Earnings summaries and quarterly performance for RBB Bancorp.

Executive leadership at RBB Bancorp.

Johnny Lee

President and Chief Executive Officer

Gary Fan

Executive Vice President and Chief Operations Officer

Jeffrey Yeh

Executive Vice President and Chief Credit Officer

Lynn Hopkins

Executive Vice President and Chief Financial Officer

Mina Rizkalla

Executive Vice President and Chief Risk Officer

Vincent (I-Ming) Liu

Executive Vice President and Chief of Staff

Board of directors at RBB Bancorp.

Christina Kao

Chair of the Board

Christopher Lin

Director

David R. Morris

Director

Dr. James W. Kao

Director

Frank Wong

Director

Geraldine Pannu

Director

Joyce Wong Lee

Director

Robert M. Franko

Director

Scott Polakoff

Director

William Bennett

Director

Research analysts who have asked questions during RBB Bancorp earnings calls.

Brendan Nosal

Hovde Group, LLC

8 questions for RBB

Kelly Motta

Keefe, Bruyette & Woods

8 questions for RBB

Matthew Clark

Piper Sandler

8 questions for RBB

Andrew Terrell

Stephens Inc.

4 questions for RBB

Jackson Laurent

Stephens, Inc.

2 questions for RBB

Tim Coffey

Janney Montgomery Scott

2 questions for RBB

Timothy Coffey

Janney Montgomery Scott LLC

2 questions for RBB

Recent press releases and 8-K filings for RBB.

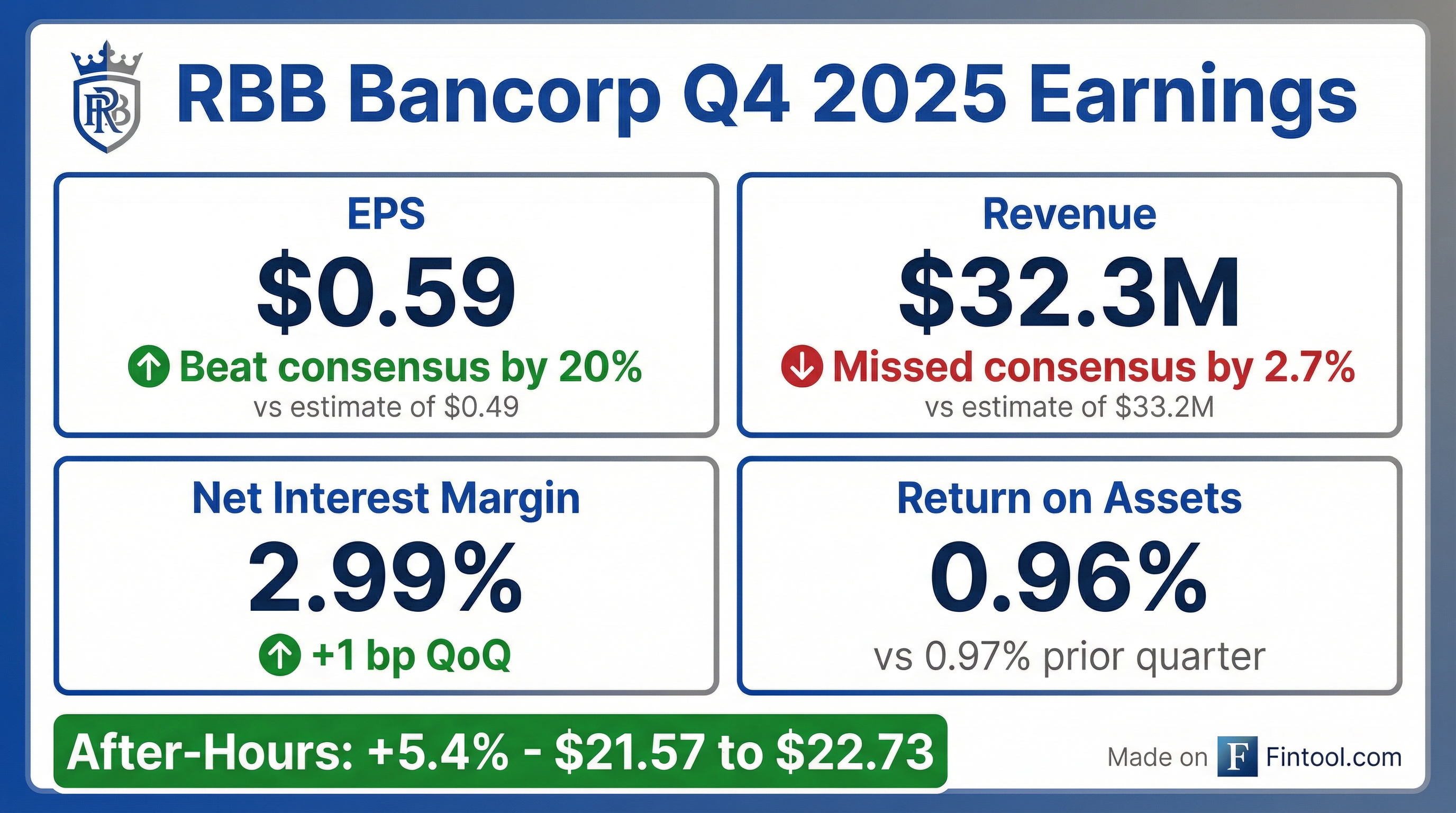

- RBB Bancorp reported Net Income of $10.177 million and Diluted EPS of $0.59 for Q4 2025, representing 132.1% and 136% increases year-over-year, respectively.

- Net Interest Income for Q4 2025 was $29.508 million, a 13.6% year-over-year increase, with a Net Interest Margin (NIM) of 2.99%.

- As of December 31, 2025, Gross Loans Held for Investment (HFI) reached $3.314 billion and Total Deposits were $3.350 billion, both showing an 8.6% increase year-over-year.

- The company maintained strong capital ratios, with a Common Equity Tier 1 (CET1) Ratio of 17.49% and a Tangible Common Equity (TCE) Ratio of 10.90% at December 31, 2025.

- Nonperforming Loans (NPLs) decreased by 44.9% year-over-year to $44.632 million in Q4 2025, and RBB returned $25.3 million in capital to stockholders in FY 2025.

- RBB Bancorp reported net income of $10.2 million, or $0.59 per share, for Q4 2025, which was stable from the third quarter and more than double the earnings from the same quarter a year ago.

- For the full year 2025, loans grew 8.6%, with originations 32% higher than in 2024, and the company is optimistic for another year of high single-digit growth in 2026.

- Credit quality showed significant improvement in 2025, with non-performing loans decreasing 45% and non-performing assets decreasing 34% since the end of the prior year.

- Tangible book value per share increased 7.8% to $26.42 by year-end 2025, and the company returned over $25 million to shareholders through dividends and repurchases of approximately 4% of outstanding shares.

- The company plans to address $120 million of sub-debt eligible for redemption in April 2026 and expects to become more active in its share buyback program following this.

- RBB Bancorp reported net income of $10.2 million, or $0.59 per diluted share, for Q4 2025, which was stable from Q3 2025 and more than double the earnings from Q4 2024.

- The company achieved solid loan growth of 8.6% for the full year 2025, with $145 million in originations during Q4 2025, and total deposits increased 8.6% compared to Q4 2024.

- Asset quality significantly improved in 2025, with non-performing loans decreasing 45% and non-performing assets decreasing 34%.

- Tangible book value per share increased 7.8% during 2025 to $26.42, and the company returned over $25 million to shareholders through dividends and repurchases of approximately 4% of outstanding shares.

- The net interest margin (NIM) was 2.99% in Q4 2025, with management expecting further opportunities for deposit cost reduction and NIM expansion as 99.5% of its $1.7 billion in CDs mature within the next 12 months.

- RBB Bancorp concluded 2025 with a strong fourth quarter, reporting net income of $10.2 million and $0.59 per diluted share, and a net interest margin of 2.99%.

- For the full year 2025, loans grew 8.6% and total deposits increased 8.6% compared to the fourth quarter of the prior year, with management optimistic for another year of high single-digit loan growth in 2026.

- Asset quality showed significant improvement in 2025, with non-performing loans decreasing 45% and non-performing assets decreasing 34% since the end of 2024, and the company anticipates resolving larger non-performing assets in the first half of 2026.

- The company returned over $25 million in capital to shareholders in 2025 through dividends and repurchases of approximately 4% of outstanding shares, and plans for a more active buyback program following the refresh of $120 million in sub-debt in April 2026.

- Fourth quarter non-interest expenses were in line with expectations, and first quarter 2026 expenses are projected to increase due to seasonal adjustments before stabilizing in the $18 million-$19 million range for subsequent quarters, with the 2026 effective tax rate expected to be between 27% and 28%.

- For the fourth quarter ended December 31, 2025, RBB Bancorp reported net income of $10.2 million and diluted earnings per share of $0.59. Fiscal year 2025 saw net income of $31.9 million and diluted EPS of $1.83, marking increases of 19.8% and 24.5% respectively, over fiscal 2024.

- The company's net interest margin (NIM) improved to 2.99% in Q4 2025, up from 2.98% in the prior quarter, and reached 2.95% for the full fiscal year 2025, a 25 basis point increase from fiscal 2024.

- Credit quality showed improvement, with nonperforming assets decreasing 1.6% quarter-over-quarter to $53.5 million, representing 1.27% of total assets at December 31, 2025, and a 34.0% reduction from year-end 2024.

- RBB Bancorp's Board of Directors declared a quarterly cash dividend of $0.16 per common share, payable on February 13, 2026, to shareholders of record on January 30, 2026.

- RBB Bancorp reported net income of $31.9 million and diluted earnings per share of $1.83 for fiscal year 2025, representing increases of 19.8% and 24.5%, respectively, compared to fiscal year 2024. For the fourth quarter of 2025, net income totaled $10.2 million and diluted EPS was $0.59.

- The company's credit quality improved significantly, with nonperforming assets decreasing $27.6 million, or 34.0%, to $53.5 million at December 31, 2025, compared to year-end 2024. Classified and criticized loans also decreased $71.3 million, or 43.0%, to $94.4 million at December 31, 2025.

- RBB Bancorp experienced loans held for investment growth of $261.1 million, or 8.6%, and total deposits increased by $266.6 million, or 8.6%, for fiscal year 2025.

- The Board of Directors declared a quarterly cash dividend of $0.16 per common share. For fiscal year 2025, the company returned $25.3 million to shareholders through quarterly dividends and common stock repurchases.

- RBB Bancorp reported net income of $10.1 million and earnings per share of $0.59 for the third quarter of 2025, marking a 9% and 12% increase from the prior quarter, respectively.

- The company's net interest margin expanded for the fifth consecutive quarter, reaching 2.98% in Q3 2025, a 6 basis point increase from the previous quarter.

- Loans held for investment grew by $68 million, an 8% annualized increase, driven by $188 million in new loan originations at a blended yield of 6.70%.

- Asset quality showed significant improvement, with non-performing loans decreasing by $11.3 million (20%) to $44.5 million and special mention loans decreasing by 46% to $49 million.

- RBB Bancorp repurchased 660,000 shares, representing 4% of shares outstanding, during Q3 2025, with approximately $4 million remaining on the current authorization.

- RBB Bancorp reported net income of $10.1 million or $0.59 per diluted share for Q3 2025, marking a 9% increase in net income and a 12% increase in EPS from the prior quarter.

- The company's net interest margin expanded by six basis points to 2.98% in Q3 2025, representing the fifth consecutive quarter of expansion.

- Loans held for investment grew by $68 million, an 8% annualized increase, with third-quarter loan originations totaling $188 million at a blended yield of 6.7%.

- Asset quality showed significant improvement, as nonperforming loans decreased by $11.3 million (20%) to $44.5 million and special mention loans decreased by 46% to $49 million.

- RBB Bancorp repurchased 660,000 shares, equivalent to 4% of shares outstanding, during the third quarter, with $4 million remaining on the current authorization.

- RBB Bancorp reported diluted earnings per share of $0.59 and net income of $10.148 million for Q3 2025.

- The company achieved 8% annualized loan growth and a 22% annualized increase in deposits, with a Net Interest Margin (NIM) of 2.98%.

- Asset quality improved significantly, with Nonperforming Loans (NPLs) decreasing by $11.3 million, or 20%, leading to an NPLs/Total Loans ratio of 1.38%.

- Capital ratios remained strong, including a Common Equity Tier 1 (CET1) Ratio of 17.28% and a Tangible Common Equity to Tangible Assets Ratio of 10.67%.

- During the quarter, RBB Bancorp invested $12.5 million in its common stock buyback program.

- RBB Bancorp reported net income of $10.1 million, or $0.59 diluted earnings per share, for the third quarter ended September 30, 2025, an 8.7% increase from the previous quarter.

- The company's net interest margin expanded to 2.98% in Q3 2025, up from 2.92% in Q2 2025, and its return on average assets was 0.97%.

- Loans held for investment grew by $67.9 million (8.3% annualized), and total deposits increased by $178.3 million (22.2% annualized) as of September 30, 2025.

- Credit quality improved with classified and criticized loans decreasing by $56.1 million (30.8%) to $126.2 million, and nonperforming assets decreasing by $6.7 million (11.0%) to $54.3 million at September 30, 2025.

- The Board of Directors declared a quarterly cash dividend of $0.16 per common share and the company completed common stock repurchases totaling $12.5 million.

Quarterly earnings call transcripts for RBB Bancorp.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more