorganization.

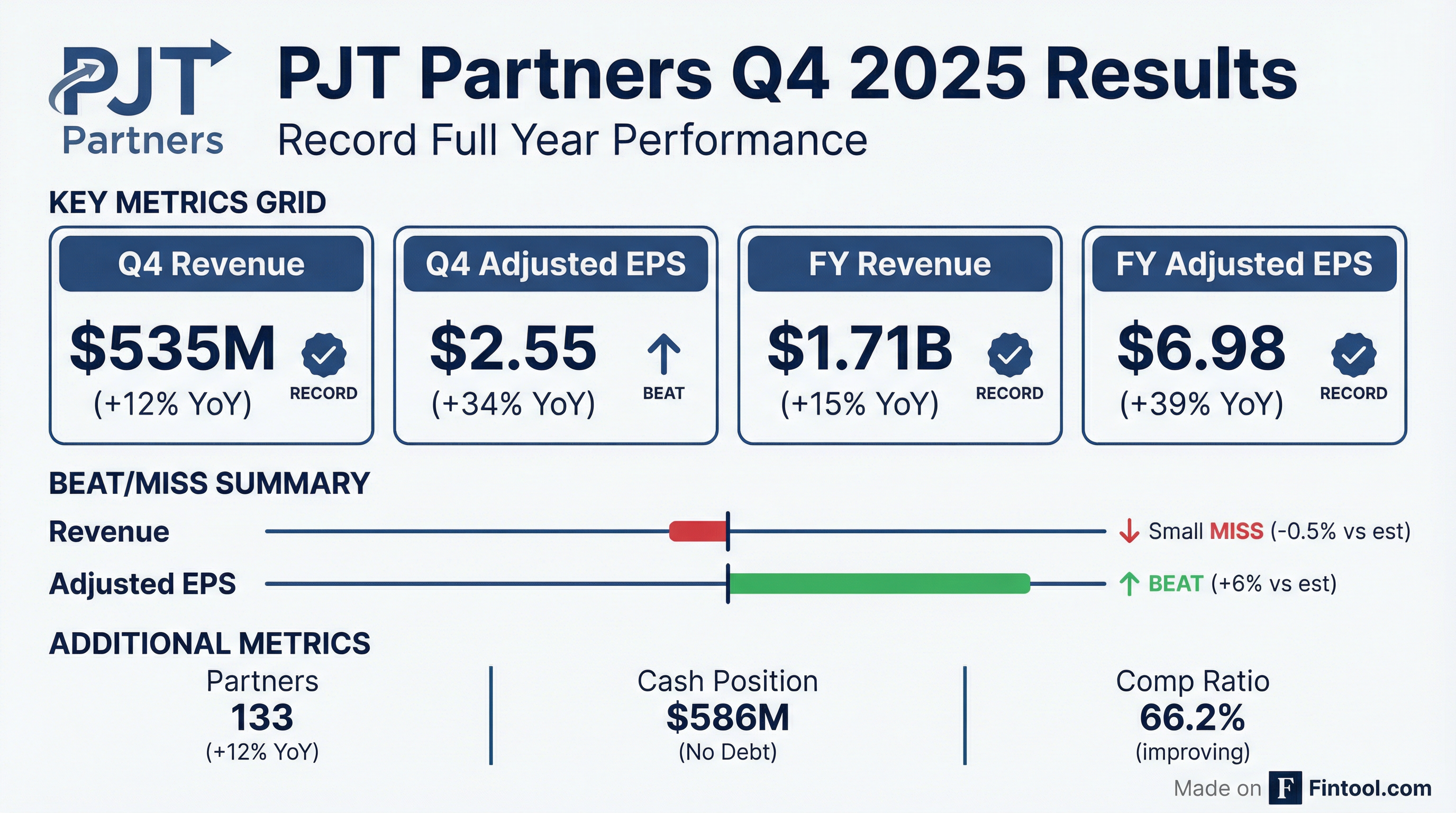

- PJT Partners achieved record-setting results for full year 2025, with total revenues reaching $1.714 billion, an increase of 15% year-over-year, and adjusted EPS of $6.98 per share.

- For the fourth quarter of 2025, total revenues were $535 million, up 12% year-over-year, and adjusted EPS was $2.55 per share.

- The company returned a record $384 million to shareholders through share repurchases in 2025, acquiring approximately 2.4 million shares, and ended the year with $586 million in cash balances.

- The full-year 2025 adjusted compensation ratio improved to 67.1% from 69% in 2024, and the adjusted pre-tax margin was 20.8%.

- PJT Partners anticipates a highly constructive M&A environment for 2026, with a meaningfully increased pipeline of pre-announced Strategic Advisory transactions and continued elevated activity in Restructuring and Private Capital Solutions.

- PJT Partners reported full-year 2025 revenues of $1,714 million, a 15% increase year-over-year, and Q4 2025 revenues of $535 million, up 12% year-over-year.

- Adjusted EPS for full-year 2025 was $6.98, a 39% increase year-over-year, with Q4 2025 Adjusted EPS at $2.55, up 34% year-over-year.

- The company repurchased 2.4 million shares for $384 million during 2025, reflecting its capital priority to offset dilution.

- PJT Partners is described as a premier, global, advisory-focused investment bank with 1,224 firmwide headcount and 133 partners globally as of 2025.

- PJT Partners reported record-setting financial results for Q4 and full year 2025, with total revenues reaching $1.714 billion for the full year and $535 million for Q4.

- The firm achieved record adjusted pre-tax income of $357 million for the full year and record adjusted EPS of $6.98 for the full year.

- All business segments, including Strategic Advisory, Restructuring, and PJT Park Hill, delivered record revenues, with Strategic Advisory being the primary driver for the full year.

- PJT Partners ended 2025 with record cash balances of $586 million and executed record share repurchases of $384 million during the year. A quarterly dividend of $0.25 per share was also approved.

- Management expects a highly constructive M&A environment in 2026, with continued elevated Restructuring activity and growth in Private Capital Solutions within PJT Park Hill.

- PJT Partners achieved record-setting financial results for both Q4 and the full year 2025, with total revenues reaching $535 million in Q4 and $1.714 billion for the full year, representing a 12% and 15% year-over-year increase, respectively. Adjusted EPS for Q4 was $2.55 and $6.98 for the full year.

- The company ended 2025 with record cash balances of $586 million and executed a record $384 million in share repurchases, reducing the weighted average share count. A quarterly dividend of $0.25 per share was also approved.

- All business segments, including Strategic Advisory, Restructuring, and PJT Park Hill, delivered record revenues in 2025, with the firm expecting a multi-year period of elevated activity in Restructuring and a favorable M&A environment to continue through 2026.

- PJT Partners Inc. reported record full year 2025 revenues of $1.71 billion, a 15% increase from a year ago, and record fourth quarter 2025 revenues of $535 million, up 12% year-over-year.

- For the full year 2025, GAAP diluted EPS was $6.68, a 36% increase, and Adjusted EPS was $6.98, up 39% year-over-year.

- As of December 31, 2025, the company held $586 million in cash, cash equivalents, and short-term investments with no funded debt.

- PJT Partners Inc. repurchased 2.4 million shares and share equivalents through December 31, 2025, and declared a quarterly dividend of $0.25 per share of Class A common stock.

- PJT Partners Inc. reported record Revenues, Pretax Income, and EPS for both the full year and fourth quarter ended December 31, 2025.

- For the full year 2025, Revenues reached $1.71 billion, a 15% increase from a year ago, with Adjusted EPS growing 39% to $6.98.

- Fourth quarter 2025 revenues were $535 million, up 12% from the prior year, and Adjusted EPS increased 34% to $2.55.

- As of December 31, 2025, the company held $586 million in Cash, Cash equivalents, and Short-term investments with no funded debt and repurchased 2.4 million shares and share equivalents during the year.

- The Board of Directors declared a quarterly dividend of $0.25 per share of Class A common stock, payable on March 18, 2026.

- Multi-Color Corporation (MCC) has initiated a pre-packaged Chapter 11 bankruptcy process to implement a restructuring support agreement (RSA).

- The restructuring aims to significantly reduce MCC's net debt from approximately $5.9 billion to $2.0 billion and decrease annualized interest expenses from $475 million to $140 million in 2026.

- The RSA includes a new investment of $889 million in common and preferred equity and provides $250 million in new debtor-in-possession (DIP) financing to capitalize the business during the Chapter 11 process.

- Post-restructuring, MCC expects to have over $500 million in liquidity, with debt maturities extended to 2033.

- All global operations and services to customers are expected to continue without interruption, and all suppliers and service providers are to be paid in full.

- China Vanke has secured creditor approval to defer payment on a 1.1 billion yuan puttable bond, with over 90% of holders backing the revised plan.

- The new terms involve an immediate payment of 40% of the principal, with the remaining 60% extended for one year.

- This agreement provides temporary liquidity relief, but analysts caution that Vanke's liquidity will likely remain strained due to weak contracted sales.

- The company is still negotiating with creditors on approximately 5.7 billion yuan of other onshore bonds and carries roughly US$50 billion in total debt.

- CleanCapital secured a $300 million HoldCo debt financing from Infranity to fund the development, construction, acquisition, and operations of distributed generation (DG) solar and energy storage assets across the U.S..

- This financing positions CleanCapital as one of the best-capitalized leaders in the sector, enhancing its capabilities to develop, build, and operate solar and battery assets.

- CleanCapital is recognized as the second-largest owner of commercial and community solar assets in the U.S., having deployed over $1.5 billion of total capital in clean energy investments and expanded its asset portfolio to over 350 projects totaling over 500 MW.

- PJT Partners served as the financial advisor to CleanCapital for this transaction.

Quarterly earnings call transcripts for PJT Partners.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more