Earnings summaries and quarterly performance for PROSPECT CAPITAL.

Executive leadership at PROSPECT CAPITAL.

Board of directors at PROSPECT CAPITAL.

Research analysts who have asked questions during PROSPECT CAPITAL earnings calls.

Recent press releases and 8-K filings for PSEC.

Prospect Credit REIT Reports Strong 2025 Performance and Distribution Rate

PSEC

Dividends

Earnings

New Projects/Investments

- Prospect Credit REIT (PCRED) achieved an annualized total return of 13.14% from February 6, 2025, through December 31, 2025.

- This performance outperformed the 1-year annualized return of the Robert A. Stanger Composite NAV REIT Index by 2.01x, which returned 6.50% in 2025.

- As of January 2026, PCRED's current shareholder distribution rate is 9.00% per annum based on the most recent quarterly net asset value.

- PCRED focuses on higher-priority, less-volatile credit investments with returns primarily driven by income, contrasting with equity-focused NAV REITs.

Feb 13, 2026, 12:00 PM

Prospect Capital Corporation Amends Dealer Manager Agreement, Increases Preferred Stock Offering

PSEC

- Prospect Capital Corporation (PSEC) entered into Amendment No. 7 to its Amended and Restated Dealer Manager Agreement with Preferred Capital Securities, LLC on February 10, 2026.

- The amendment increased the aggregate liquidation preference of the preferred stock offering from $2,250,000,000 to $2,646,457,550.

- The company proposes to offer up to 105,858,302 shares of preferred stock, with each share having a public offering price of $25.00.

- The offering will specifically include the 7.50% Series A5 Preferred Stock and 7.50% Series M5 Preferred Stock, while the company is no longer offering several older series of preferred stock.

Feb 10, 2026, 10:46 PM

Prospect Capital Reports Q2 2026 Results, Announces Distributions, and Details Portfolio Rotation

PSEC

Earnings

Dividends

New Projects/Investments

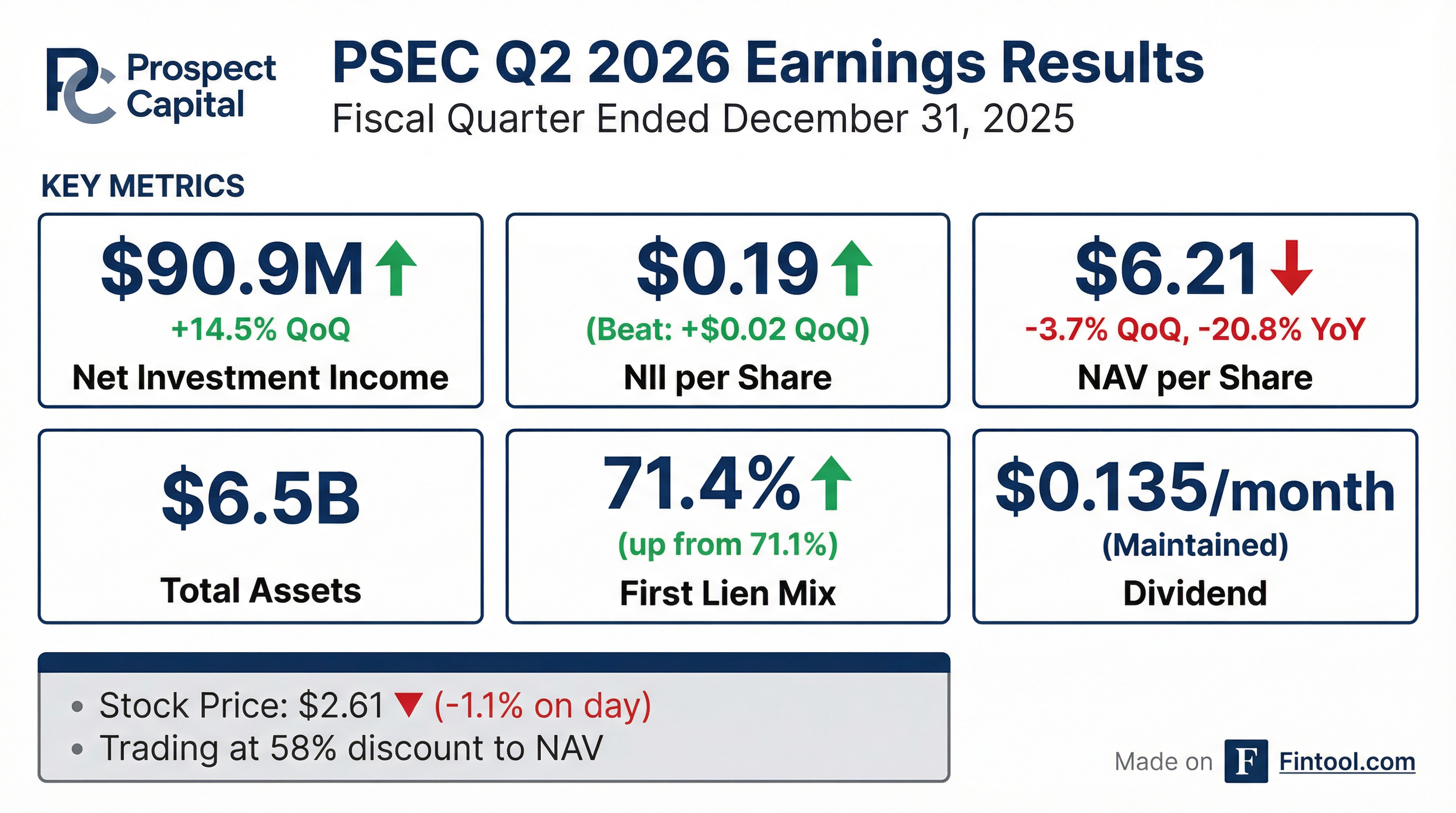

- For the December quarter (Q2 2026), Prospect Capital reported net investment income of $91 million, or $0.19 per common share, and a Net Asset Value (NAV) of $6.21 per common share. The net debt-to-total assets ratio was 28.2% as of December 31, 2025.

- The company announced monthly common shareholder distributions of $0.04 per share for February, March, and April 2026. Since its IPO, total distributions will reach $4.7 billion, or $21.93 per share, through April 2026.

- Prospect Capital is actively rotating its portfolio, increasing its first lien mix by 728 basis points to 71.4% since June 2024 and focusing on middle market lending, which now comprises 85% of investments at cost as of December 2025. This includes reducing second lien loans and exiting subordinated structured notes and targeted equity-linked assets like real estate.

- As of December 2025, the company maintained strong liquidity with $1.6 billion in combined balance sheet cash and undrawn revolving credit facility commitments and $4.2 billion in unencumbered assets. The weighted average cost of unsecured debt financing was 4.68% at December 31, 2025.

Feb 10, 2026, 2:00 PM

Prospect Capital Reports Q2 2026 Results and Strategic Portfolio Shift

PSEC

Earnings

Dividends

New Projects/Investments

- For Q2 2026, Prospect Capital reported net investment income of $91 million, or $0.19 per common share, and a NAV of $6.21 per common share as of December 31st.

- The company is actively rotating its portfolio, with the first lien mix increasing 728 basis points to 71.4% since June 2024, while reducing second lien loans and exiting subordinated structured notes and targeted equity-linked assets, including real estate.

- Monthly common shareholder distributions of $0.04 per share have been announced for February, March, and April.

- As of December 2025, the portfolio included 91 companies across 32 industries with a fair value of $6.4 billion, and software investments constituted only 2.8% of the portfolio at cost, significantly below the 22% average for BDCs with publicly traded unsecured bonds.

- The company maintains strong liquidity with $1.6 billion in combined balance sheet cash and undrawn revolving credit facility commitments, and $4.2 billion in unencumbered assets as of December.

Feb 10, 2026, 2:00 PM

Prospect Capital Reports Q2 2026 Results and Strategic Portfolio Shifts

PSEC

Earnings

Debt Issuance

Dividends

- Prospect Capital reported net investment income of $91 million, or $0.19 per common share, and a net asset value (NAV) of $6.21 per common share for the December quarter. Monthly common shareholder distributions of $0.04 per share were announced for February, March, and April 2026.

- As of December 31, 2025, the company's net debt-to-total assets ratio was 28.2%. They also completed an institutional issuance of $168 million in senior unsecured 5.5% notes due 2030 on October 30, 2025.

- The company is actively rotating its portfolio, with the first lien mix increasing 728 basis points to 71.4% and the second lien mix decreasing 371 basis points to 12.7% since June 2024. Subordinated structured notes have been reduced by 818 basis points to near zero.

- The portfolio's aggregate fair value was $6.4 billion as of December 2025, with middle market lending comprising 100% of originations during the December quarter. Software investments represent only 2.8% of the portfolio at cost, significantly lower than the BDC average of 22%.

Feb 10, 2026, 2:00 PM

Prospect Capital Reports December 2025 Financial Results

PSEC

Earnings

Dividends

Debt Issuance

- For the fiscal quarter ended December 31, 2025, Prospect Capital Corporation announced Net Investment Income of $90,888 thousand ($0.19 per common share) and a Net Loss Applicable to Common Shareholders of $(6,576) thousand ($(0.01) per common share).

- As of December 31, 2025, Net Asset Value per Common Share was $6.21. The company declared monthly cash common shareholder distributions of $0.0450 per share for February, March, and April 2026.

- The company successfully completed the institutional issuance of approximately $167.6 million in senior unsecured 5.5% Series A Notes due 2030 on October 30, 2025. Middle market lending comprised 85% of investments at cost as of December 31, 2025, with first lien senior secured loans increasing to 71.4% of the portfolio.

Feb 9, 2026, 9:50 PM

Prospect Capital Announces Financial Results for Quarter Ended December 31, 2025

PSEC

Earnings

Dividends

Debt Issuance

- For the fiscal quarter ended December 31, 2025, Prospect Capital reported Net Investment Income of $90.888 million and Net Investment Income per common share of $0.19, with a Net Asset Value per common share of $6.21.

- The company's investment strategy continues to focus on first lien senior secured middle market loans, which comprised 71.4% of investments at cost and 100% of the $80.4 million originations during the December 2025 quarter.

- Prospect Capital declared monthly distributions of $0.0450 per share for February, March, and April 2026.

- The company enhanced its capital structure by issuing $167.6 million in senior unsecured 5.5% Series A Notes due 2030 on October 30, 2025, and held $1,647.216 million in Balance Sheet Cash plus Undrawn Revolving Credit Facility Commitments as of December 31, 2025.

Feb 9, 2026, 9:08 PM

ProCap Financial to Acquire CFO Silvia, Inc. and Become First Publicly Traded Agentic Finance Firm

PSEC

M&A

New Projects/Investments

Share Buyback

- ProCap Financial announced an agreement to acquire CFO Silvia, Inc., an AI agent lab focused on finance, with the strategic goal of becoming the first publicly traded agentic finance firm.

- Silvia's platform currently manages more than $30 billion in assets and serves users with an average net worth exceeding $2.5 million.

- The acquisition is structured as an all-stock transaction and is subject to a shareholder vote expected by the end of the first quarter of 2026, with 50% of the equity consideration contingent on ProCap Financial's stock price reaching $9.00.

- ProCap Financial updated its balance sheet, reporting 5,007 Bitcoin, $72 million in cash, and $100 million in outstanding convertible notes after repurchasing $135 million.

- The company is scheduled to release its fiscal year December 31, 2025 earnings on February 18, 2026.

Feb 9, 2026, 11:00 AM

Prospect Capital Expands Perpetual Preferred Stock Offerings to iCapital Marketplace

PSEC

Dividends

New Projects/Investments

Debt Issuance

- Prospect Capital Corporation’s Perpetual Preferred Stock Series A5 and Series M5 ongoing offerings are now available on the iCapital Marketplace, expanding access for institutions, Registered Investment Advisors, private wealth managers, financial advisors, and their investor clients.

- These offerings feature a 7.50% per annum contractual and fixed dividend rate, intended to be paid monthly, and have already raised nearly $2 billion to date.

- The preferred stock is designed to emphasize low volatility, capital preservation, and attractive cash income, with a $25.00 stated value per share and a $5,000 minimum investment, and no upfront or ongoing fees.

- The offerings are supported by approximately $3.0 billion of common equity subordinated to preferred shareholders, and management and employees own approximately 29% of Prospect Capital Corporation’s common equity, aligning interests with investors.

Jan 23, 2026, 12:01 PM

Prospect Credit REIT Reports 13.35% Annualized Total Return Through Q3 2025

PSEC

Earnings

Dividends

- Prospect Credit REIT (PCRED) achieved an annualized total return of 13.35% to investors through September 30, 2025.

- This performance was higher than the average total return of 6.28% for the 35 non-traded net asset value real estate investment trusts (NAV REITs) tracked by Robert A. Stanger & Company, Inc..

- PCRED focuses on higher-priority, less-volatile credit investments with returns primarily driven by income from current and contractual coupon terms.

- As of December 2025, PCRED's current shareholder distribution rate is 9.00% per annum, based on the most recent quarterly net asset value, and it has declared ten months of consecutive distributions fully covered by net investment income.

- Investors in PCRED's current finite period private offering do not bear management or performance fees for the life of their investment.

Jan 5, 2026, 12:01 PM

Quarterly earnings call transcripts for PROSPECT CAPITAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more