Earnings summaries and quarterly performance for REGIS.

Executive leadership at REGIS.

Board of directors at REGIS.

Research analysts who have asked questions during REGIS earnings calls.

Recent press releases and 8-K filings for RGS.

Regis Corporation Reports Q2 Fiscal 2026 Results, Driven by Acquisition and Strategic Initiatives

RGS

Earnings

M&A

Debt Issuance

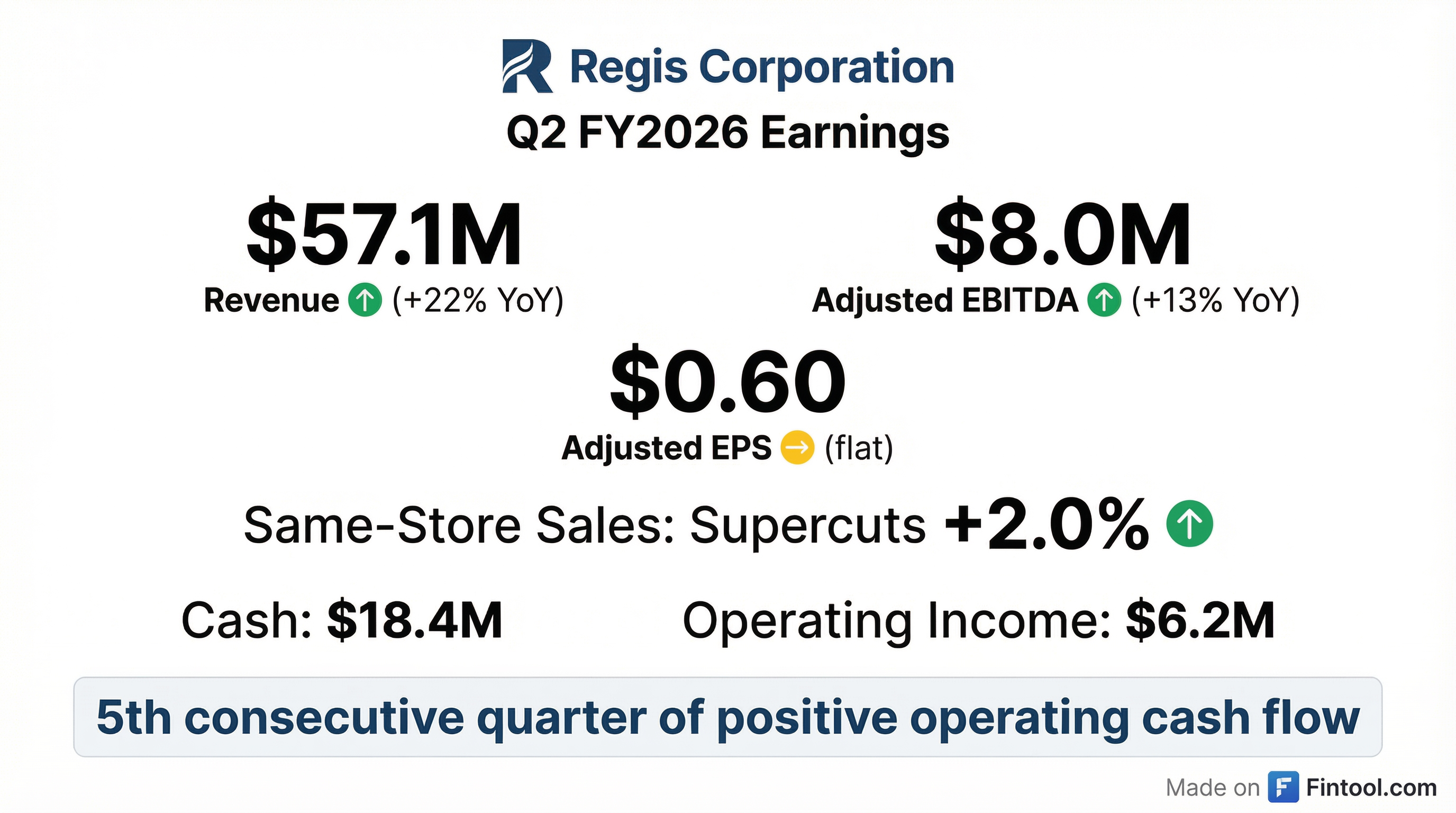

- Regis Corporation reported Q2 fiscal 2026 Adjusted EBITDA of $8 million, an increase of $900,000 year-over-year, and total revenue of $57.1 million, up 22.3%. This revenue growth was largely attributed to the acquisition of approximately 300 salons from Alline in December 2024.

- The company generated $1.5 million of unrestricted cash from operations in Q2 and $3.9 million year-to-date, reflecting improved operating discipline.

- Traffic headwinds remain the most significant challenge, leading to a modest 0.10% decline in consolidated same-store sales, although Supercuts achieved 2% same-store sales growth year-to-date.

- Strategic initiatives include refining a new stylist pay plan, implementing pricing adjustments, and utilizing a labor optimization tool, alongside efforts to modernize Supercuts through loyalty and digital engagement.

- Regis is actively exploring refinancing options for its $126 million outstanding debt as it nears the June 2026 anniversary of the current agreement.

1 day ago

Regis Reports Q2 2026 Financial Results with Revenue Growth Driven by Acquisition

RGS

Earnings

M&A

Debt Issuance

- Regis reported Q2 2026 consolidated adjusted EBITDA of $8 million, an 11.9% increase year-over-year, and total revenue of $57.1 million, up 22.3%, primarily driven by the acquisition of approximately 300 salons from Align in December 2024.

- The company generated $1.5 million in unrestricted cash from operations in Q2 2026, contributing to $3.9 million year-to-date.

- Consolidated same-store sales declined modestly by 0.10%, with Supercuts delivering 2% same-store sales growth in the quarter, though traffic remains a significant challenge.

- As of December 31, 2025, there was a net decrease of 374 franchise locations compared to the prior year, with 96 closures in the first six months of fiscal year 2026.

- Regis is exploring options to refinance its $126 million outstanding debt as it nears the two-year anniversary of the agreement in June 2026, with $27.4 million in available liquidity as of December 31, 2025.

1 day ago

Regis Reports Q2 Fiscal 2026 Results

RGS

Earnings

Debt Issuance

M&A

- Regis reported Q2 Fiscal 2026 Adjusted EBITDA of $8 million, an 11.9% increase compared to the prior year, and total revenue of $57.1 million, up 22.3%, primarily driven by the acquisition of approximately 300 Alline salons in December 2024.

- The company generated $1.5 million of unrestricted cash from operations in Q2 and $3.9 million year-to-date.

- Consolidated same-store sales for the quarter declined modestly by 0.10%, while Supercuts delivered 2% same-store sales growth year-to-date.

- As of December 31, 2025, Regis experienced a net decrease of 374 franchise locations year-over-year, with 96 closures occurring in the first half of fiscal 2026.

- Regis is exploring refinancing options for its $126 million outstanding debt as it approaches the two-year anniversary of the agreement in June 2026.

1 day ago

Regis Corporation Reports Q2 Fiscal 2026 Results with Increased Adjusted EBITDA and Revenue

RGS

Earnings

Debt Issuance

Demand Weakening

- Regis Corporation reported Q2 fiscal 2026 Adjusted EBITDA of $8 million, an increase of $900,000 year-over-year, and total revenue of $57.1 million, up 22.3%, primarily due to the acquisition of approximately 300 salons from Align in December 2024.

- The company generated $1.5 million of unrestricted cash from operations in Q2 and $3.9 million year-to-date, reflecting improved operating discipline and cash management.

- Consolidated same-store sales declined 0.10% in Q2 2026, with Supercuts delivering 2% growth, though traffic headwinds remain the most significant challenge.

- Regis experienced a net decrease of 374 franchise locations compared to December 31, 2024, with 96 closures in the six months ended December 31, 2025, primarily involving underperforming stores.

- The company is actively exploring refinancing options for its $126 million outstanding debt as it nears the June 2026 two-year anniversary of the agreement, aiming to reduce debt service.

1 day ago

Regis Reports Q2 2026 Financial Results with Increased Adjusted EBITDA and Revenue

RGS

Earnings

Guidance Update

Debt Issuance

- Regis Corporation reported Q2 2026 Adjusted EBITDA of $8 million, an 11.9% increase year-over-year, and total revenue of $57.1 million, up 22.3%, primarily driven by the Align acquisition.

- The company generated $1.5 million of unrestricted cash from operations in Q2 and $3.9 million year-to-date, marking its fifth consecutive quarter of positive cash from operations.

- Consolidated same-store sales for the quarter declined modestly by 0.10%, though Supercuts delivered 2% same-store sales growth. The company also reported a net decrease of 374 franchise locations as of December 31, 2025, compared to the prior year.

- As of December 31, 2025, Regis had $27.4 million of available liquidity and $18.4 million in unrestricted cash and cash equivalents, with $126 million in outstanding debt. The company is actively exploring refinancing options for its debt as it approaches the two-year anniversary of the agreement in June 2026.

1 day ago

Regis Reports Q2 Fiscal 2026 Financial Results

RGS

Earnings

Debt Issuance

Demand Weakening

- Regis Corporation reported Q2 fiscal 2026 Adjusted EBITDA of $8 million, an increase of $900,000 year-over-year, and total revenue of $57.1 million, up 22.3%, primarily driven by the Alline acquisition. The company also generated $1.5 million in unrestricted cash from operations during the quarter.

- Consolidated same-store sales declined modestly by 0.10%, with traffic identified as the primary challenge, though Supercuts delivered 2% same-store sales growth year-to-date. The company is focusing on initiatives like loyalty programs and digital engagement to stabilize traffic.

- Regis experienced a net decrease of 374 franchise locations year-over-year as of December 31, 2025, primarily from underperforming stores. The company also has $126 million in outstanding debt and is exploring refinancing options ahead of the agreement's two-year anniversary in June 2026.

1 day ago

Regis Corporation Reports Second Fiscal Quarter 2026 Financial Results

RGS

Earnings

Debt Issuance

Revenue Acceleration/Inflection

- Regis Corporation reported consolidated revenue of $57.1 million for the second fiscal quarter ended December 31, 2025, an increase of $10.4 million compared to the prior year, primarily driven by the Alline acquisition.

- The company achieved operating income of $6.2 million and Adjusted EBITDA of $8.0 million for Q2 FY2026, representing year-over-year improvements from $5.5 million and $7.1 million, respectively.

- Diluted EPS was $0.16 for Q2 FY2026, compared to $2.71 in the prior year, with the prior year including $2.63 of income from discontinued operations.

- Regis generated positive cash from operations for the fifth consecutive quarter and saw Supercuts same-store sales increase by 2.0%.

- The company is focused on reducing debt service and is evaluating refinancing opportunities as its credit agreement approaches its two-year anniversary in June 2026.

2 days ago

Regis Corporation Reports Second Fiscal Quarter 2026 Financial Results

RGS

Earnings

Revenue Acceleration/Inflection

Debt Issuance

- Regis Corporation reported consolidated revenue of $57.1 million for the second fiscal quarter ended December 31, 2025, an increase of $10.4 million compared to the prior year, primarily driven by the Alline acquisition.

- The company achieved operating income of $6.2 million and Adjusted EBITDA of $8.0 million for Q2 2026, both showing year-over-year improvements.

- Diluted EPS was $0.16 for Q2 2026, compared to $2.71 in the prior year, with the prior year including $2.63 of income from discontinued operations.

- Supercuts same-store sales increased by 2.0% in Q2 2026.

- Regis Corporation generated positive cash from operations for the fifth consecutive quarter and is evaluating refinancing opportunities for its credit agreement due in June 2026.

2 days ago

Regis Corporation Reports Q1 Fiscal Year 2026 Results with Increased Revenue and Adjusted EBITDA

RGS

Earnings

Revenue Acceleration/Inflection

M&A

- Regis Corporation reported a 0.9% increase in consolidated same-store sales and $8 million in adjusted EBITDA for Q1 fiscal year 2026, an improvement of $400,000 from the prior year.

- Total first quarter revenue increased 28% to $59 million, primarily driven by contributions from the 281 company-owned salons acquired from Align in December 2024.

- The company generated $2.3 million in positive operating cash flow for the quarter, marking the fourth consecutive quarter of positive cash from operations, and expects annualized G&A to be between $40 million and $43 million for fiscal year 2026.

- Supercuts same-store sales were up 2.5% in Q1 fiscal year 2026, with ongoing modernization efforts including new digital interaction pilots and the development of a new prototype store design.

- As of September 30, 2025, Regis had $25.5 million of available liquidity, including $16.6 million in unrestricted cash and cash equivalents, and does not plan to refinance its existing debt in the near term due to unfavorable economics.

Nov 12, 2025, 1:30 PM

Regis Corporation Reports Q1 Fiscal 2026 Results

RGS

Earnings

Guidance Update

CEO Change

- For Q1 Fiscal Year 2026, Regis Corporation reported a 0.9% increase in consolidated same-store sales and adjusted EBITDA of $8 million, up from $7.6 million in the prior year.

- Total revenue for the quarter was $59 million, a 28% increase compared to the prior year, primarily driven by increased revenue from 281 company-owned salons acquired from Align in December 2024.

- The company generated $2.3 million in positive operating cash flow, marking its fourth consecutive quarter of positive cash from operations.

- Regis anticipates fiscal year 2026 G&A to be in the range of $40 million to $43 million and expects a meaningful increase in unrestricted cash generated from core operations compared to fiscal year 2025. The board is expected to make a final decision on the CEO position in the coming months.

Nov 12, 2025, 1:30 PM

Quarterly earnings call transcripts for REGIS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more