Earnings summaries and quarterly performance for Perella Weinberg Partners.

Executive leadership at Perella Weinberg Partners.

Board of directors at Perella Weinberg Partners.

Research analysts who have asked questions during Perella Weinberg Partners earnings calls.

Devin Ryan

Citizens JMP

8 questions for PWP

Also covers: AMTD, COIN, CRCL +20 more

Brendan O'Brien

Wolfe Research

6 questions for PWP

Also covers: CG, EVR, HLI +4 more

AB

Alex Bond

Keefe, Bruyette & Woods (KBW)

5 questions for PWP

Also covers: EVR, HLI, HLNE +4 more

James Yaro

Goldman Sachs

5 questions for PWP

Also covers: COIN, CRCL, ETOR +11 more

AH

Aidan Hall

KBW

2 questions for PWP

Also covers: EVR, HLI, HLNE +5 more

JE

James Edwin Yarrow

Goldman Sachs

1 question for PWP

Also covers: HOOD, MC, PIPR

Recent press releases and 8-K filings for PWP.

Perella Weinberg Partners Advises on CapVest's Proposed Acquisition of TSG

PWP

M&A

New Projects/Investments

- CapVest Partners LLP has entered exclusive discussions with HLD for the proposed acquisition of a majority stake in TSG, a European leader in technical services for critical energy infrastructure.

- Perella Weinberg Partners served as a financial advisor to CapVest for this proposed transaction.

- Since HLD's acquisition in 2020, TSG's annual revenues have grown to more than €1.4 billion, with new energies accounting for approximately half of the revenue.

- HLD and TSG management are expected to retain significant minority stakes in TSG, partnering with CapVest on the company's future growth.

Feb 10, 2026, 8:00 AM

Perella Weinberg Partners Reports Full Year and Q4 2025 Results

PWP

Earnings

Dividends

Share Buyback

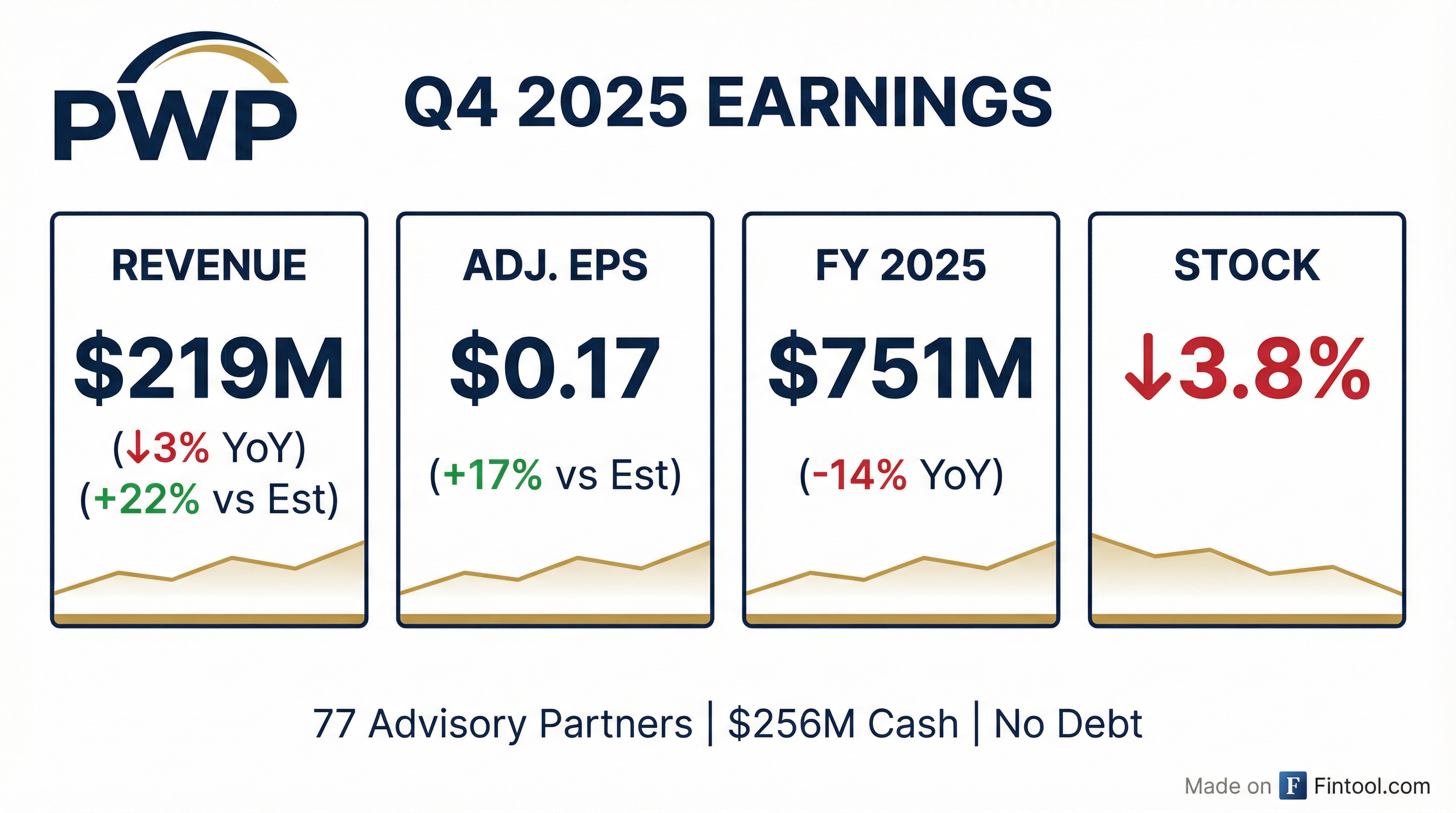

- Perella Weinberg Partners reported full year 2025 revenues of $751 million and Q4 2025 revenues of $219 million, marking its third highest revenue year despite a 14% decrease from 2024.

- The firm's adjusted compensation margin was 68% for full year 2025, and adjusted non-compensation expense was $159 million, down 2% from the prior year, with a projected further single-digit decrease in 2026.

- PWP returned over $163 million to equity holders in 2025 through dividends, RSU settlements, share repurchases, and unit exchanges, retiring 6.5 million shares.

- The company ended 2025 with $256 million in cash and no debt, declared a quarterly dividend of $0.07 per share, and achieved record revenues in Europe and its Restructuring practice.

Feb 6, 2026, 2:00 PM

Perella Weinberg Partners Reports Q4 and Full Year 2025 Results

PWP

Earnings

Dividends

Share Buyback

- Perella Weinberg Partners reported full year 2025 revenues of $751 million and fourth quarter revenues of $219 million, marking the third highest revenue year in the firm's history despite a 14% decrease from 2024.

- The firm achieved record revenues in Europe and its Restructuring practice in 2025, with a strong outlook for the restructuring business in 2026. They also invested significantly in talent, adding 23 new senior bankers in 2025, and have a record-high gross pipeline.

- The adjusted compensation margin for full year 2025 was 68%, with the Q1 2026 compensation accrual set to start at 67%. The firm expects a further single-digit percentage decrease in adjusted non-compensation expense for 2026.

- Perella Weinberg returned over $163 million to equity holders in 2025, including retiring 6.5 million shares, and declared a quarterly dividend of $0.07 per share. The company ended the year with $256 million in cash and no debt.

Feb 6, 2026, 2:00 PM

Perella Weinberg Partners Reports Q4 and Full Year 2025 Results

PWP

Earnings

Dividends

Hiring

- Perella Weinberg Partners reported full year 2025 revenues of $751 million and Q4 2025 revenues of $219 million, a 14% decrease from 2024, though 2025 was the third highest revenue year in the firm's history. The adjusted compensation margin for the full year was 68%, and adjusted non-compensation expense was $159 million, down 2% from the prior year.

- In 2025, the firm returned over $163 million to equity holders through dividends, RSU settlements, share repurchases, and unit exchanges, retiring 6.5 million shares. A quarterly dividend of $0.07 per share was declared.

- The firm achieved record revenues in Europe and its Restructuring practice in 2025 and added 23 new senior bankers. Looking ahead, the gross pipeline stands at record highs, and the announced impending backlog is strong. The compensation accrual for Q1 2026 will start at 67%.

Feb 6, 2026, 2:00 PM

Perella Weinberg Partners Reports Q4 and Full Year 2025 Results

PWP

Earnings

Share Buyback

Dividends

- Perella Weinberg Partners reported FY 2025 revenues of $751 million and Q4 2025 revenues of $219 million.

- Adjusted non-GAAP earnings per share (EPS) were $0.68 for FY 2025 and $0.17 for Q4 2025.

- As of December 31, 2025, the company maintained a strong balance sheet with $256 million in cash and no debt.

- The firm returned approximately $695 million to equity holders from 2021 to 2025 through unit exchanges, net settlements, share repurchases, dividends, and distributions.

Feb 6, 2026, 2:00 PM

Perella Weinberg Partners Reports Full Year and Fourth Quarter 2025 Results

PWP

Earnings

M&A

Dividends

- Perella Weinberg Partners reported full year 2025 revenues of $751 million, a 14% decrease from 2024, and GAAP diluted EPS of $0.47. For the fourth quarter of 2025, revenues were $219 million, down 3% year-over-year but up 33% from the prior quarter, with GAAP diluted EPS of $0.10.

- The firm made strategic talent investments in 2025, adding twelve partners and eleven managing directors, and acquired Devon Park Advisors to establish secondaries advisory capability.

- PWP maintained a strong balance sheet with $256 million of cash and no debt. In 2025, the company returned $163 million to equity holders, including retiring over six million shares, and declared a quarterly dividend of $0.07 per share.

- The CEO highlighted a record-level pipeline entering 2026 and anticipated broadly favorable conditions for M&A, financing, and capital solutions.

Feb 6, 2026, 12:40 PM

Perella Weinberg Reports Full Year and Fourth Quarter 2025 Results

PWP

Earnings

Dividends

Share Buyback

- Perella Weinberg Partners reported full-year 2025 revenues of $751 million, a 14% decrease from a record 2024, and fourth-quarter 2025 revenues of $219 million, down 3% from the prior year quarter.

- For the full year 2025, GAAP diluted EPS was $0.47 and Adjusted EPS was $0.68; for the fourth quarter 2025, GAAP diluted EPS was $0.10 and Adjusted EPS was $0.17.

- The firm maintained a strong balance sheet with $256 million of cash and no debt as of December 31, 2025.

- In 2025, PWP returned $163 million to equity holders and retired over six million shares and share equivalents. A quarterly dividend of $0.07 per share was declared.

- Strategic investments in 2025 included adding twelve Partners and eleven Managing Directors and acquiring Devon Park Advisors, with the CEO noting a record pipeline entering 2026.

Feb 6, 2026, 11:59 AM

Perella Weinberg Reports Q3 2025 Adjusted Non-GAAP Financial Results

PWP

Earnings

Share Buyback

Demand Weakening

- Perella Weinberg reported $165 million in adjusted non-GAAP revenue for Q3 2025, a 41% decrease year-over-year, with adjusted non-GAAP EPS of $0.13. For the last twelve months (LTM) ended Q3 2025, adjusted non-GAAP revenues were $757 million, down 12% year-over-year, and adjusted non-GAAP EPS was $0.77.

- As of September 30, 2025, the firm maintained a strong balance sheet with $186 million in cash and no debt.

- Year-to-date 2025, Perella Weinberg retired 6.4 million shares and share equivalents at an average price of $21.66.

- The firm operates with 76 advisory partners globally and approximately 700 employees across 12 offices.

Nov 7, 2025, 2:00 PM

Perella Weinberg Reports Q3 2025 Financial Results and Business Updates

PWP

Earnings

M&A

Guidance Update

- Perella Weinberg reported Q3 2025 revenues of $165 million and year-to-date revenues of $532 million.

- The firm maintained an adjusted compensation margin of 67% of revenues and lowered its full-year 2025 non-compensation expense guidance to a low single-digit increase.

- The company closed the quarter with $186 million in cash and no debt, and declared a quarterly dividend of $0.07 per share.

- Strategic investments include adding 25 senior bankers in 2025 and the acquisition of Devon Park on October 1, which is expected to be a significant revenue contributor and expands the firm's addressable market.

- The firm reported a record number of active engagements and a record overall pipeline, with its European business up over 50% from last year.

Nov 7, 2025, 2:00 PM

Perella Weinberg Reports Q3 2025 Results and Strategic Growth

PWP

Earnings

M&A

New Projects/Investments

- Perella Weinberg reported Q3 2025 revenues of $165 million and year-to-date revenues of $532 million. The adjusted compensation margin remained at 67% of revenues, and adjusted non-compensation expense for the quarter was $37 million.

- The firm made significant strategic investments, adding 25 senior bankers in 2025 and closing the acquisition of Devon Park on October 1, which expands capabilities and client relationships. The number of active engagements and the overall pipeline are at a record high.

- In Q3 2025, $12 million was returned to equity holders, contributing to over $157 million returned year-to-date, and more than 6 million shares were retired in 2025. The company ended the quarter with $186 million in cash and no debt, and declared a quarterly dividend of $0.07 per share.

Nov 7, 2025, 2:00 PM

Quarterly earnings call transcripts for Perella Weinberg Partners.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more